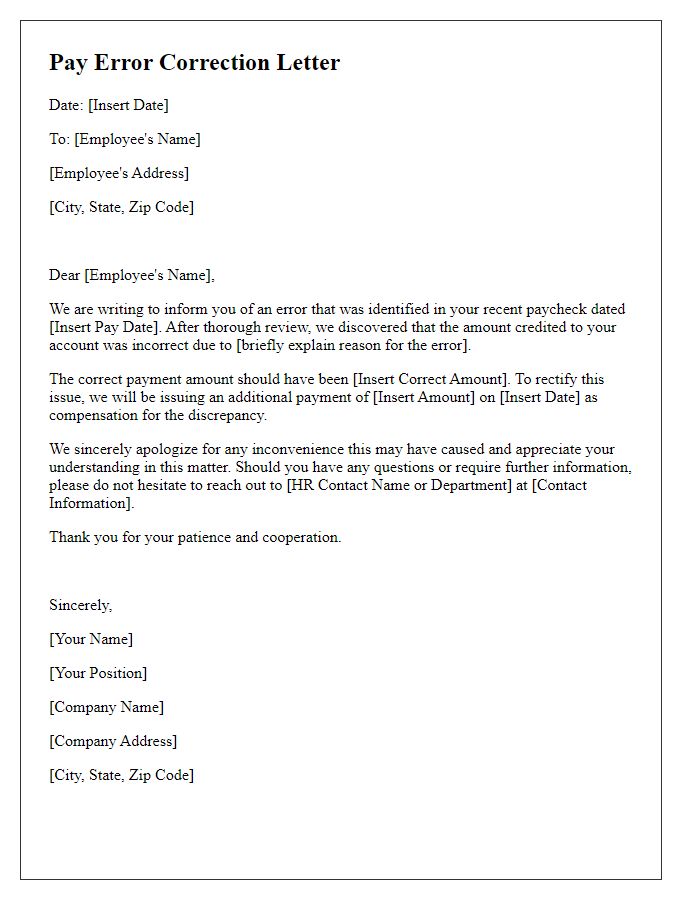

Have you ever experienced the headache of a payroll discrepancy? It can be frustrating to find an error that affects your hard-earned paycheck, leaving you feeling undervalued and anxious. Luckily, addressing these discrepancies doesn't have to be complicated; with the right approach, you can ensure swift correction and peace of mind. So, if you're ready to learn how to draft the perfect letter for payroll discrepancy correction, keep reading for our step-by-step guide!

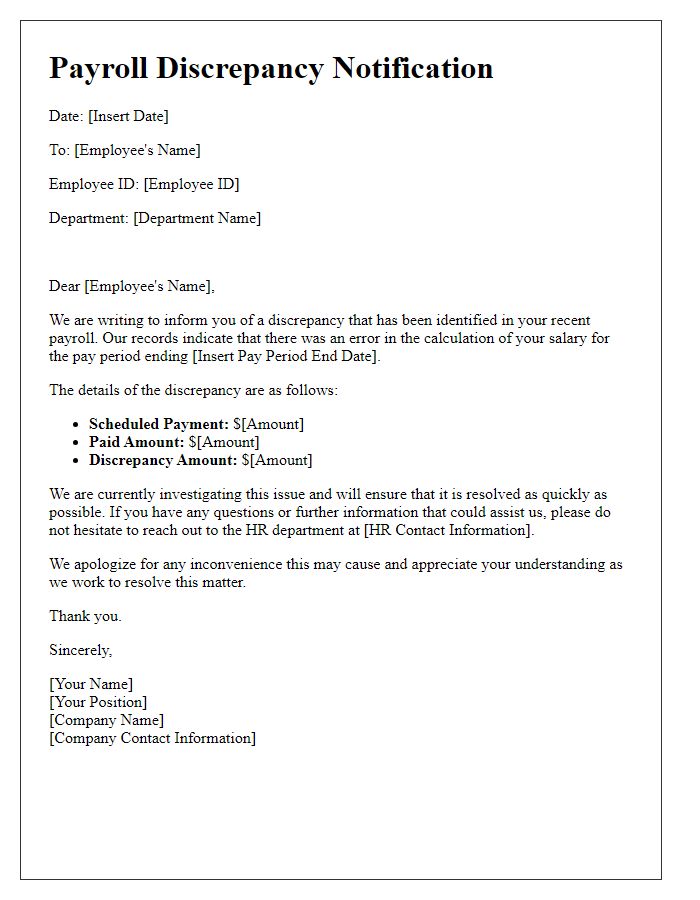

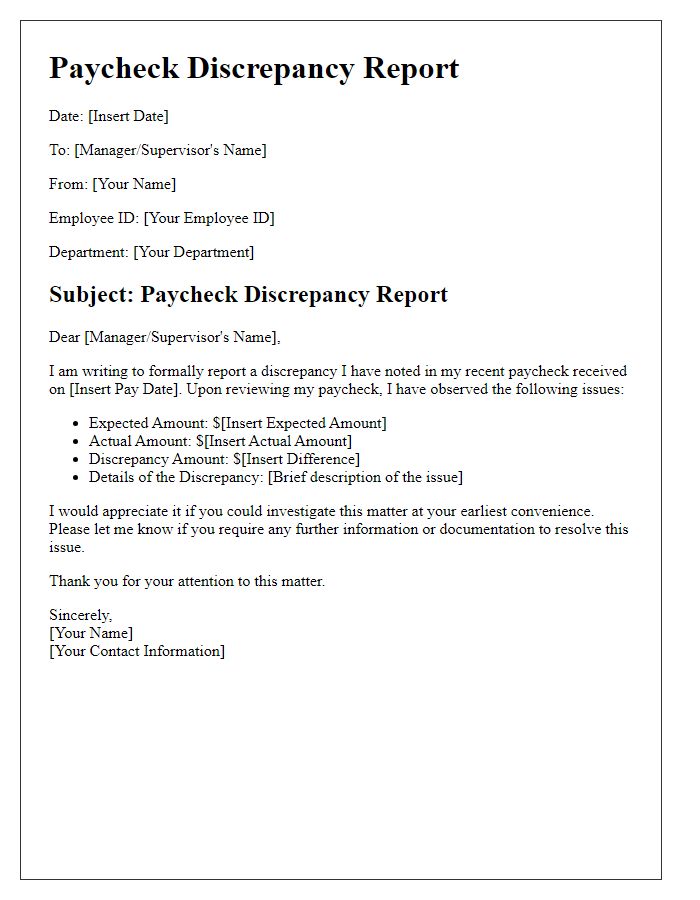

Employee Information: Name, Employee ID, Department.

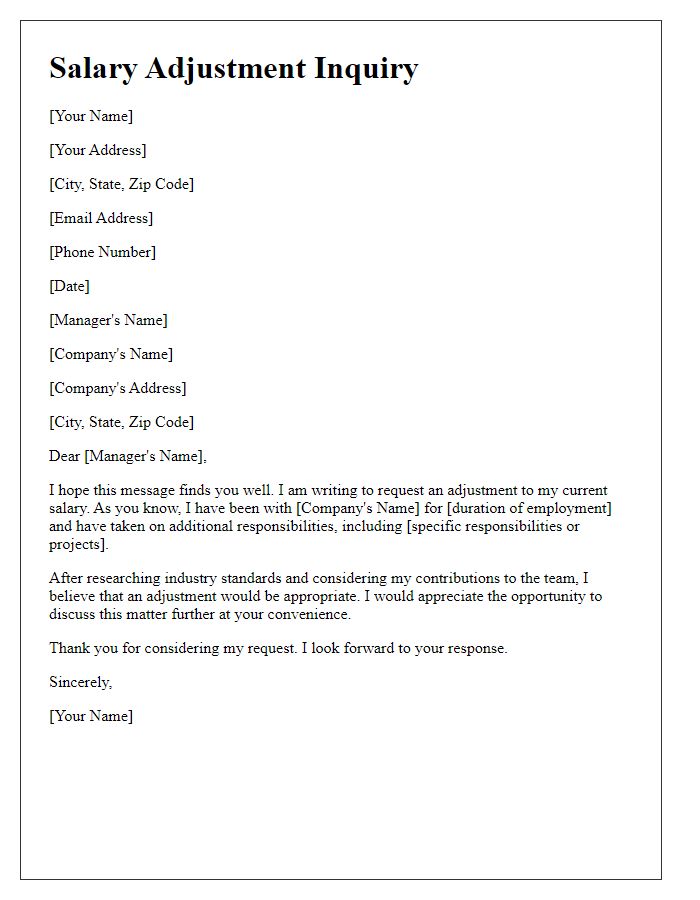

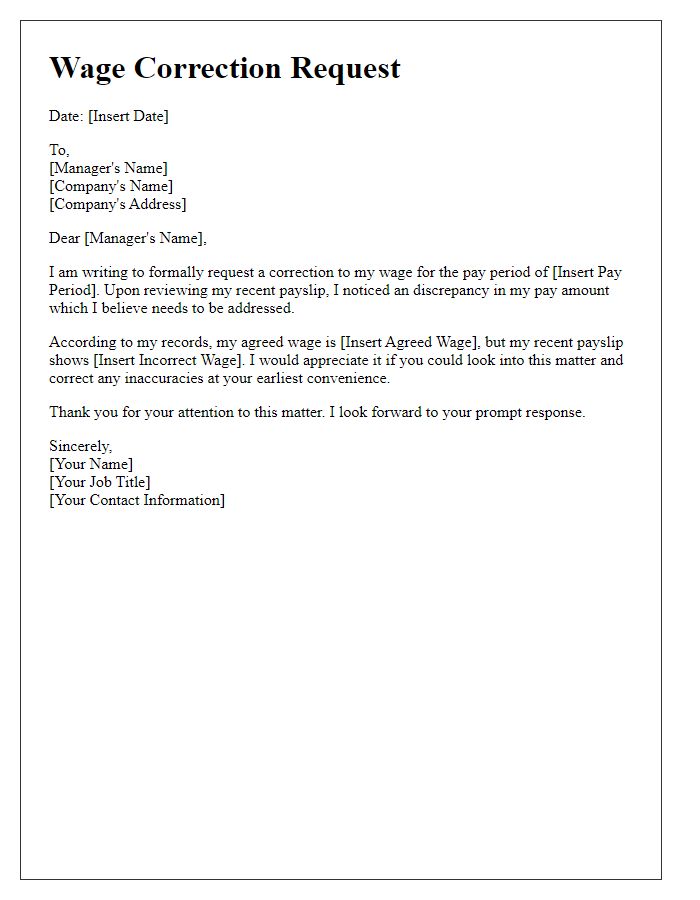

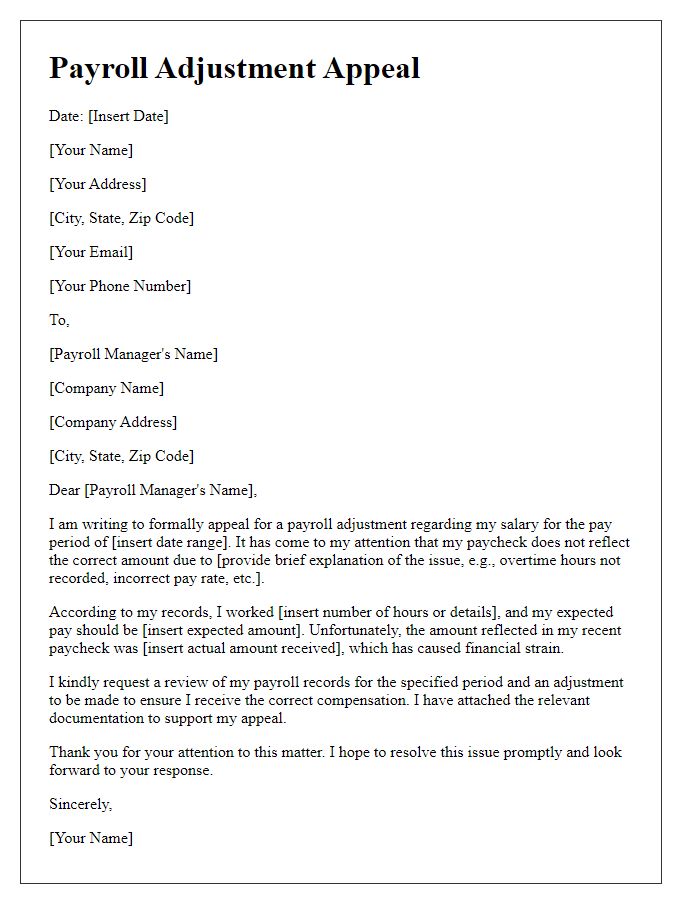

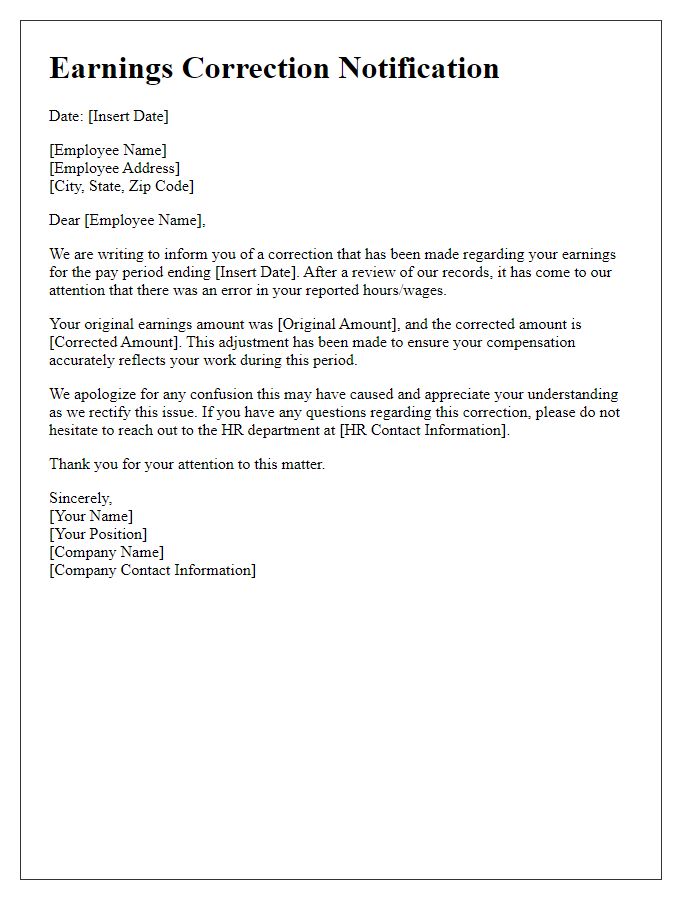

Payroll discrepancies can significantly impact employee satisfaction and financial planning. For instance, incorrect payment amounts can arise from miscalculated hours (e.g., overtime) or incorrect data entry in payroll systems like ADP or Paychex. Employees often experience stress from discrepancies in gross income versus net income, resulting in potential issues related to budgeting and monthly expenses. Accurate employee information, including full name, Employee ID (a unique identifier often used for internal record-keeping), and specific department details (such as Human Resources or Information Technology), is essential for resolving any discrepancies efficiently. Providing clear documentation and records can expedite the correction process and restore trust between employees and the payroll department.

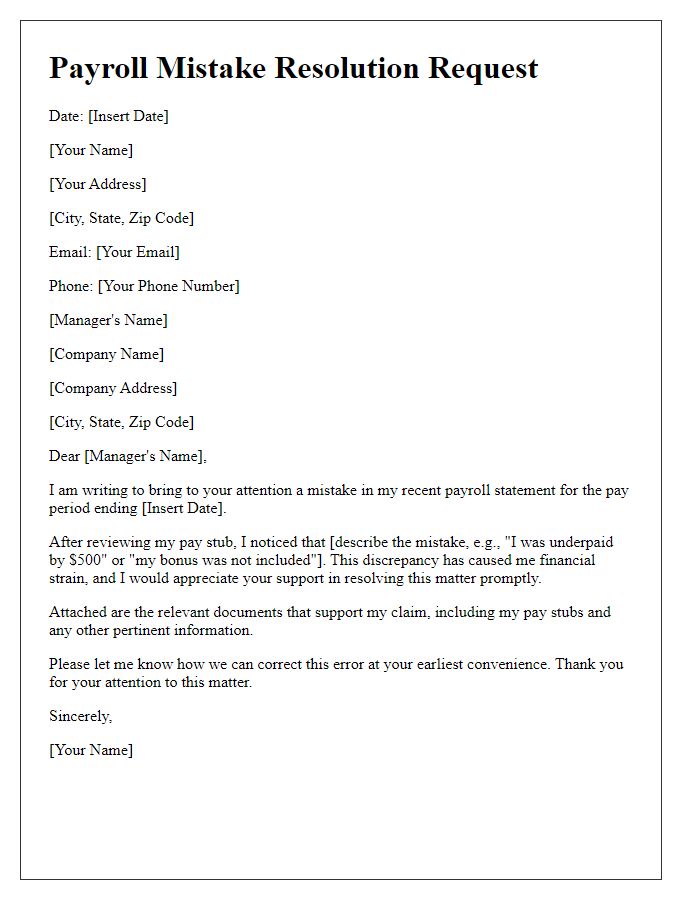

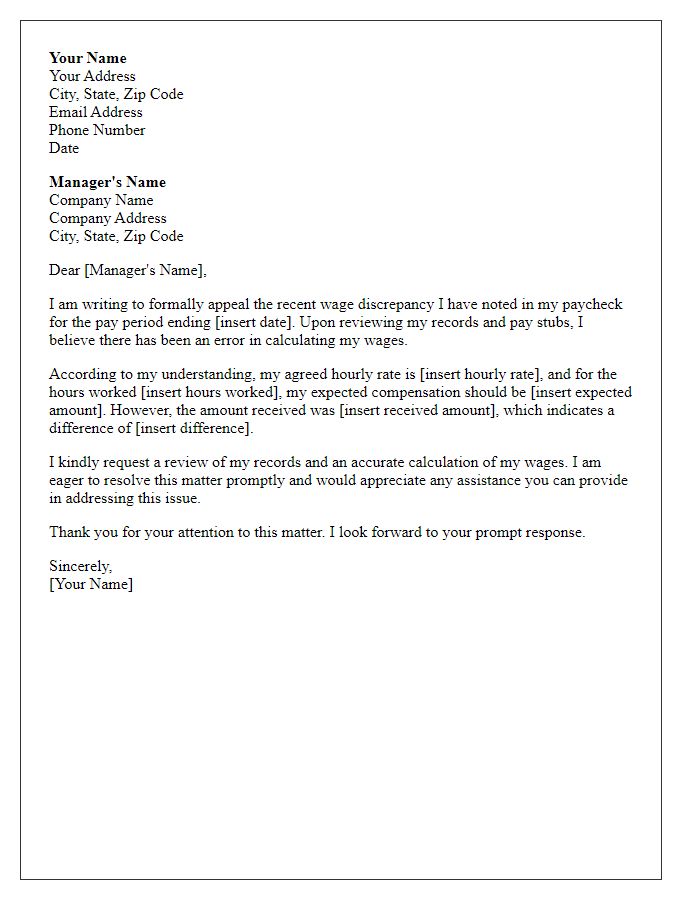

Discrepancy Details: Date, Specific Issue, Pay Period Involvement.

Payroll discrepancies can significantly impact employee finances, particularly in companies like Amazon that process thousands of payroll transactions weekly. A common issue might arise on specific dates, such as January 15th, when errors may occur in overtime calculations, affecting the pay period spanning January 1st to January 15th. This specific issue can lead to underpayment or overpayment, causing confusion for employees relying on accurate compensation. Timely resolution of such discrepancies is crucial for maintaining workforce morale and trust in the payroll system. Proper documentation and clear communication regarding the nature of the error can facilitate a smoother correction process.

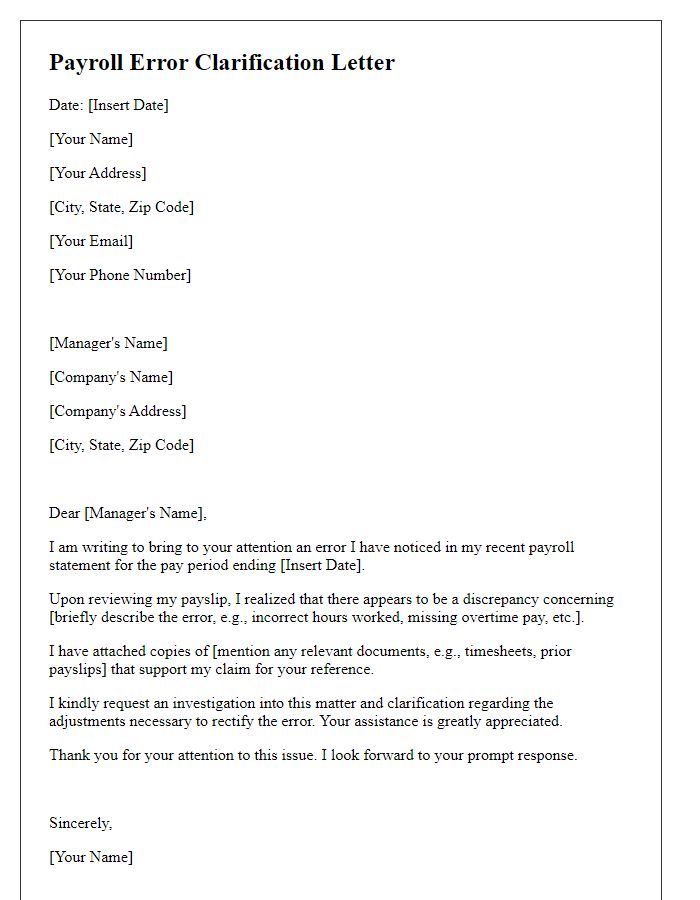

Evidential Support: Timesheets, Pay Stubs, Documentation.

Payroll discrepancies can lead to significant financial misunderstandings for employees and employers alike. Accurate evidential support, such as timesheets--documenting hours worked on specific dates at various job sites--pay stubs reflecting the employee's gross and net earnings, and other official documentation like employee contracts are crucial for resolving these issues. Detailed examination of timesheets (which outline hours per week and overtime) and pay stubs (providing clear breakdowns of deductions for taxes and benefits) ensures a precise correction is implemented. Proper record-keeping not only aids in rectifying current discrepancies but also establishes a reliable system for future payroll processing, fostering trust between the workforce and management in corporations.

Desired Correction: Correct Amount, Payment Method, Timetable.

A payroll discrepancy often arises when an employee receives an incorrect amount for their wages. This can stem from various factors such as errors in hours reported, miscalculations in overtime pay, or incorrect application of tax deductions. The desired correction typically includes adjusting the correct amount owed to the employee, ensuring timely payment through an appropriate method (such as direct deposit or check), and adhering to the established timetable for processing corrections, often within one or two pay cycles. Addressing these discrepancies promptly is crucial for maintaining employee trust and satisfaction, as well as complying with labor regulations.

Contact Channels: Email, Phone, Best Time to Reach.

Payroll discrepancies can lead to significant financial stress for employees, affecting their trust in the organization. Common issues arise from incorrect deductions, missed overtime payments, or benefits miscalculations. Employees should utilize designated contact channels such as official email addresses (usually maintained by the HR department), phone lines (often staffed during business hours), and online portal messaging systems (available 24/7) to report discrepancies. Key times for resolution typically include early mornings or just after lunch to ensure key personnel are available for immediate assistance. Employers must prioritize clear communication and prompt responses to maintain employee satisfaction and morale.

Comments