Are you wondering how to effectively request reimbursement for your recent travel expenses? Writing a clear and concise letter is key to ensuring your request is processed smoothly. In this article, we'll walk you through a simple template that covers all the important details needed for a successful reimbursement submission. So, let's dive in and help you get those expenses reimbursed promptly!

Contact Information

Travel expense reimbursement forms require clear contact information for efficient processing. Essential details include the traveler's full name, job title, and department for identification purposes. Include a professional email address, typically ending with the company's domain, ensuring easy communication with the finance department. A phone number, preferably a mobile number for accessibility, facilitates quick verification or clarification of any requests. Additionally, providing a home address may be necessary for mailing checks or correspondence related to the reimbursement. All these details help streamline the reimbursement process and ensure timely payments.

Expense Details

Travel expense reimbursement requests require precise documentation to ensure clarity and transparency. Common expense categories include transportation (flights, taxis, mileage), accommodation (hotel stays, Airbnb rentals), and meals (daily meal allowances, business dinners). It is crucial to provide detailed receipts for each expense, showing dates, amounts, and the purpose of the expenditure. For instance, a flight to New York City (JFK Airport) on April 10, 2023, costing $350, should be accompanied by the corresponding boarding pass and ticket invoice. Moreover, hotel accommodations at the Hilton Garden Inn in Chicago, totaling $600 for three nights, need itemized billing showing the check-in and check-out dates. Including a summary table can further clarify categories and total expenses claimed, aiding in efficient processing and approval.

Relevant Documentation

Travel expense reimbursement often requires relevant documentation to ensure accuracy and compliance with organizational policies. Detailed receipts (including date, merchant name, itemized list of expenses) are essential for validation. Mileage logs must include the starting and ending locations, total miles traveled, and purpose of the trip, following IRS reimbursement guidelines. For lodging, invoices should clearly state the accommodation's name, address, nightly rate, and total duration of stay. Per diem claims necessitate documentation of the travel dates and locations, with allowances based on federal rates for meals and incidentals. All documentation should adhere to company-specific formatting requirements and submission deadlines for timely processing.

Submission Procedure

Submitting a travel expense reimbursement request involves adhering to a specific procedure to ensure timely processing and compliance with company policies. Employees must complete a travel expense report form, detailing each expense incurred during the business trip, such as accommodation costs at hotels, meals consumed, transportation costs including flights or rental cars, and incidentals. All receipts from vendors, such as airlines or restaurants, must accompany the report as proof of expenditure. The completed report should be submitted to the finance department within 30 days post-travel to avoid delays. Additional audit trails may necessitate providing explanations for any discrepancies or unusually high expenses, ensuring transparency in the reimbursement process.

Deadlines and Approval Process

Travel expense reimbursement processes are crucial in organizations. Employees must submit travel expense reports within 30 days post-travel completion, ensuring timely processing. Receipts for transportation (air ticket, train, car rental), accommodation (hotel bills), and meals (restaurant invoices) are mandatory documentation. Each report requires supervisor approval, who assesses compliance with company policy, ensuring expenses align with budget expectations. Finance departments typically finalize reimbursements within a two-week period after approval, transferring funds directly to employee bank accounts. Failure to submit within the designated timeframe may lead to denial of reimbursement claims.

Letter Template For Travel Expense Reimbursement Samples

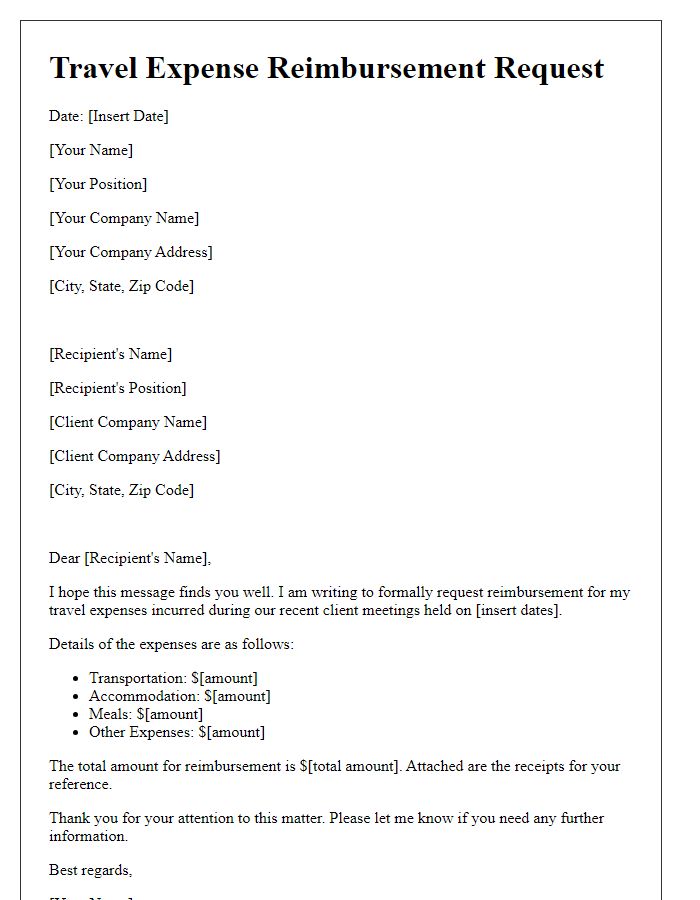

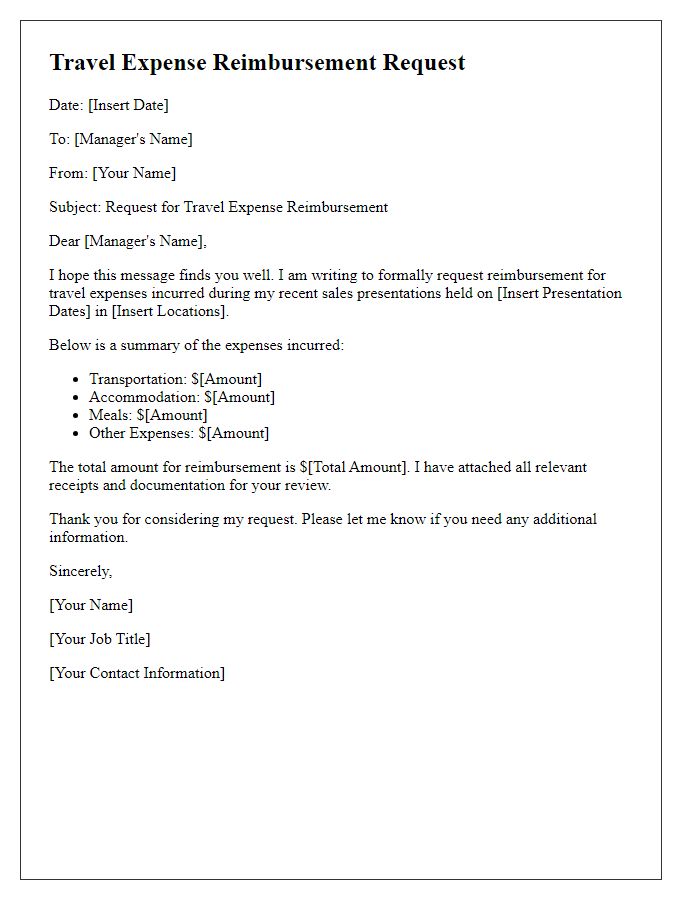

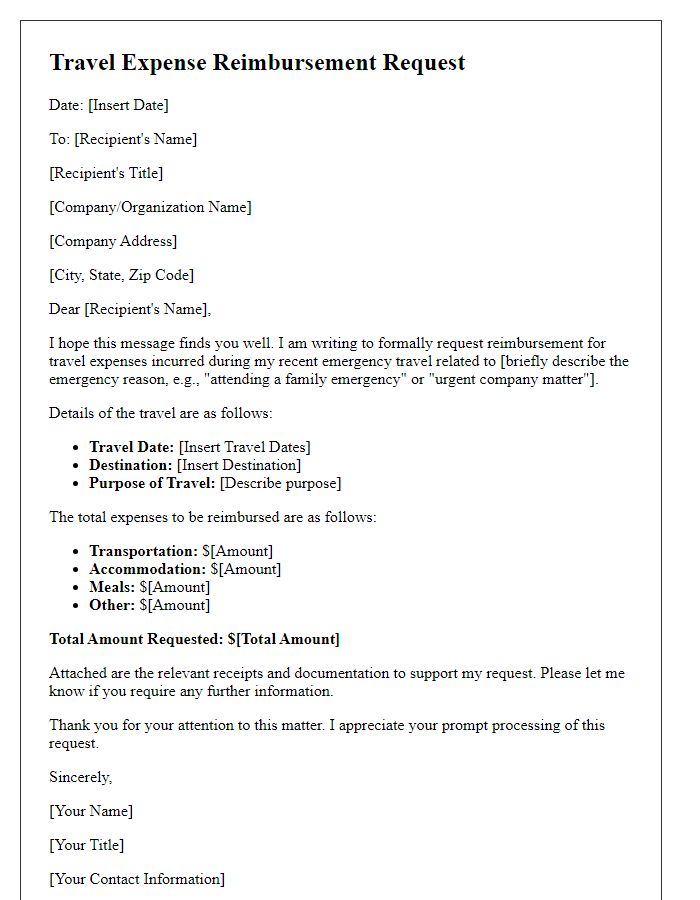

Letter template of travel expense reimbursement request for business trip

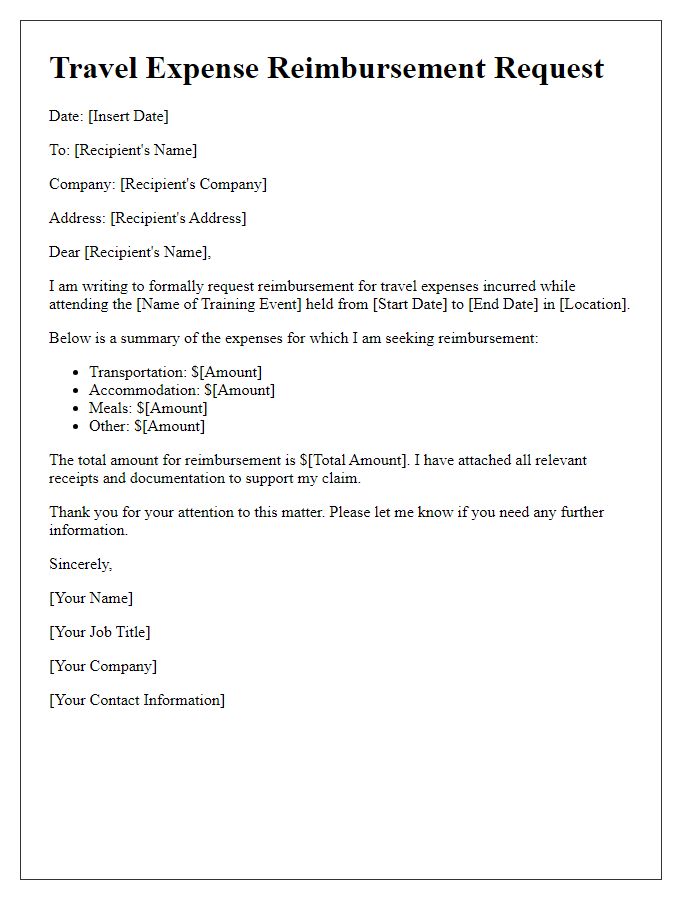

Letter template of travel expense reimbursement for conference attendance

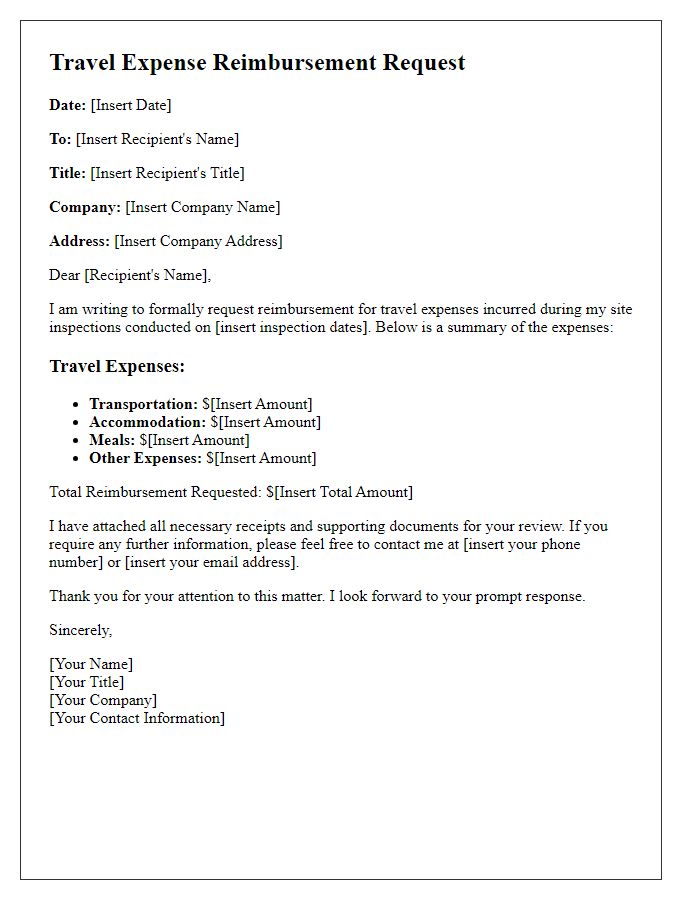

Letter template of travel expense reimbursement for team-building activities

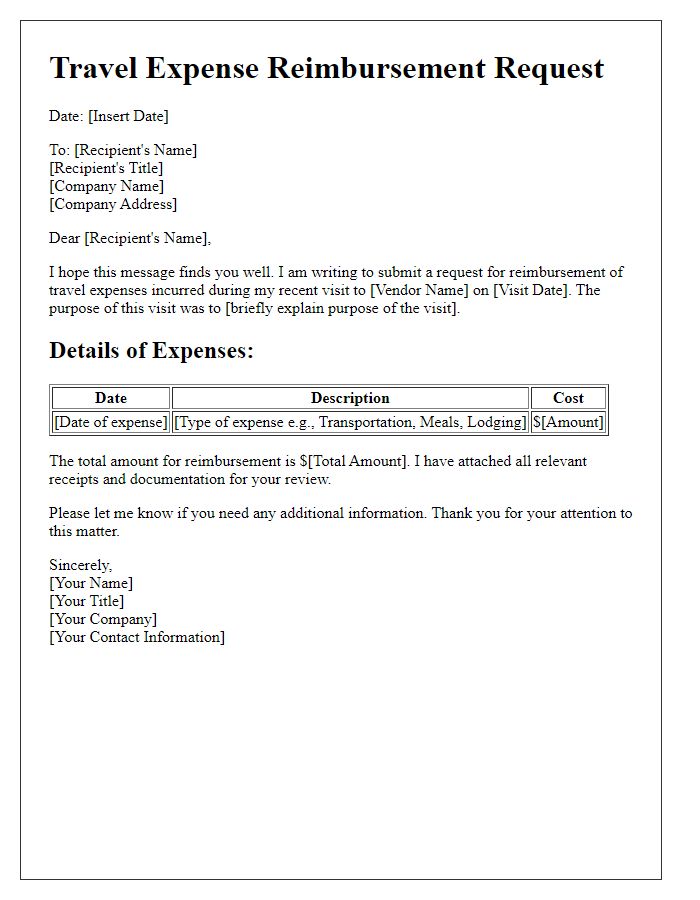

Letter template of travel expense reimbursement for project-related travel

Comments