Are you considering a big move and in need of some guidance on relocation assistance? Whether you're moving across town or across the country, understanding the various options available to ease your transition can make a world of difference. From logistics and financial support to settling into your new community, there's a lot to unpack! Join me as we explore the ins and outs of relocation assistance details in the article ahead.

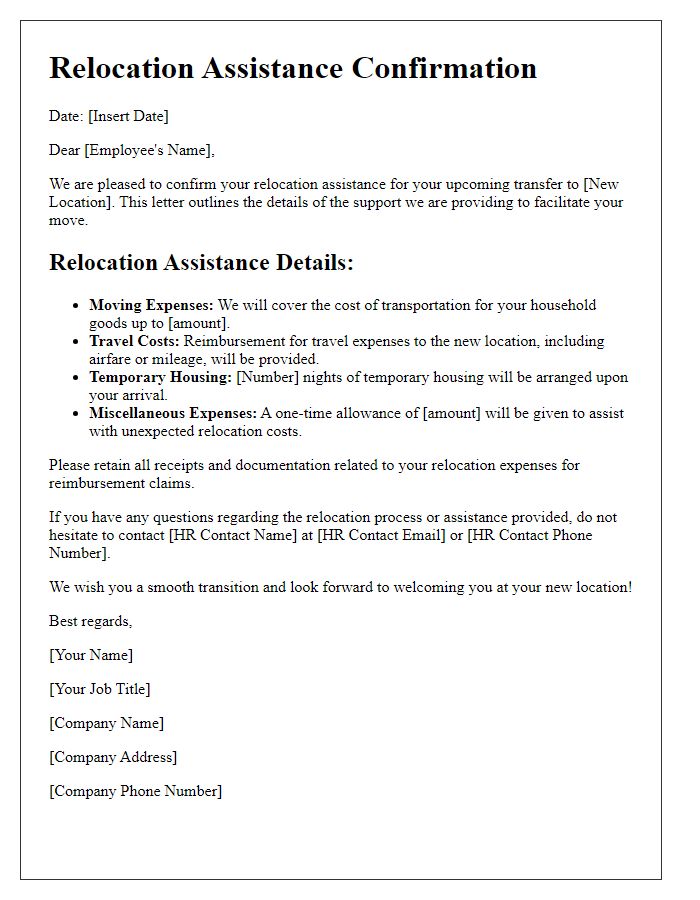

Company Policy Coverage

Relocation assistance programs typically include various aspects such as moving expenses, travel costs, temporary housing allowances, and real estate expenses. For instance, coverage may encompass moving services, which can range from $2,000 to $15,000 depending on distance and volume of the move. Travel costs may allow for reimbursement of airfare or mileage rates set by the IRS--currently .65 cents per mile for personal vehicle use. Temporary housing may be covered for a duration of 30 to 90 days, providing employees with suitable accommodations while securing new permanent residences. Real estate expenses could assist with closing costs, home sale assistance, or lease-breaking fees, potentially saving workers thousands of dollars during their transition to a new location. Understanding these details aids employees in calculating the financial impact of their move.

Eligible Expenses

Relocating to a new city requires careful financial planning to manage eligible expenses effectively. Key eligible expenses typically include moving truck rental fees, which can range from $100 to $2,000 depending on distance and size. Professional moving services can incur costs of $800 to $4,000, particularly for longer distances or larger homes. Temporary housing arrangements might also be necessary while transitioning, with costs often between $1,000 and $3,000 monthly for short-term rentals. Additionally, storage fees are common for households in transition, averaging $150 to $300 per month. Other notable expenses could encompass utility connection fees, which vary by location, often averaging $50 to $150. Finally, mileage reimbursement might apply, calculated at the current IRS rate of $0.655 per mile for personal vehicle usage during the relocation process.

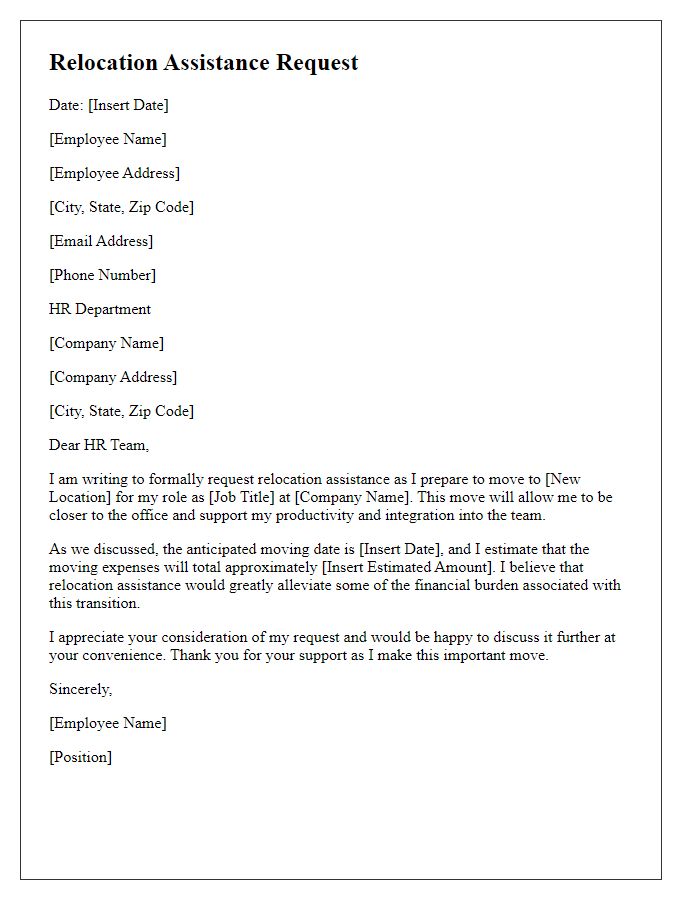

Reimbursement Process

Relocation assistance often includes specific reimbursement processes that employees must follow to receive financial support. To initiate the reimbursement process, employees should first retain all original receipts related to moving expenses, such as transportation costs, packing supplies, and temporary lodging. Within 30 days of relocation, employees must submit a completed reimbursement form, specifying eligible expenses incurred, to the human resources department. The form may require documentation like itemized receipts and any relevant agreements, such as lease contracts, to validate the claims. Reimbursements are typically processed within six to eight weeks, with payments issued via direct deposit or company checks. This structured approach ensures a smooth transition for employees relocating for job-related reasons.

Important Deadlines

Relocation assistance programs often come with crucial timelines that employees must adhere to in order to receive support effectively. For instance, the relocation request must typically be submitted no later than 30 days before the move date, ensuring adequate processing time. Additionally, employees may need to provide necessary documentation, such as lease agreements or purchase agreements for new residences, usually due 15 days after the relocation request approval. Final reimbursement requests may be required within 60 days of the relocation completion date, accompanied by itemized receipts and proof of expenditures. Awareness of these deadlines is essential for a smooth transition during the relocation process, especially for employees moving for new job placements across state lines or international borders.

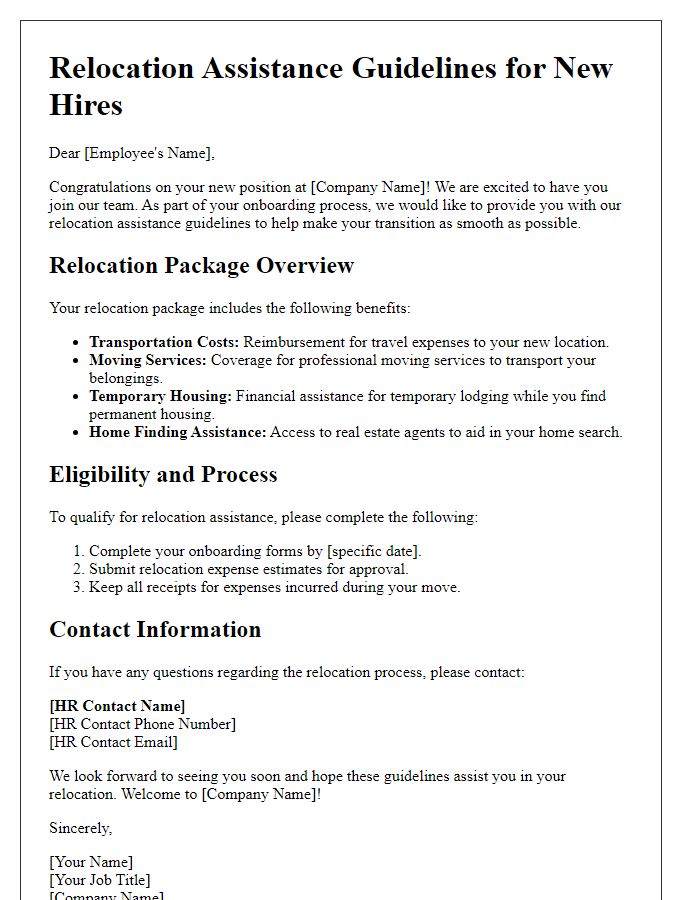

Contact Information for Assistance

Relocation assistance programs often provide essential support for employees moving to new job locations. Resources typically include financial reimbursements for relocating expenses, such as moving service costs, temporary housing allowances, and travel expenses. In various companies, a relocation coordinator (often named, e.g., John Smith or Jane Doe) serves as a point of contact, available to address inquiries or facilitate necessary arrangements. Contact information for assistance may include dedicated email addresses, such as relocation@company.com, and direct phone lines, e.g., (123) 456-7890, to ensure employees can easily access relocation support. Programs often aim to streamline the transition process, alleviating burden and ensuring a smooth relocation experience.

Comments