Navigating the world of health insurance claims can often feel overwhelming, but it doesn't have to be! Understanding the essential components of a claim letter can make the process much smoother for you. Whether you're facing a denied claim or seeking reimbursement for medical expenses, having a well-structured letter can significantly impact the outcome. Ready to dive deeper into crafting the perfect claim letter? Let's explore the key elements together!

Policy Information

Health insurance claims play a crucial role in ensuring that individuals receive financial support for medical expenses. Key components include policy numbers, which uniquely identify insurance agreements, and coverage types that specify services such as hospital stays, outpatient procedures, and prescription drugs. Various insurers, like Aetna and Blue Cross Blue Shield, may have distinct claims processes that require specific documentation, including itemized bills and medical records. Timely submission is vital, with many policies stipulating a claim submission window, typically 30 to 90 days post-service. Detailed understanding of policy limits and co-pays can significantly impact the reimbursement amount, thus facilitating smoother transitions through the complex healthcare financial system.

Detailed Description of Medical Event

A health insurance claim regarding a medical event often centers around significant incidents such as hospitalizations or surgeries. For instance, a patient named John Smith, 45 years old, was admitted to City Hospital (located in Springfield) on March 15, 2023, after experiencing severe chest pain. The attending physician diagnosed him with acute myocardial infarction (a medical term for a heart attack). The treatment involved a coronary angioplasty (a minimally invasive procedure to open blocked arteries), which took place on March 16, 2023. The total stay in the hospital lasted five days, with additional costs arising from diagnostic tests such as an electrocardiogram (ECG) and blood work. The claim submission should include itemized bills totaling approximately $25,000, detailing services rendered, medication administered, and follow-up outpatient care scheduled for April 2023.

Claim Amount and Itemized Costs

Health insurance claims are crucial financial documents that allow policyholders to seek reimbursements for medical expenses incurred. When detailing claim amounts, it's essential to provide specific figures related to each service received. Itemized costs often include charges for consultations, diagnostic tests (like MRIs or X-rays), surgical procedures, and medications. Accurate documentation of these costs ensures clarity for the insurance provider, facilitating quicker processing. Including unique identifiers such as policy numbers and claim numbers can streamline communication with the insurer and expedite the approval process. Organizing expenses chronologically can also help illustrate the nature of the medical care provided and support the request for the full claim amount.

Supporting Documentation Enclosures

Supporting documentation enclosures play a critical role in the health insurance claims process, ensuring that necessary evidence accompanies submissions for review. Key documents may include detailed medical records, including treatment notes from healthcare providers, diagnostic images such as X-rays or MRIs, itemized bills showing specific costs incurred for services, and proof of payment receipts to confirm transactions made. Additional requirements may involve completion of specific claim forms mandated by insurance companies, including all relevant dates of service and procedure codes, which provide clarity on the nature of the medical care delivered. Properly organized and submitted supporting documents greatly enhance the likelihood of prompt and favorable claim processing.

Contact Information for Follow-up

Contact information for follow-up regarding health insurance claims must be accurate and easily accessible, ensuring smooth communication. Include full name, preferably John Doe, along with a phone number formatted as (555) 123-4567 for immediate inquiries. An email address, such as johndoe@example.com, can facilitate document submission and updates. Additionally, including a physical address, like 123 Main Street, Suite 4, Anytown, State, Zip Code 12345, provides a reference for official correspondence. Clear and precise contact details reduce delays, enhancing the efficiency of the claims process and ensuring prompt responses from the insurance provider, such as Blue Cross Blue Shield or UnitedHealthcare.

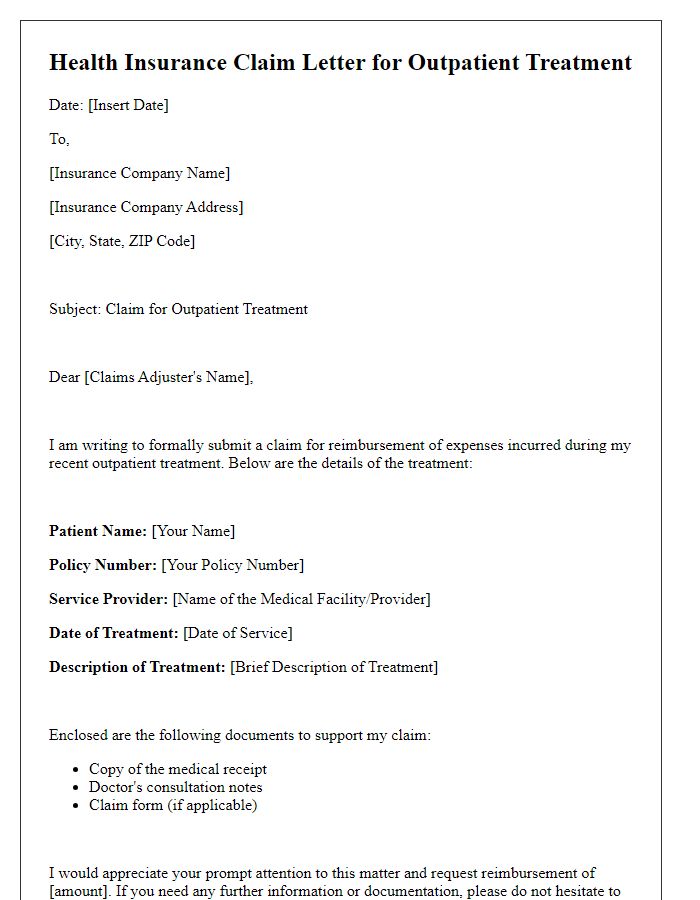

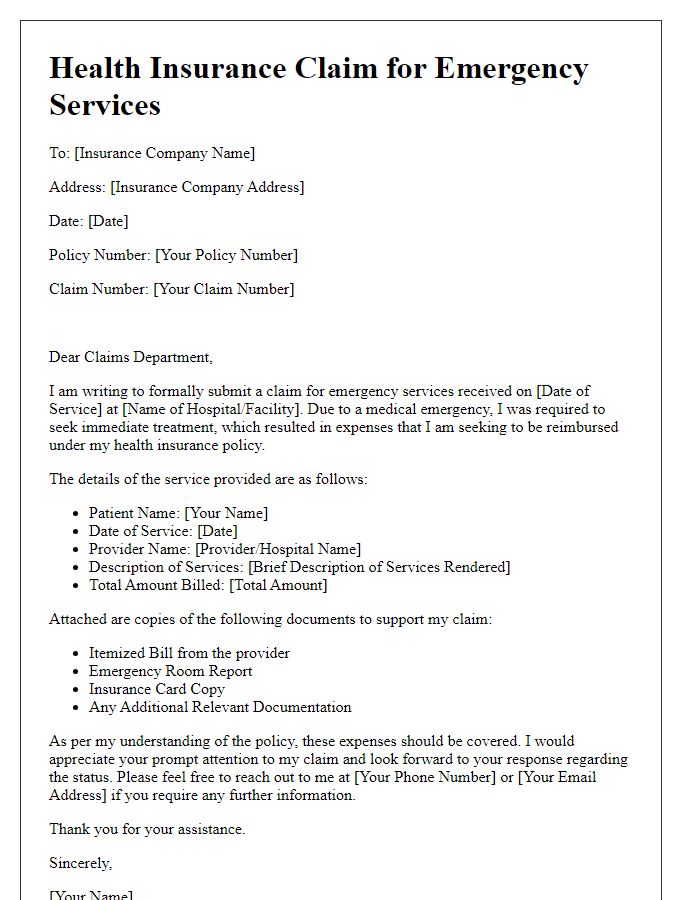

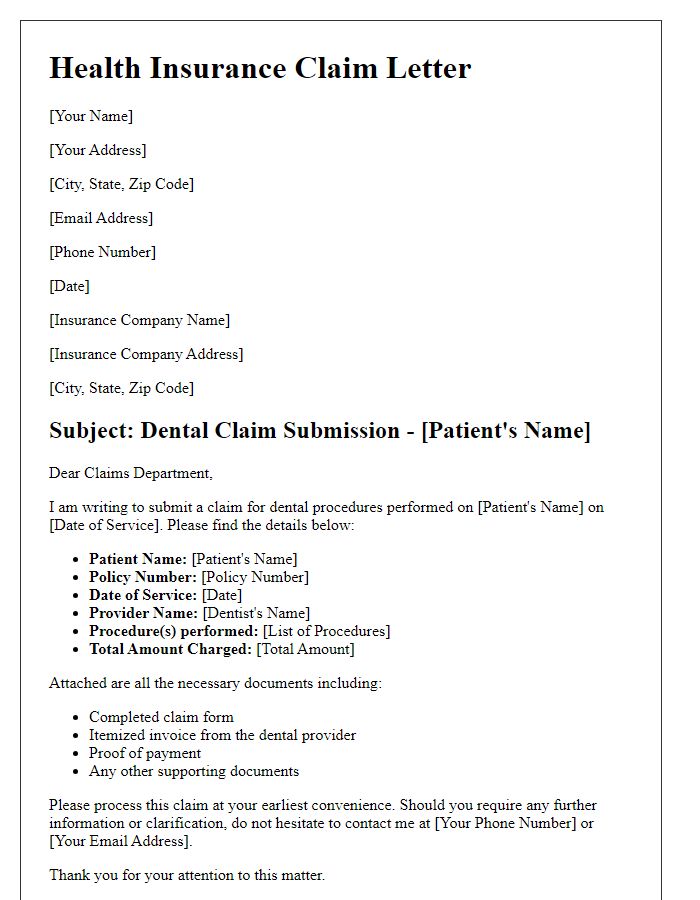

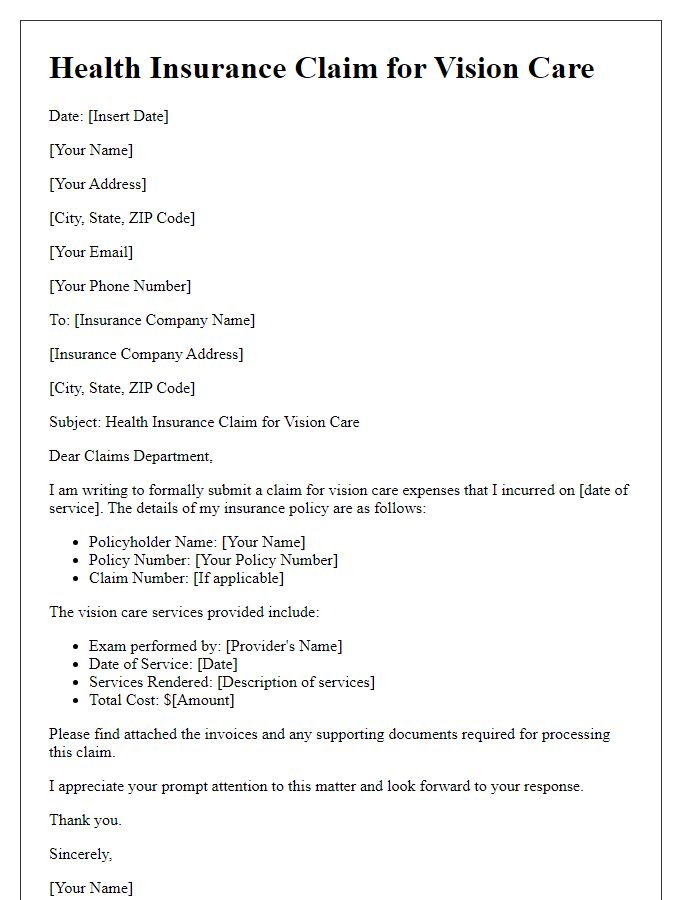

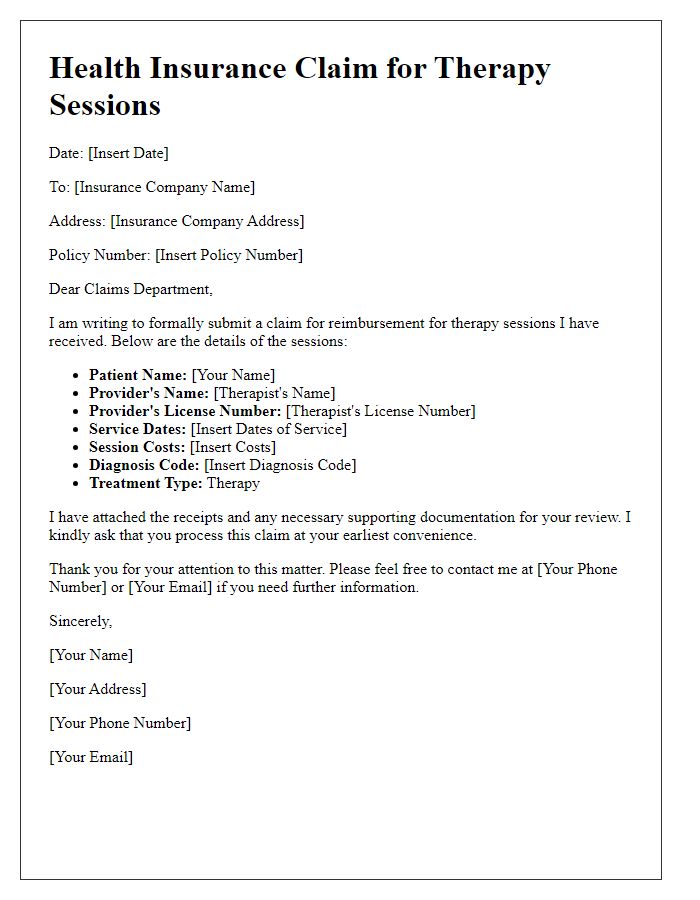

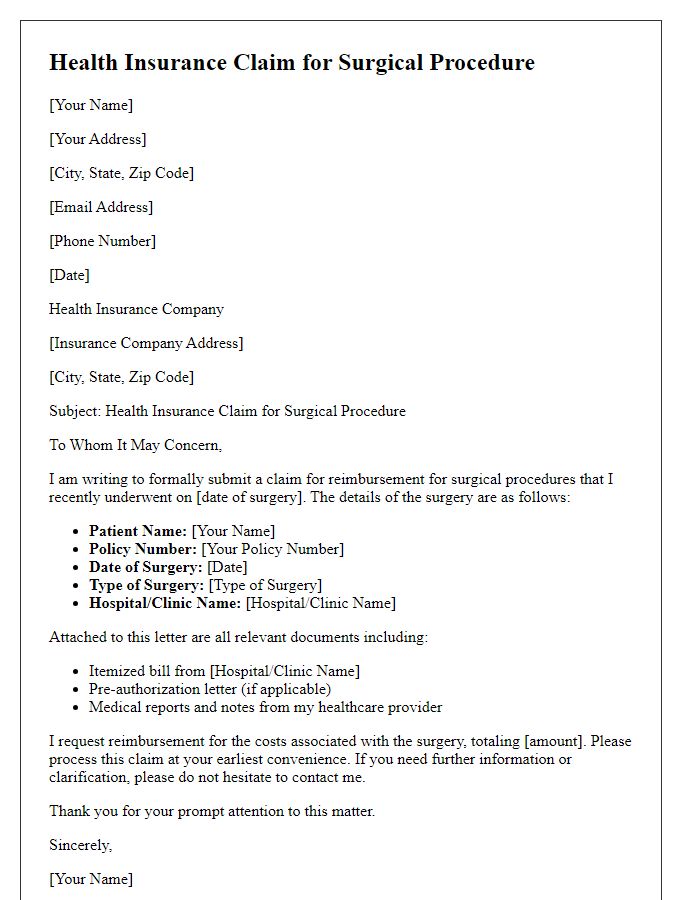

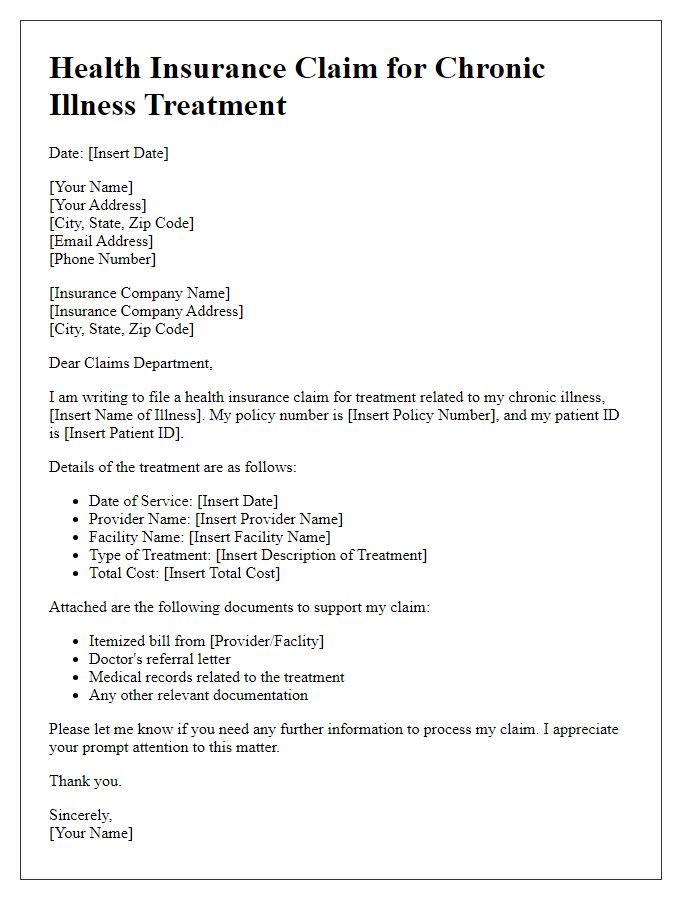

Letter Template For Health Insurance Claim Samples

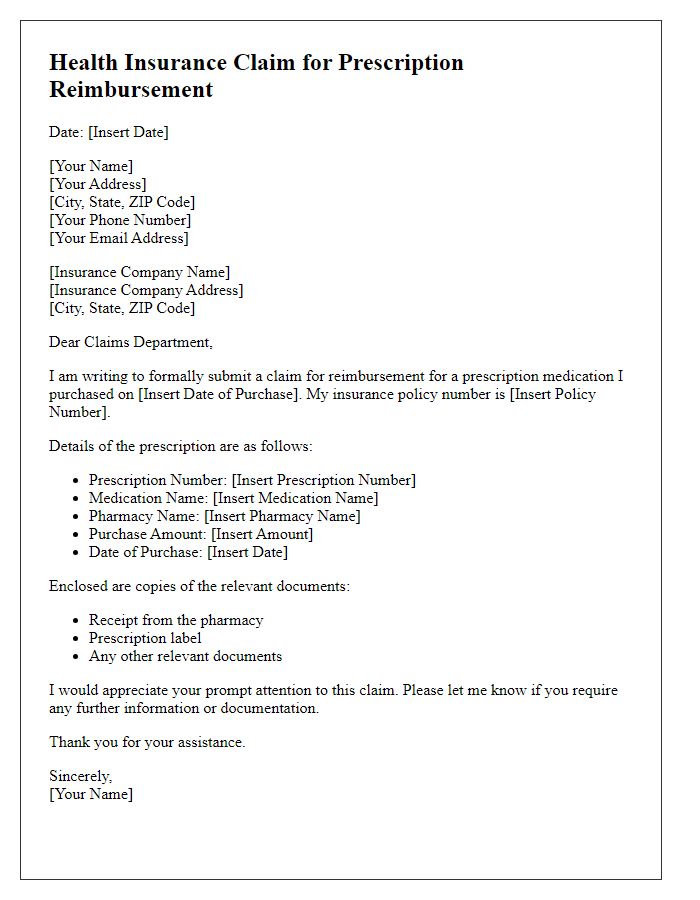

Letter template of health insurance claim for prescription reimbursement.

Comments