Are you tired of stressing over medical bills that seem to pile up? A healthcare payment plan agreement can be your saving grace, allowing you the flexibility to manage expenses without the burden of a one-time payment. This type of arrangement helps ease financial strain while ensuring you receive the care you need without delays. Curious to learn how to create the perfect payment plan? Read on!

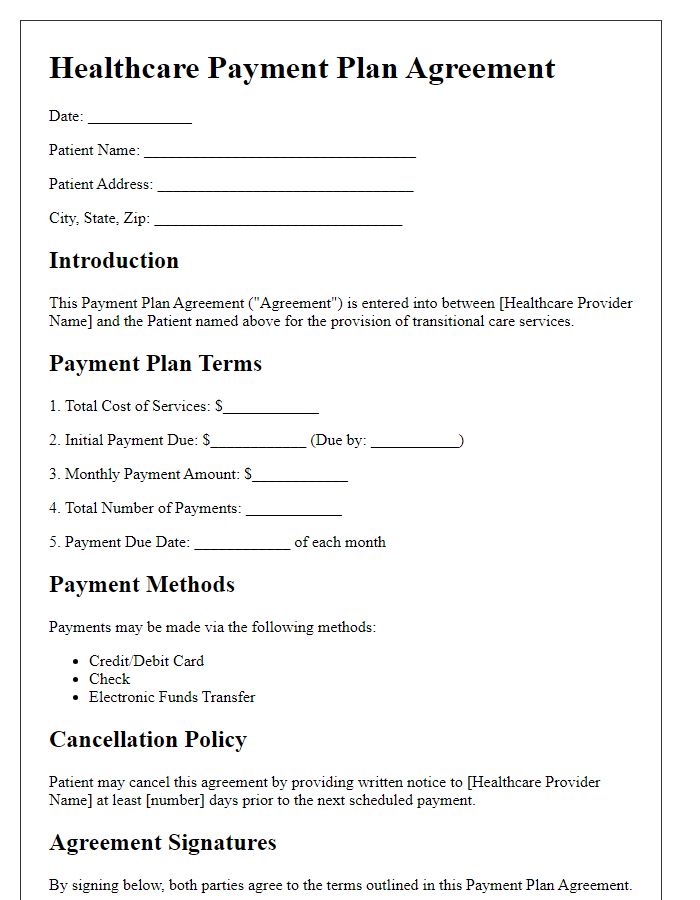

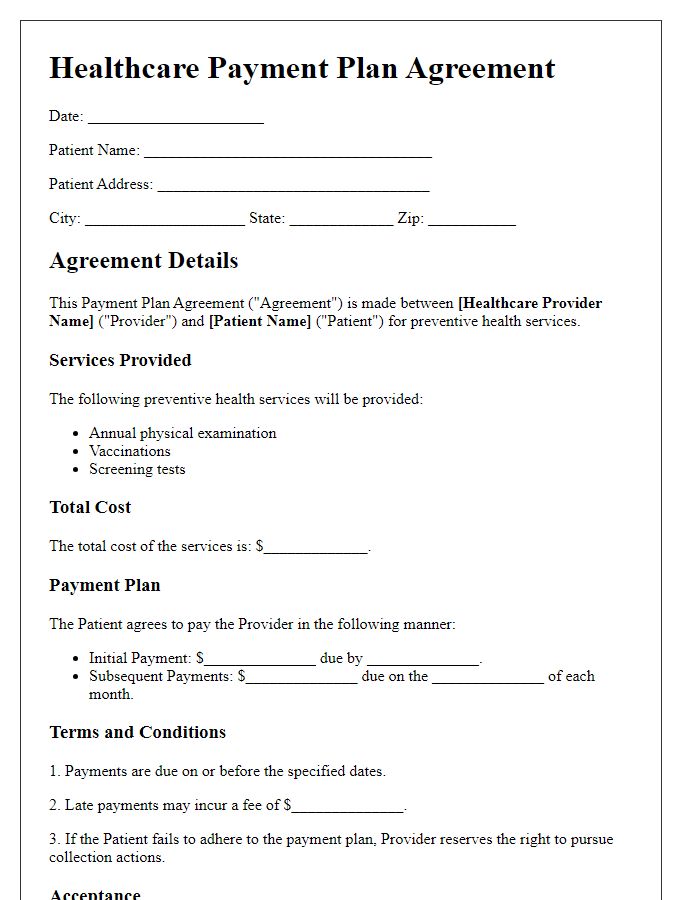

Personal Information (Names, Contact Details)

Creating a healthcare payment plan agreement necessitates detailed personal information. First, collect the full legal names of both the patient and the healthcare provider, ensuring clarity in identity. Include contact details for each party, which may consist of phone numbers, email addresses, and physical addresses for correspondence purposes. The inclusion of the patient's insurance information (if applicable) can enhance understanding of coverage limitations. Also, record the date of the agreement, establishing a timeline for the payment plan. Lastly, clearly outline key terms related to the payment schedule, interest rates, and any penalties for late payments to avoid misunderstandings in financial obligations.

Payment Terms (Amount, Schedule, Method)

A healthcare payment plan agreement outlines the structured approach patients can follow to manage their medical expenses. Typically, this agreement specifies the total amount due, such as $2,000 for a specific procedure or treatment, and breaks it down into manageable installments. Payment schedules often involve monthly payments, for instance, $200 due on the first of each month over ten months. Additionally, payment methods may include options like credit card, direct bank transfer, or check, ensuring flexibility for the patient's financial situation. This agreement serves to alleviate the burden of large medical bills while securing the healthcare provider's commitment to deliver services.

Services Covered (Details of Medical Services)

A healthcare payment plan agreement outlines the financial responsibilities of patients while ensuring access to essential medical services. This document specifies covered services, including routine exams, preventive care, surgeries, diagnostic tests, and emergency treatments in licensed healthcare facilities like hospitals or clinics. It also delineates specific procedures such as MRIs (Magnetic Resonance Imaging), lab tests, physical therapy sessions, and specialist consultations. Each service is associated with cost estimates, payment schedules, and co-payment details to foster transparency. Furthermore, the agreement may incorporate provisions regarding insurance coverage coordination, ensuring patients understand their potential out-of-pocket expenses, and outlining any financial assistance programs available based on income assessments.

Agreement Duration (Start and End Dates)

In healthcare payment plan agreements, the agreement duration is critical for both parties. The start date, typically the day after signing, marks the commencement of the payment plan. The end date, predetermined based on the total amount due and payment frequency, outlines the completion of the plan. For example, a six-month payment plan starting from January 1, 2024, would end on June 30, 2024. Clear timelines assist in financial planning for patients and healthcare providers. Patients understand their obligations, while providers can manage their expected cash flow and ensure budgetary compliance. Proper documentation of these dates prevents future disputes and fosters a transparent relationship between healthcare providers and patients.

Signatures (Patient and Provider Authorized Personnel)

The healthcare payment plan agreement outlines the financial responsibilities between the patient and the healthcare provider, detailing the payment amounts, due dates, and any potential interest rates. Patients, often residing in communities served by facilities such as hospitals or clinics, must acknowledge their obligation to settle their accounts in accordance with this plan, which is particularly important in light of rising medical expenses in the United States. Provider authorized personnel, often including billing specialists or administrative staff, are responsible for verifying the terms and ensuring compliance. Signatures from both parties indicate mutual understanding and agreement, marking the commitment to uphold the stipulated terms of the payment plan.

Letter Template For Healthcare Payment Plan Agreement Samples

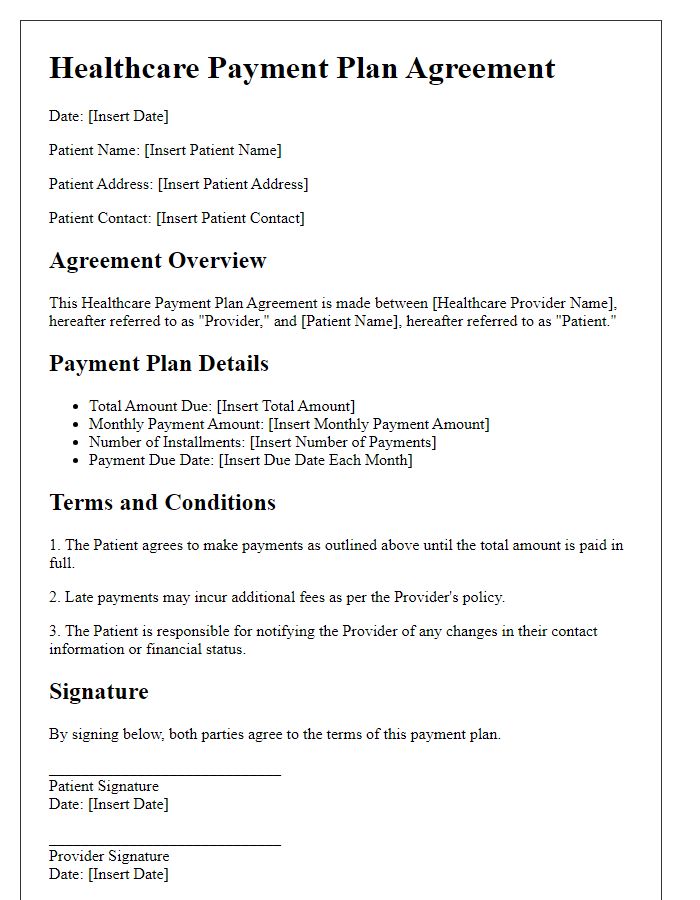

Letter template of healthcare payment plan agreement for patients experiencing financial hardship.

Letter template of healthcare payment plan agreement for uninsured patients.

Letter template of healthcare payment plan agreement for individuals with high medical bills.

Letter template of healthcare payment plan agreement for elective procedure financing.

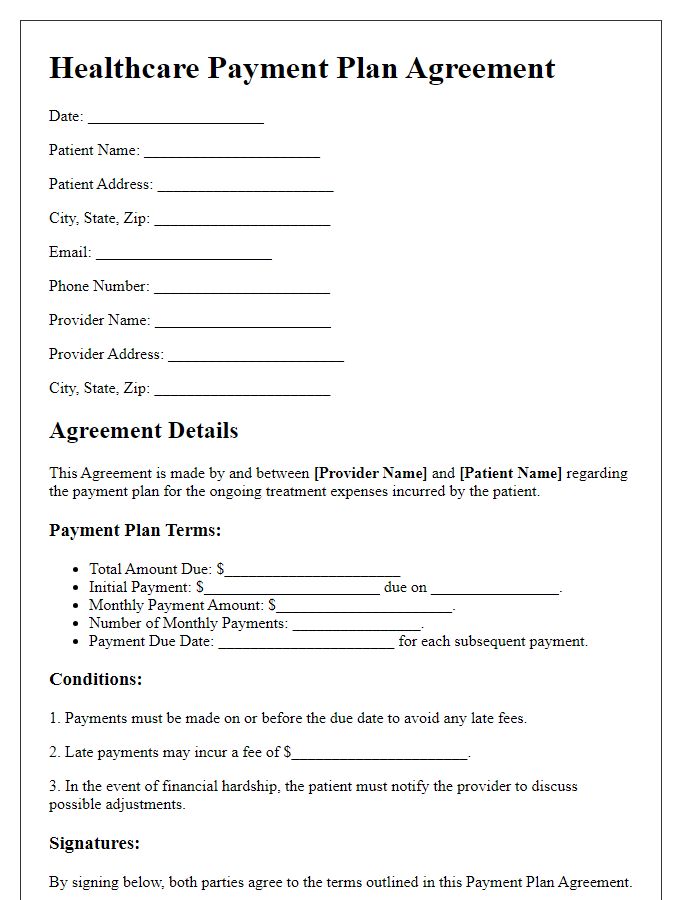

Letter template of healthcare payment plan agreement for ongoing treatment expenses.

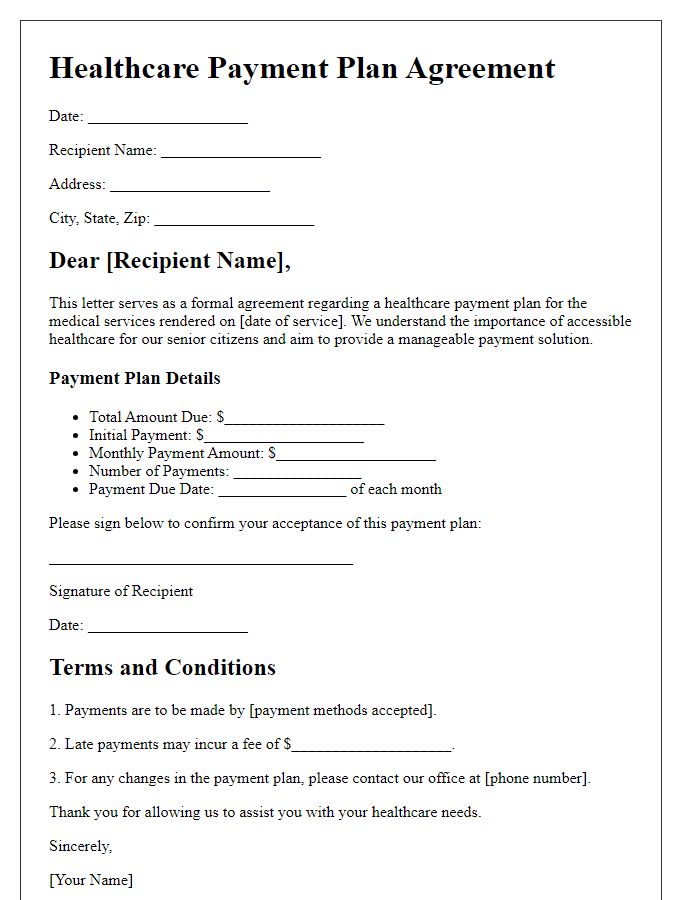

Letter template of healthcare payment plan agreement for senior citizens.

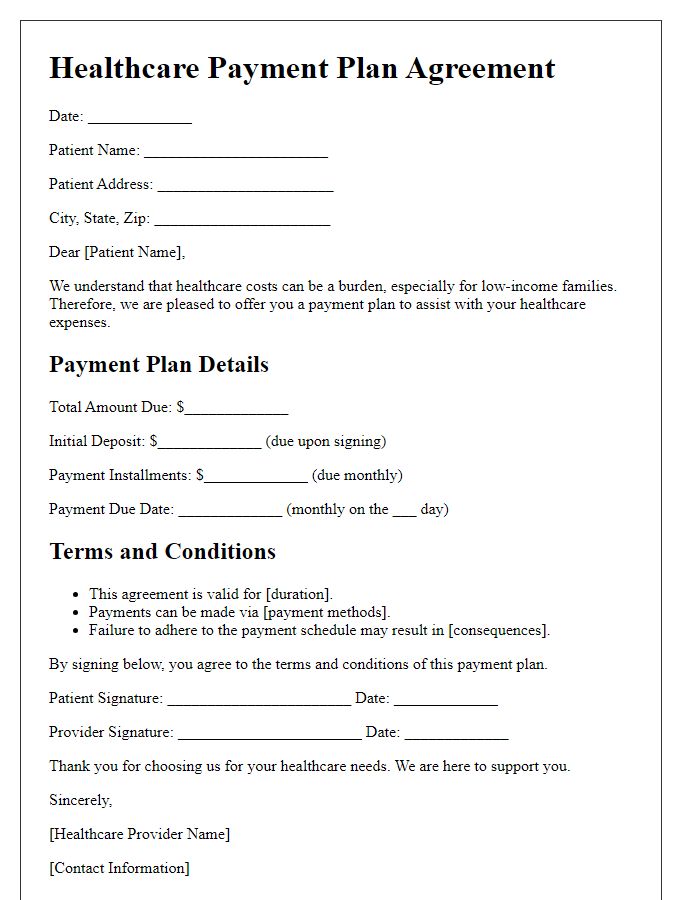

Letter template of healthcare payment plan agreement for low-income families.

Letter template of healthcare payment plan agreement for patients with chronic conditions.

Letter template of healthcare payment plan agreement for transitional care services.

Comments