Are you feeling overwhelmed by the process of submitting a health insurance claim? You're not alone! Navigating the intricacies of health insurance can be a daunting task, but understanding a well-structured letter template can simplify the experience. Let's unravel the essentials of crafting an effective health insurance claim submission letter to help you get the reimbursement you deserveâkeep reading to discover the key components you'll need!

Policyholder information

The submission of health insurance claims is vital for policyholders seeking reimbursement for medical expenses incurred during treatment. Claim forms often require specific details related to the policyholder, including full name, policy number, and date of birth. The policyholder's contact information, such as phone number and mailing address, is essential for the insurance company to communicate effectively regarding the claim status. Additionally, the type of health insurance plan, typically covering either individual or family members, should be stated clearly. The policy start date and any lapse in coverage should also be noted to validate the claim submission process. Providing accurate and detailed personal information ensures a smooth processing experience for both the policyholder and the insurer.

Insurance policy details

Health insurance claims often require thorough documentation to facilitate the reimbursement process. A health insurance policy typically includes essential details such as the policyholder's name, which identifies the individual covered under the plan. The policy number, a unique identifier assigned by the insurance provider, serves as a reference point for claims processing. Coverage start and end dates indicate the effective period of the insurance, affecting eligibility for claims. Premium amount details outline the regular payment required to maintain coverage. Additionally, providers may list co-pay and deductible amounts, reflecting the insured individual's out-of-pocket expenses for services received. Understanding these key components is vital for a seamless claims submission process.

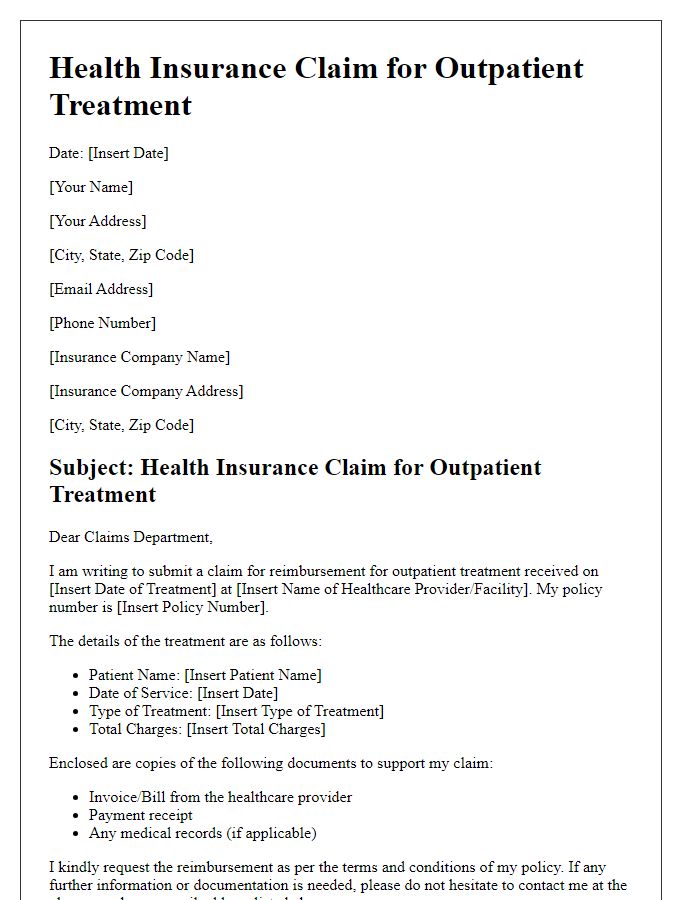

Medical service description

The detailed medical service description for health insurance claims often involves specifying the type of procedure performed, such as an MRI (Magnetic Resonance Imaging), which typically lasts around 30 minutes and is used to diagnose internal health issues. Important details include the date of the service, for instance, October 1, 2023, at St. Mary's Hospital in New York City, where the advanced imaging technology provided essential insights into potential injuries or diseases. The attending physician, Dr. Smith, noted symptoms that prompted urgent evaluation, highlighting the necessity for immediate investigation. Costs associated with this service, estimated at $1,200, should also be included for accurate reimbursement consideration when submitting the claim to the respective health insurance provider.

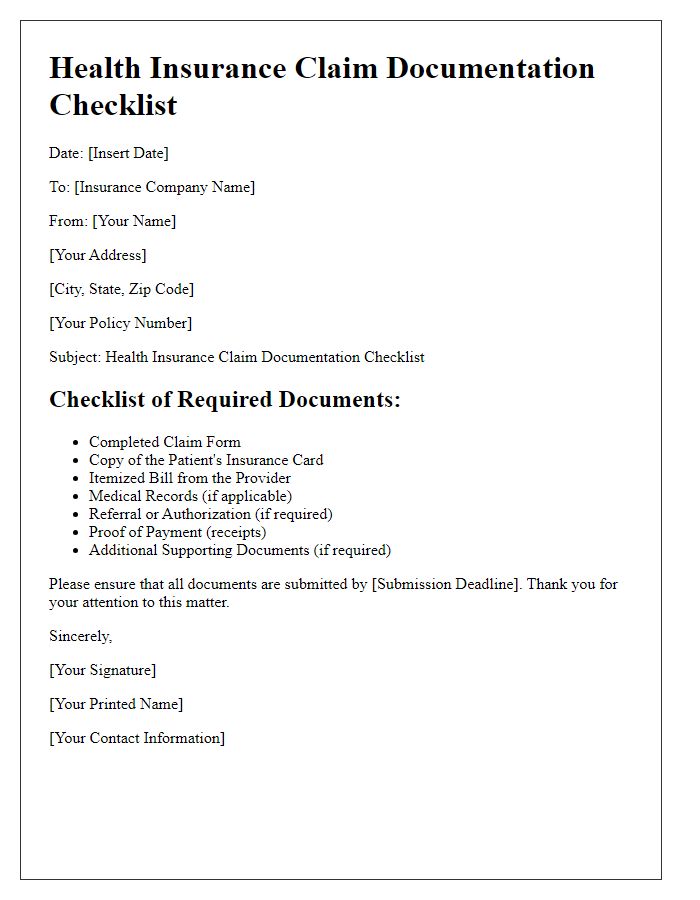

Itemized billing and documentation

To submit a health insurance claim successfully, it is essential to include itemized billing and comprehensive documentation. An itemized bill includes detailed charges related to the medical treatment provided, specifying individual services such as consultations, diagnostic tests like MRIs, or therapeutic procedures like physical therapy sessions. Documentation must include all relevant medical records, such as notes from healthcare providers, discharge summaries, and laboratory results, showcasing the necessity of treatment. Furthermore, including the date of service, procedural codes like CPT (Current Procedural Terminology) codes, and diagnosis codes, called ICD (International Classification of Diseases) codes, enhances clarity and aids the insurer in processing the claim efficiently. Properly organized submissions expedite the reimbursement process and minimize potential delays.

Claim submission instructions

Health insurance claim submission instructions require careful adherence to specific guidelines to ensure prompt processing. First, gather all necessary documentation, including policy details, patient identification, and itemized bills that specify dates of service and related medical codes. Submit claims to the insurance company, such as Aetna or Cigna, within designated timeframes, usually within 90 days after receiving treatment or incurring expenses. Use the designated claim form, often available on the insurer's website, to provide accurate and comprehensive information regarding the services received. Double-check all information for completeness to avoid delays. Remember to retain copies of all submitted documents and correspondence for future reference, especially if further communication is needed regarding the claim process.

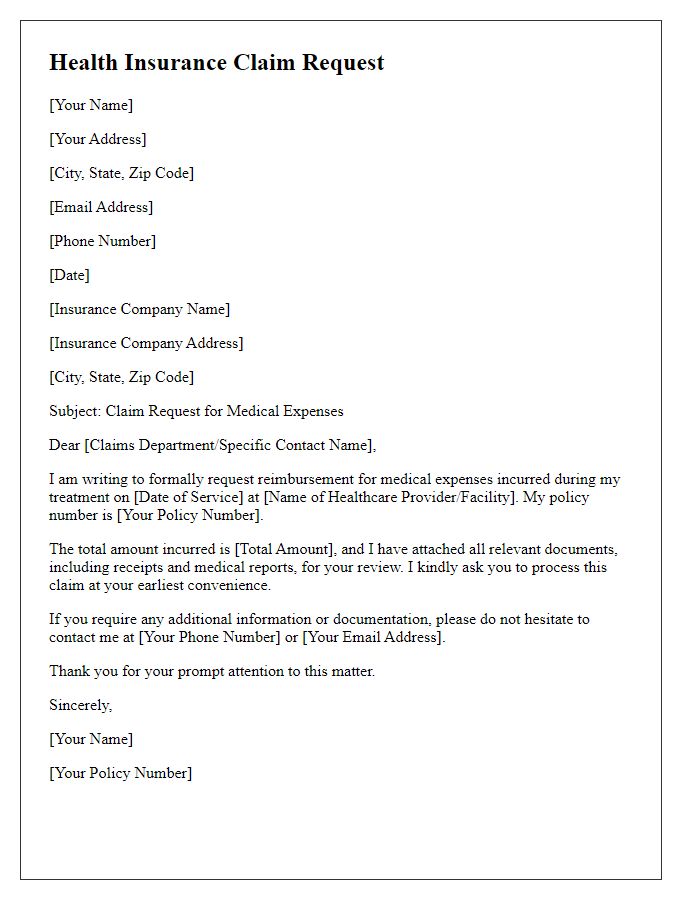

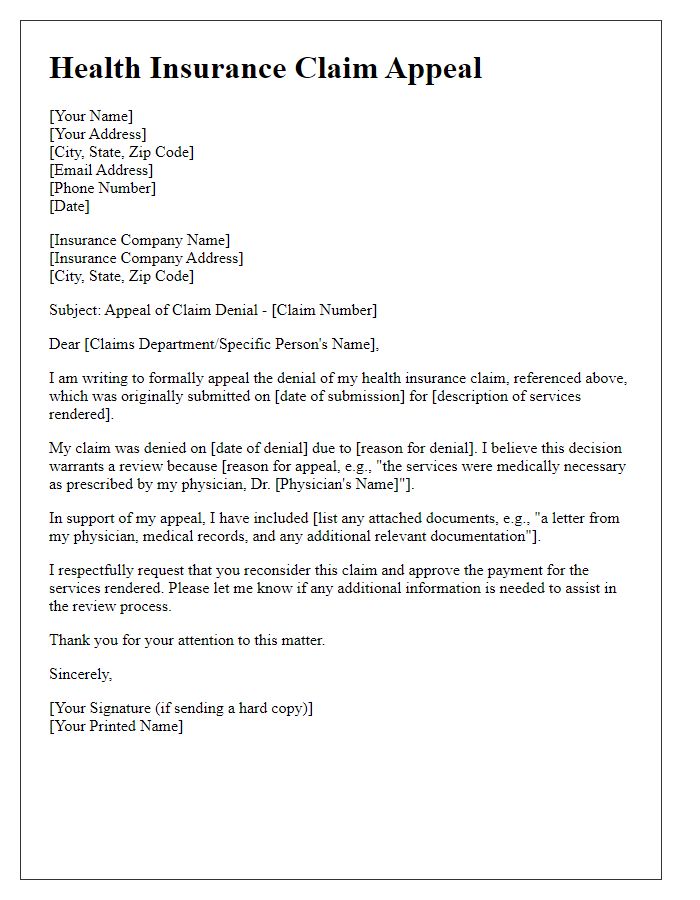

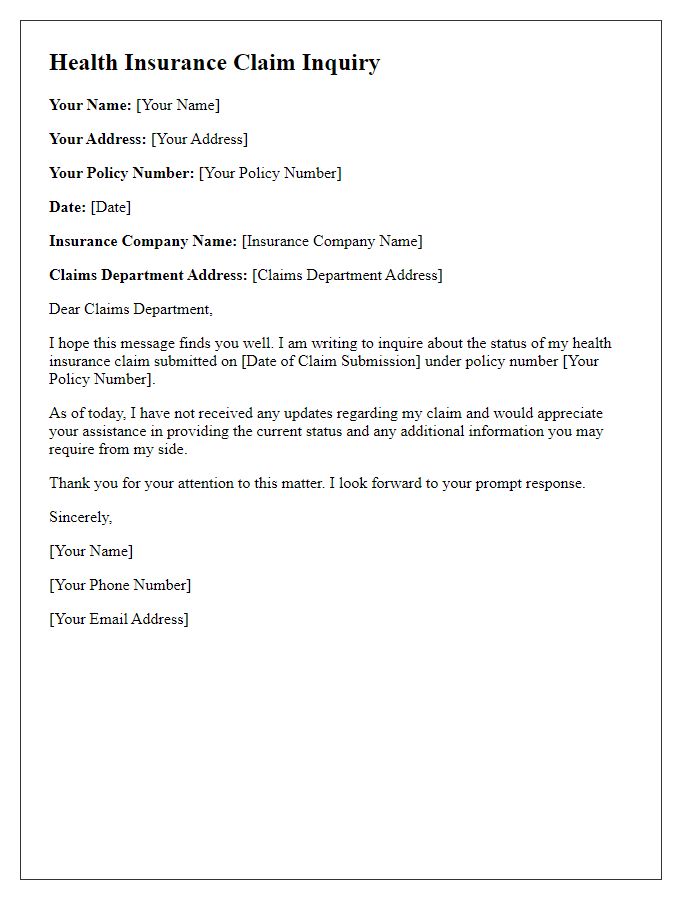

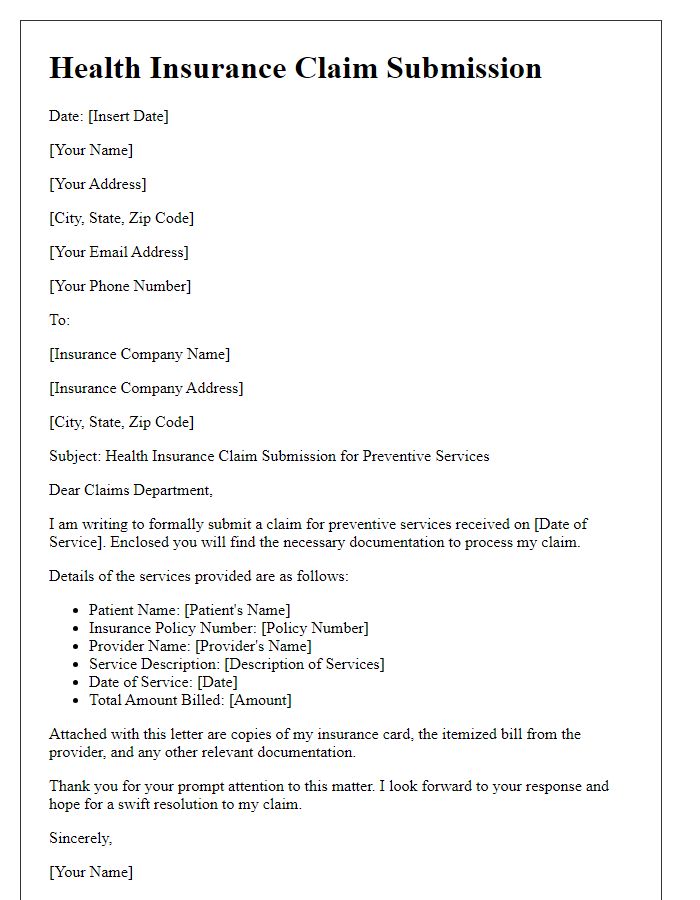

Letter Template For Health Insurance Claim Submission Samples

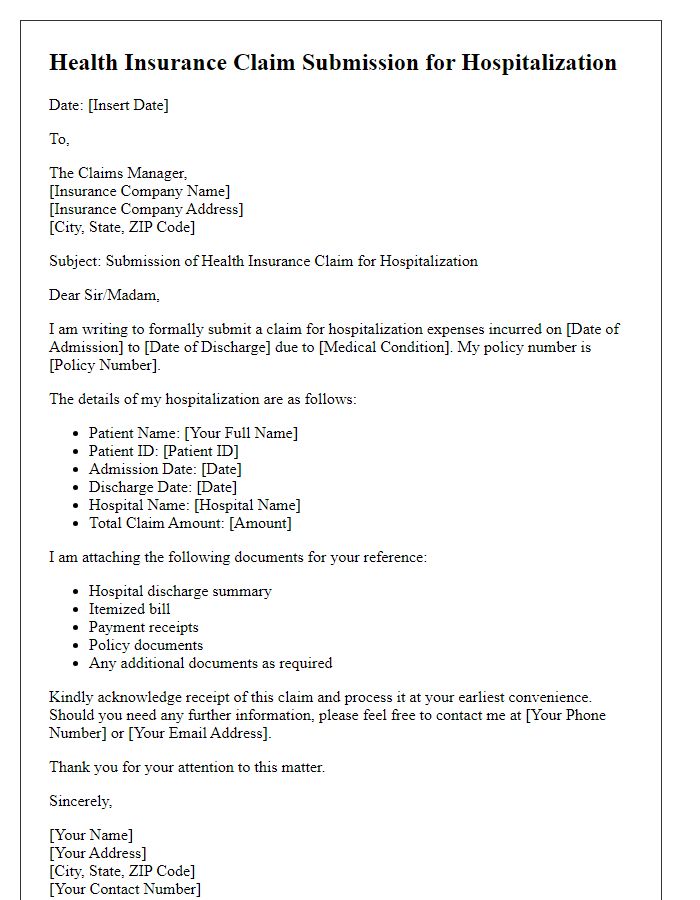

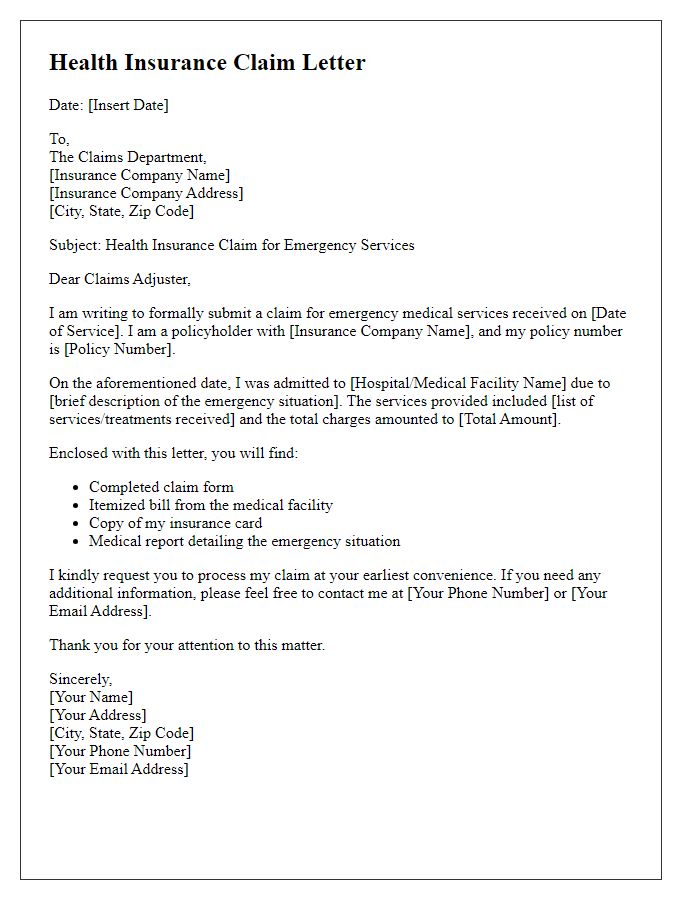

Letter template of health insurance claim submission for hospitalization.

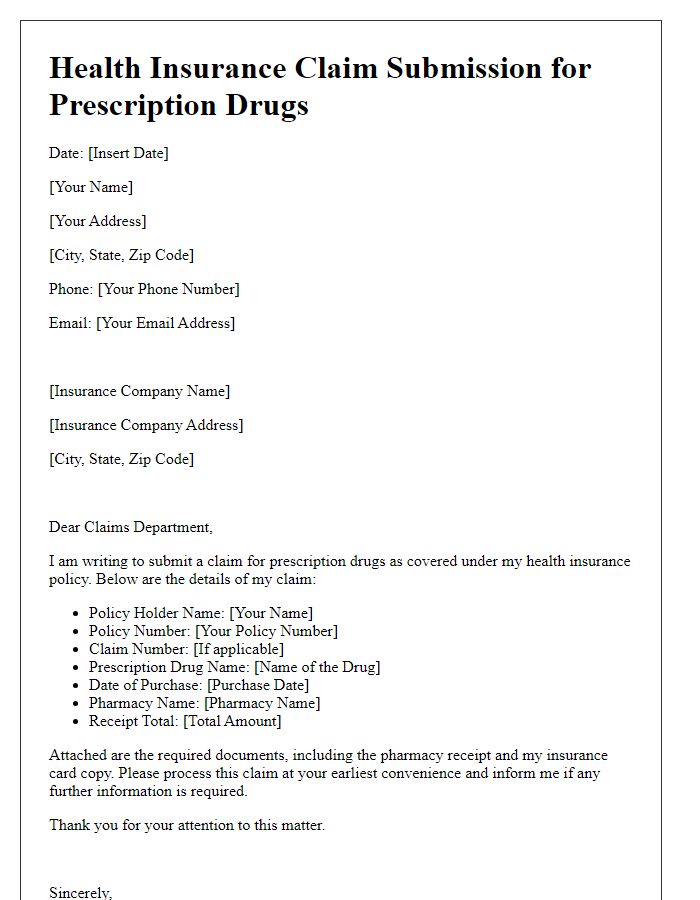

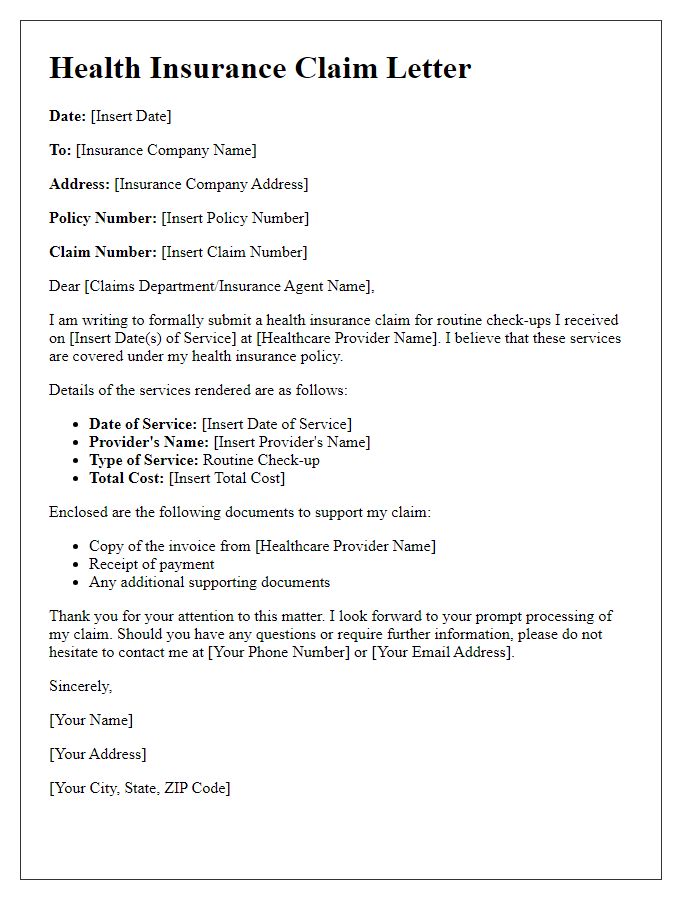

Letter template of health insurance claim submission for prescription drugs.

Comments