Navigating the world of medical insurance claims can often feel overwhelming, but it doesn't have to be. Understanding the right procedures and documentation can make a significant difference in getting the support you need. In this article, we'll break down the essential steps and provide a helpful letter template for those seeking assistance with their claims. So, if you're ready to simplify the process and ensure your medical expenses are covered, read on!

Policyholder Information

Submitting a medical insurance claim requires precise information for accurate processing. Policyholder details, including full name (as on the policy document), policy number (unique identifier provided by the insurance company), contact information (phone number and email address for correspondence), and date of birth (to verify identity), must be included. Additionally, providing specific details about the medical treatment, such as the healthcare provider's name, diagnosis code (ICD-10 for billing), treatment date, and total cost (itemized statement) enhances clarity and expedites the claims process. Documenting these elements ensures that claims are reviewed efficiently, increasing the likelihood of timely reimbursement.

Policy Number and Details

Medical insurance claims often involve submitting specific information related to the policy number and other pertinent details. Key aspects may include the policyholder's personal identification, such as full name, date of birth, and contact information. The policy number serves as a unique identifier for the insurance plan, allowing the claims department to access the account efficiently. Detailed descriptions of medical services received, including dates of treatment, healthcare provider names (such as XYZ Hospital), and specific procedures (like MRI scans or surgeries), should be included for clarity. Supporting documents, such as itemized bills, diagnostic reports, and referral letters, are essential for substantiating claims. Timely submission before the policy's deadline one year from the service date is crucial to ensure eligibility for coverage.

Description of Medical Event

Patients often experience various medical events requiring insurance claims. One common scenario involves a surgical procedure at a well-known hospital, such as Mercy General Hospital, where a patient underwent an appendectomy due to acute appendicitis diagnosis. The surgery, performed by Dr. Jane Smith, a board-certified surgeon, took place on March 15, 2023. The procedure lasted approximately 90 minutes, following pre-operative assessments and anesthesia administration. Post-surgery complications, including infection, necessitated a two-day hospital stay for monitoring and treatment, incurring additional costs. The total medical expenses reached $15,000, encompassing surgical fees, anesthesia, hospital accommodation, and medications. Submission of insurance claim for coverage is imperative to alleviate financial burden associated with this unexpected healthcare event.

Itemized Billing and Receipts

An itemized billing statement is essential for medical insurance claims, detailing each service provided during a patient's visit. For instance, emergency room visits can range from $150 to $3,000 based on treatment complexity. Receipts should include the service provider's name, facility name such as Mercy Hospital, and date of service, specifying items like diagnostic tests (e.g., X-rays costing approximately $200), physician consultations averaging $100, or surgical procedures. Each entry must show corresponding procedure codes, crucial for reimbursement processing. Supporting documents, such as pre-authorization notices from insurance providers, enhance the claim's validity, ensuring that eligible expenses are accounted for in insurance settlements.

Relevant Medical Documentation

Relevant medical documentation plays a crucial role in the medical insurance claim process, ensuring that all necessary information is submitted for a successful reimbursement. Essential documents include detailed medical records from healthcare providers, such as hospital discharge summaries, laboratory test results, and imaging studies, which provide evidence of diagnosis and treatment. Additionally, itemized billing statements from medical facilities outline specific charges for services rendered, while prescriptions and pharmacy receipts verify medication costs. Documentation should also feature dates of service, provider information, and any insurance policy numbers, as these elements are vital for accurate processing of claims by insurance companies like Blue Cross Blue Shield or Aetna. Timely submission of complete and organized documentation can significantly enhance the chances of quick approval and payment for medical expenses.

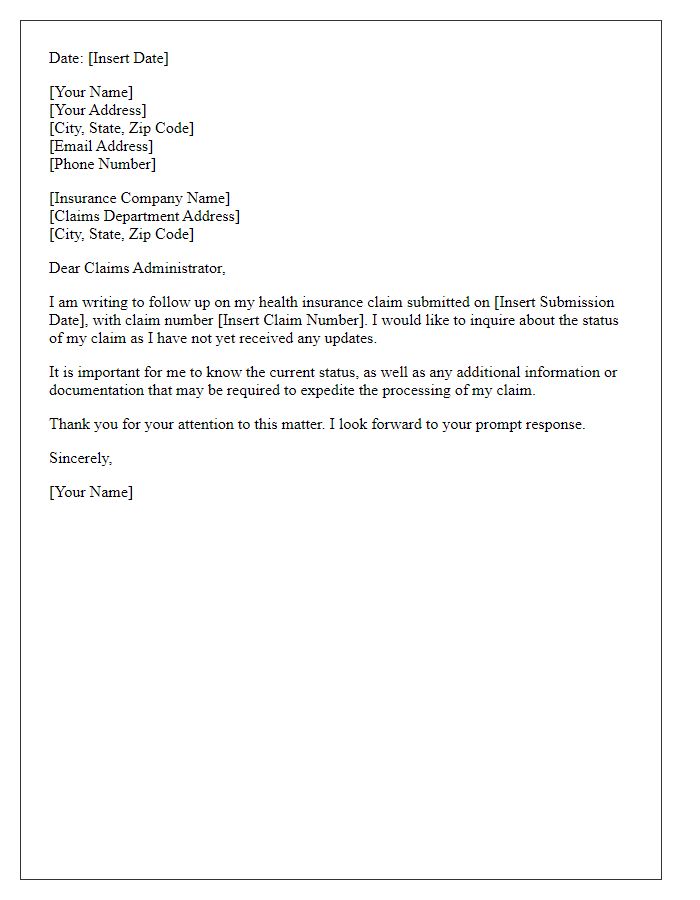

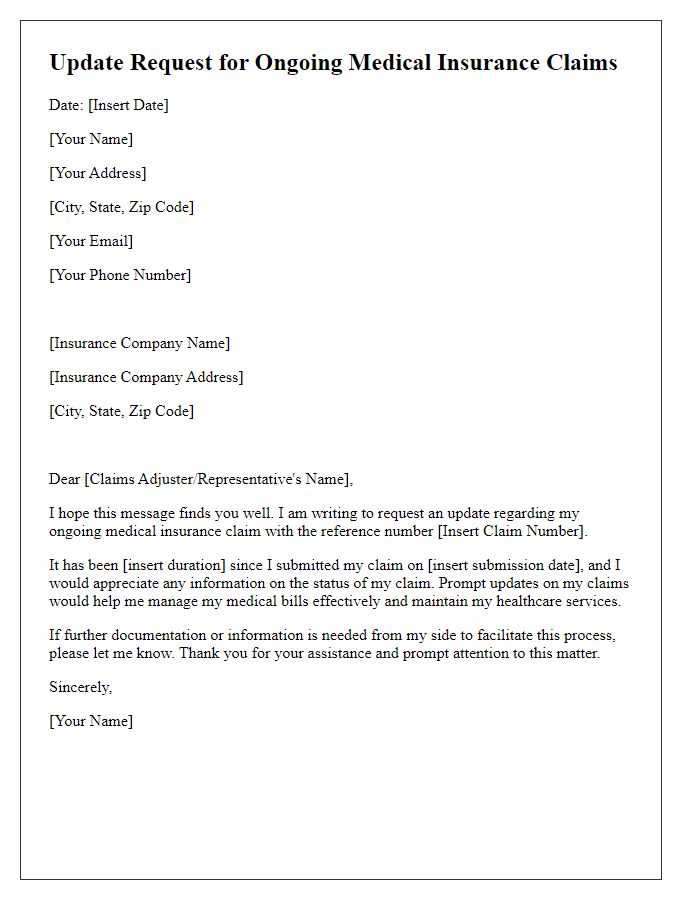

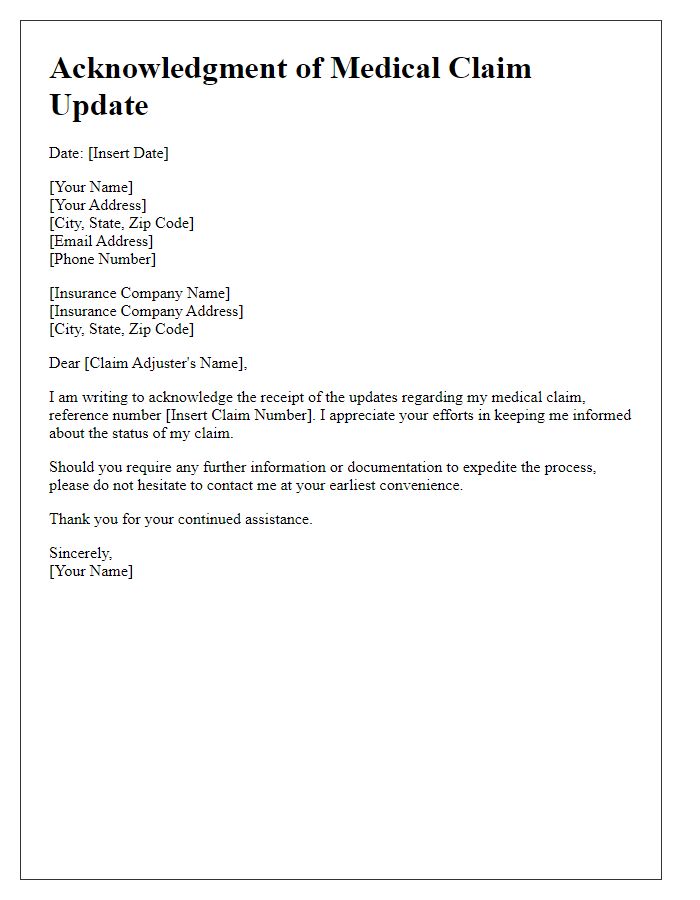

Letter Template For Medical Insurance Claim Assistance Samples

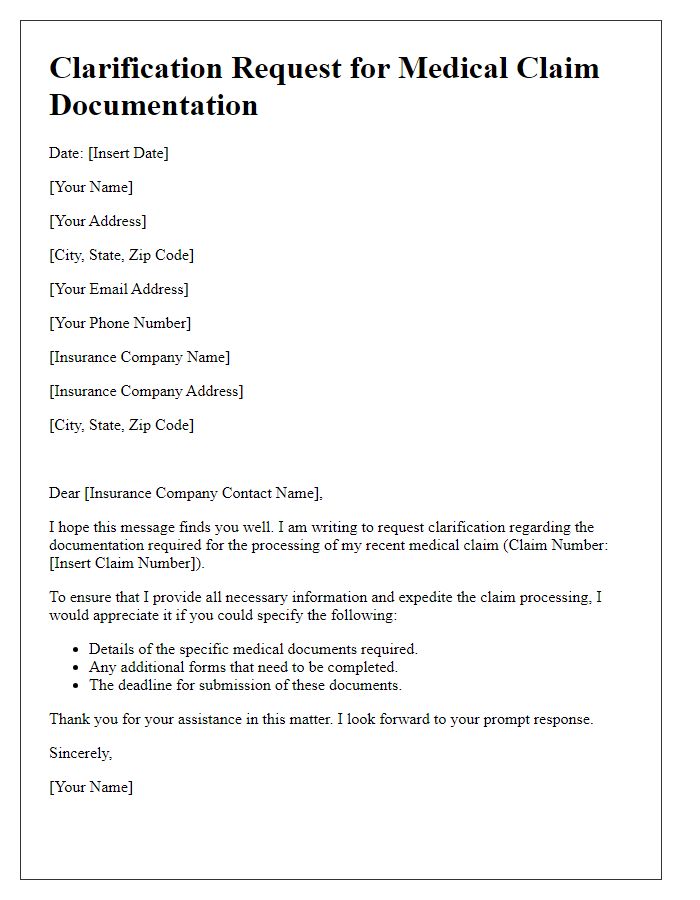

Letter template of clarification request for medical claim documentation

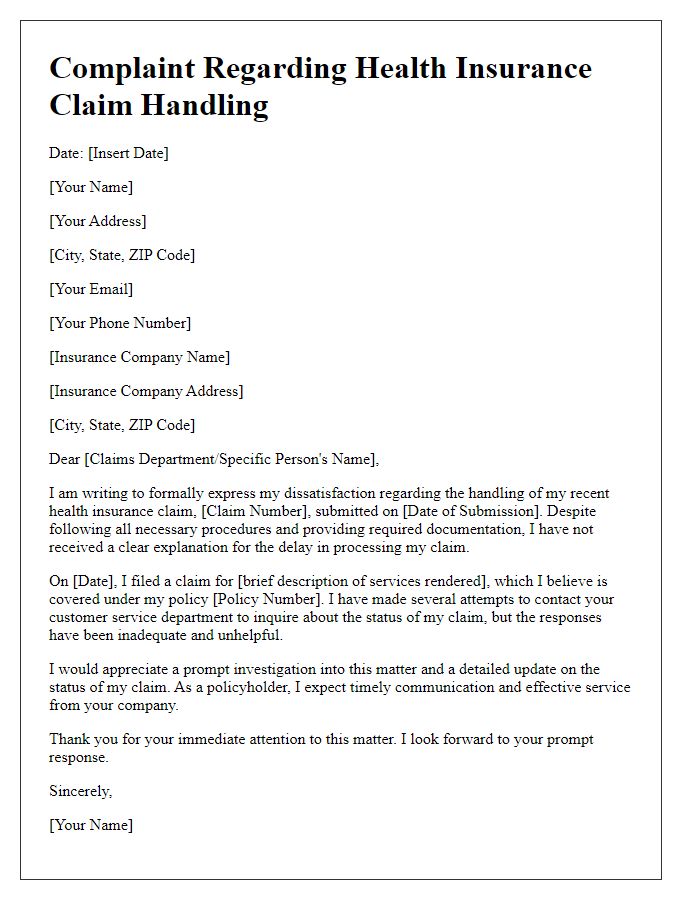

Letter template of formal complaint about health insurance claim handling

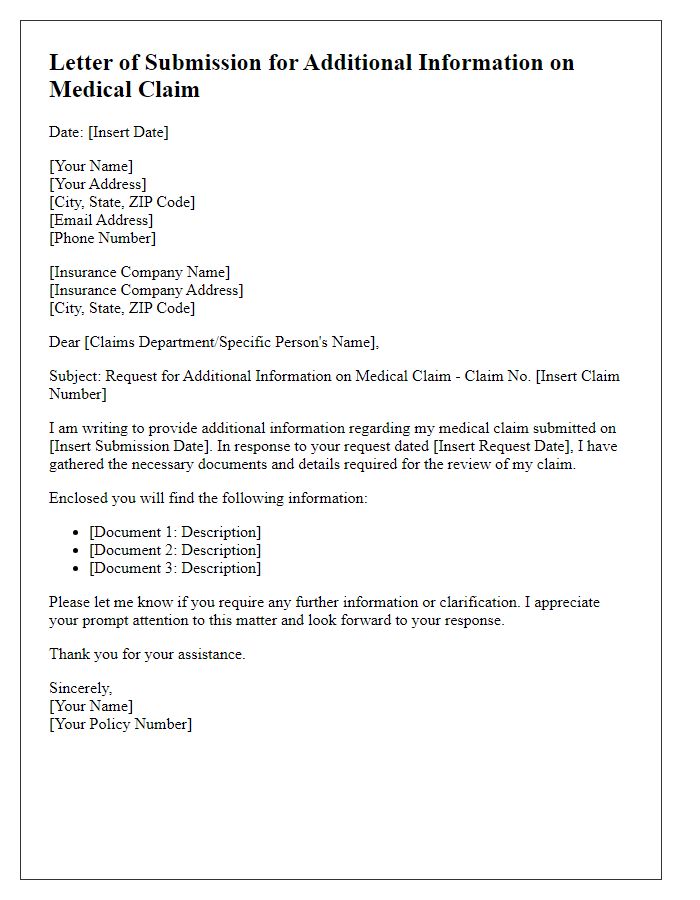

Letter template of submission for additional information on medical claim

Letter template of notification for health insurance claim reimbursement

Comments