If navigating the world of healthcare reimbursement has left you feeling overwhelmed, you're not alone. Many individuals face challenges when seeking to understand their coverage options and the reimbursement process. It's crucial to effectively communicate your needs and concerns to your insurance provider, and having the right letter template can make all the difference. So, let's dive deeper into how you can craft a compelling inquiry letter that gets results!

Patient Information

Patient information includes essential details regarding the individual seeking reimbursement. This encompasses full name, date of birth (often formatted as MM/DD/YYYY), and current address (including street, city, state, and zip code). Health insurance information, such as policy number and provider name, is crucial for processing claims effectively. Additionally, the procedure or service date, diagnostic codes (often listed as ICD-10 codes), and itemized billing statements are necessary to support the reimbursement request. Proper documentation, including any referral or authorization letters from healthcare providers, can significantly expedite the review process by insurance companies.

Treatment Details

Healthcare reimbursement inquiries often require detailed treatment information to facilitate the claims process. Patients should specify the type of treatment received, including names of procedures such as outpatient surgery or diagnostic testing, dates of service highlighting the exact timing of treatments, and the healthcare provider's name (e.g., Dr. Jane Smith, MD) to ensure accurate identification. Including the location of treatment, like St. Mary's Hospital, can also aid in processing. Additionally, insurance information should include policy numbers and group numbers for verification. Clear details about any co-pays, deductibles, and billing amounts enhance clarity, ensuring that the reimbursement assessment can be conducted efficiently.

Insurance Policy Number

Healthcare reimbursement inquiries often involve essential details such as insurance policy numbers, which identify individual coverage plans. Specifics can include the date of service, the type of procedure or treatment provided, and the healthcare provider's information. For instance, a policy number might be tied to insurance companies like Blue Cross Blue Shield or Aetna, which have numerous guidelines for reimbursement under various circumstances. Ensuring accurate documentation is critical; missing or incorrect policy numbers can delay claims processing or result in denied requests. Providing detailed information on covered services and exploring appeal processes can enhance the likelihood of favorable outcomes in reimbursement inquiries.

Reimbursement Amount Requested

Healthcare reimbursement inquiries require precise documentation to ensure accurate processing. Typically, a reimbursement amount requested should detail specific expenses incurred, including medical services received on dates such as January 15, 2023, and February 20, 2023, during visits to hospitals like Midwest General Hospital and Lakeview Medical Center. Include acceptable medical codes, such as CPT codes (Current Procedural Terminology), alongside a detailed breakdown of costs for consultations, prescriptions, and laboratorial tests. Documentation must also reference policy numbers and specific claim forms submitted, such as those required by insurers like Blue Cross Blue Shield and UnitedHealthcare, to facilitate efficient resolution of claims and ensure prompt reimbursement processing.

Supporting Documentation

Healthcare reimbursement inquiries often require supporting documentation to ensure proper processing and approval. Items such as itemized billing statements, Explanation of Benefits (EOB) from insurance providers, medical records showing the necessity of services, and copies of referral letters are critical for validating claims. Providers must include specific details like treatment dates, procedural codes (CPT codes), and descriptions of the services rendered. Furthermore, patient identification numbers and insurance policy details are essential for matching claims with the correct accounts, facilitating a smoother reimbursement process. Ensuring all documentation is accurate and comprehensive can significantly enhance the likelihood of timely reimbursements.

Letter Template For Healthcare Reimbursement Inquiry Samples

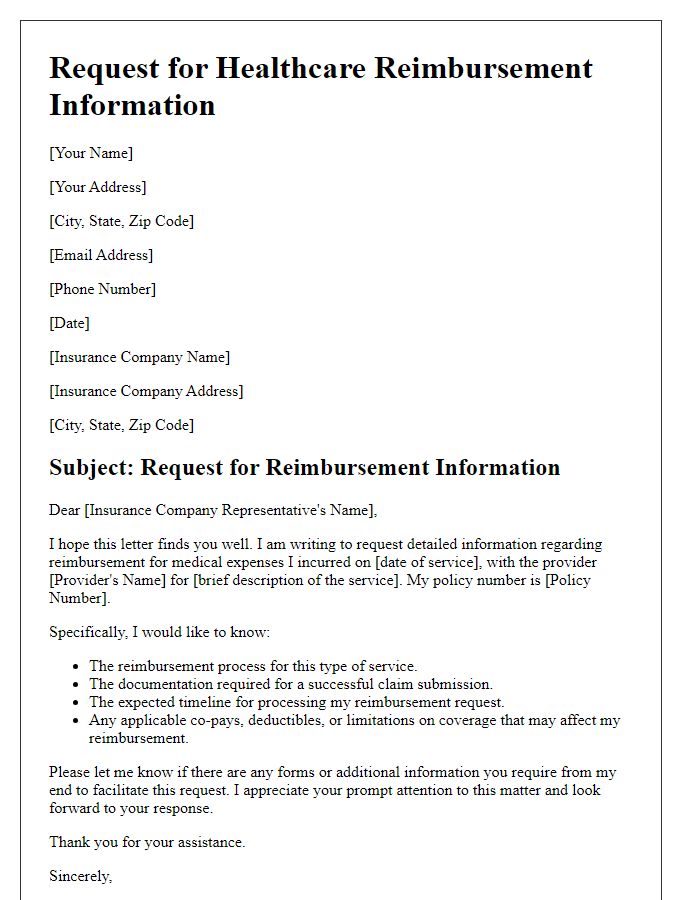

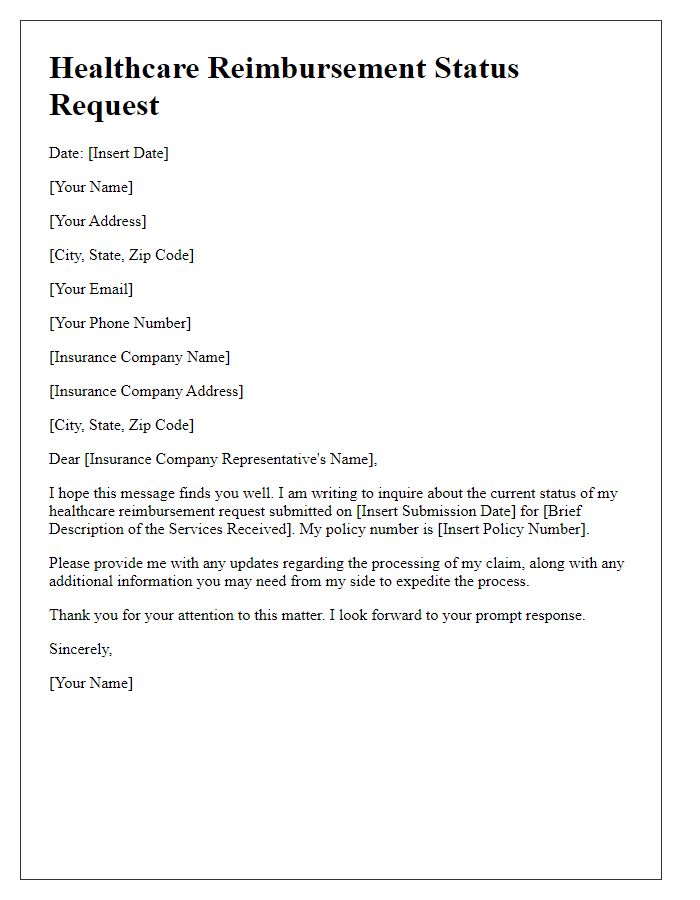

Letter template of detailed request for healthcare reimbursement information

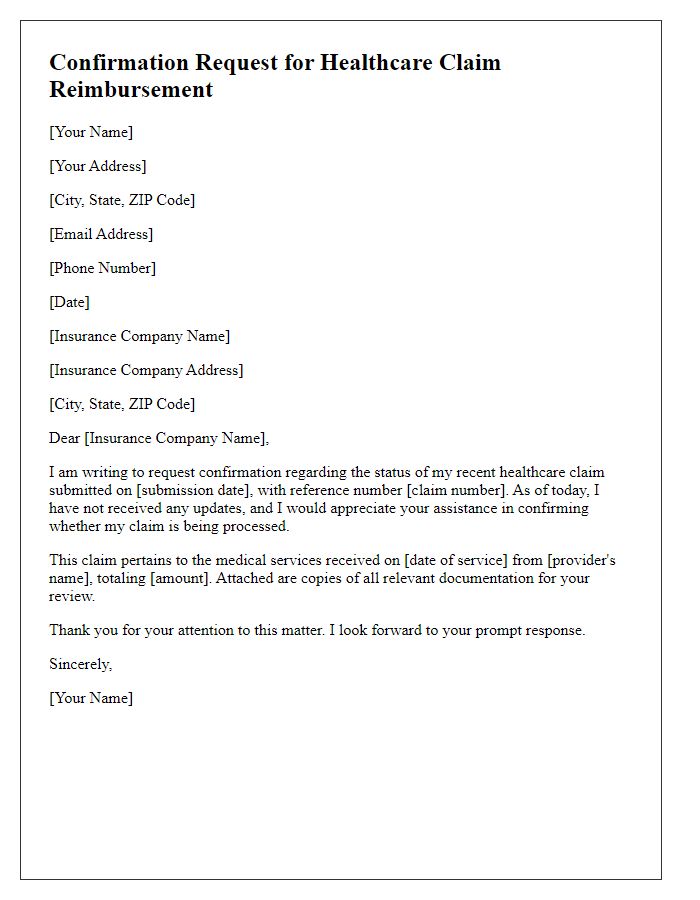

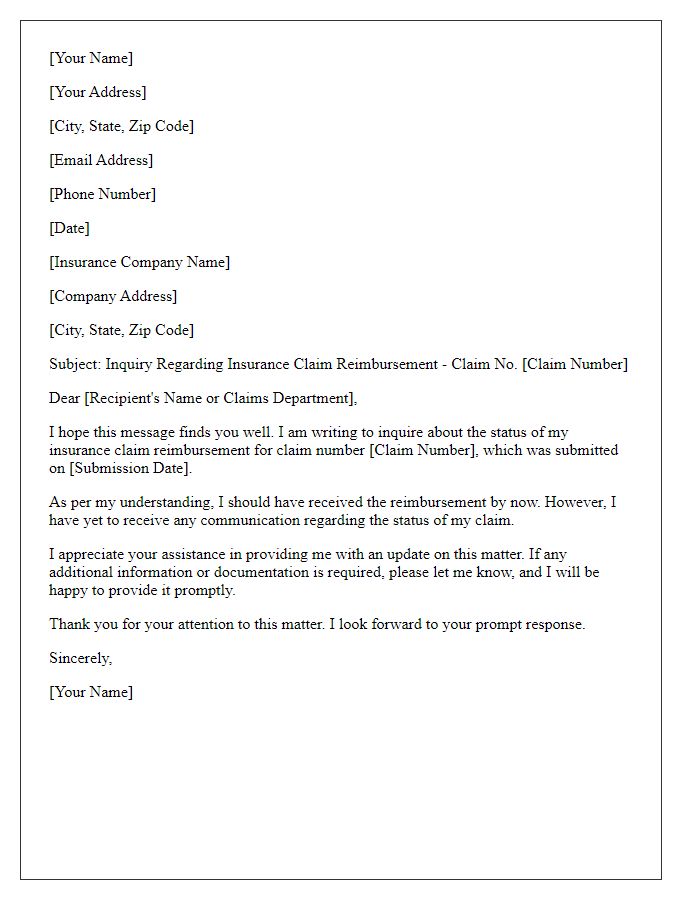

Letter template of confirmation request for healthcare claim reimbursement

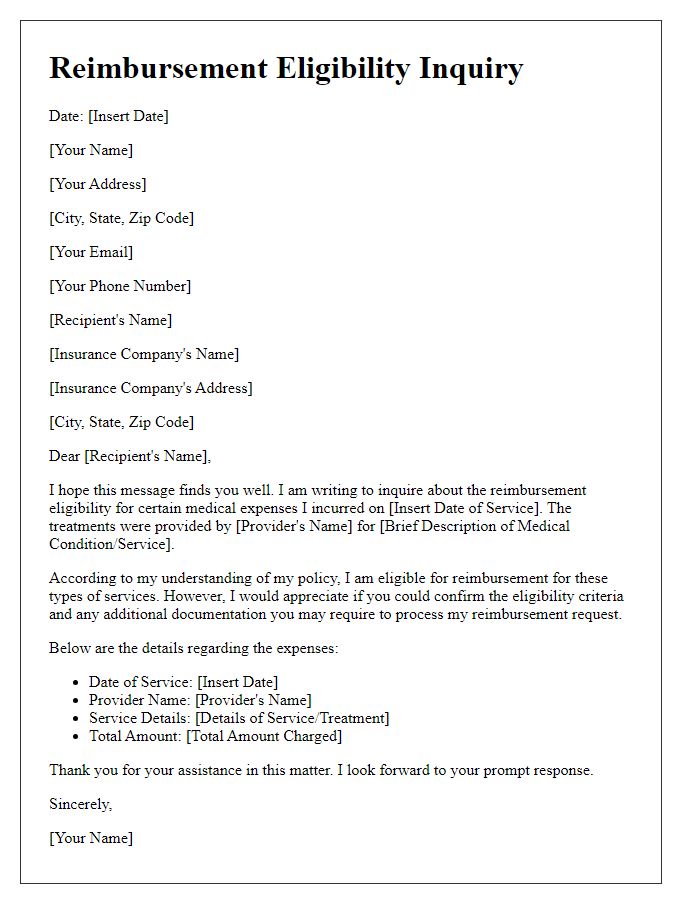

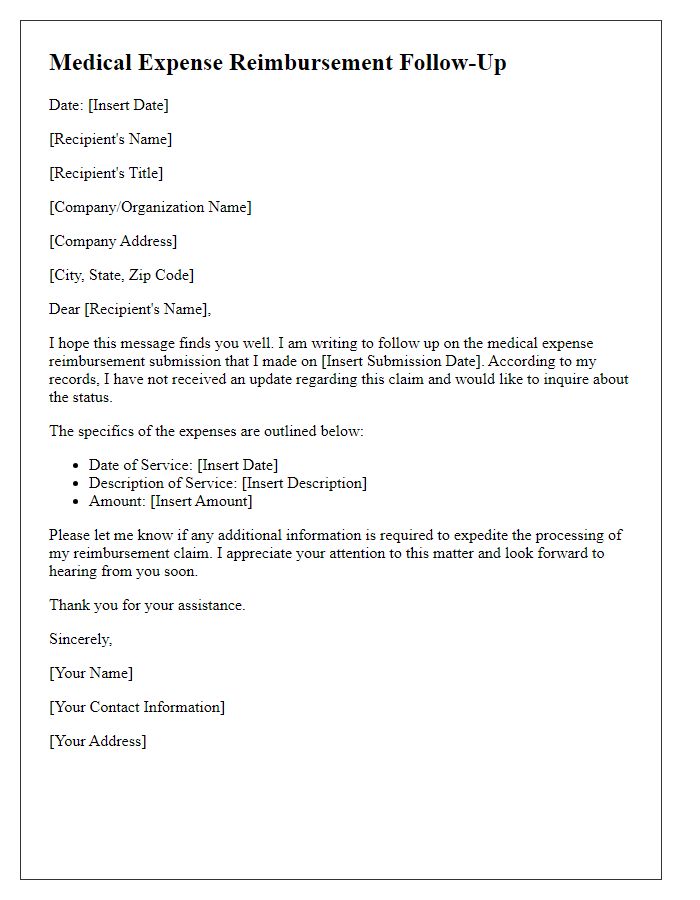

Letter template of reimbursement eligibility inquiry for medical expenses

Comments