Are you passionate about empowering individuals with the knowledge they need to achieve financial independence? Our financial literacy program is dedicated to equipping people with essential skills that can transform their lives. We're hosting a fundraiser to support this vital initiative, and your involvement could make a significant impact. Join us in making a difference and read on to discover how you can help us build a financially literate community!

Persuasive Call to Action

Financial literacy programs can empower individuals with essential money management skills, fostering better life choices and economic stability. Initiatives like the 2023 Financial Empowerment Summit in San Francisco aim to educate diverse communities. A successful fundraising effort of $50,000 is crucial to provide workshops, resources, and mentorship to over 500 participants. Engaging local businesses and educational institutions can create partnerships that enhance program effectiveness. Highlighting success stories from past participants shows tangible benefits of financial literacy. Fostering a culture of informed financial decisions can lead to improved credit scores, increased savings, and overall community growth. Supporting this cause directly impacts lives and builds a financially aware society for the future.

Clear Program Objectives

A financial literacy program fundraiser focuses on enhancing individuals' understanding of money management, budgeting, investment, and credit. The primary objective includes empowering community members with essential financial skills to make informed decisions, ultimately reducing debt levels. Additionally, the program aims to provide resources that promote savings and investment strategies to improve participants' financial stability. Workshops and interactive sessions will cater to various demographics, ensuring accessibility for low-income families and young adults. Collaboration with local schools and community centers will amplify outreach efforts, ensuring maximum participation in the program. Through these initiatives, the program seeks to foster a financially knowledgeable community capable of achieving long-term financial health.

Defined Target Audience

The financial literacy program targets young adults aged 18 to 24, residing in urban areas such as Los Angeles, Chicago, and New York. This demographic often faces challenges in managing personal finances, including budgeting, saving, and understanding credit. Events like the National Financial Literacy Month (April) highlight the urgent need for education in financial management. Participants benefit from workshops held in community centers, emphasizing real-world applications like student loans and credit scores. The program aims to equip these individuals with essential skills to navigate their financial futures confidently, reducing the cycle of debt and empowering informed decision-making.

Emotional Storytelling

A financial literacy program transforms lives by empowering individuals with essential money management skills. Participants, often from low-income communities, learn to navigate their financial futures, understanding concepts like budgeting, saving, and investing. In 2022, a participant named Maria, a single mother in Chicago, faced insurmountable debt and overwhelming anxiety about her family's financial stability. After attending the program, she discovered not only how to manage her finances but also how to create a sustainable plan for her children's education. Maria's story is one among many, highlighting the profound impact of education on financial empowerment. The need for funding is critical, aiming to reach over 500 families in the Chicago area in 2023, providing them with tools to break the cycle of poverty. Your support can directly change lives, fostering resilience and self-confidence in a community that desperately needs it.

Specific Financial Goals

The financial literacy program aims to achieve essential goals that empower individuals with knowledge and skills necessary for effective money management. By targeting a fundraising goal of $50,000, the program seeks to provide resources and workshops for 500 participants across various communities in Chicago, Illinois. These funds will facilitate the development of comprehensive curricula covering budgeting, saving, investing, and credit management. Reaching this financial target will enable the program to offer scholarships to low-income individuals, ensuring accessibility to vital educational materials that enhance financial decision-making abilities. Furthermore, the initiative intends to partner with local businesses to provide practical hands-on experiences, fostering financial confidence and independence within the community.

Letter Template For Financial Literacy Program Fundraiser Samples

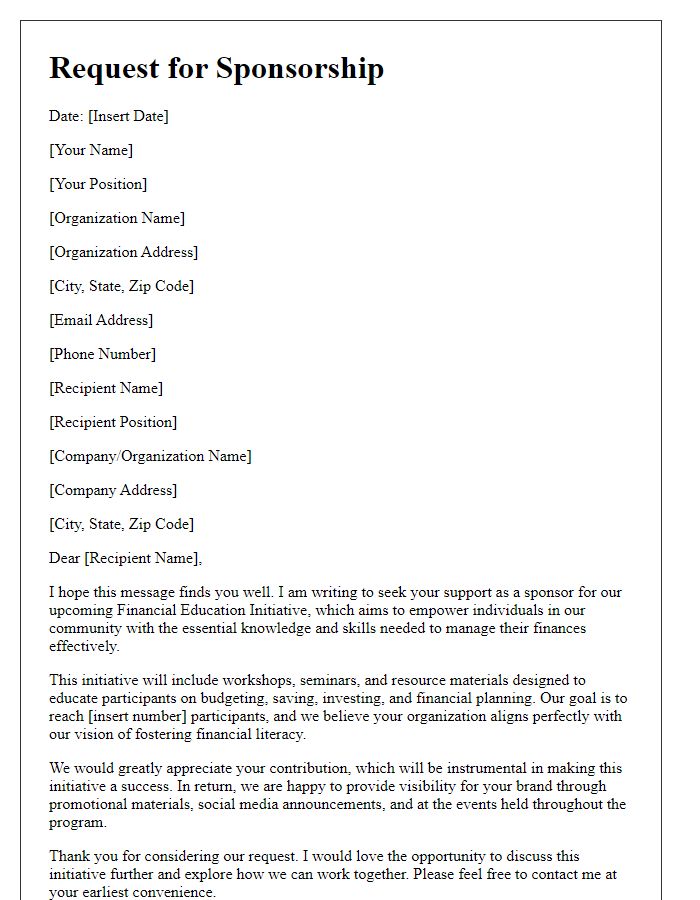

Letter template of sponsorship request for financial education initiative

Letter template of donation solicitation for financial literacy workshop

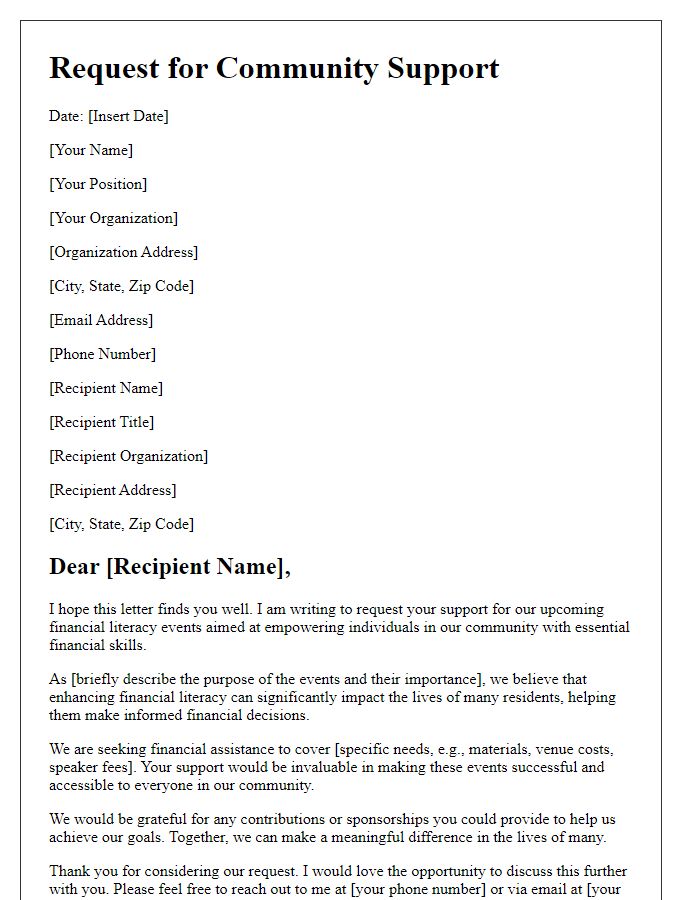

Letter template of community support request for financial literacy events

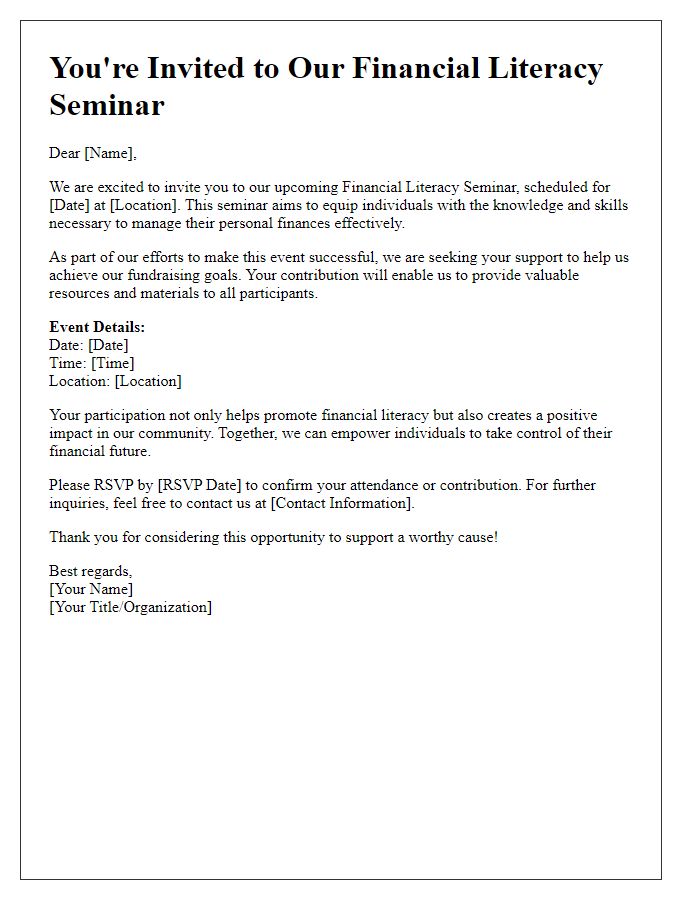

Letter template of fundraising invitation for financial literacy seminar

Letter template of volunteer recruitment for financial education programs

Comments