Are you a franchisee navigating the essential task of royalty payments? Understanding the nuances of your franchise agreement can be a bit overwhelming, but it's crucial for maintaining a successful partnership with your franchisor. In this article, we'll break down the steps you need to follow for making your royalty payments smoothly and on time. So, let's dive in and explore how to ensure you're fulfilling your obligations effortlesslyâread on for expert tips and detailed instructions!

Clear Payment Schedule

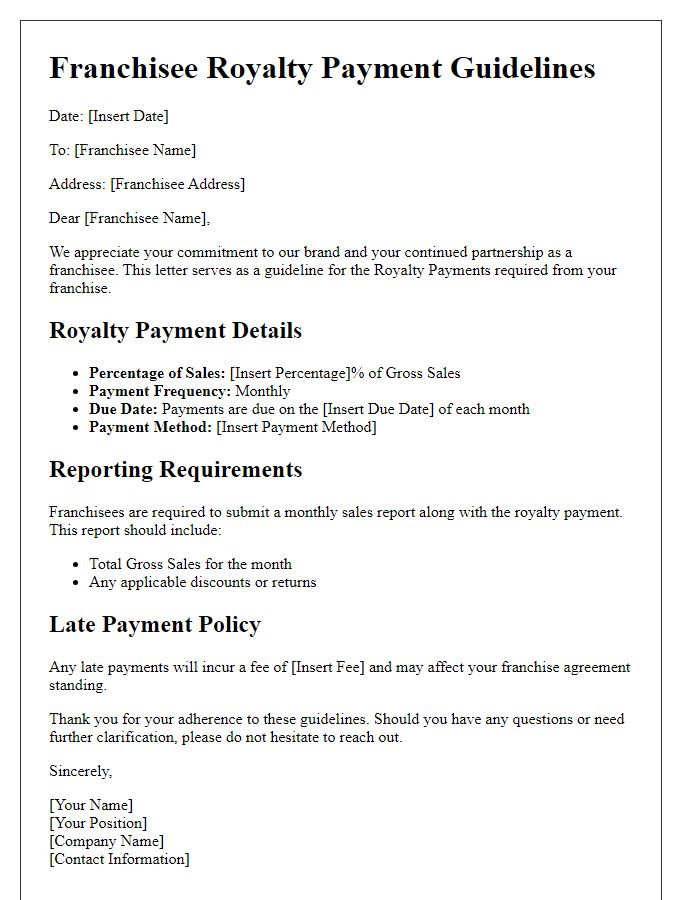

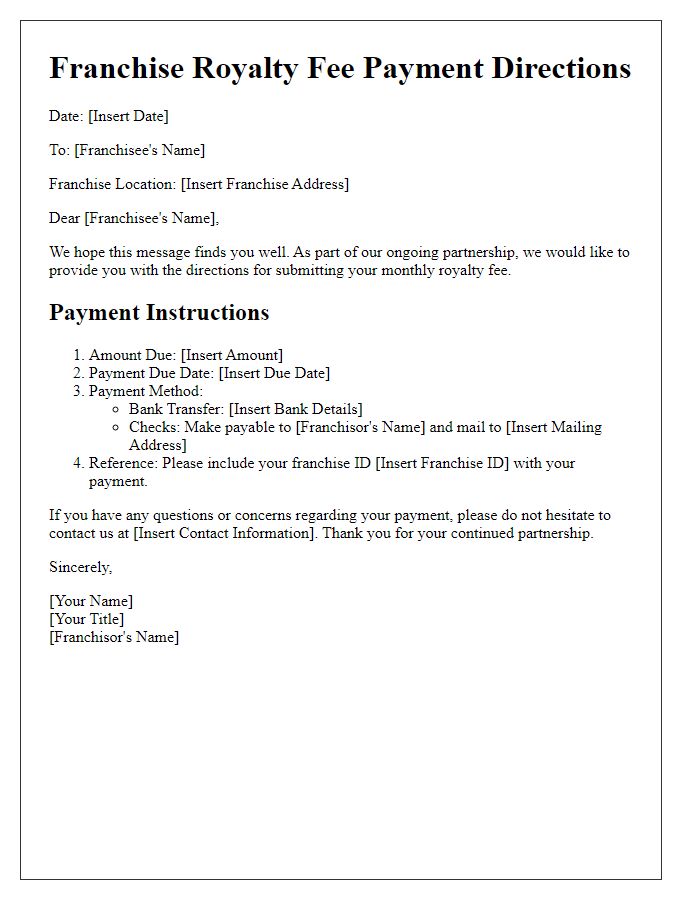

Franchisee royalty payments represent a crucial aspect of the franchise business model, serving as ongoing financial compensation to franchisors for brand support and operational guidance. A clear payment schedule must outline the payment frequency, which may be monthly or quarterly, and specify the percentage of gross sales (often between 4% to 8% depending on the franchise agreement). Deadlines for submitting these payments should be clearly indicated, typically within a specific number of days after the end of the billing period, such as 10 days for monthly payments. Additionally, preferred payment methods might include bank transfers, online payment platforms, or checks, accompanied by detailed instructions to ensure efficient transactions. Consistent adherence to this schedule is imperative for maintaining brand integrity and continued franchisee support.

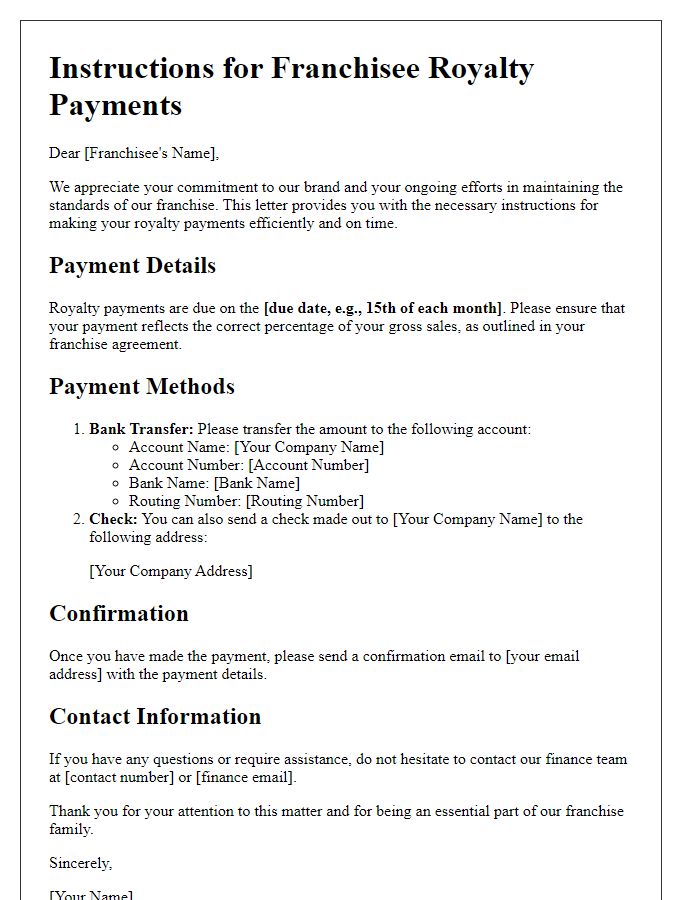

Accepted Payment Methods

Franchisee royalty payments are critical to maintaining the operational integrity of a franchise network. Accepted payment methods include bank transfers, credit cards, and online payment platforms like PayPal. Bank transfers provide direct deposits into the franchisor's account (commonly requiring account numbers and routing information for processing). Credit card payments often utilize secure transaction systems (Visa, MasterCard, or American Express), ensuring convenience yet may incur processing fees. Online platforms like PayPal allow for quick, secure payments, typically linked to email addresses and requiring verification for added security. Clear guidelines and deadlines (generally the 15th of each month) for these payments ensure consistency within contractual agreements among franchisees.

Detailed Breakdown of Royalty Calculation

Royalty payments for franchise businesses typically involve a structured calculation based on various metrics related to sales performance. Franchisees must report their gross sales figures consistently, providing a transparent view of their financial performance. Royalties are often calculated as a percentage (often ranging from 4% to 8%) of these gross sales, depending on the franchise agreement clauses. In addition, franchisees should be aware of any additional fees or contributions to shared marketing funds, which can add another percentage to the total deductions from gross sales. Accurate reporting is vital, as discrepancies can lead to penalties or misalignment of franchisor support. Record-keeping tools and regular financial audits can help streamline this process, ensuring compliance with contractual obligations. Franchises in various sectors, from fast-food chains like McDonald's to retail outlets like 7-Eleven, utilize these calculations to sustain brand integrity and operational excellence.

Contact Information for Queries

Franchisees must ensure timely payment of royalties to maintain brand standards and operational consistency. Royalty payments are typically calculated as a percentage of gross sales, which can vary by franchise agreement. Payments usually occur on a monthly basis, often due by the 15th of the following month. For any inquiries regarding payment processes, franchisees should contact the corporate franchisor's finance department at the designated email or phone number provided in the franchise documentation. Clear communication is essential to address any potential discrepancies and ensure compliance with contractual obligations. Timely communication fosters a positive relationship and supports overall business success.

Consequences of Late or Non-Payment

Franchise royalty payments are crucial for maintaining the operational integrity of franchised businesses. Late or non-payment can lead to severe consequences, including penalties, loss of franchise rights, and even legal action. In 2022, many franchise agreements specify a grace period of only 10 days after the due date, post which a late fee (usually around 1.5% of the amount owed) is imposed. Failure to adhere to payment schedules might also result in suspension of brand support services, leading to a potential decline in customer engagement and sales performance. Additionally, franchisees may be subject to audits, further straining financial resources. Legal fees from disputes could escalate rapidly, with average costs exceeding $15,000, highlighting the importance of timely payments for the sustainability of franchise operations.

Comments