Are you a franchise owner preparing for an upcoming financial audit? Understanding the implications and requirements of such an audit can be overwhelming, but it doesn't have to be. In this article, we'll guide you through what to expect, how to prepare, and the best practices to ensure a smooth audit process. So, grab a cup of coffee and let's dive into the essentials you need to know!

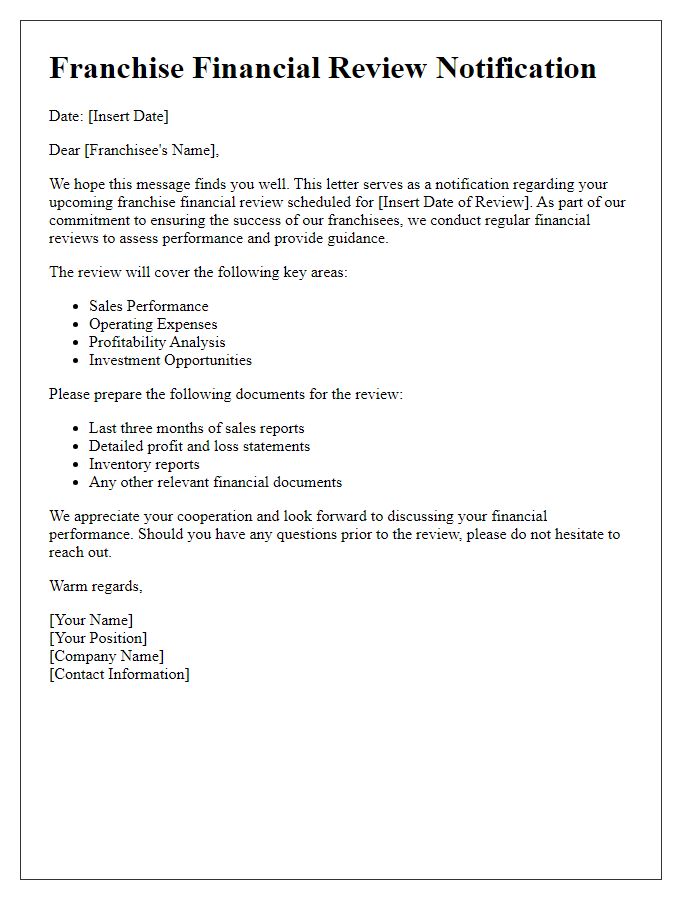

Franchisee information and contact details

The franchise financial audit process requires franchisees to prepare comprehensive documentation for review. Franchisee information must include the franchisee's full legal name, business structure designation (such as sole proprietorship or LLC), and exact operating address, including city, state, and postal code. Contact details should specify the primary contact person's name, phone number (including area code), and email address, ensuring prompt communication during the audit. Essential financial records include sales reports, profit and loss statements, and tax returns from the past fiscal year, aligning with the audit timeline. Prepared documentation guarantees compliance with franchise agreements and provides transparency to both the franchisor and the franchisee throughout the auditing process.

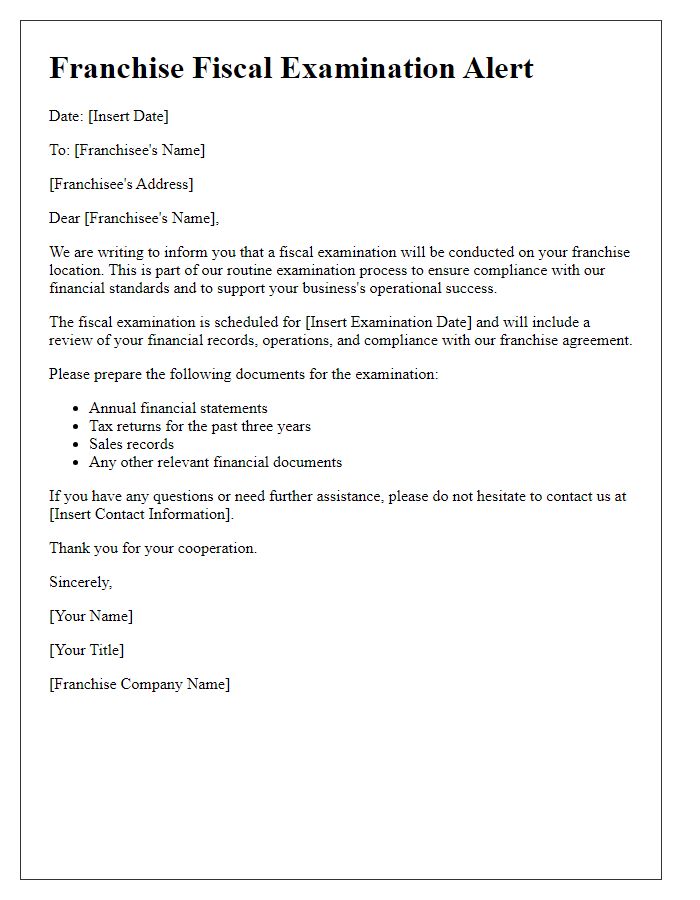

Purpose of the financial audit

The financial audit serves as a comprehensive examination of the franchise's financial statements, ensuring accuracy and compliance with accounting standards and regulations. This process involves a meticulous review of documents, such as income statements, balance sheets, and cash flow statements, to identify discrepancies or areas of concern. A key aspect of the audit includes verifying revenue streams, operational expenses, and royalty payments aligned with the franchise agreement terms. The goal is to provide stakeholders, including owners and investors, with confidence in the franchise's financial health and assist in strategic decision-making. Additionally, audit findings may lead to recommendations for financial improvements or operational efficiencies, enhancing overall franchise performance.

Scope and timeline of the audit process

Franchise financial audits are critical assessments aimed at evaluating financial performance and compliance with brand standards. The audit process will encompass a review of all financial statements, including profit and loss statements, balance sheets, and cash flow statements, for the fiscal year ending December 31, 2023. Auditors will examine transactions, invoices, and accounting practices to ensure adherence to Generally Accepted Accounting Principles (GAAP). The timeline for this process is scheduled to begin on January 15, 2024, and conclude by February 28, 2024, with preliminary findings communicated by March 5, 2024. The franchise locations subject to audit include all branches operating under the XYZ brand across the United States, with a particular focus on areas demonstrating unusual revenue fluctuations.

Required documentation and data submission

Franchise financial audits require precise documentation to ensure compliance and accuracy. Franchisees must submit their annual financial statements, including profit and loss statements, balance sheets, and cash flow statements, typically covering the fiscal year ending December 31. Additionally, supporting documents such as bank statements for the corresponding period, payroll records detailing employee wages and benefits, and tax returns filed with the Internal Revenue Service (IRS) are essential. Data regarding sales reports, including daily sales logs and inventory records, should be compiled meticulously, as these documents provide insight into the franchise's operational efficiency. Timely submission of this documentation is crucial to maintain franchise standards and ensure a seamless audit process.

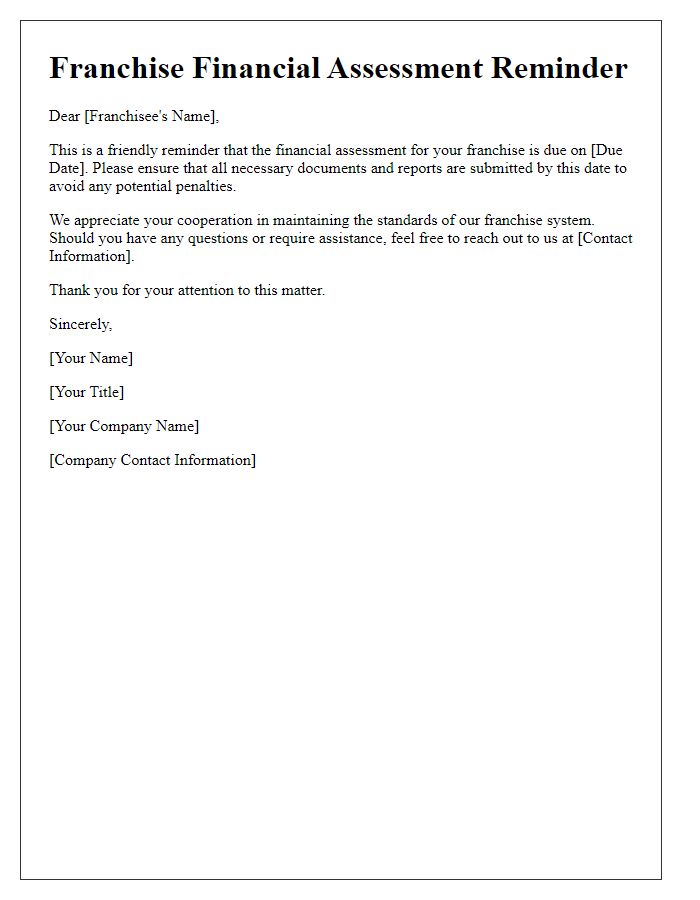

Contact information for audit inquiries

Franchise financial audits play a crucial role in ensuring compliance and transparency within franchising agreements. Contact details (including phone numbers and email addresses) should be clearly provided for addressing audit inquiries. These contacts are typically designated individuals or departments responsible for overseeing the audit process. Timely responses to inquiries (often expected within 48 hours) can significantly expedite the audit procedure, minimizing disruption to franchise operations. An efficient communication channel not only fosters collaboration but also enhances trust between franchisees and the franchisor. Regulatory bodies may also require documentation of these audits to ensure adherence to industry standards.

Comments