Have you ever found yourself puzzled over unexpected charges on your bill? It's a frustrating experience that many face, and addressing billing errors is crucial for maintaining trust with service providers. In this article, we'll guide you through writing a formal complaint letter that effectively articulates your concerns and demands resolution. So, let's dive into the essential steps and tips that can help you craft a powerful complaint letter!

Accurate contact information for sender and recipient.

Billing discrepancies can lead to significant frustration for customers and create obstacles in maintaining satisfactory business relationships. Accurate account statements, reflecting transactions on specifically designated billing cycles (monthly, quarterly), are essential for transparency. Errors (such as incorrect charges, double billing) can affect payment timelines and credit ratings. Proper identification (full name, account number) of both parties (sender, recipient) ensures effective communication and prompt resolution of issues through proper channels (customer service department, billing department). Detailed descriptions of discrepancies, alongside copies of relevant invoices or statements, enhance the clarity and facilitate a smoother complaint process.

Clear subject line indicating the purpose.

Formal complaint regarding billing errors requires immediate attention. In multiple instances, discrepancies in charges have surfaced, leading to potential financial loss. For example, Invoice #123456 dated September 15, 2023, contains incorrect billing for services, amounting to $250 instead of $150, reflecting a significant difference. The issue spans across various months, with additional charges in October and November also being inaccurate. Immediate rectification of these errors is essential to maintain trust and ensure accurate accounting. Documentation regarding the errors is attached for reference, highlighting each instance clearly. Timely resolution is anticipated.

Detailed description of the billing error.

Inaccurate billing statements can create significant inconvenience for consumers, particularly in industries like telecommunications and utilities, where monthly charges fluctuate based on usage. For example, a recent bill from XYZ Telecom dated October 2023 reflected an erroneous charge of $150 for international calls made to Spain, despite the account holder having an unlimited calling plan that includes free calls to European countries. This discrepancy not only highlights a miscalculation, given the promotional agreement that was confirmed during the account setup, but also led to unauthorized late fees, compounding the financial impact on the customer. Moreover, the billing error persisted even after previous communications with customer service, where representatives acknowledged the mistake and promised a corrective adjustment. Such unresolved issues necessitate immediate attention and resolution to maintain trust and service integrity.

Reference to account details or invoice number.

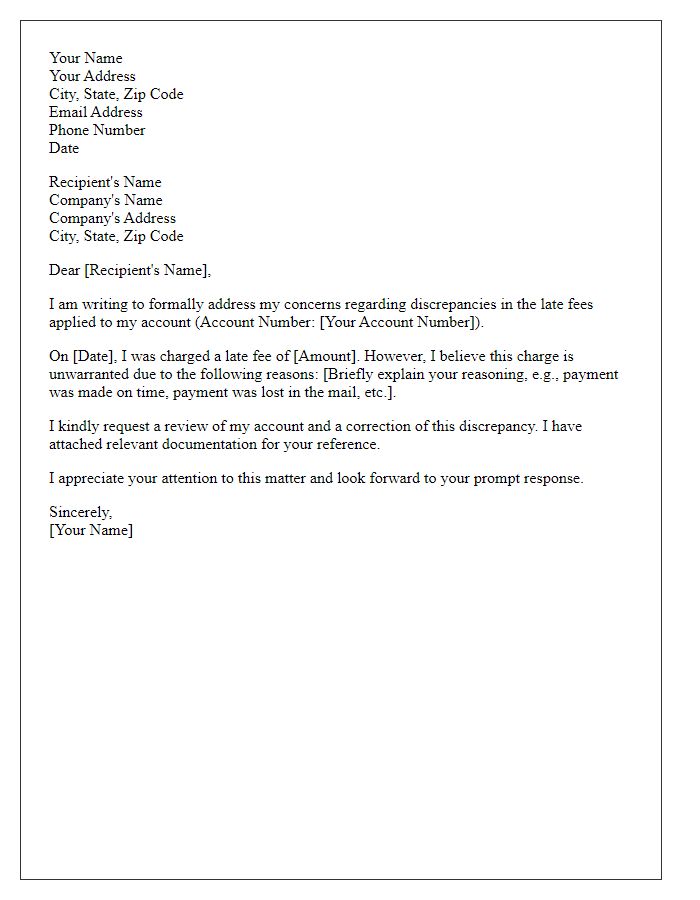

A formal complaint regarding billing errors typically begins by referencing the account number or invoice number associated with the issue. An inaccurate invoice, for instance, might display an incorrect total of $250.00, rather than the expected amount of $200.00 due for a service rendered at a specific location, such as a local branch on Main Street. Additionally, any discrepancies involving late fees or unrecognized charges should be highlighted, especially if they lack proper documentation or prior notification. Clear communication regarding the timeline of events surrounding the disputed charges enhances the situation, as does a request for a prompt resolution or a correction to the billing statement.

Formal closing and request for resolution.

Billing errors frequently occur in customer accounts, often leading to frustration and financial discrepancies. Common issues involve overcharges, incorrect service fees, or missing discounts, which can significantly impact individual budgets. It is essential to address these discrepancies promptly to avoid further complications. Customers should gather relevant documentation such as invoices, account statements, or communication records and present them to the billing department. Efficient resolution often relies on the clarity of submitted information, including account numbers, transaction dates, and specific details of the error in question. By doing so, customers can facilitate a smoother review process and achieve satisfactory adjustments to their account balances.

Letter Template For Formal Complaint Regarding Billing Errors Samples

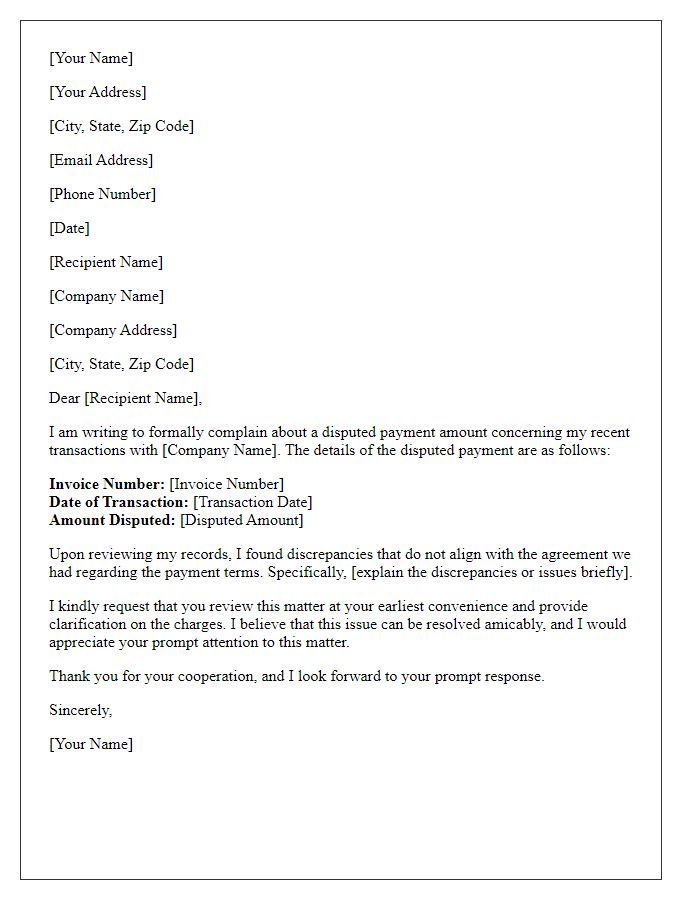

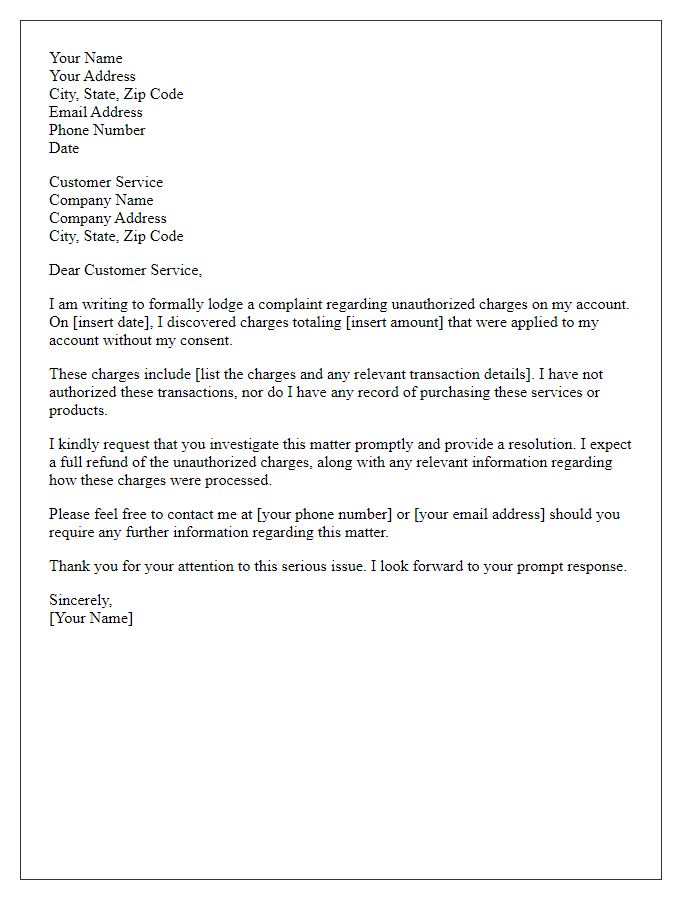

Letter template of formal complaint concerning disputed payment amounts.

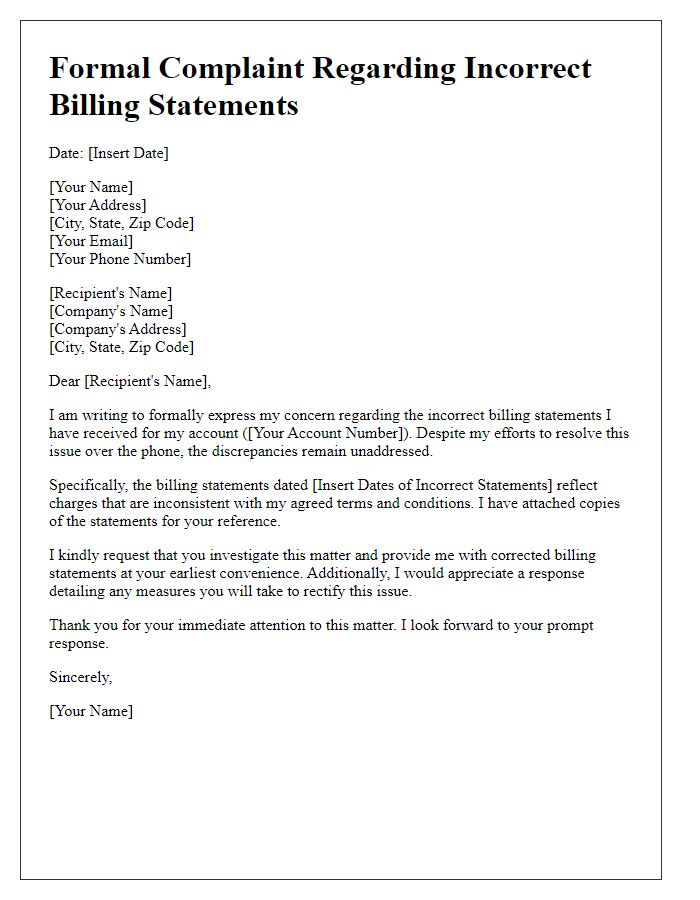

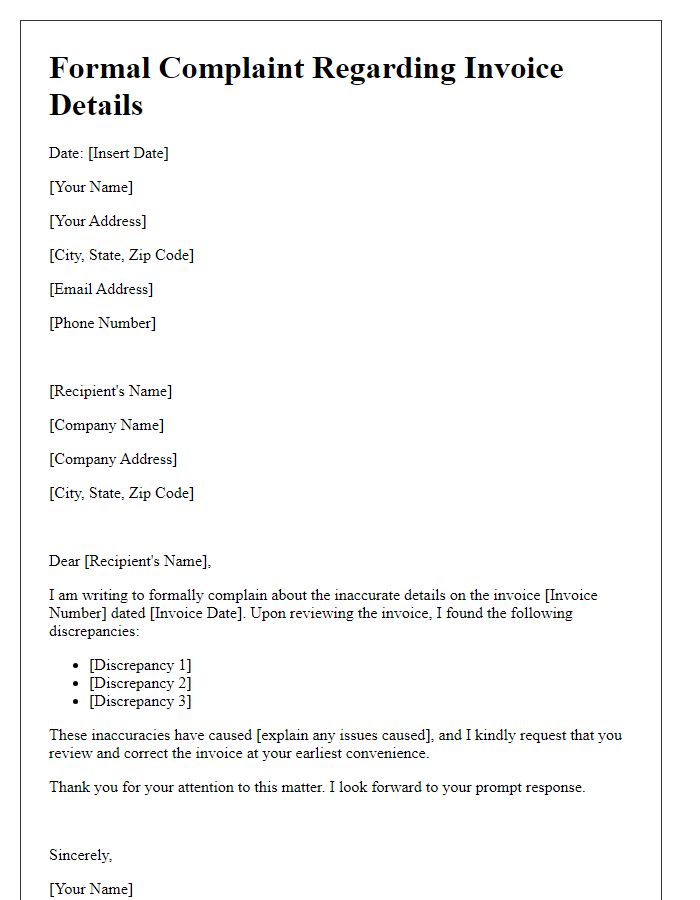

Letter template of formal complaint related to incorrect billing statements.

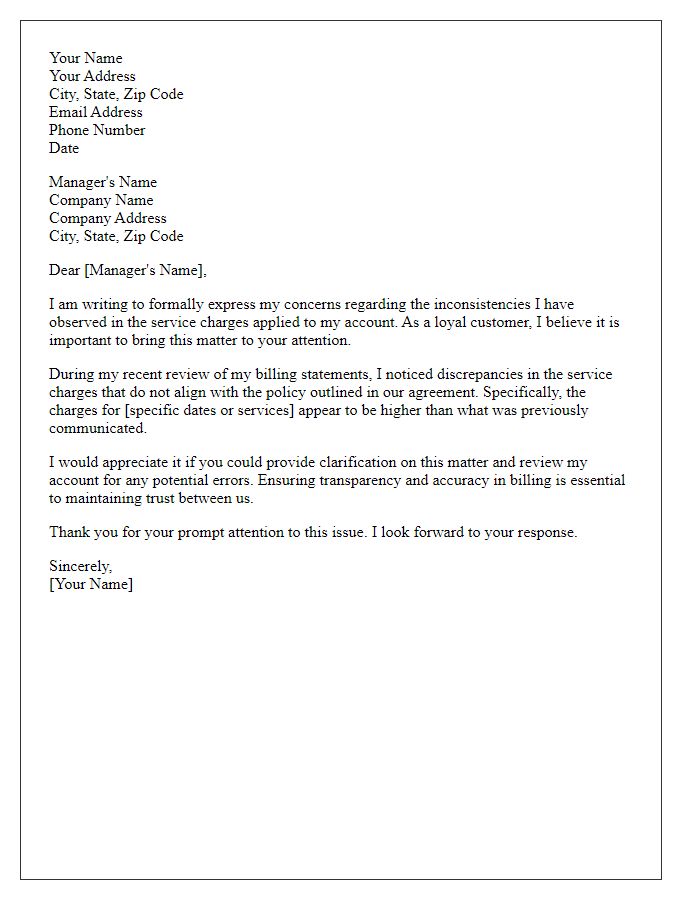

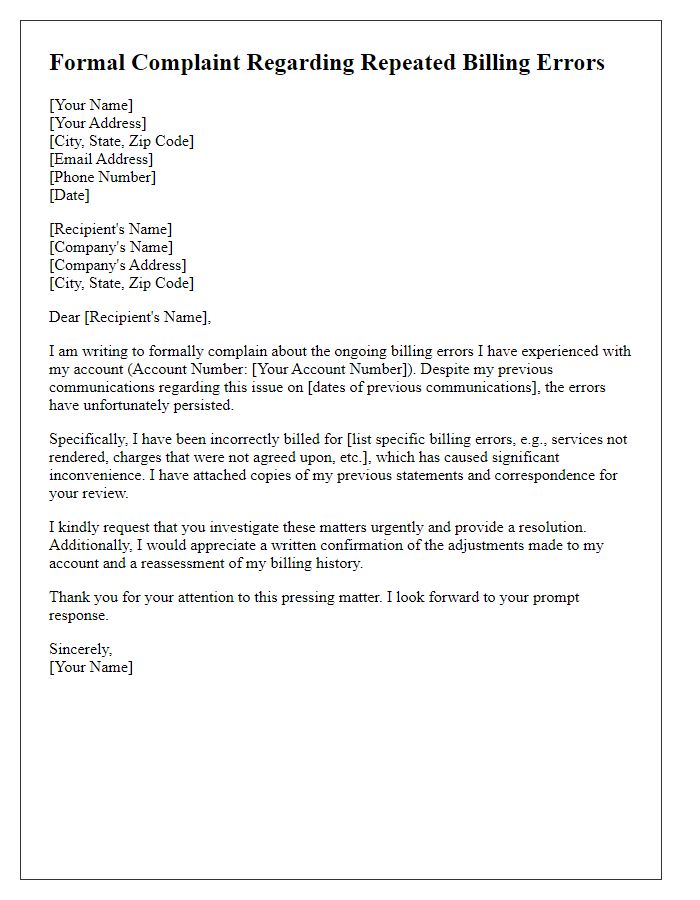

Letter template of formal complaint regarding service charge inconsistencies.

Comments