Are you feeling frustrated with your insurance provider and unsure how to voice your concerns? Writing a formal complaint letter can be an effective way to communicate your issues clearly and professionally. This article will provide you with a structured template that helps you articulate your grievances while ensuring that your message is taken seriously. So, let's dive in and explore how to craft the perfect complaint letter to get the resolution you deserve!

Policyholder Information

Policyholders face numerous challenges while navigating the complexities of insurance claims. Specific details such as policy numbers (e.g., 123456789), claim numbers (e.g., CLM987654), and the date of the incident (e.g., March 15, 2023) play a crucial role in clarifying the situation. It's essential to provide comprehensive personal information, including the policyholder's full name (e.g., John Doe), address (e.g., 123 Elm Street, Springfield), and contact details, to ensure proper identification of the policy and swift response from the insurance company. Outlining the nature of the complaint, such as inadequate claim handling or delayed response times, allows the company to address particular grievances effectively while maintaining accurate records of negotiations and resolutions.

Policy Details

The original policy documents are critical for establishing clear communication with the insurance company, such as XYZ Insurance Group. It is essential to include specific details like the policy number (123456789) and the type of coverage, for example, comprehensive auto insurance, to ensure accurate processing. A claim reference number (987654321) may also be necessary to facilitate quick reference to any ongoing claims. Specific dates of incidents, such as service interruptions or denied claims, and communication logs can provide context for the complaint. Clearly outlining the desired resolution, such as a claim approval or reimbursement amount (e.g., $5,000), can aid in expediting the review process.

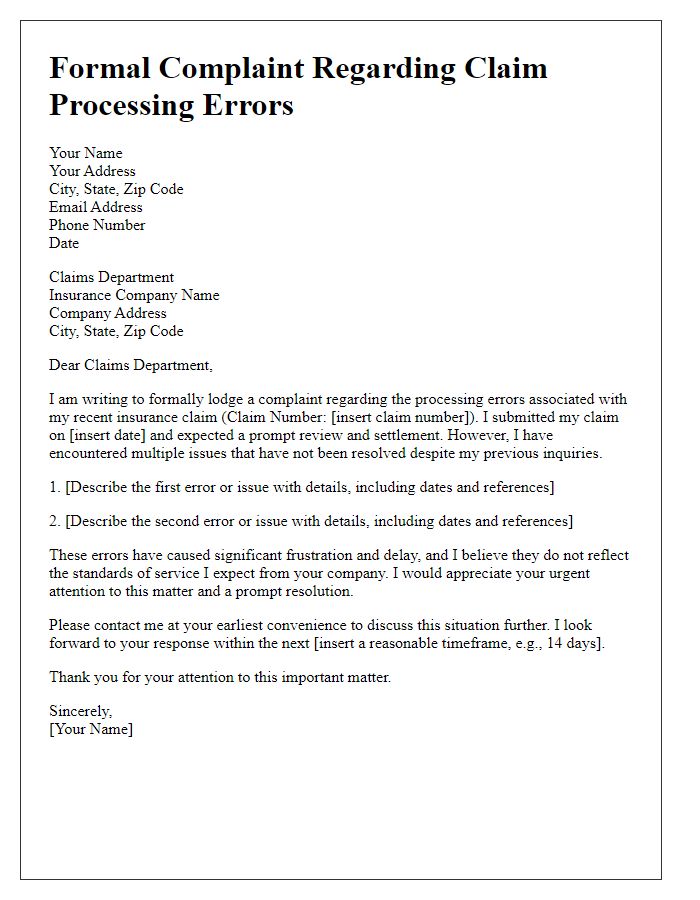

Clear Description of Issue

A formal complaint to an insurance company regarding an unresolved claim can stem from various issues, such as lack of communication, delays in processing, or denial of benefits. Customers often face challenges when insurance claims are mistakenly denied, resulting in financial stress. For instance, a homeowner's insurance claim for storm damage might be delayed for over six months, with the insurance adjuster failing to return calls or emails. The lack of timely responses can lead to frustration and deteriorate client relations, as policyholders expect prompt service in emergencies. Moreover, misunderstood policy details, such as coverage limits or exclusions, could complicate the claims process, resulting in an unsatisfactory resolution.

Supporting Documentation

Formal complaints to insurance companies often require robust supporting documentation to validate claims and grievances. Essential documents include policy agreements outlining coverage terms, copies of past correspondence (emails, letters) between the policyholder and the insurance company, and evidence of the claim such as receipts, photographs, and witness statements from incidents (like car accidents or property damage). Additionally, medical records and invoices may be necessary for health-related claims, highlighting treatment received and costs incurred. It's crucial to include a detailed timeline of events related to the claim and any previous complaint references to ensure clarity and facilitate the review process by the company's claims department. Organizing this information chronologically improves accessibility and demonstrates the thoroughness of the complaint.

Desired Resolution and Timeline

A formal complaint to an insurance company should clearly articulate the issues faced, with specifics regarding policy numbers, dates of claim submissions, and the lack of response or inadequate responses. For example, in the case of a delayed claim processing under Policy No. 123456789, submitted on June 15, 2023, the complainant experienced a lack of communication for over 45 days, breaching the standard time frame outlined in the insurance guidelines. Desired resolutions may include immediate processing of the claim or a formal acknowledgment of the delay, with clear timelines set for response, ideally within 14 days. Adding details such as the impact of the delay on the complainant's health or finances enhances the urgency of the situation, promoting a quicker response from the company.

Letter Template For Formal Complaint To Insurance Company Samples

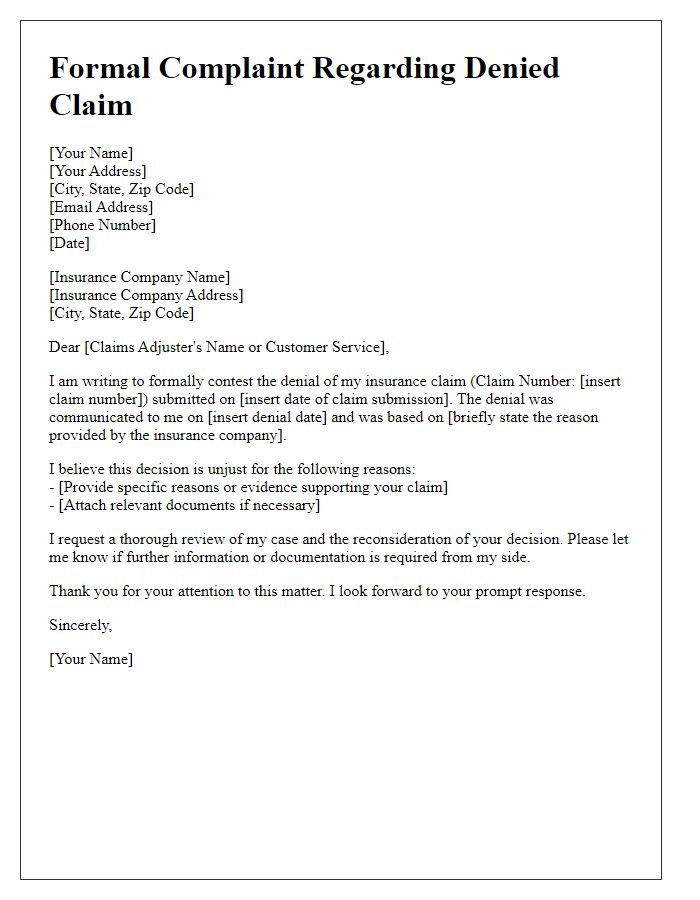

Letter template of formal complaint regarding denied claim to insurance company.

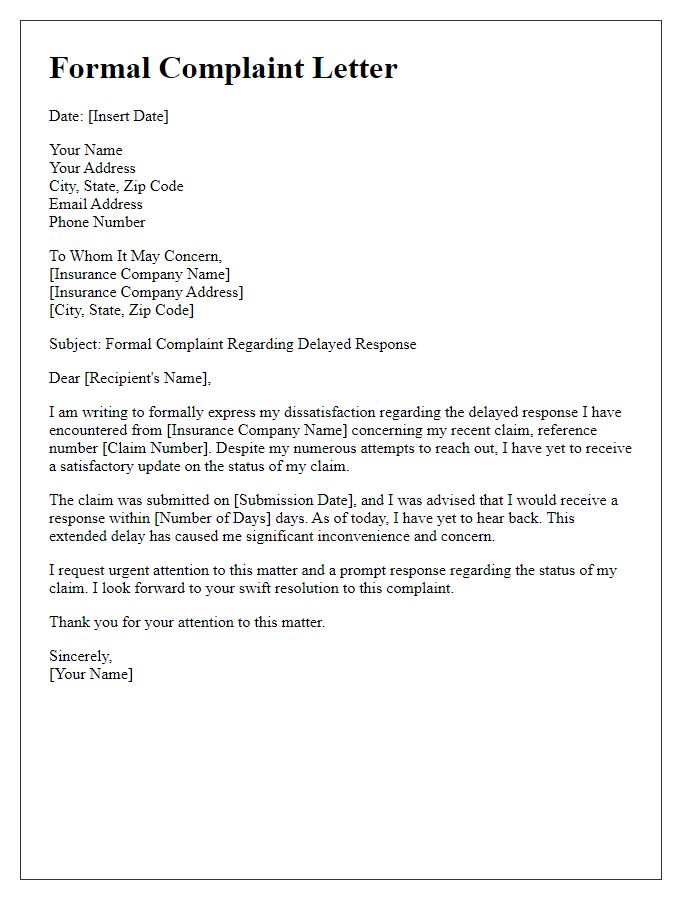

Letter template of formal complaint about delayed response from insurance company.

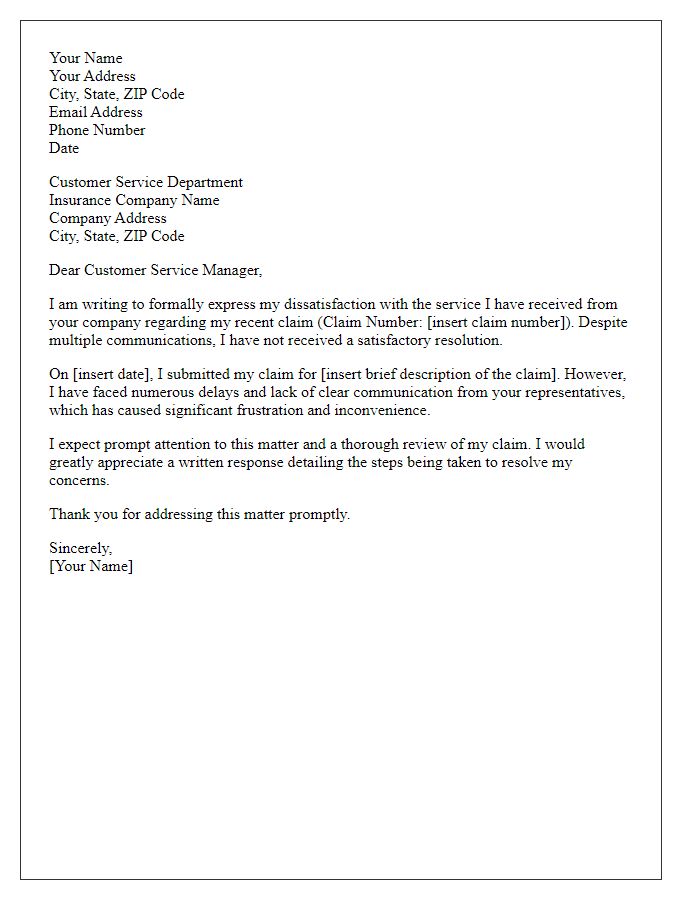

Letter template of formal complaint concerning unsatisfactory service from insurance company.

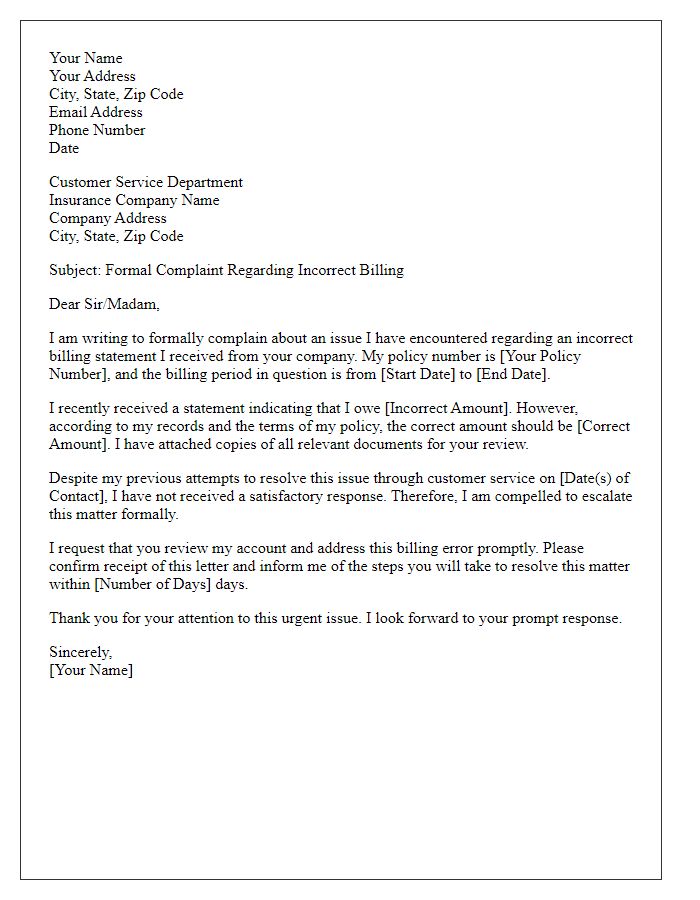

Letter template of formal complaint related to incorrect billing from insurance company.

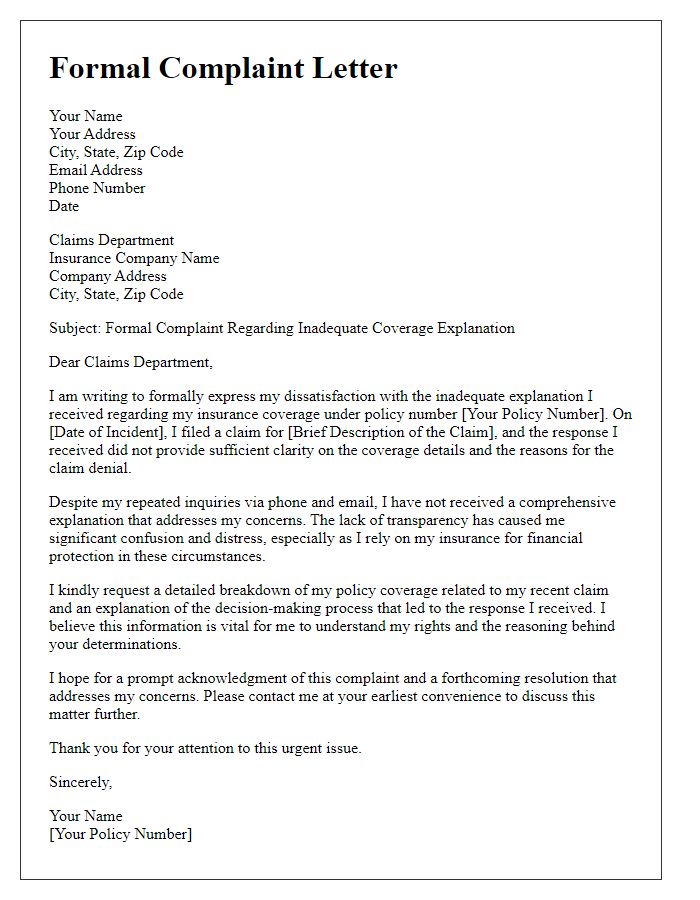

Letter template of formal complaint for inadequate coverage explanation from insurance company.

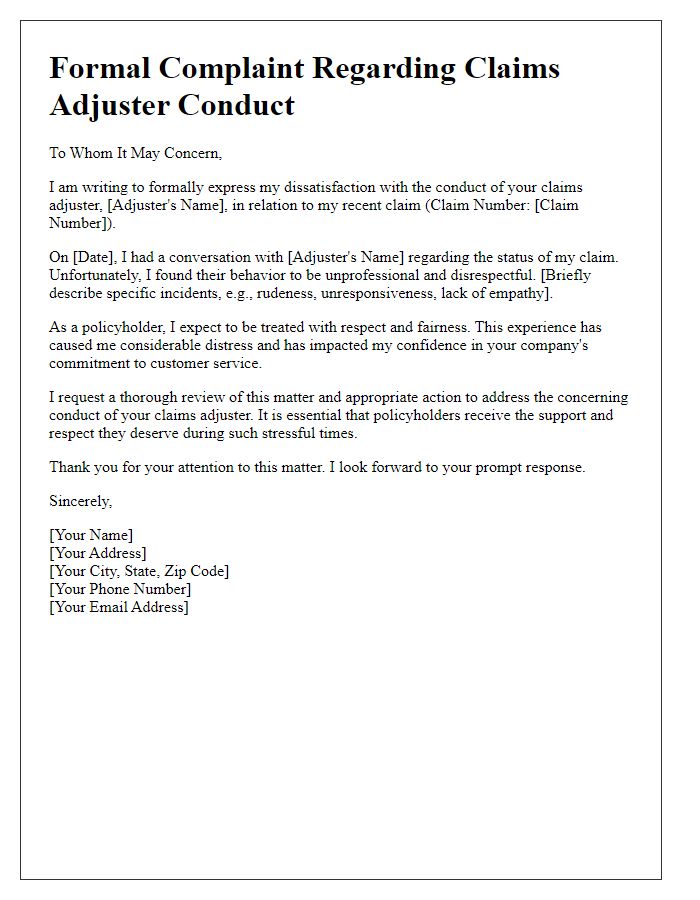

Letter template of formal complaint addressing claims adjuster conduct from insurance company.

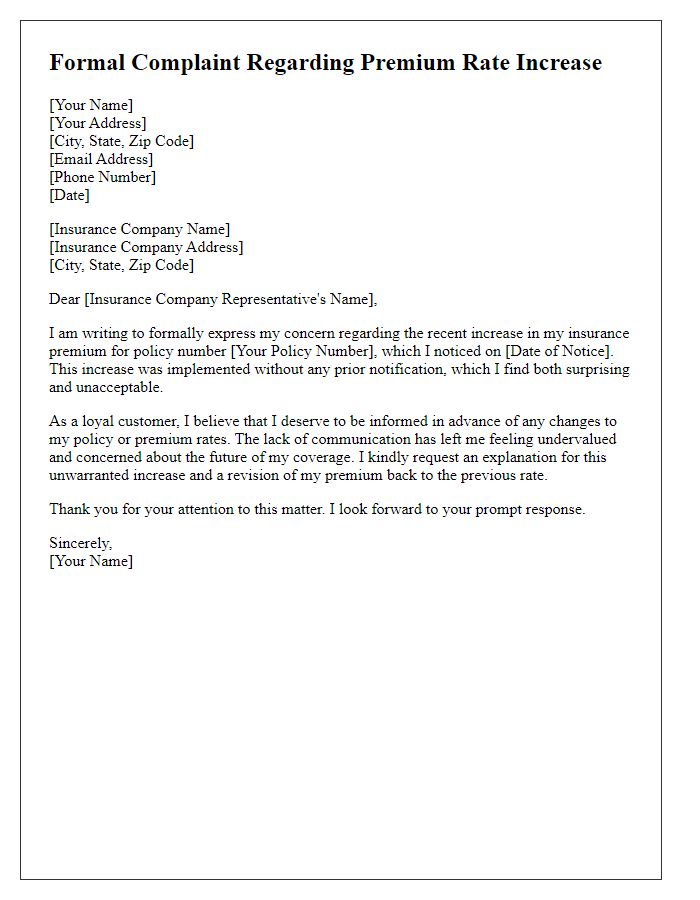

Letter template of formal complaint regarding premium rate increase without notice from insurance company.

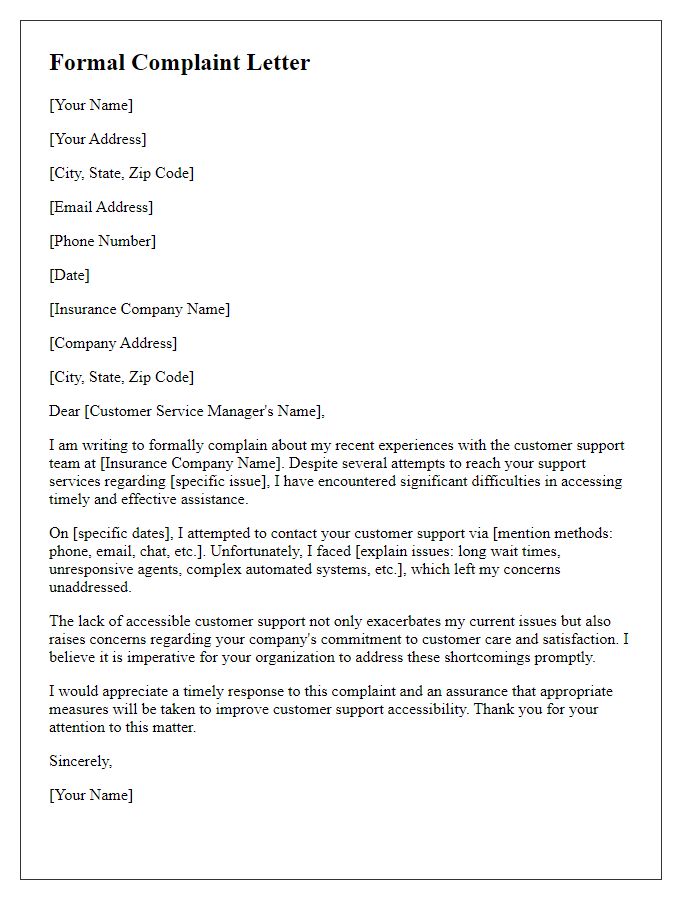

Letter template of formal complaint about inaccessible customer support from insurance company.

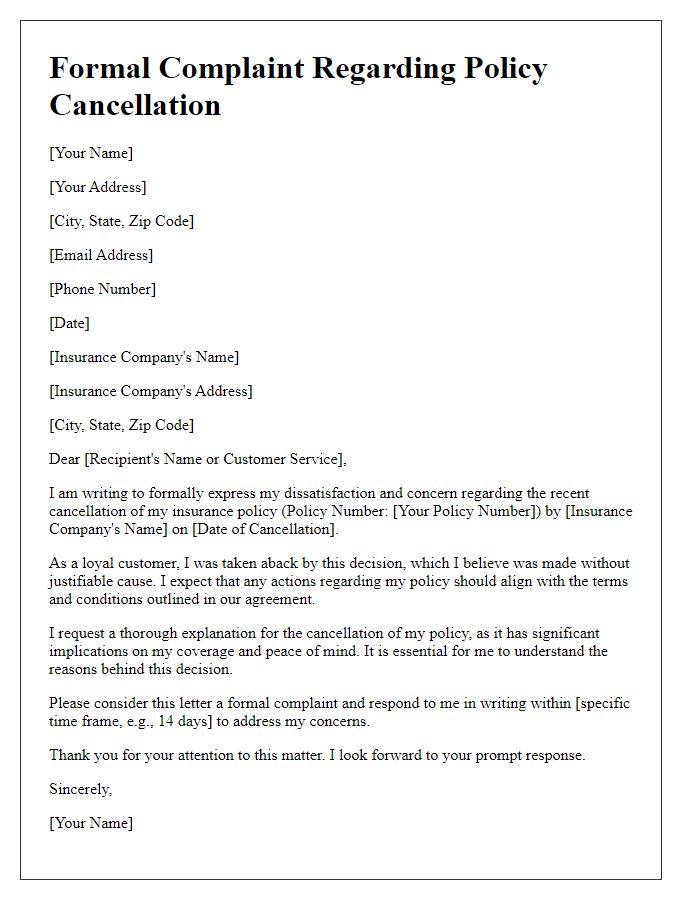

Letter template of formal complaint on policy cancellation without justification from insurance company.

Comments