Are you struggling to keep track of overdue payments? You're not aloneâmany businesses face the challenge of reminding clients about outstanding invoices. Sending a polite yet firm follow-up letter can help bridge that communication gap and encourage prompt payment. Dive into our comprehensive guide to learn effective strategies for crafting the perfect overdue payment follow-up letter!

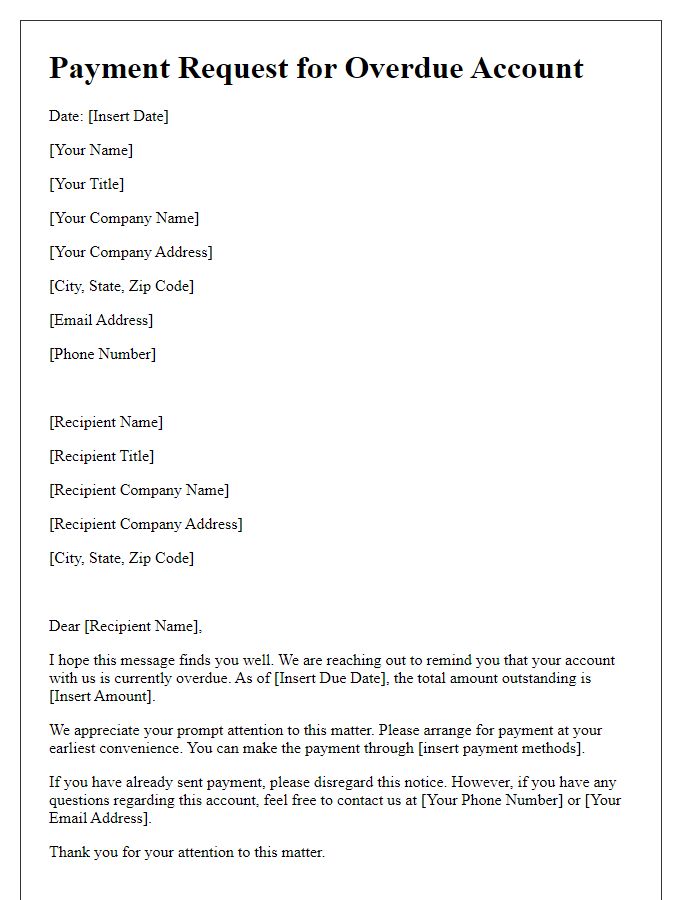

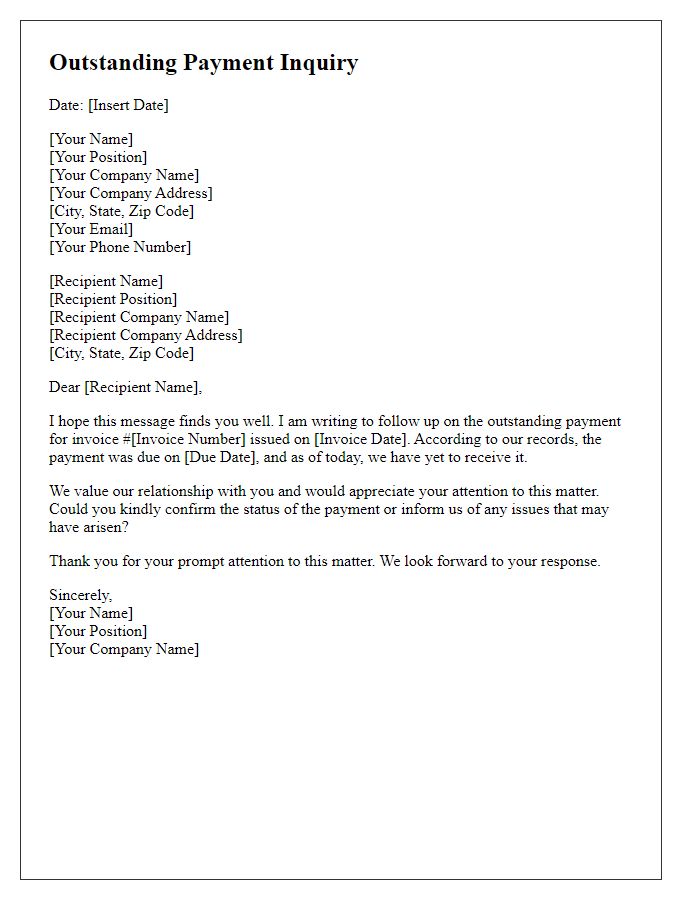

Sender's contact information

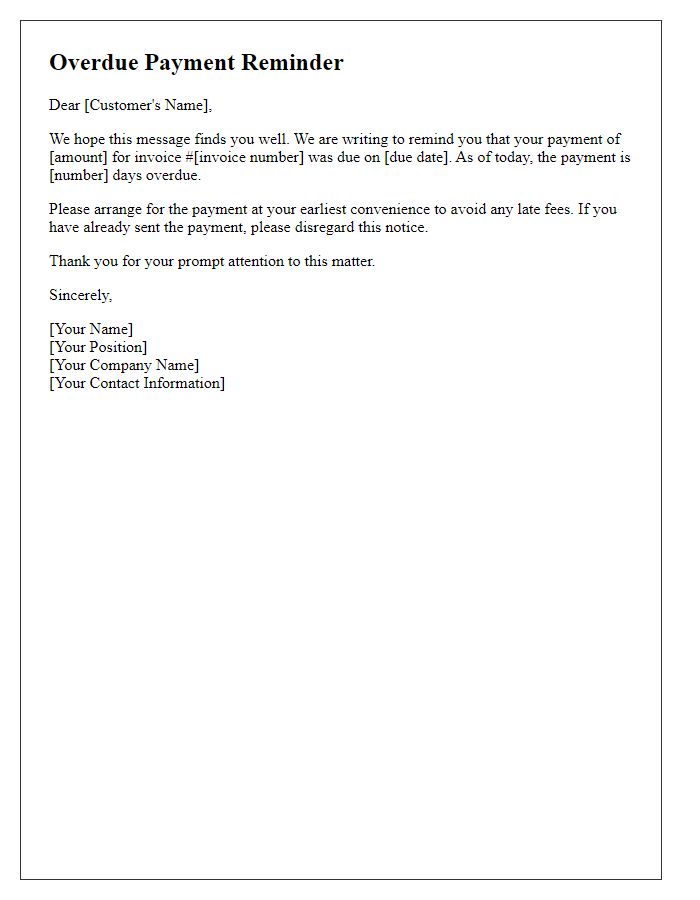

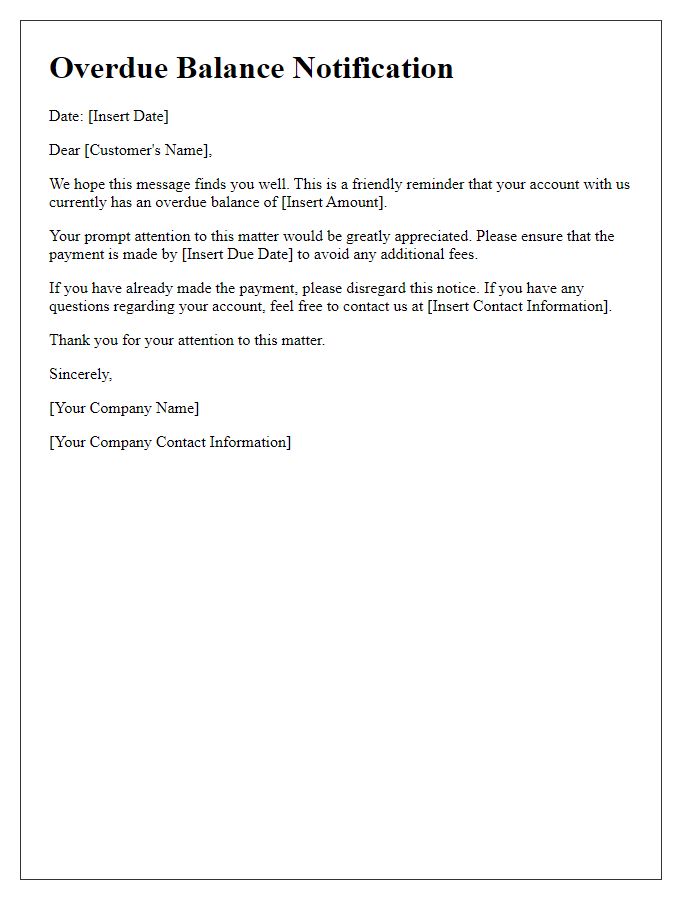

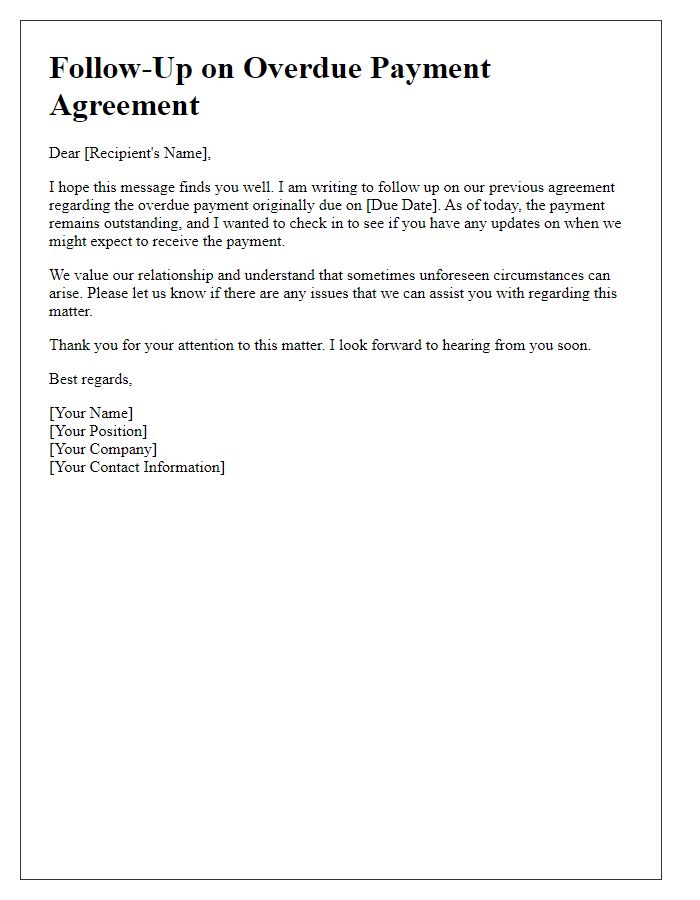

Clients facing overdue payment situations often experience significant stress due to potential cash flow issues. Consistent follow-up is crucial in ensuring timely collection of outstanding dues. Consider mentioning payment methods available (bank transfer, credit card) and providing clear due dates for each invoice. Including previous correspondence reference can help Establish a context. A polite yet firm tone, emphasizing consequences of further delay, can encourage prompt action while maintaining professional relationships. Attach relevant documents, such as invoices or contracts, to enhance clarity and provide proof.

Recipient's contact information

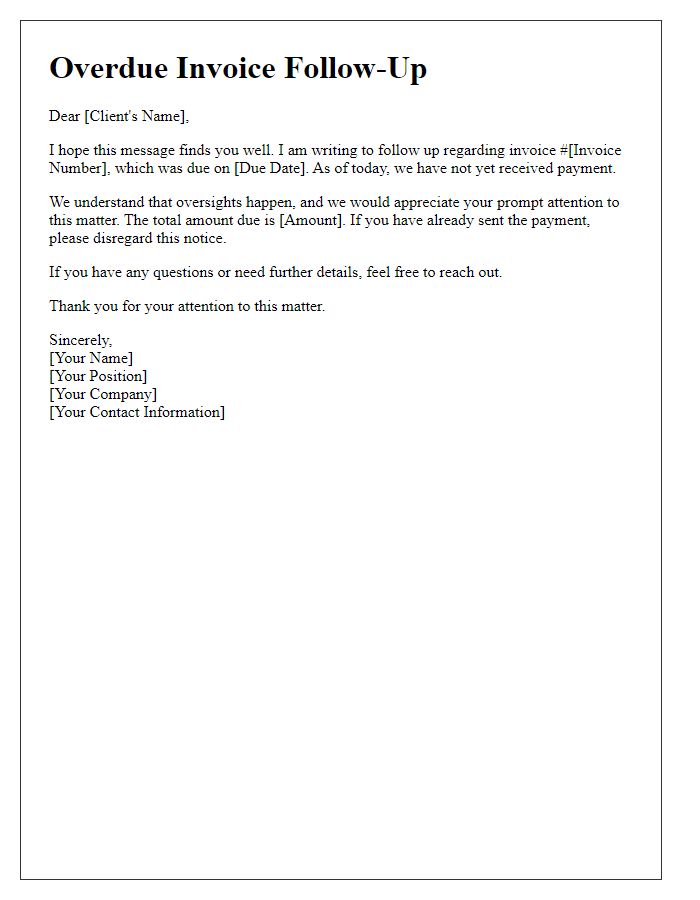

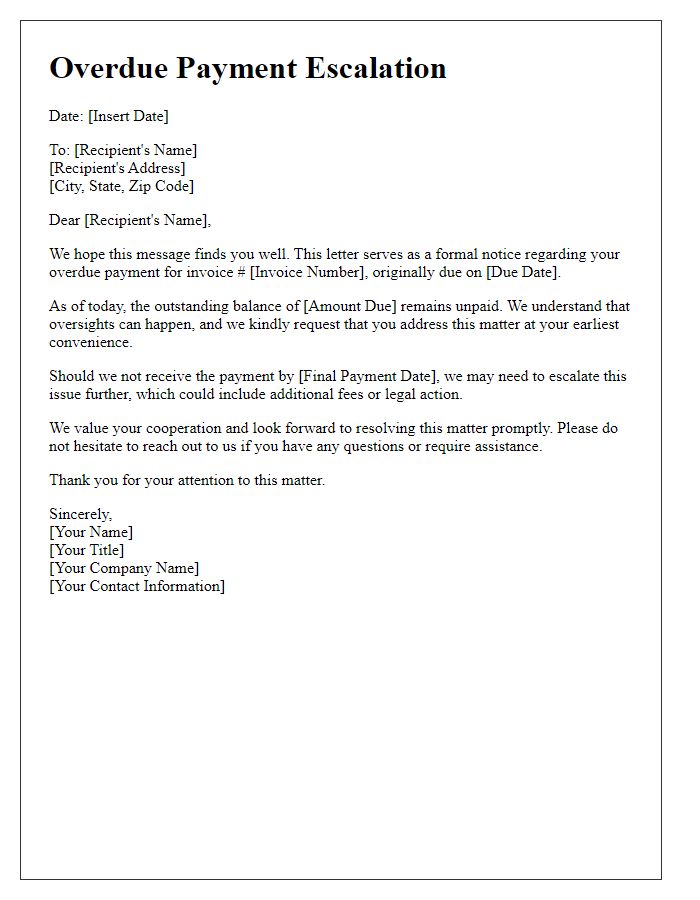

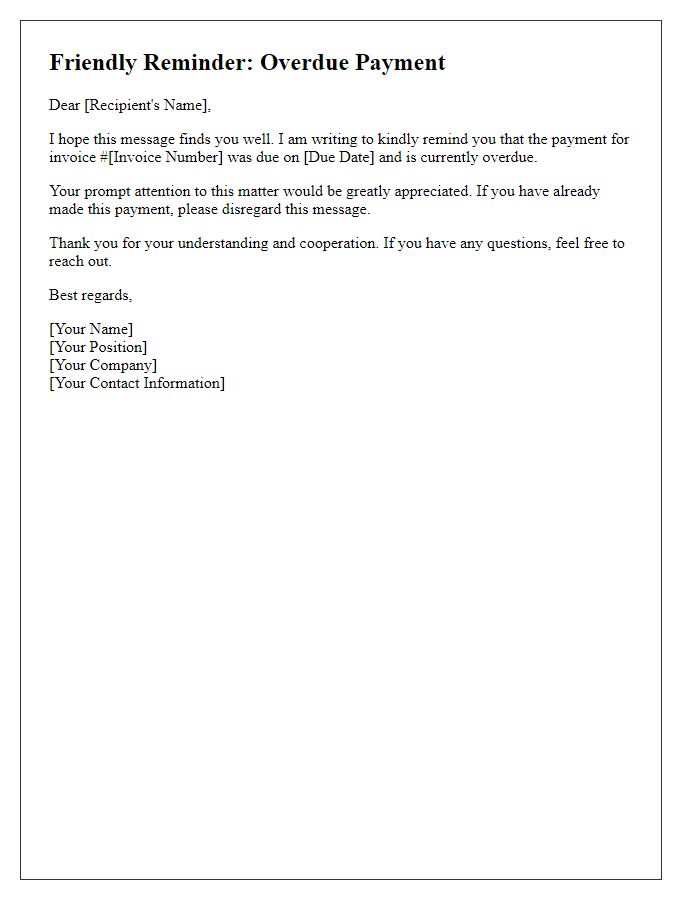

Overdue payments can disrupt financial flow for businesses, especially in sectors like retail or services. Tracking overdue invoices, such as those exceeding 30 days past due, is crucial for maintaining cash flow. Businesses may utilize accounting software, like QuickBooks, to manage late payments and automatically send reminders. Effective follow-up strategies include personalized emails and phone calls, which often result in a higher success rate than automated messages. Establishing clear payment terms upon initiation of service can also help mitigate delays in payments.

Reference to previous communication

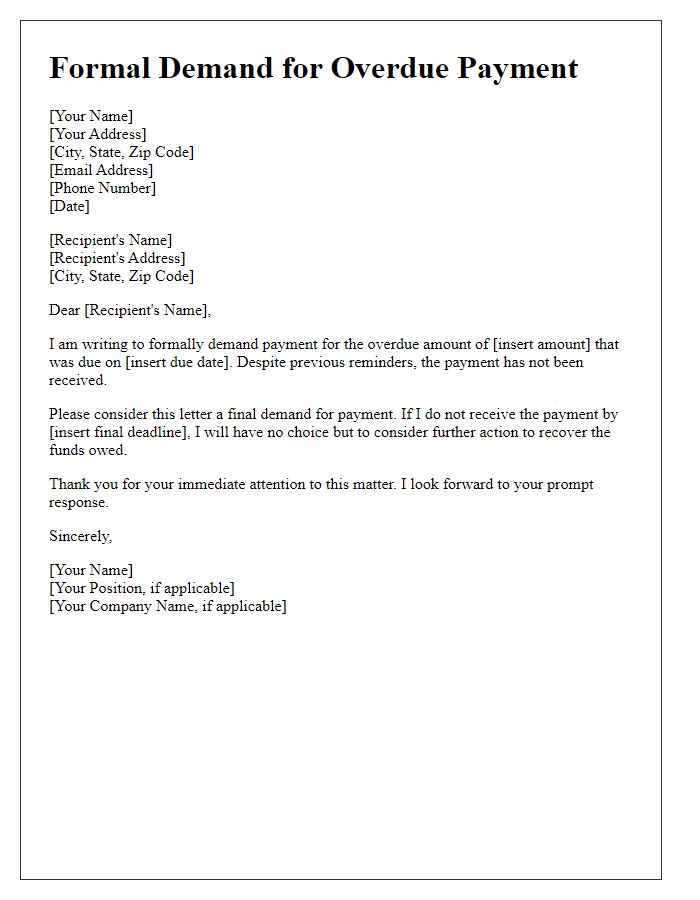

Businesses often encounter overdue payments, which necessitate respectful follow-ups. Accounts receivable frequently highlights situations where invoices, like Invoice #10345 from June 15, 2023, remain unpaid past the specified terms. Effective communication regarding these concerns is crucial for cash flow management. A reminder email should reference previous discussions or notices sent, including the communication on September 1, 2023, which indicated outstanding balances. Clear articulation of the overdue amount should follow, specifying any potential consequences, such as late fees as stipulated in the original contract. This strategy emphasizes professionalism while encouraging swift resolution of financial obligations.

Outstanding balance statement

Many businesses encounter overdue payments from clients, contributing to cash flow challenges. An outstanding balance statement serves as a formal notice, detailing the amount owed, invoice numbers, and payment due dates. For instance, if a company provided services worth $5,000 with an initial due date of September 15, 2023, a follow-up would emphasize the overdue status of the payment. Clear identification of the client's account, such as the business name and account number, is crucial for efficient tracking. Additionally, including a prompt for immediate payment, such as "Please remit payment within 7 days," can encourage prompt actions. This statement often conveys the importance of maintaining a positive business relationship while seeking resolution for the overdue balance.

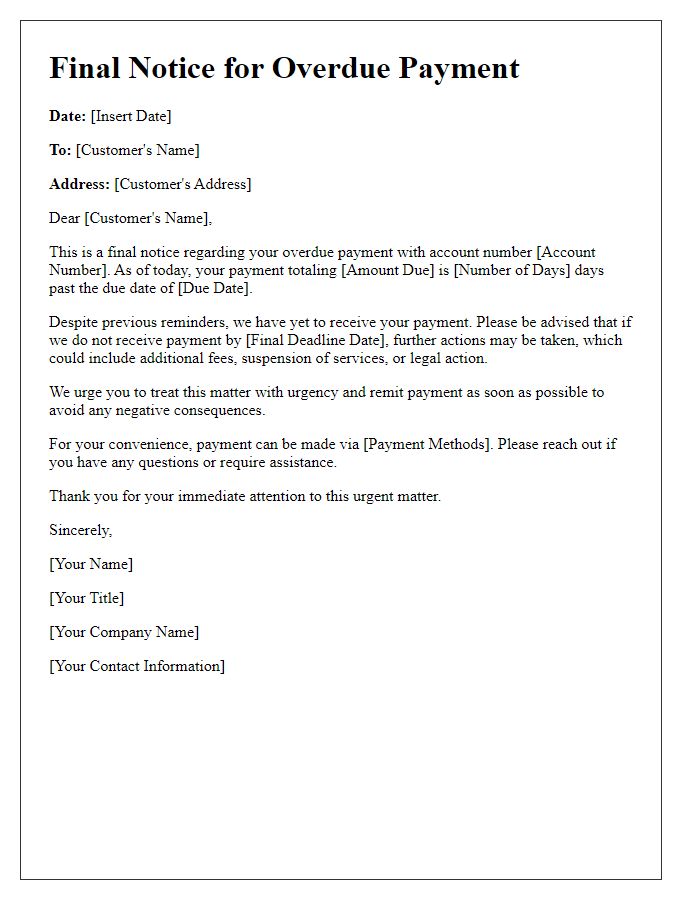

Payment deadline and consequences

A missed payment deadline can result in significant consequences for both individuals and businesses. For example, in real estate, failing to pay rent by the specified date can lead to late fees averaging around 5% of the monthly charge. Additionally, a lag in payment may trigger eviction notices, impacting credit scores negatively for up to seven years. In the realm of credit cards, missing a payment can lead to an increase in the interest rate, sometimes exceeding 29%, and potential debt collection actions after 180 days. Furthermore, businesses may face disruptions in service or supply due to unpaid invoices, leading to strained vendor relationships and operational delays. Timely payments ensure smooth transactions and maintain trust between parties involved.

Comments