Have you ever had a moment when you realized it's time to reevaluate your health insurance? Whether it's been a couple of years or just a few months since your last review, staying informed about your options can make a significant difference. In this article, we'll provide you with a simple yet effective letter template for following up on your health insurance, ensuring you get the coverage you deserve. Ready to take charge of your health? Let's dive right in!

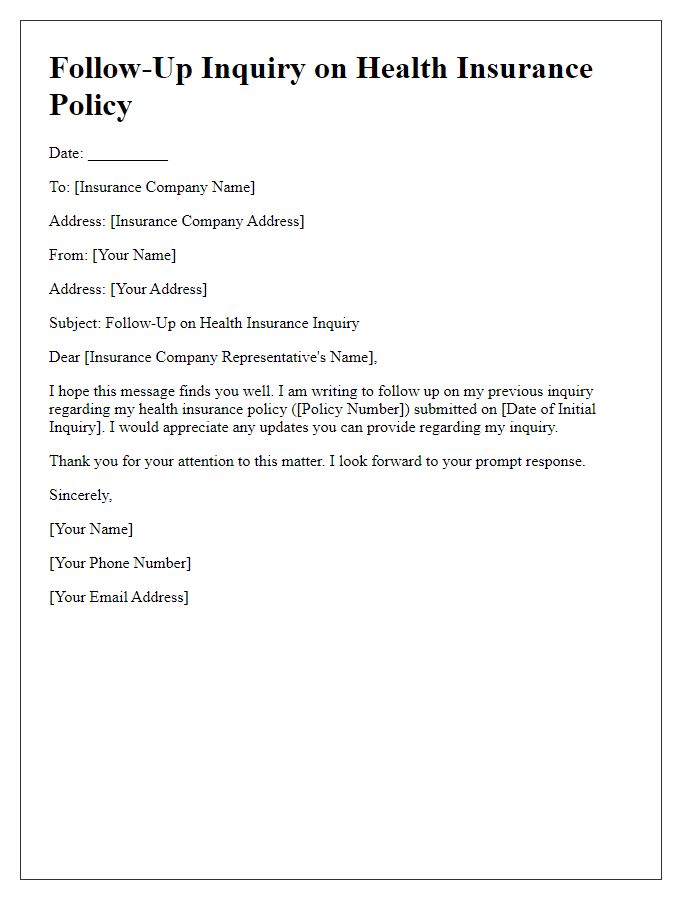

Personal Information Overview

Following up on health insurance applications requires a comprehensive personal information overview. Essential details include full name, date of birth, and social security number, which uniquely identify the applicant. Address, including city, state, and zip code, is crucial for correspondence and policy documentation. Employment information, such as employer name, position, and duration of employment, ensures accurate assessment of coverage eligibility and premium calculations. Health history, detailing pre-existing conditions or previous treatments, is vital for underwriting processes. Lastly, contact information, including phone numbers and email address, facilitates communication regarding policy status and any needed documentation.

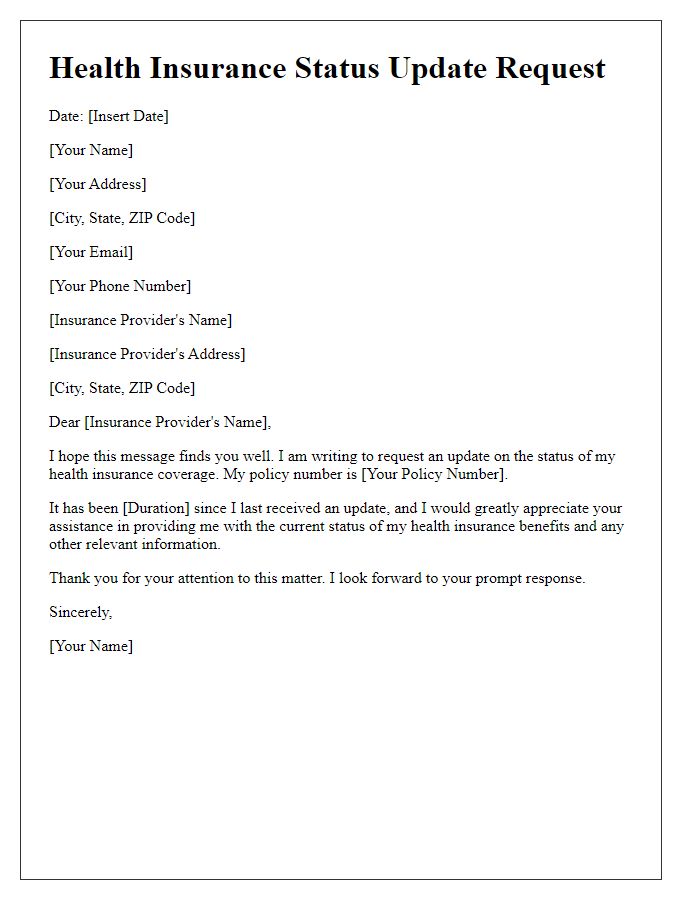

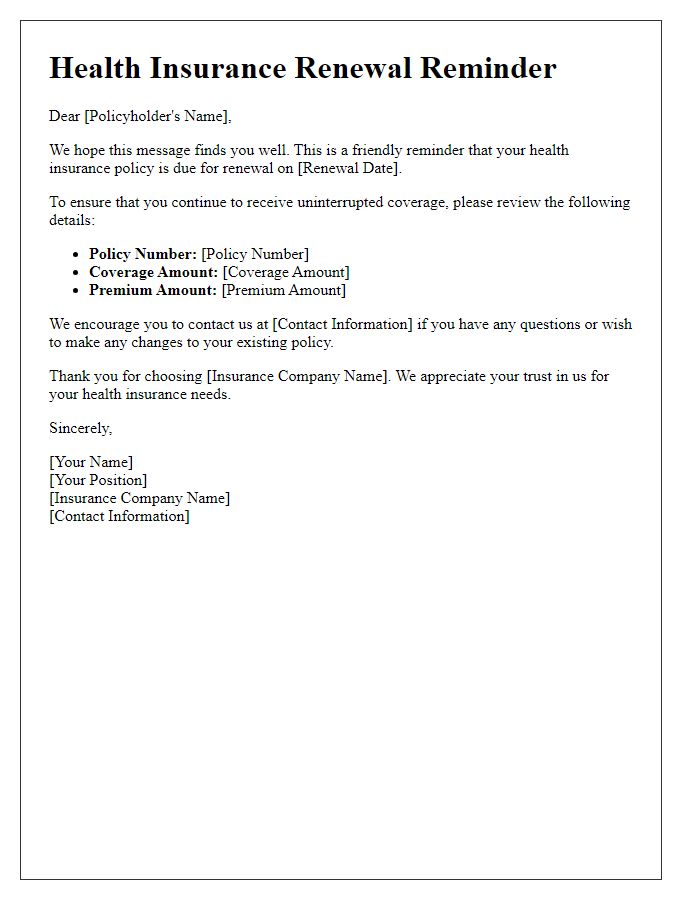

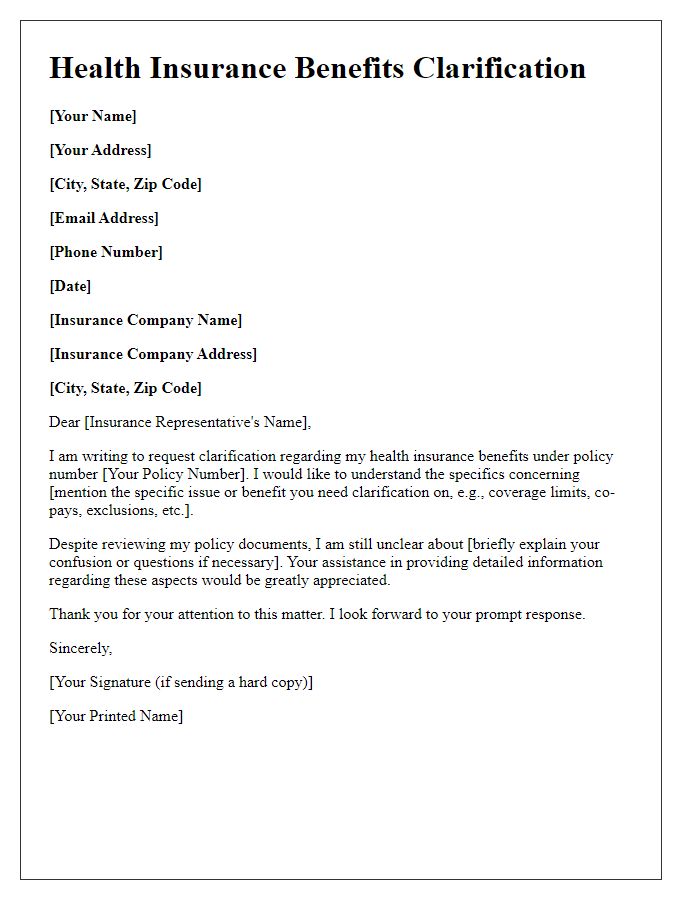

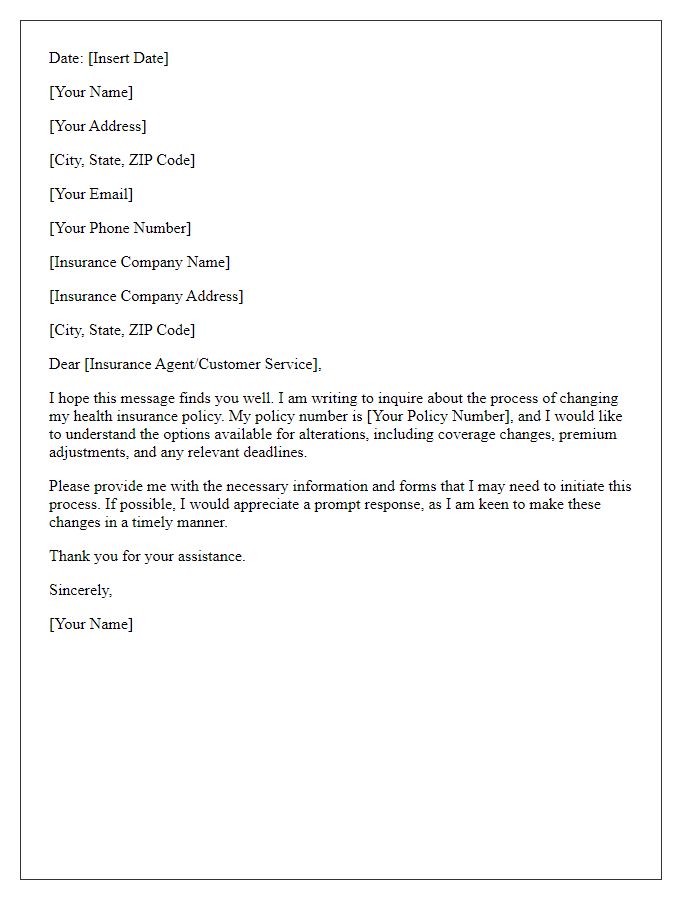

Policy Details and Reference Number

Health insurance policies are essential for safeguarding one's financial stability in medical emergencies. Policy details, such as coverage limits, premium amounts, and specific conditions, generally vary among providers like Blue Cross Blue Shield and Aetna. A reference number, typically a unique alphanumeric code assigned to each policy, assists in tracking claims and updates efficiently. The importance of a comprehensive understanding of these details cannot be overstated, especially when navigating complex systems involving medical treatments, hospitalizations, or prescription medications. Timely follow-ups can prove crucial, especially when addressing claims issues or modifications to coverage plans.

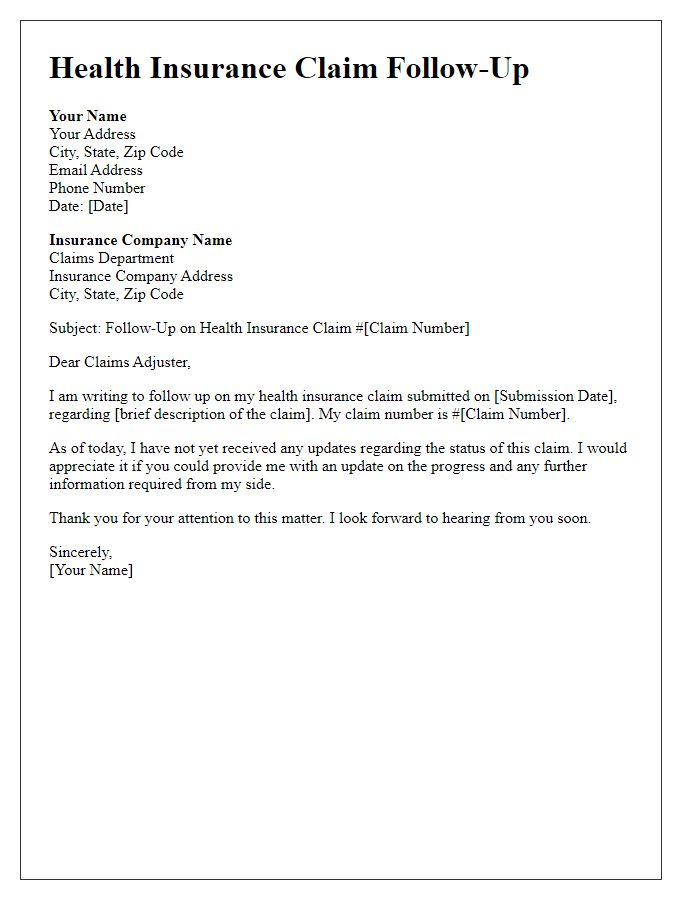

Specific Inquiry or Concern

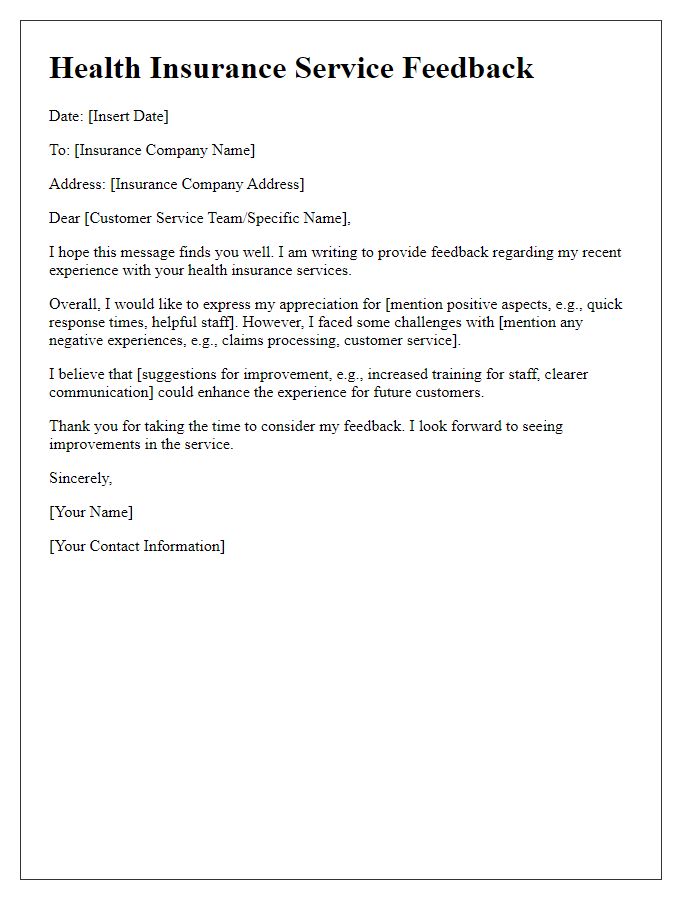

Health insurance policies often include specific clauses that dictate coverage, exclusions, and claims processes. For example, a pre-existing condition may affect eligibility for certain treatments, especially within policies governed by the Affordable Care Act, which was enacted in 2010. Premiums might vary based on demographics such as age, location (such as urban versus rural areas), and risk factors. Furthermore, understanding the claim submission timeline, which typically ranges from 30 to 180 days post-treatment, is critical to ensure timely processing. Health plans, like those from Blue Cross Blue Shield or Aetna, may also include specific customer service hotlines and dedicated representatives for inquiries, ensuring clients receive assistance tailored to their needs. Therefore, a clear follow-up communication should address these points succinctly to facilitate a resolution to any outstanding issues.

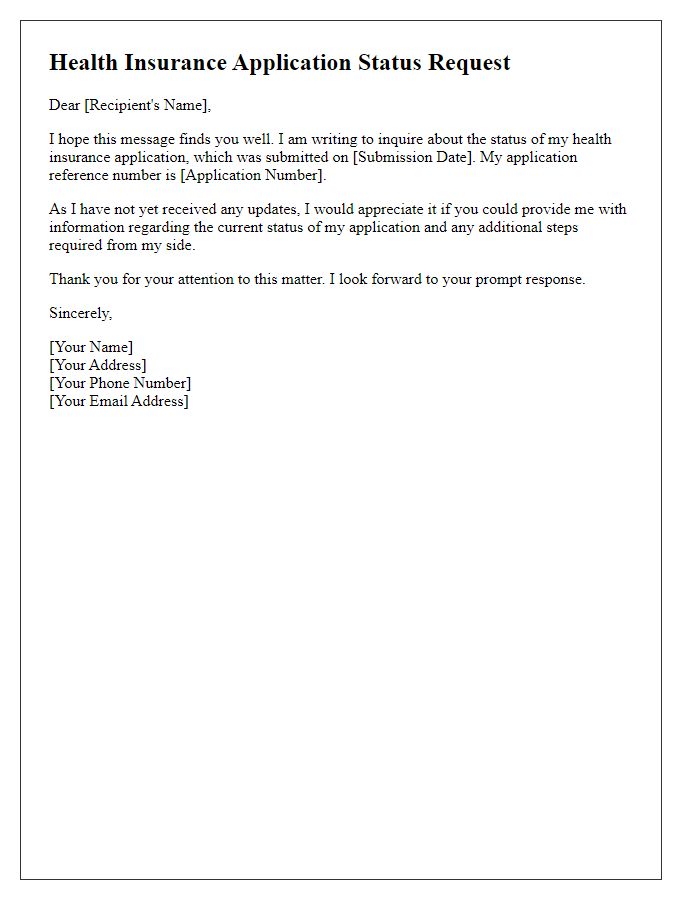

Request for Status Update

Many individuals are often interested in tracking the progress of their health insurance claims or applications. Important factors include the processing time, which can vary significantly across insurers, often ranging from a few days to several weeks. A health insurance policy typically covers a range of services, such as hospitalization costs, outpatient treatments, and prescription medications. Insurers such as Aetna or UnitedHealth Group provide online portals for users to check the status of their claims. Timely follow-up can ensure that any potential issues are addressed, preventing delays that could impact the availability of necessary medical services.

Contact Information and Availability

Following up with health insurance providers requires clear communication of contact details and scheduling preferences. For effective outreach, include your full name, email address, and phone number, ensuring that the provider can easily reach you for inquiries or to clarify any issues. Specify your preferred times for a follow-up conversation, such as weekdays from 9 AM to 5 PM, and mention your willingness to accommodate specific time slots if necessary. This proactive approach fosters more efficient dialogue and demonstrates organization in managing your health insurance matters.

Comments