Hey there! If you've recently applied for credit and are eagerly awaiting approval, you're not alone. Many people find themselves in similar situations, wondering what to expect next and how to follow up effectively. In this article, we'll explore some tips and templates to help you craft the perfect follow-up letter for your credit approval status. Stick around to learn how to increase your chances of a positive outcome!

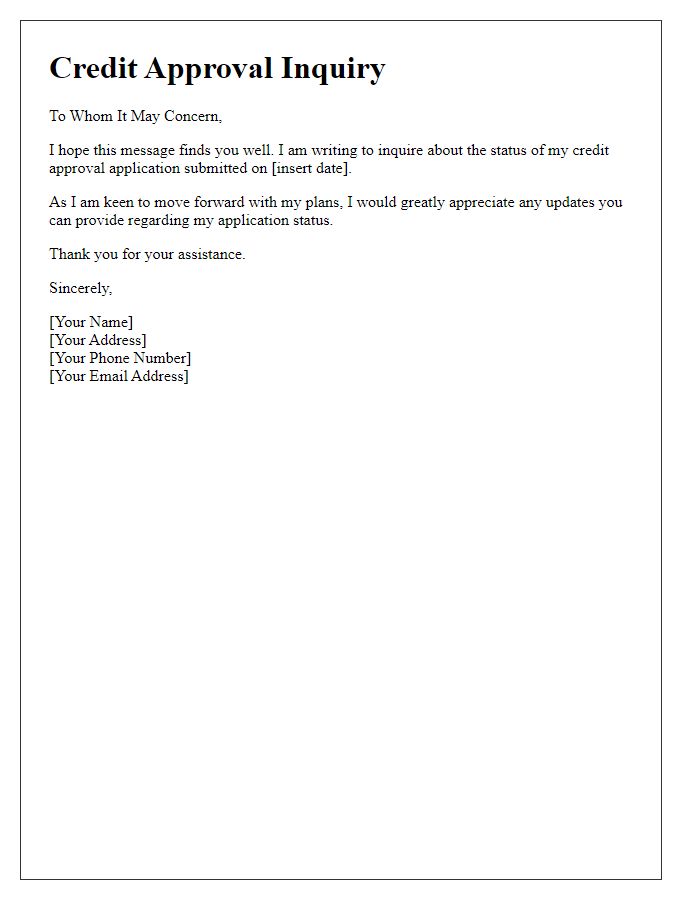

Personalized Salutation

Credit approval follow-ups are crucial for maintaining communication with clients who have applied for loans or credit. After an initial application, it is vital to provide personalized attention to ensure a smooth process. Custom greetings using the applicant's name enhance engagement, while detailing the specific credit product, such as a home mortgage or personal loan, fosters clarity. Including relevant timelines, such as processing timeframes or expiration dates for offers, further establishes transparency. Additionally, addressing any outstanding documentation requirements underscores the importance of a complete application, setting a professional tone for the communication and encouraging timely responses.

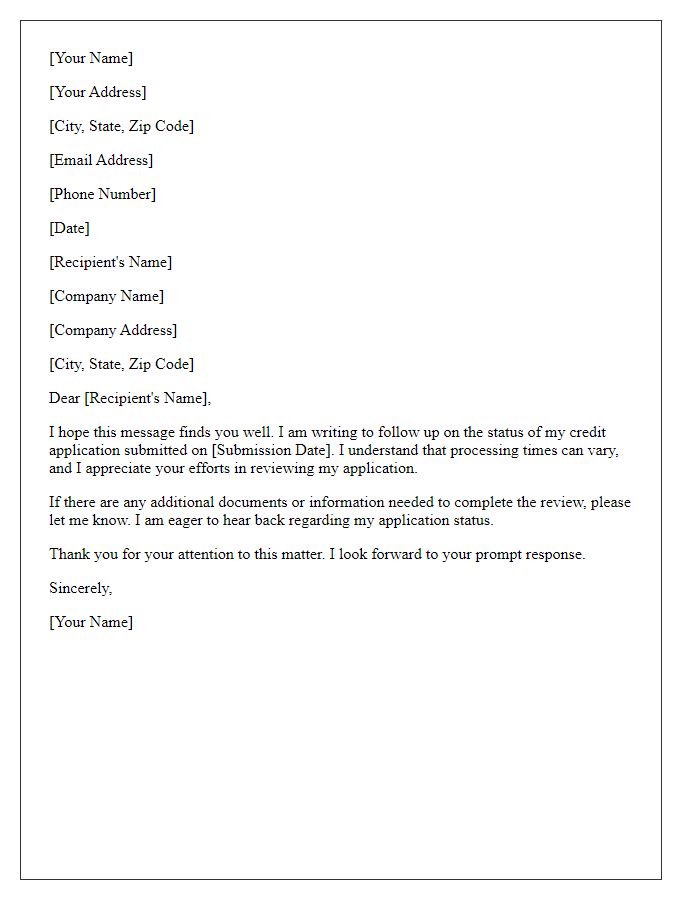

Clear Subject Line

Credit approval follow-up is crucial after submission of documentation. Timely communication can expedite the review process. Include specific details such as application number (often a series of alphanumeric characters), submission date (e.g., October 15, 2023), and the type of credit requested (e.g., personal loan, mortgage). A clear subject line, like "Follow-Up on Credit Approval Application #123456", helps ensure immediate recognition by the recipient. Indicate urgency without overwhelming the reviewer; express gratitude for their attention. Keeping a professional tone while requesting an update on the application's status can foster a positive relationship with the credit institution. Include preferred methods of communication for a prompt response.

Credit Approval Reference

Credit approval processes can determine the financial opportunities available to individuals. Approval timelines often vary, with many banks and credit unions processing applications within five to ten business days. Reference numbers assigned to applications (such as a 10-digit unique identifier) allow lenders to track progress and handle inquiries efficiently. Applicants often seek clarity on their credit score, crucial in determining approval chances, which can range from 300 to 850, impacting loan terms and interest rates. Communication through emails, phone calls, or online portals ensures applicants remain informed of their status throughout the approval journey.

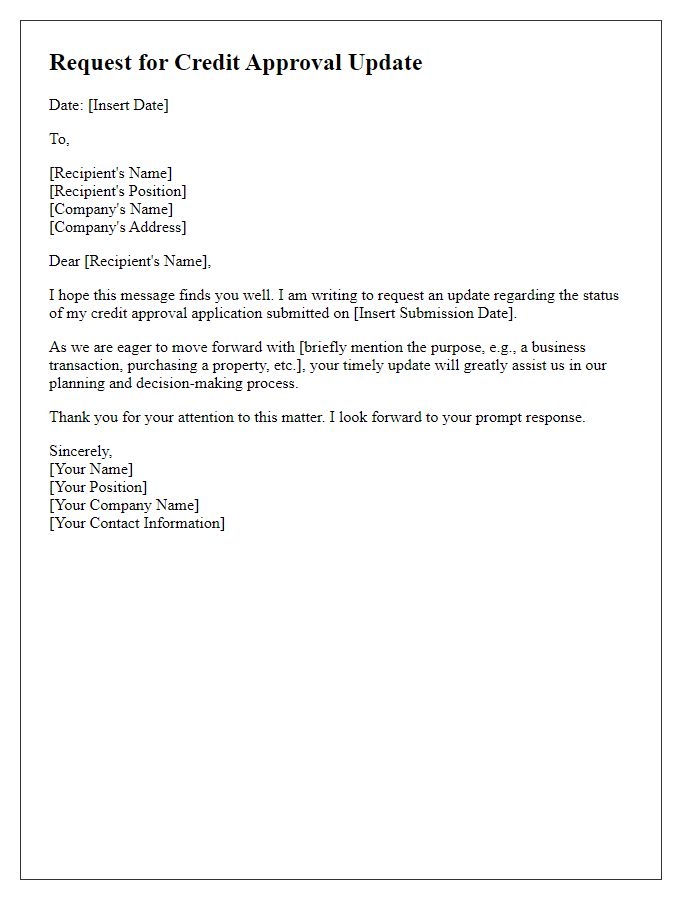

Expressing Gratitude

A follow-up email expressing gratitude after receiving credit approval highlights the excitement and appreciation for the opportunity provided by the financial institution. Mentioning the specific credit amount approved establishes clarity and relevance, while referencing the initial application date reinforces the timeline of the approval. Affirming the positive impact this approval will have on achieving financial goals, such as purchasing a new home or funding a business venture, shows intent and purpose. Acknowledging the support from the lending team enhances the personal connection, fostering goodwill for potential future interactions. Ending with a note of anticipation for the next steps in the process ensures a proactive approach, inviting continued engagement.

Contact Information for Queries

Credit approval processes require thorough verification and communication. Banks and financial institutions often provide dedicated contact information for queries, ensuring applicants can reach out with specific questions. For instance, Wells Fargo may offer a customer service hotline at 1-800-869-3557 to address concerns regarding credit applications. Additionally, email support options like creditquestions@wellsfargo.com can facilitate quicker responses, especially for inquiries requiring documentation. Clear guidelines on response times can significantly enhance the applicant's experience, improving overall satisfaction during the approval journey.

Comments