Are you feeling a bit overwhelmed with your personal finances lately? You're not aloneâmany people find it challenging to keep track of their spending and savings in today's fast-paced world. A personal budget review can be a game-changer, helping you take control of your financial situation and set achievable goals for the future. So, stick around as we dive deeper into the steps to create an effective budget that works for you!

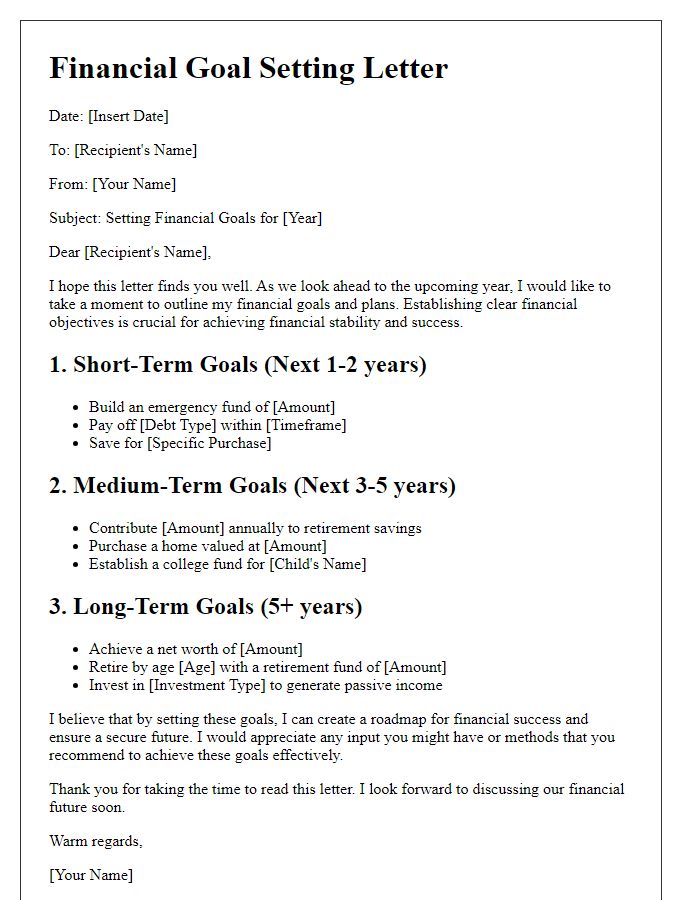

Financial Goals and Priorities

Conducting a personal budget review involves assessing financial goals and priorities, focusing on income sources, expenses, and savings strategies. Establishing specific targets, like saving $5,000 for an emergency fund or reducing monthly discretionary spending by 20%, can provide clarity. Tracking expenses through budgeting apps or spreadsheets allows for detailed analysis of spending habits, highlighting areas for improvement. Prioritizing high-interest debts, such as credit card bills averaging 18% APR, can increase financial security over time. Regular reviews every three months enable adjustments based on changing financial situations, ensuring alignment with long-term goals.

Income and Revenue Streams

Conducting a personal budget review is essential for managing financial stability, particularly focusing on income and revenue streams. Detailed income sources may include salaries from employment at companies like Microsoft or Google, freelance earnings from platforms such as Upwork, and rental income from properties located in cities like New York or San Francisco. Analyzing this income over months can provide insights into patterns and fluctuations, particularly during seasonal events such as holiday shopping periods. It's also important to consider passive income streams, which might involve dividends from investments in stocks like Apple or index funds, providing significant contributions to overall revenue. Careful tracking of these elements helps in making informed decisions about savings and investments.

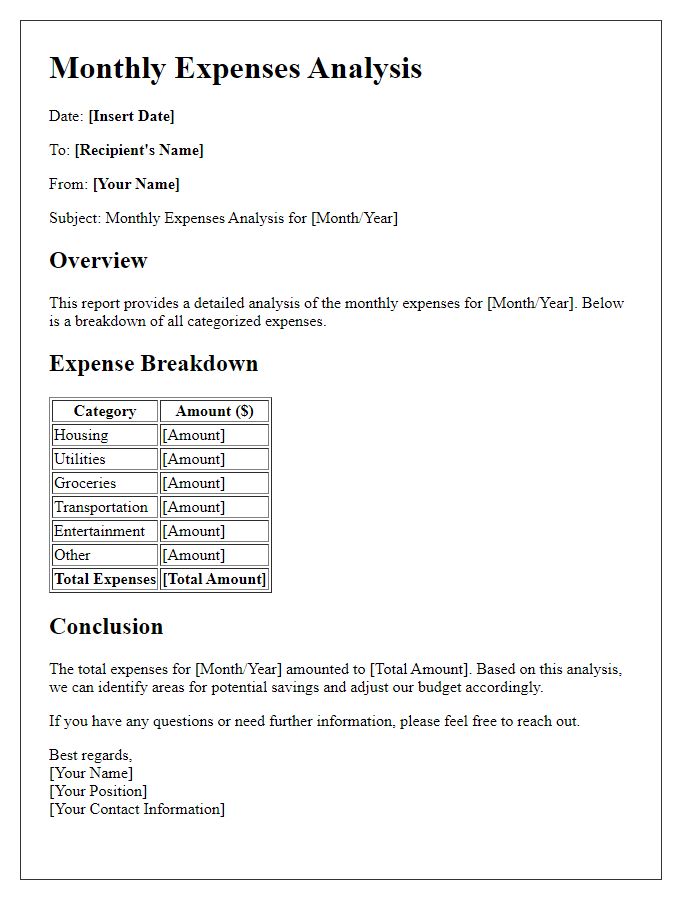

Expenses and Spending Categories

Examining personal budgets reveals significant insights into spending habits and financial health. Common expense categories include housing costs, which can account for over 30% of monthly income, transportation expenses that often encompass public transit, vehicle maintenance, and fuel, typically around 15%, and groceries representing roughly 10% of total expenses. Other expenses that may arise include discretionary spending like entertainment, dining out, and hobbies, which can fluctuate between 5% to 20% based on lifestyle choices. Additionally, monitoring fixed costs such as insurance, utilities, and loan payments ensures awareness of commitments that cannot be altered monthly. Understanding these categories aids in identifying areas for potential savings, fostering more informed financial decisions.

Savings and Investment Plans

A personal budget review focuses on an individual's Savings and Investment Plans, examining financial objectives and growth potential. Budgeting involves a detailed analysis of monthly income, expenses, and discretionary spending to identify opportunities for increased savings. Savings accounts, typically offered by banks like Chase or Wells Fargo, often accumulate interest rates around 0.01% to 0.05%, while high-yield savings accounts may offer rates between 1% and 2.5%. Investment plans, such as 401(k) accounts, allow individuals to allocate pre-tax income towards retirement, with matching contributions from employers in some cases. Real estate investments also represent a significant opportunity, with potential returns averaging 8% annually in desired locations like Austin or Orlando. Regularly reviewing these financial strategies ensures alignment with personal goals and market conditions, enhancing overall financial health and security.

Debt Management and Reduction Strategies

Comprehensive debt management strategies play a pivotal role in personal finance. Effective approaches include creating a detailed budget, identifying essential expenses, and minimizing discretionary spending. Conducting a thorough analysis of outstanding liabilities, such as credit card balances or student loans, provides insight into high-interest debts that require immediate attention. Implementing the snowball method, where the smallest debts are paid off first, can foster motivation and a sense of accomplishment. Commitment to regular monthly payments, even in small amounts, helps reduce overall debt levels over time. Utilizing resources such as credit counseling services can provide personalized guidance and financial education, enhancing the individual's ability to navigate and ultimately achieve long-term financial wellness.

Comments