Are you curious about the financial well-being of your business? A comprehensive financial health check can provide invaluable insights, helping you identify strengths and weaknesses in your operations. By understanding key metrics and trends, you can make informed decisions to steer your company toward sustainable growth. Dive into our article to discover how to perform a financial health check and ensure your business is on the right track!

Clear Purpose Statement

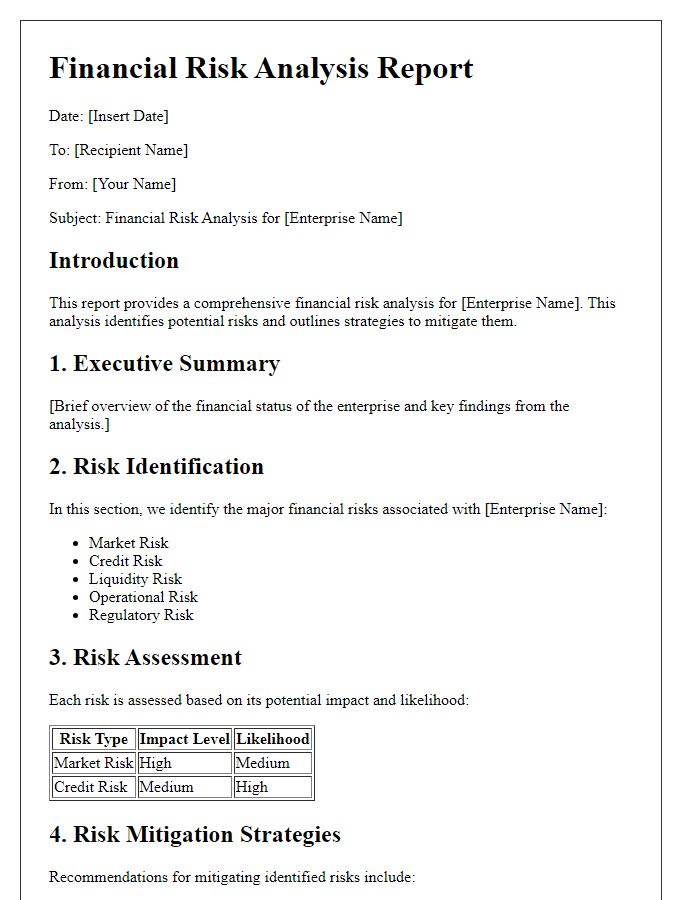

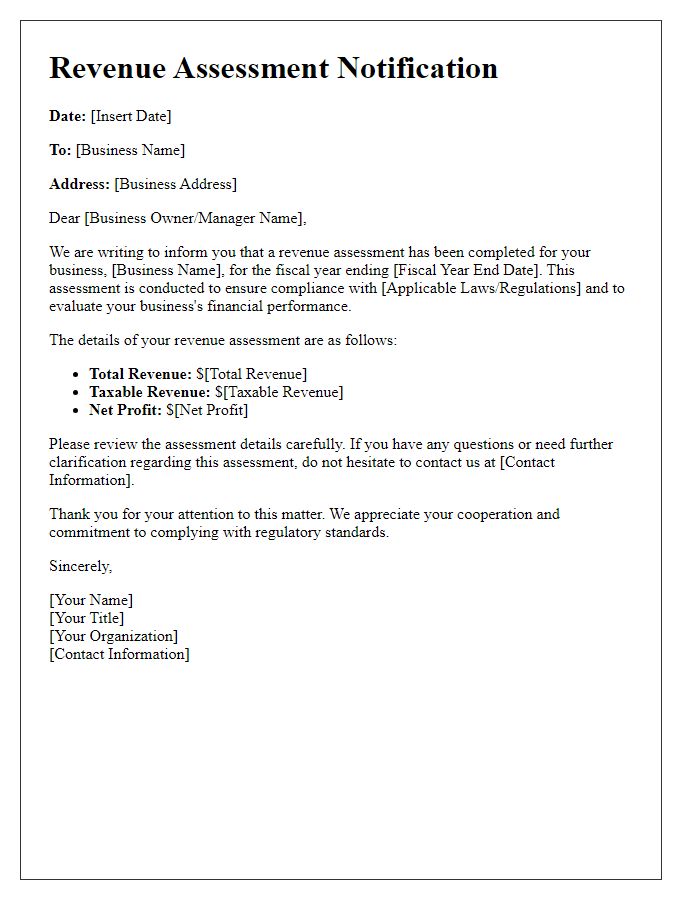

A financial health check is critical for businesses looking to assess their fiscal stability and profitability. This comprehensive evaluation includes analysis of key financial statements such as balance sheets and income statements, as well as cash flow metrics to identify trends and discrepancies. A healthy liquidity ratio (ideally between 1.5 and 2) indicates sufficient short-term assets to cover liabilities, while a strong debt-to-equity ratio (preferably below 1) reflects balanced financing strategies. Evaluating these metrics can help highlight areas for improvement, mitigate risks, and drive informed decision-making, ultimately enhancing long-term sustainability and growth potential.

Financial Overview

A comprehensive financial overview is crucial for evaluating the fiscal vitality of a business entity. Key metrics such as revenue growth, operating margins, and net profit margins offer insightful perspectives on financial health. Examining financial statements--specifically the balance sheet, income statement, and cash flow statement--unveils the company's liquidity position and overall solvency. For instance, a current ratio (current assets divided by current liabilities) above 1.5 signifies strong liquidity, while consistent debt levels indicate manageable leverage. Additionally, a trend analysis over the last three fiscal years reveals patterns in profitability and operating efficiency that are essential for strategic decision-making. Understanding these factors enables stakeholders to make informed assessments and necessary adjustments to ensure long-term sustainability.

Key Financial Metrics

A thorough financial health check reveals critical metrics that provide insight into a company's overall performance and sustainability. Key Financial Metrics include the Current Ratio, a liquidity measurement indicating short-term financial stability, with a benchmark of at least 1.5 for most industries. The Debt-to-Equity Ratio is crucial, typically averaging around 1, highlighting the proportion of debt financing compared to shareholder equity. Gross Profit Margin, usually targeted at 50% or above, is vital for understanding profitability relative to revenue. The Return on Assets (ROA) metric assesses how efficiently a company utilizes its assets, with a standard expectation of 5% or greater. Cash Flow from Operations is essential for understanding liquidity, ensuring enough cash is generated to support ongoing business operations without relying on external financing. Regular monitoring of these metrics can provide stakeholders with valuable insights into operational efficiency and financial resilience.

Strategic Recommendations

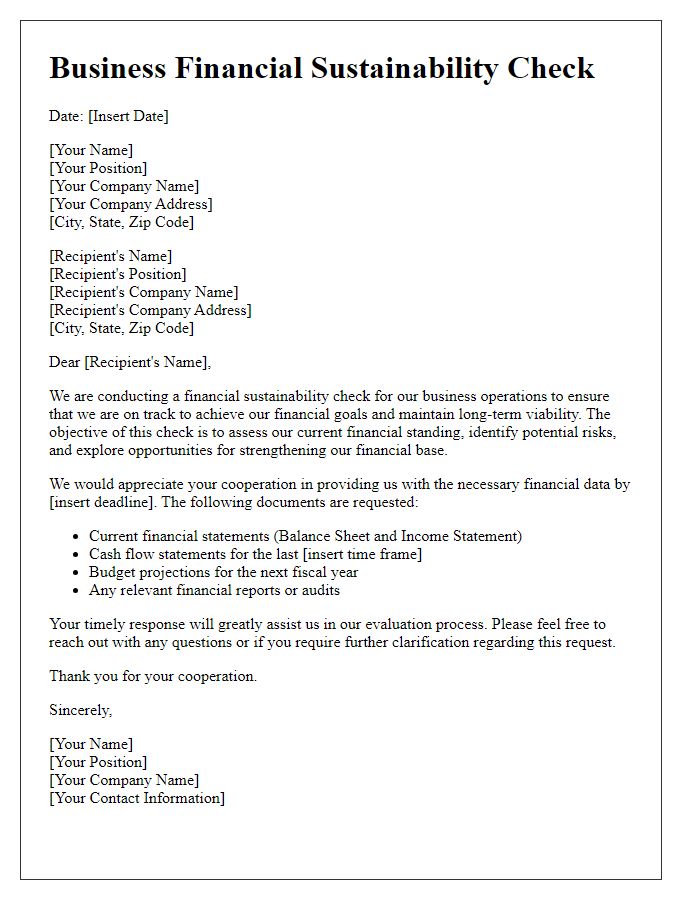

Conducting a business financial health check involves careful analysis of key financial indicators, such as profit margins, liquidity ratios, and cash flow statements. Strategic recommendations often include optimizing operating expenses, which can improve overall profitability by reducing costs associated with supplies and labor, typically accounting for 60% of total expenses in small to medium enterprises. Implementing a robust financial forecasting model, based on historical data and future market trends, ensures better cash flow management, which is crucial for sustainability. Enhancing revenue streams through diversification, like introducing new products or services, can lead to increased market share and customer engagement. Regular financial audits, performed at least annually, enable businesses to identify potential inefficiencies and ensure compliance with industry regulations, providing a clearer picture of fiscal health and operational viability.

Contact Information

In a business financial health check, detailed contact information is essential for effective communication and collaboration. This includes the business's official name, which represents the legal entity (e.g., XYZ Corporation). An address must be provided, highlighting the physical location (like 123 Commerce Street, Suite 456, Downtown, New York), ensuring compliance with local regulations. Phone numbers are crucial, enabling direct contact for consultations, including a primary line (e.g., +1-234-567-8900) and a secondary line for additional inquiries. An email address is necessary for digital correspondence (e.g., contact@xyzcorporation.com). Finally, including the website URL (e.g., www.xyzcorporation.com) offers access to further resources and information about the business's services and financial health.

Comments