Hey there! As we dive into our quarterly financial review, it's the perfect time to reflect on our achievements and challenges over the past few months. Understanding how our finances are doing not only helps us stay on track but also sheds light on the opportunities that lie ahead. Together, we'll explore key insights and strategies that can propel our growth forward. So, grab a cup of coffee and let's delve into the details!

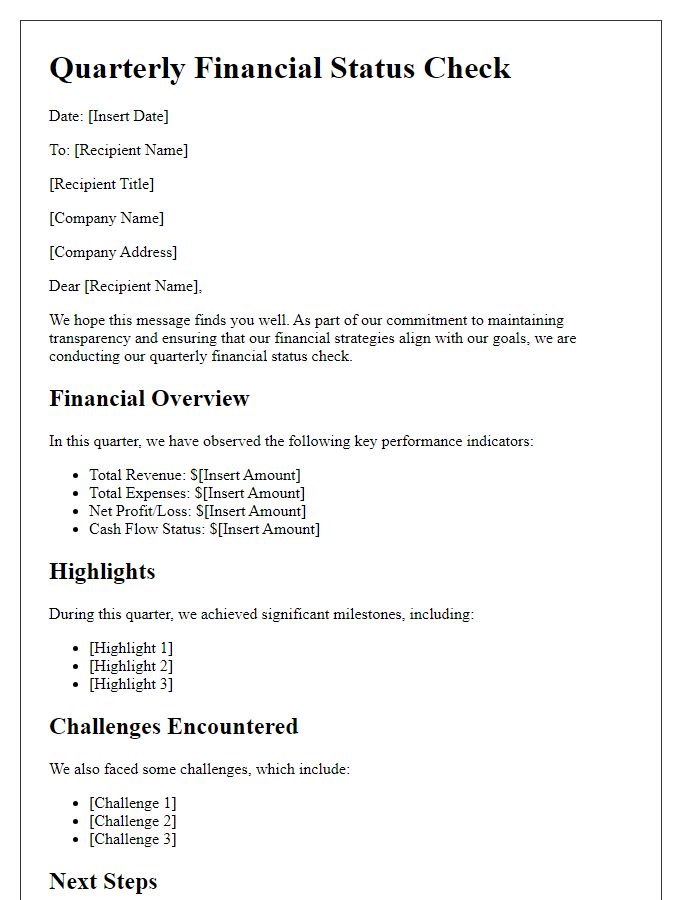

Personalization and Recipient Details

For a quarterly financial review, including personalized details significantly enhances the communication's impact. In this context, utilize the recipient's name, company title, and organization for a tailored approach, ensuring engagement. Specify the time frame of the review, such as Q1 2023 (January to March), to contextualize financial performance. Incorporate specific metrics like revenue growth percentage, net profit margins, or expenses compared to previous quarters for clarity. Mention notable events, such as product launches or market expansions, influencing financial outcomes. Depending on the recipient's role, highlight areas of interest like budgeting strategies for financial officers or investment opportunities for stakeholders. Personal touches foster a stronger connection, enhancing the effectiveness of the financial overview.

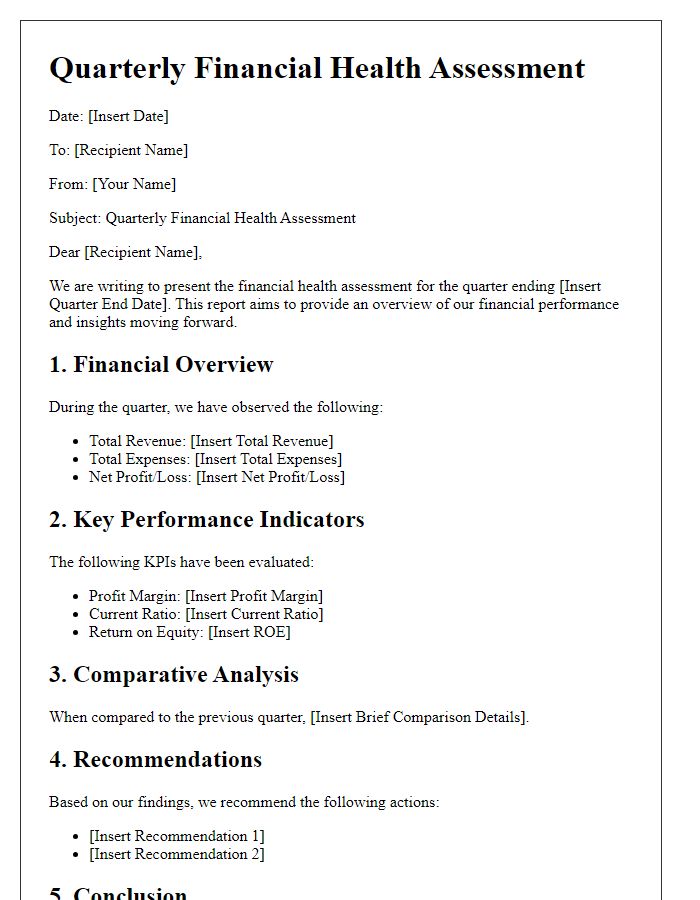

Financial Performance Highlights

The quarterly financial review report presents vital insights regarding the company's performance during the period of July to September 2023. Revenue figures reached $2.5 million, reflecting a 15% increase compared to the previous quarter, driven largely by successful product launches in the technology sector. Operating expenses totaled $1.2 million, maintaining a steady trajectory despite inflationary pressures affecting supply chains, particularly in the manufacturing area. Net profit margins improved to 22%, indicating effective cost management strategies and increased productivity levels among staff. Key performance indicators, such as customer acquisition rate, showed a significant uptick of 25% within the consumer electronics division, highlighting successful marketing campaigns and strategic partnerships formed with key retailers. The balance sheet remains robust, with total assets amounting to $5 million and liabilities at $2 million, showcasing a healthy financial footing for the upcoming quarter.

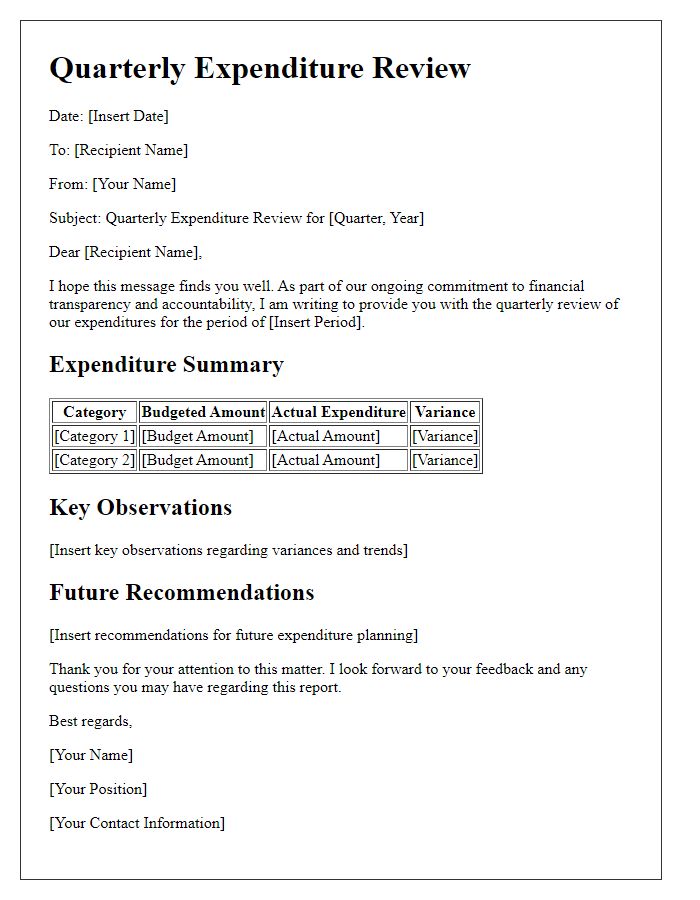

Key Metrics and Comparisons

During the quarterly financial review, key metrics emerge as essential indicators of a company's financial health. Revenue growth rate, often expressed as a percentage, highlights the increase in sales compared to the previous quarter, providing insight into market performance. Operating profit margin, a crucial figure indicating profitability from core business activities, reflects operational efficiency by comparing operating income to total revenues. Additionally, net income serves as the ultimate measure of success, revealing total profits after all expenses, taxes, and costs are deducted, essential for evaluating overall company performance. Comparing these figures to previous quarters allows for trend analysis, identifying patterns in financial growth or decline. Metrics such as earnings before interest and taxes (EBIT) further provide clarity on operational performance, excluding external financing factors. Overall, understanding these financial metrics aids stakeholders in making informed business decisions and setting strategic goals for future growth.

Strategic Initiatives and Outcomes

A quarterly financial review presents an essential opportunity to assess strategic initiatives and outcomes, focusing on key performance indicators (KPIs) such as revenue growth, profit margins, and cost management. For the third quarter of 2023, organizations can analyze changes in total revenue, identifying significant contributors like new product launches or market expansions. The profit margin, which fluctuated between 15% to 20% across sectors, can indicate effective cost control measures alongside operational efficiencies. Examining budget variances provides insights into unplanned expenses, enabling stakeholders to understand the financial impact of strategic decisions. Additionally, tracking customer acquisition costs and lifetime value ratios helps gauge the success of marketing initiatives and overall customer satisfaction levels, ultimately driving informed future investments and resource allocations.

Future Outlook and Recommendations

The quarterly financial review highlights crucial insights into the company's fiscal health, projecting a 10% growth in revenue for the next quarter due to increased sales in emerging markets, particularly Asia-Pacific regions with a GDP growth rate of 5.5%. Key performance indicators (KPIs) such as gross profit margin, currently at 35%, will need to be closely monitored to ensure sustained profitability. Recommendations include investing in technological upgrades to enhance operational efficiency and diversifying the product portfolio to mitigate risks associated with market fluctuations. Strategic initiatives should focus on strengthening customer engagement through targeted marketing campaigns, aiming for a 15% increase in customer retention rates by the end of the fiscal year.

Comments