Are you feeling the weight of your financial obligations? You're not alone, and that's why we're here to offer a solution that can ease some of that stress. A fee installment payment plan can help manage your payments in a way that suits your budget and provides peace of mind. Curious about how this flexible option works and its benefits? Keep reading to discover how you can take control of your expenses!

Formal Salutation and Proper Addressing

A fee installment payment plan provides a structured approach for students or clients to manage their financial obligations over time, typically spanning several months. This arrangement allows for a series of smaller payments instead of a lump sum, making it more manageable for individuals facing financial constraints. Educational institutions, such as universities or colleges, often offer these plans to facilitate access to education, particularly for programs costing thousands of dollars annually. Payment plans may include specific terms, such as due dates for each installment, potential interest rates, and penalties for late payments. Clear communication regarding these details is essential to ensure all parties involved understand the financial commitment and maintain compliance with the agreed terms, thereby avoiding defaults and fostering a positive relationship between the institution and the individual.

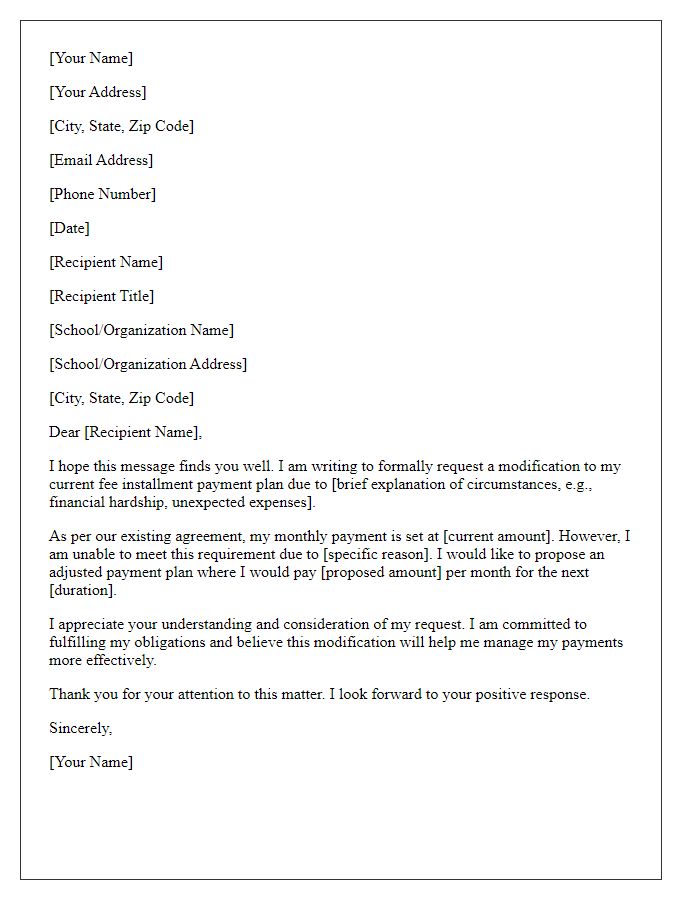

Clear Explanation of Financial Hardship

Financial hardships can significantly impact an individual's ability to meet financial obligations. For instance, unexpected events like job loss, particularly in mid-sized cities like Detroit where unemployment rates reached 20% during the economic downturn in 2020, can severely limit income. Medical emergencies can also create staggering bills; for example, an average hospital stay costs approximately $10,000 in the United States, leading to overwhelming debt for many families. Additionally, personal circumstances such as divorce can result in financial strains, with legal fees averaging around $15,000. These situations contribute to difficulty in managing expenses and maintaining timely payments on debts, necessitating seeking a fee installment payment plan to alleviate immediate financial pressure while ensuring continued commitment to meet obligations over time.

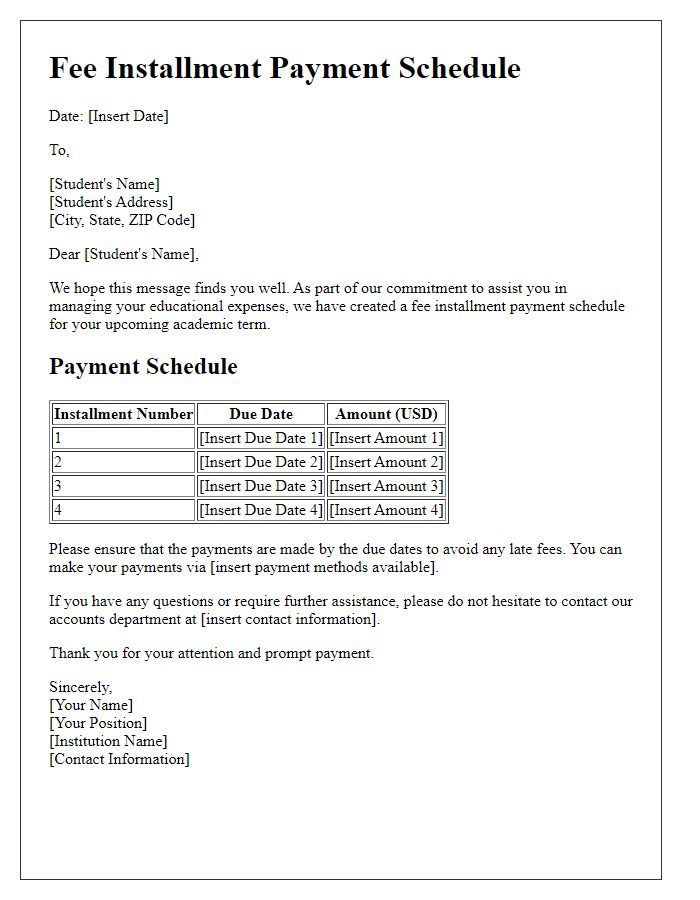

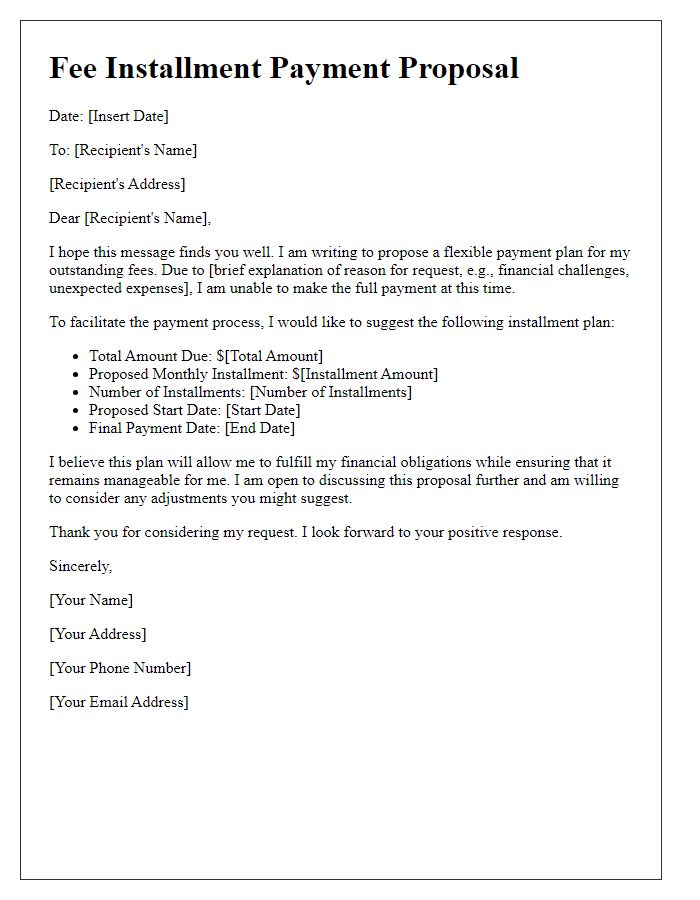

Detailed Installment Payment Schedule

The Detailed Installment Payment Schedule outlines a structured approach for managing financial obligations over a specified duration. The schedule typically includes the total amount due, broken down into manageable installments, facilitating better budgeting. Each installment, for instance, could be set at $200, with payments due on the 1st of each month for five consecutive months, starting from January 1, 2024, through May 1, 2024. This systematic payment plan encourages punctuality and financial discipline. Additionally, it may include information about late fees (often around $25) if payments are not received on time, ensuring clarity and accountability. The total projected payment amount, including possible interest (often between 3-5%), can further enhance understanding of the overall financial commitment involved.

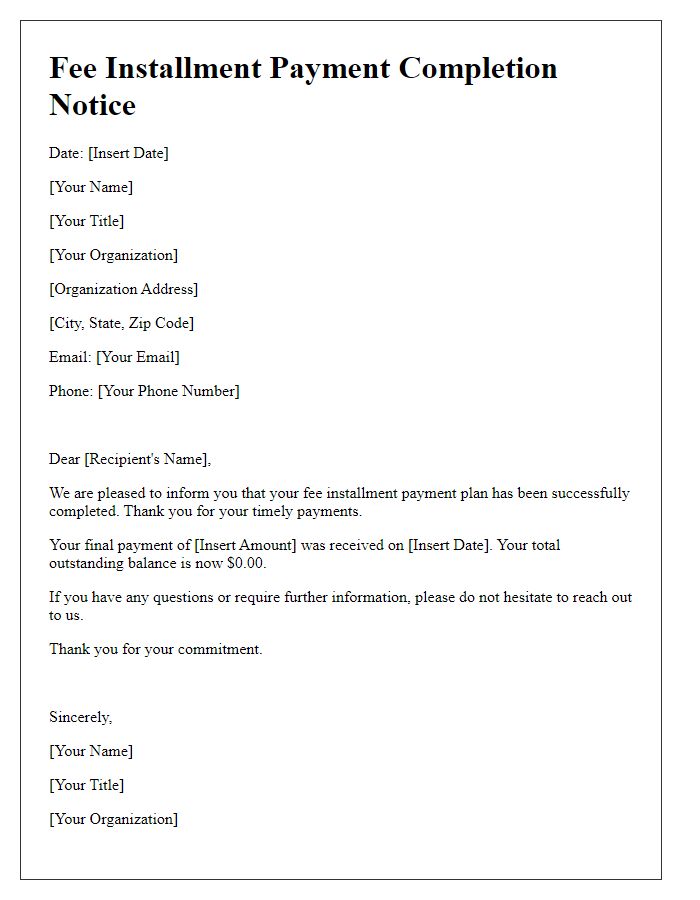

Assurance of Commitment to Payment Fulfillment

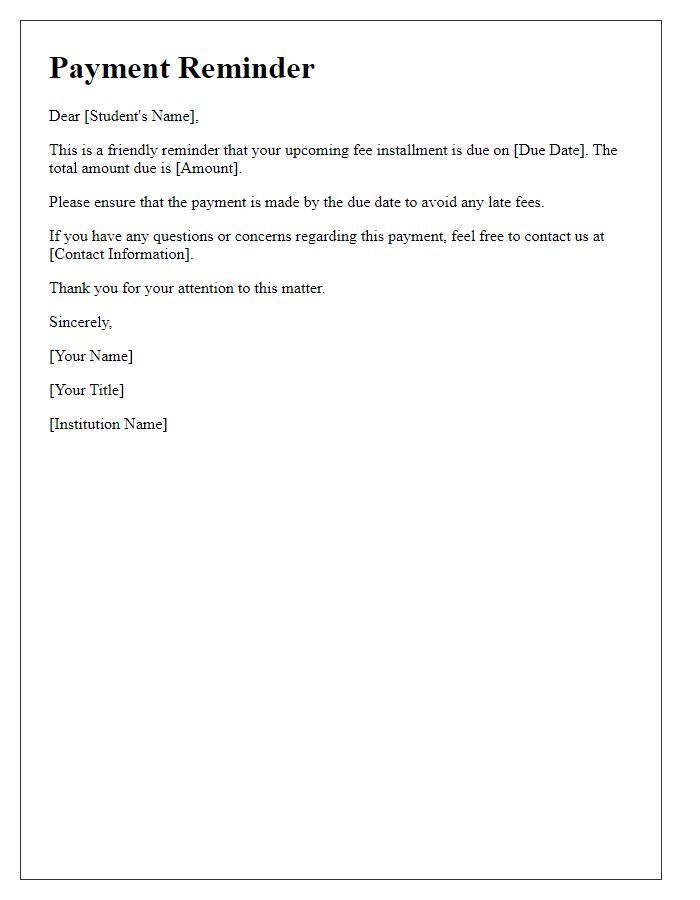

In a fee installment payment plan, structured commitments ensure financial responsibility and reliability. Each installment typically consists of a specified amount, agreed upon in advance, divided into manageable payments over a defined period, often spanning several months. Key details like due dates, which can occur monthly or quarterly, must be clearly outlined to maintain transparency. Notably, late payment penalties may be imposed after a grace period of around 15 days, encouraging timely payments. Financial institutions or educational institutions establishing such plans often require a signed agreement to formalize the commitment from the participant, enhancing accountability. Clear communication and reminders are crucial to uphold the arrangement and avoid misunderstandings.

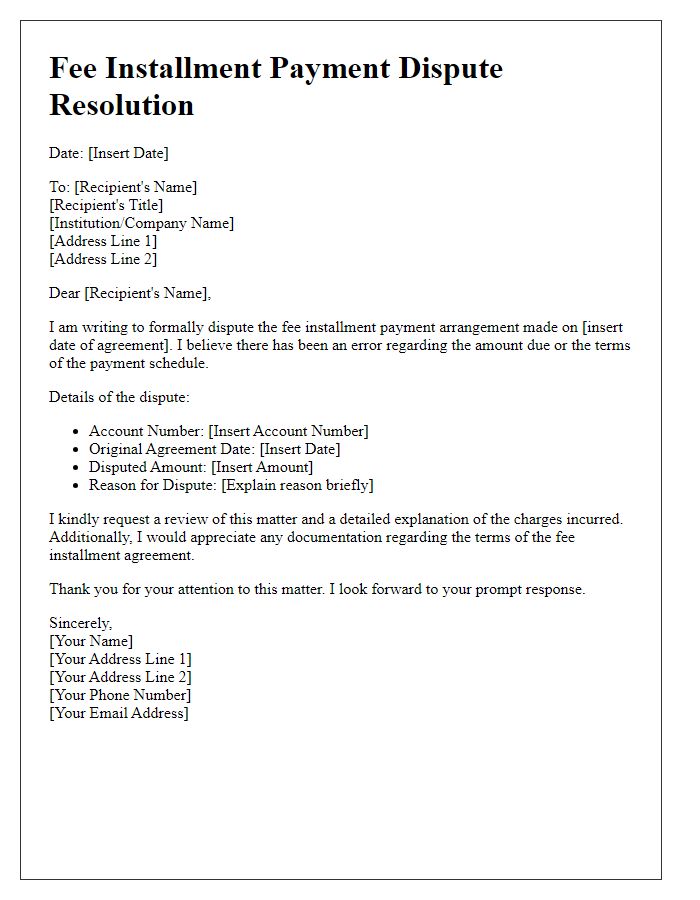

Contact Information for Further Communication

A fee installment payment plan often requires clear communication between parties involved, highlighting essential contact information for further discussions. This may include the full name of the contact person responsible for managing the payment plan, their telephone number (typically a direct line), and a dedicated email address for written correspondence. In cases involving educational institutions, specific departments such as Student Accounts or Bursar's Office may be mentioned, with extensional details to ensure accurate routing of inquiries. Additionally, the physical address of the institution or organization involved can be provided for any necessary formal correspondence. Prompt updates or responses are encouraged to guarantee a streamlined communication process throughout the payment plan duration.

Letter Template For Fee Installment Payment Plan Samples

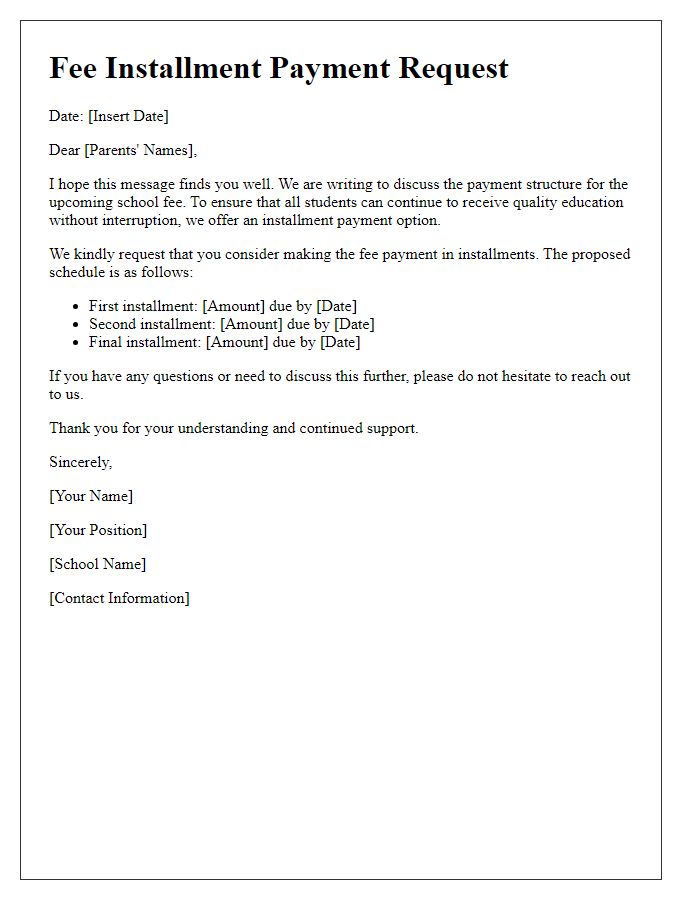

Letter template of fee installment payment confirmation for enrolled students

Letter template of fee installment payment schedule for educational institutions

Letter template of fee installment payment authorization for bank transactions

Comments