Are you feeling puzzled about your insurance premium notice? We understand that these documents can sometimes feel overwhelming, but we're here to help clarify everything for you. It's important to grasp how your insurance works, and what to expect in terms of payments and coverage. Let's dive deeper into the details, ensuring you're fully informed and confidentâread on to learn more!

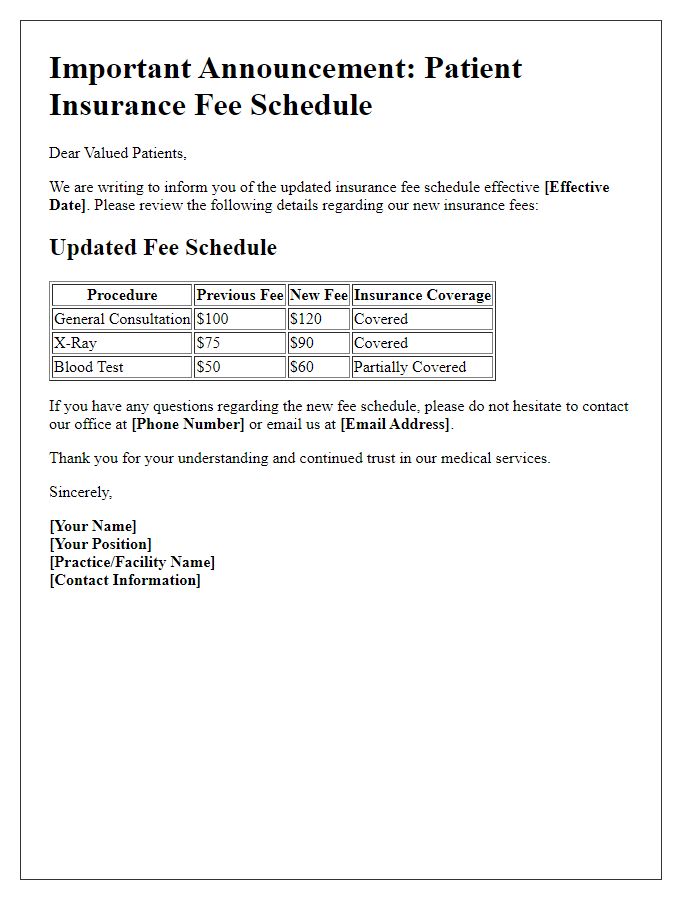

Clear Policy Information

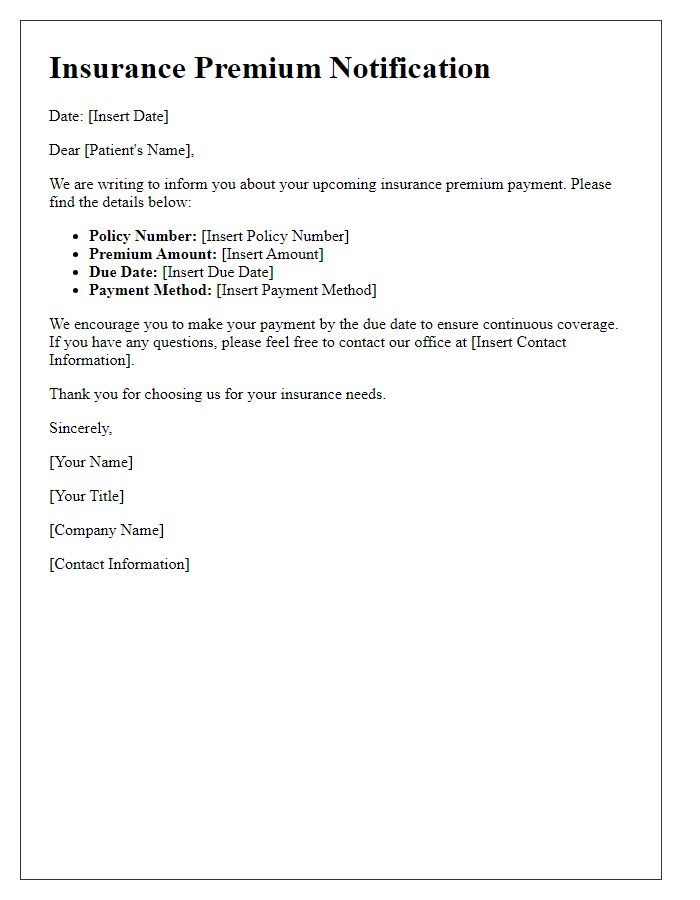

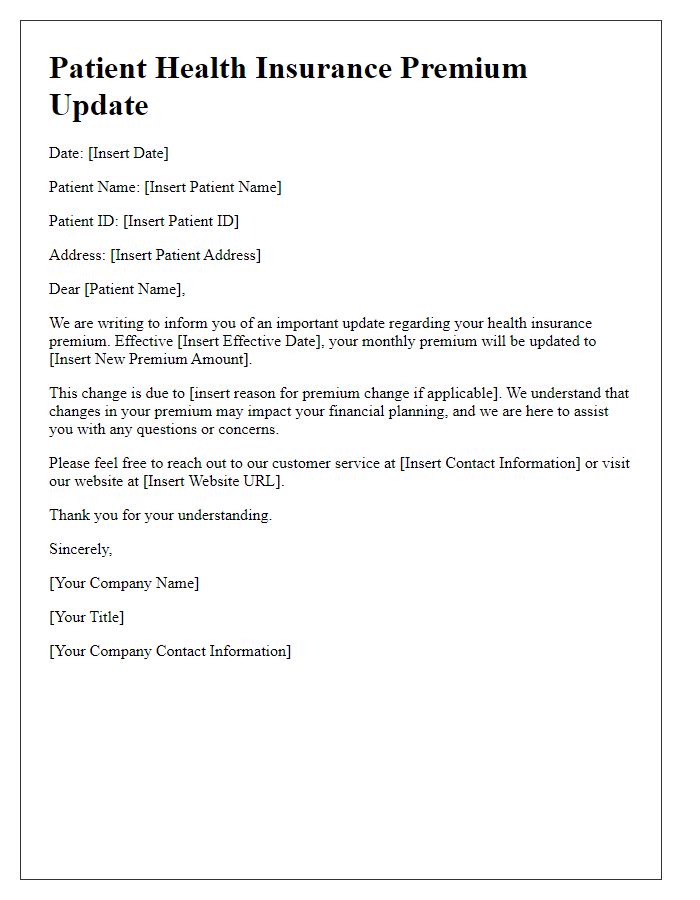

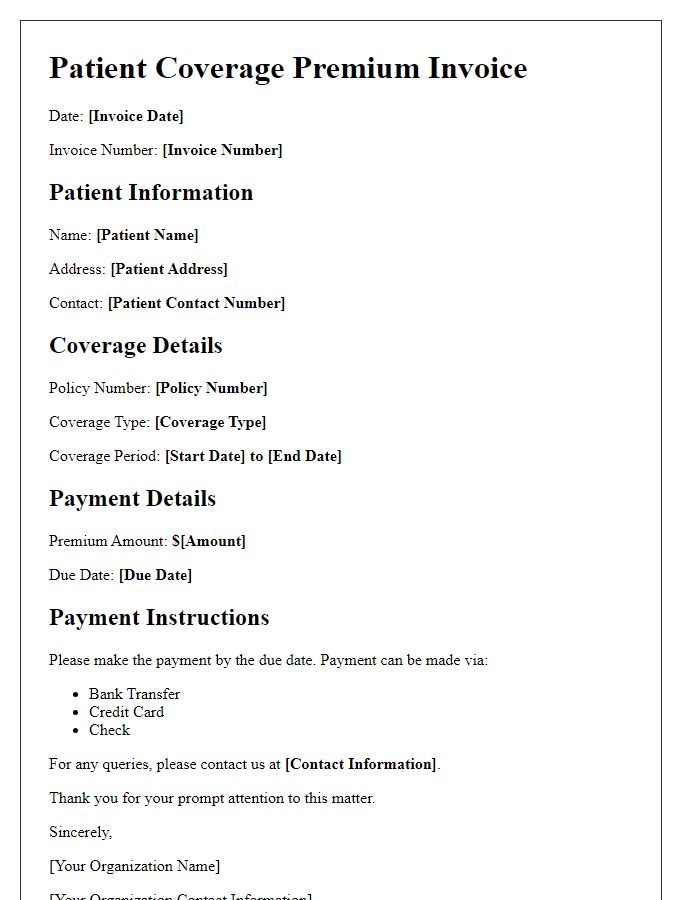

Insurance premium notices provide essential information regarding patient coverage and payment obligations. Clear policy information encompasses key elements like the policy number, effective dates, monthly premium amounts, and co-payment requirements. Patients should understand their coverage limits, including deductible amounts and out-of-pocket maximums, typically enforced annually. This communication often includes specific policy provisions, detailing the range of medical services covered under the plan, such as hospital stays, outpatient procedures, and prescription medications. Additionally, it may specify necessary procedures for claims processing and payment timelines, helping patients stay informed about their financial responsibilities regarding healthcare expenses.

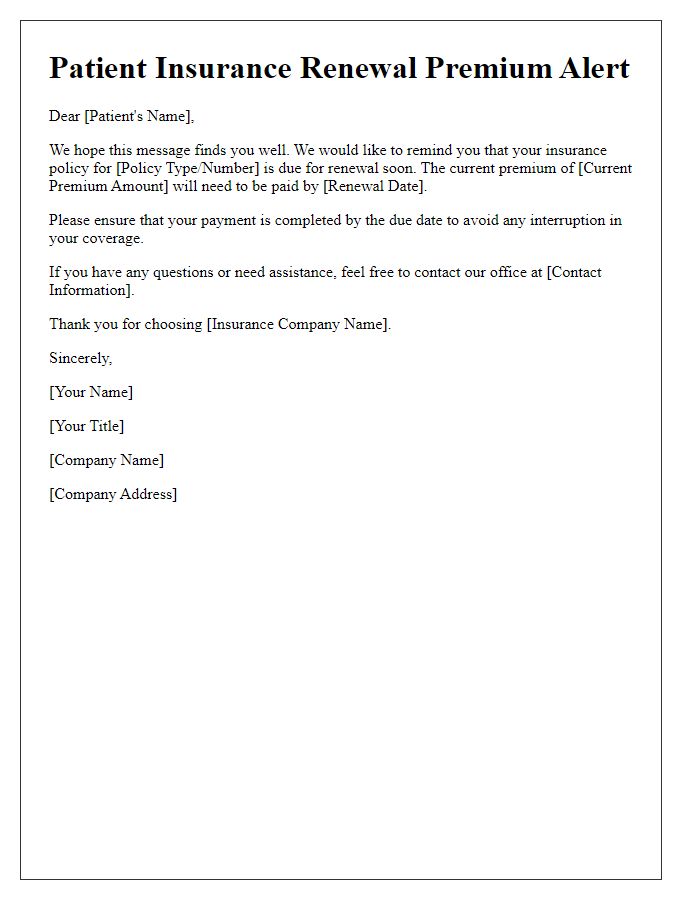

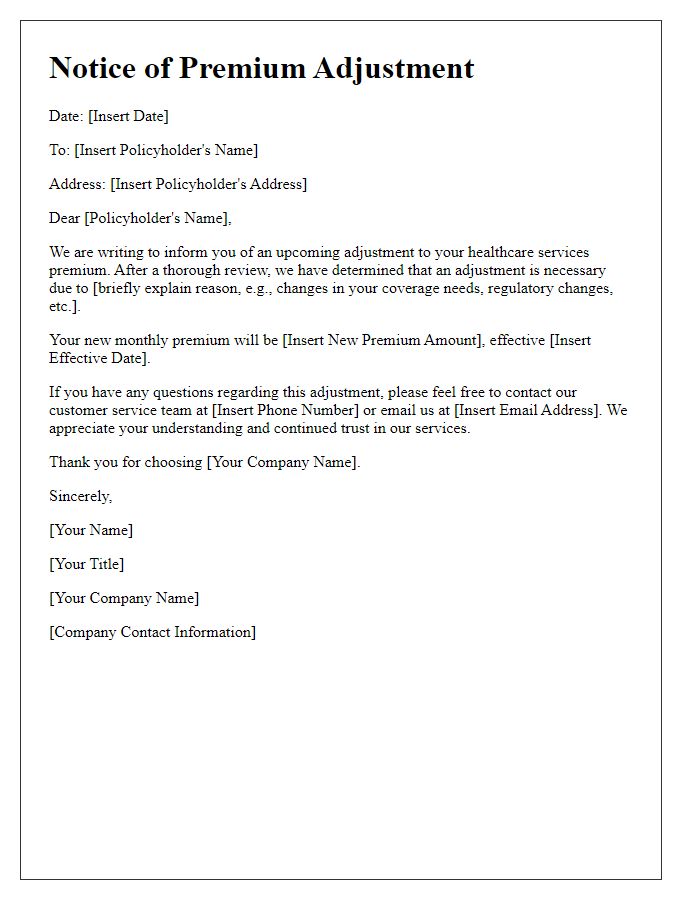

Accurate Premium Amount

Patients receiving insurance premium notices should ensure the listed premium amount accurately reflects the agreed-upon rate. Discrepancies might occur due to changes in personal information, such as income adjustments or eligibility status. For example, an increase in annual income can lead to a higher premium, while qualifying for a subsidy may decrease costs significantly. Thorough review of the notice, including terms set during the insurance enrollment period, is crucial to avoid unexpected financial burdens. In case of issues, contacting the insurance provider directly is advisable to clarify any misunderstandings related to the premium amount.

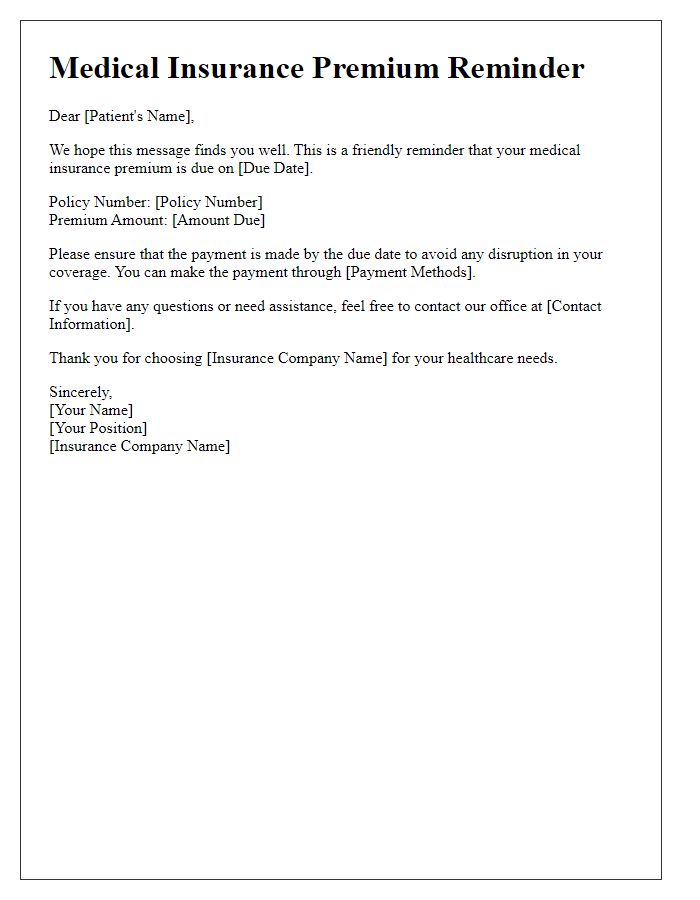

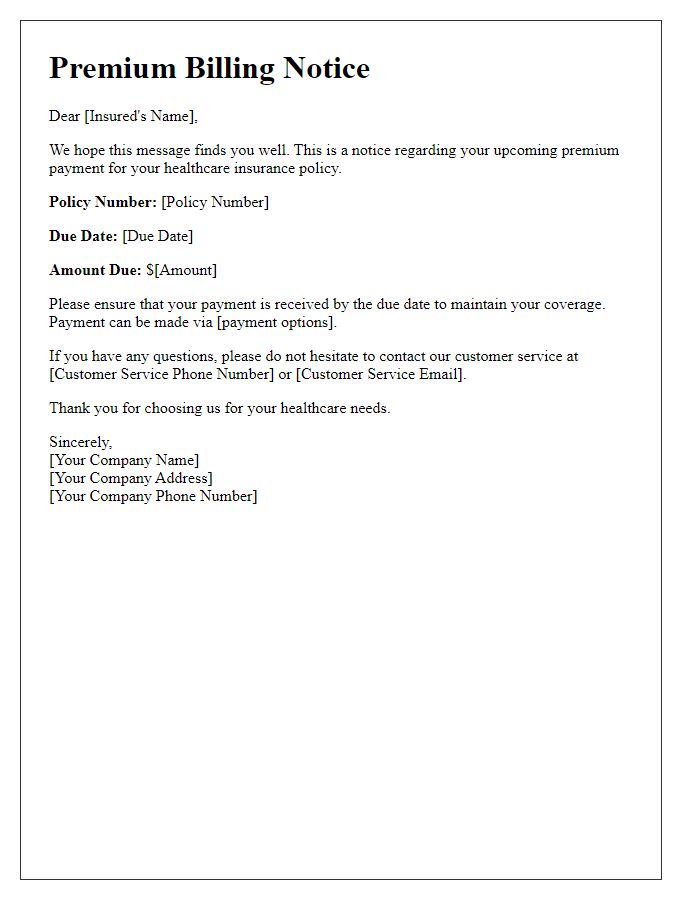

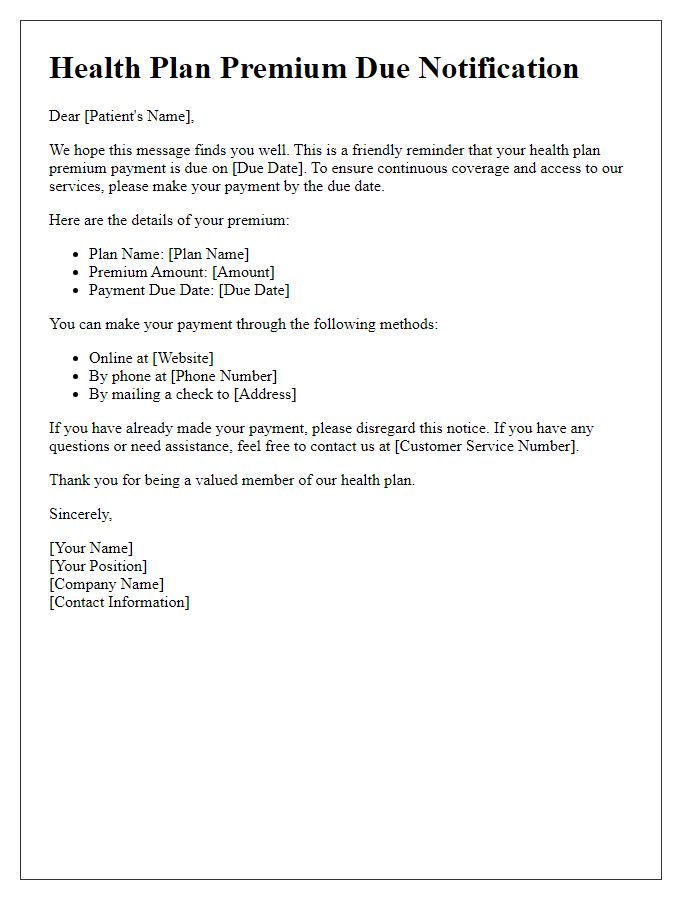

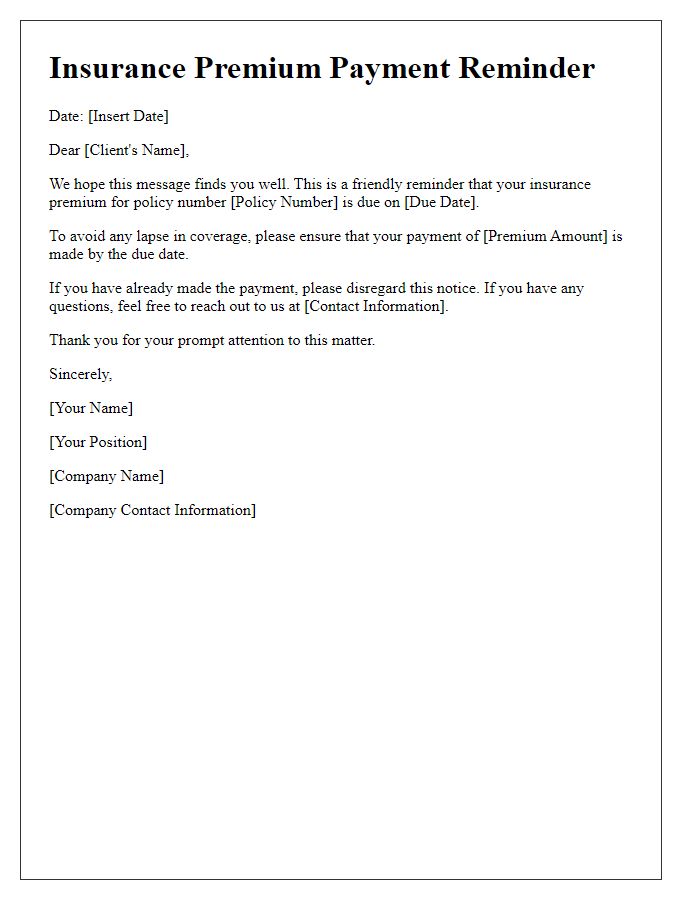

Due Date and Payment Options

Patients should be aware of their insurance premium due dates to maintain proper coverage. For example, a typical premium for health insurance, such as Blue Cross Blue Shield, may be due on the 1st of each month. Failure to pay by this date could result in a lapse in coverage, potentially leading to unexpected medical expenses. To assist patients, various payment options are available, such as online payments through the insurance provider's portal or automatic bank drafts, which can simplify the payment process. If opting for mail payments, sending a check to the designated insurance address at least five business days before the due date is advisable to ensure processing. Understanding these details helps patients manage their health insurance effectively.

Contact Information for Inquiries

Insurance premium notices typically contain essential details regarding patient coverage and billing. It is crucial for recipients to have clear contact information for inquiries. For instance, billing department phone numbers (often toll-free for ease of access), email addresses for queries (often monitored by customer service representatives), and office hours (specific time frames indicating availability for support) should be prominently displayed. Additionally, physical addresses may be included for those preferring written communication through postal service. Many insurance plans also provide a website link for online assistance and resources, encouraging patients to utilize digital services for faster resolutions.

Legal and Regulatory Compliance

Insurance premium notices serve as essential communications between healthcare insurers and policyholders, encompassing details like premium amounts, due dates, coverage options, and legal compliance obligations. Timely notifications ensure adherence to regulatory standards set forth by the Affordable Care Act, which mandates insurers provide clear and concise information regarding premium changes and policyholder rights. For example, notices must include language about potential consequences of non-payment, such as lapses in coverage. Furthermore, they should highlight statutory grace periods, typically 30 days, during which policyholders are protected from termination. Specific state regulations may impose additional requirements, necessitating insurers to maintain accurate records for auditing purposes and ensuring transparency in billing practices.

Comments