Are you navigating the world of health insurance and need to verify your coverage? Understanding the nuances of your policy can sometimes feel overwhelming, but it's crucial for ensuring you get the care you need. In this article, we'll walk you through a simple letter template that can help you request a coverage verification from your insurance provider, making the process as smooth as possible. So, let's dive in and empower you with the knowledge to take charge of your health care!

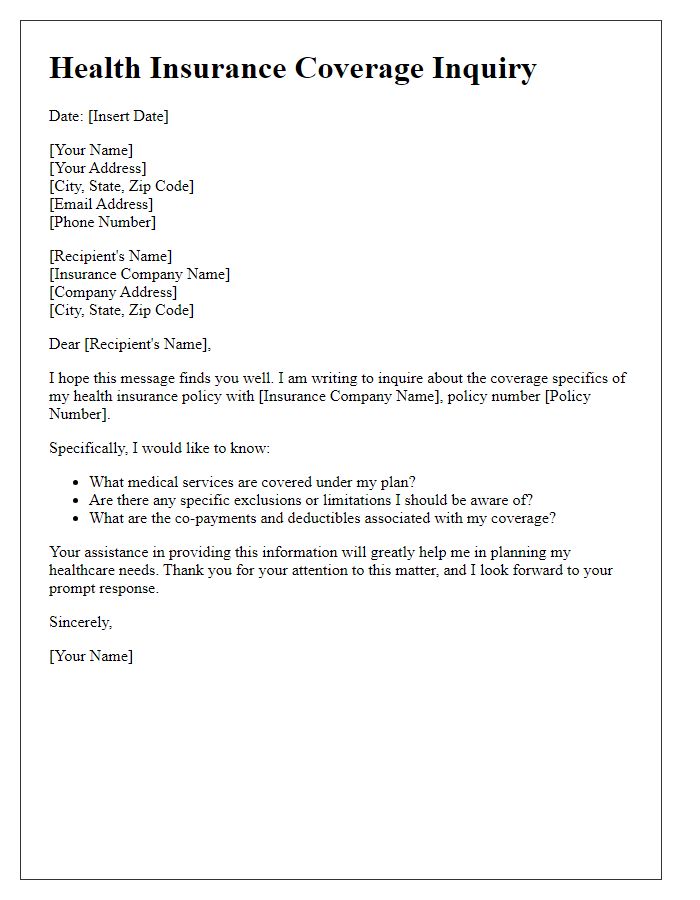

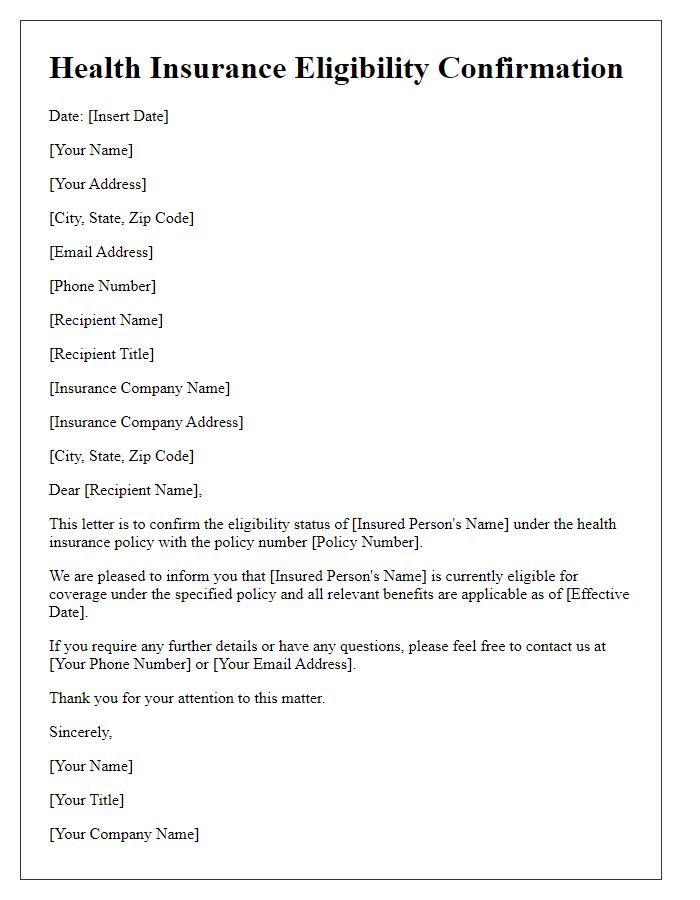

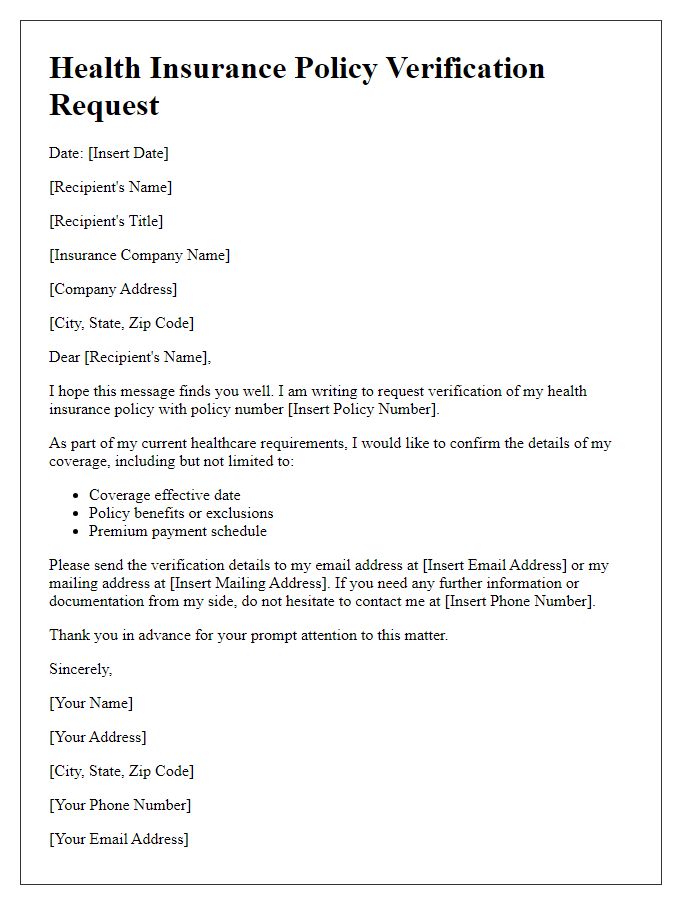

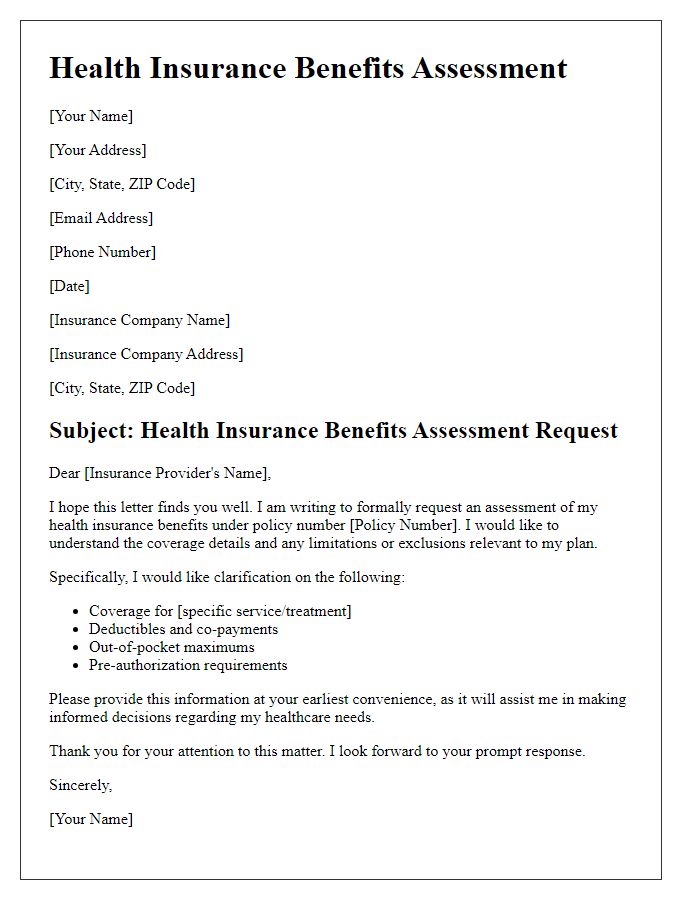

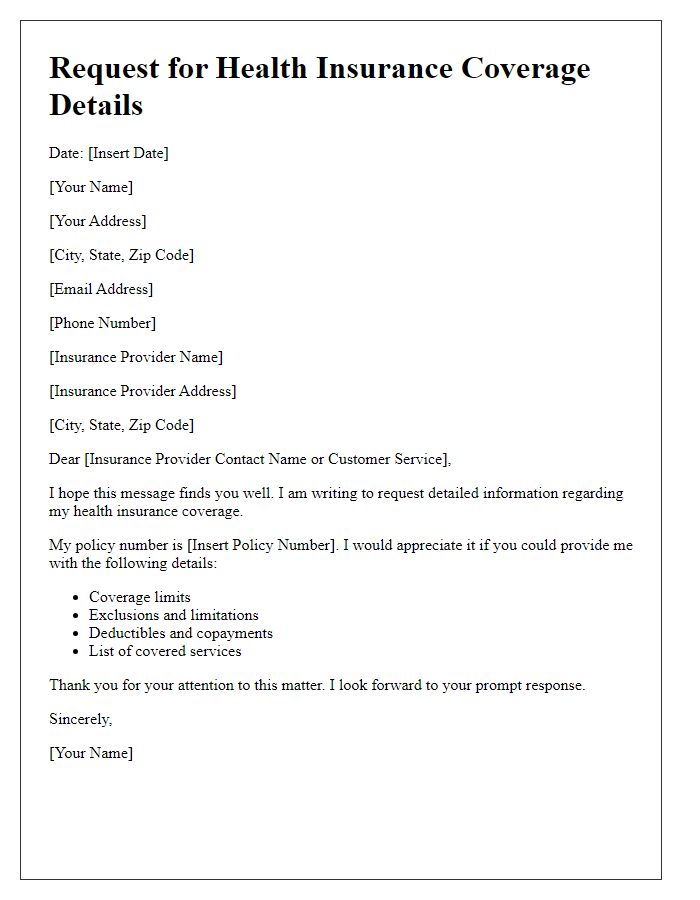

Recipient Details

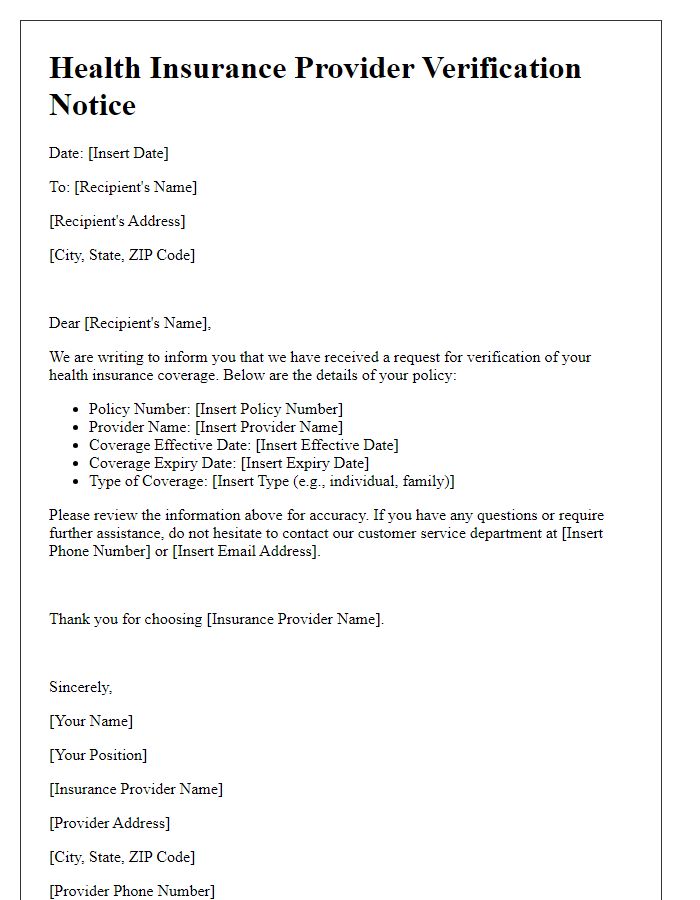

Health insurance coverage verification is essential for patients seeking medical services. Insurance policy numbers, which identify specific coverage details, must align with healthcare provider requirements. Verification involves confirming eligibility dates, deductibles, and co-payments associated with plans like PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization). Communication with insurance representatives, typically located at large companies such as Aetna or UnitedHealthcare, is crucial for resolving discrepancies in patient information. Additional documents may be requested, including government-issued IDs or proof of residency, to ensure valid coverage for procedures and services rendered at healthcare facilities such as hospitals or clinics.

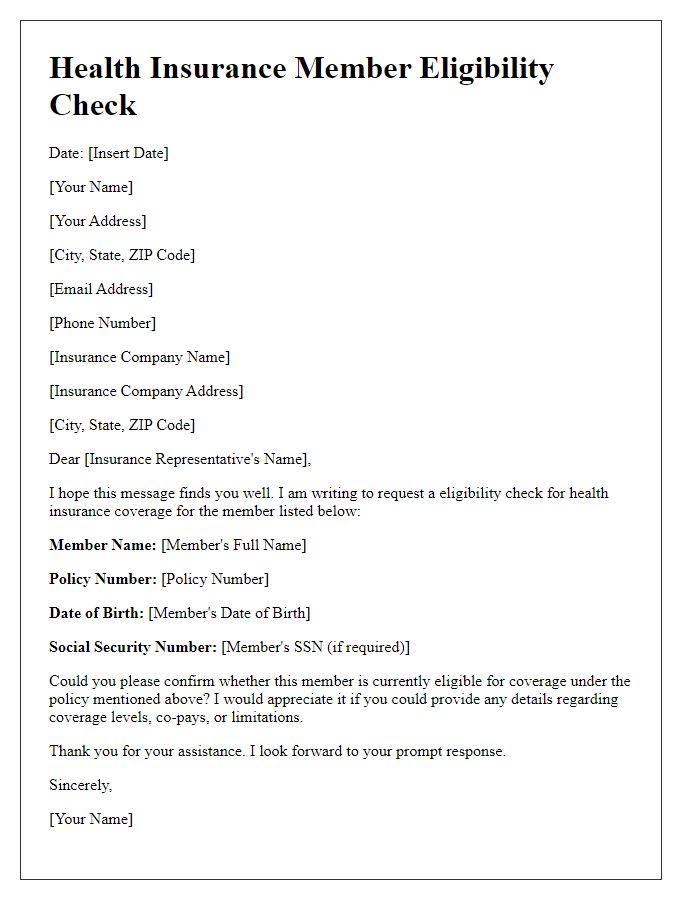

Policyholder Information

Health insurance coverage verification is essential for policyholders, affecting access to necessary medical services and treatment. Relevant details include policy numbers (typically comprising alphanumeric characters), names of insurance providers like Blue Cross Blue Shield or Aetna, and specific coverage plans detailing covered services. Dates of service are crucial, as many policies have specific timeframes for eligibility. Understanding co-pays, deductibles, and out-of-pocket maximums ensures that policyholders calculate their financial responsibilities accurately. Additionally, confirming provider network status assists in avoiding unexpected expenses during healthcare visits.

Policy Number and Coverage Dates

Health insurance coverage verification is essential for understanding the terms of benefits offered by various providers. A policy number, unique to each enrollee, serves as an identifier for specific coverage plans, while coverage dates indicate the start and end of the policy, establishing the timeline for which medical services may be utilized. For example, an insurance policy from Blue Cross Blue Shield may have a policy number like 123456789 and cover the period from January 1, 2023, to December 31, 2023, impacting the beneficiary's access to healthcare services and financial responsibilities during that timeframe. Accurate verification ensures patients receive appropriate care without unexpected costs.

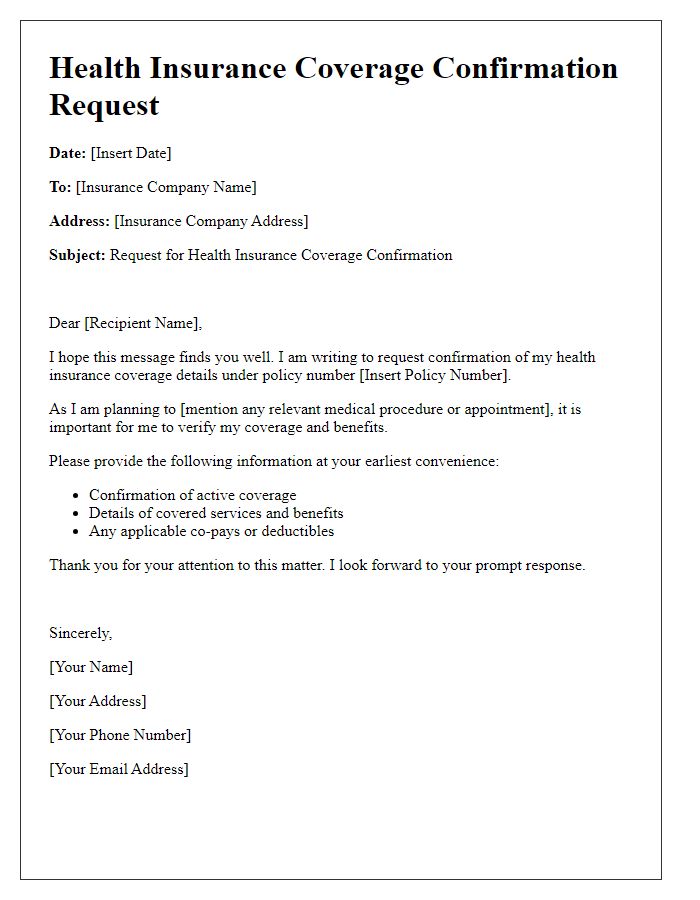

Specific Services Covered

Health insurance coverage verification is essential for understanding specific services that are included in the policy. Each plan, like those offered by Blue Cross Blue Shield or Aetna, may cover services such as preventive care visits, which typically occur biannually, or prescription medications, encompassing both generics and brand names. Furthermore, coverage may extend to treatments for chronic conditions, including diabetes management programs or hypertension care, often involving doctor consultations and necessary lab tests. Mental health services, such as therapy sessions or psychiatric evaluations, often receive coverage under most plans. Specialty services like physical therapy (with limits on visit numbers) or chiropractic adjustments may also vary among different insurers. Understanding the scope of services included within the policy can significantly affect healthcare decisions and costs.

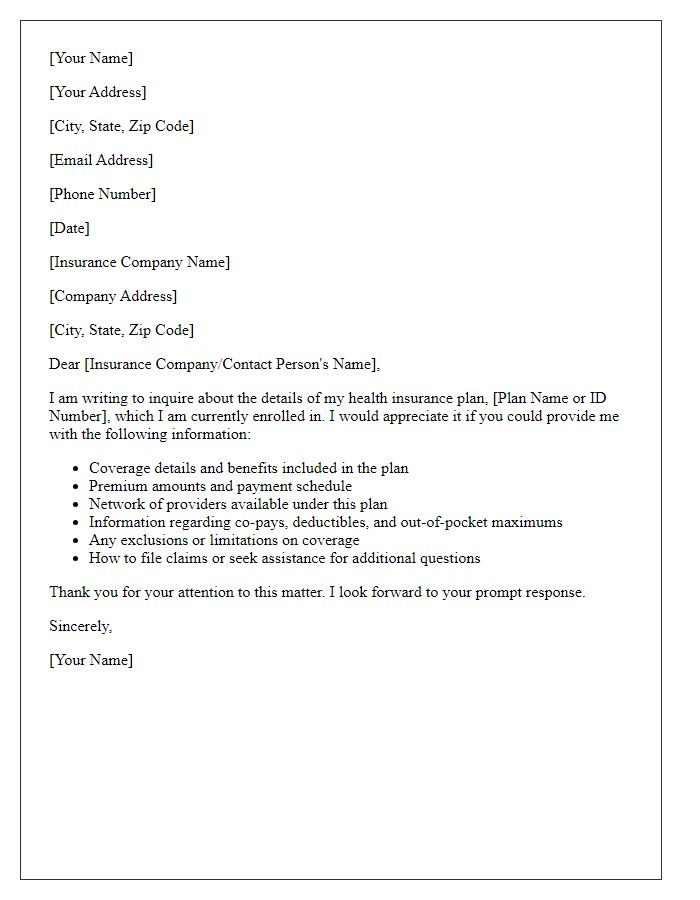

Contact Information for Questions

For questions regarding health insurance coverage verification, contact our dedicated support team. Reach us via the customer service hotline at 1-800-555-0199, available Monday through Friday from 8 AM to 8 PM Eastern Time. Email inquiries can be sent to support@healthinsurance.com, and responses are typically provided within 24 hours. For real-time assistance, visit our website at www.healthinsurance.com, where you can chat live with a representative during business hours. Additionally, our physical office located at 123 Healthway Blvd, Suite 100, New York, NY, operates with in-person hours from 9 AM to 5 PM, for those seeking direct engagement.

Comments