Navigating supplier payment negotiations can feel daunting, but it doesn't have to be! With the right approach, you can create a win-win situation that benefits both parties. In this article, we'll explore effective strategies and tips for discussing payment terms with your suppliers, ensuring clear communication and fostering positive relationships. So, let's dive in and discover how to make these conversations more productive and collaborative!

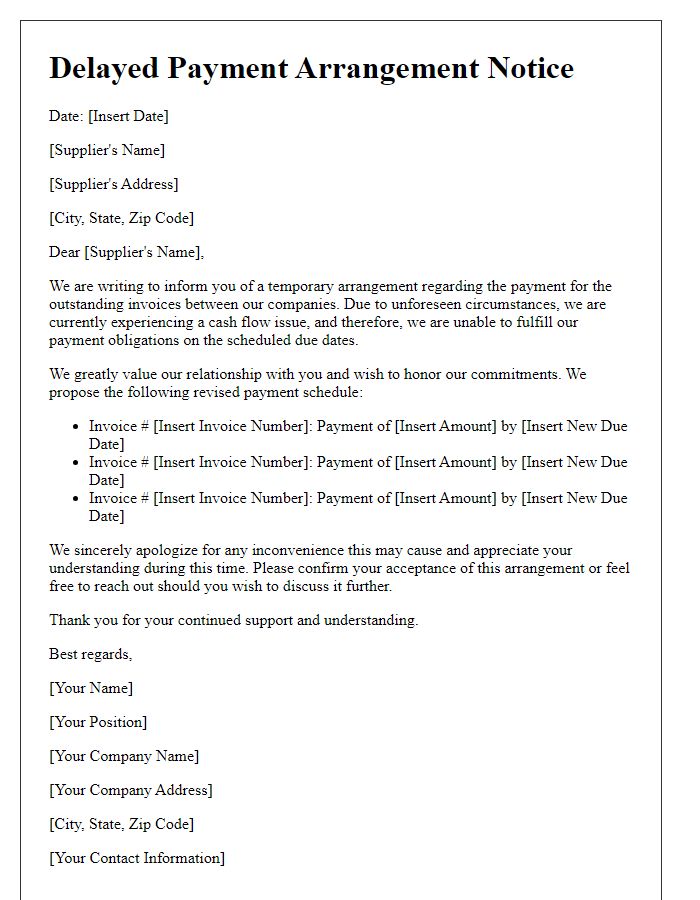

Professional tone and clarity

Suppliers often require timely payments to maintain smooth operations. Payment negotiations can become necessary when unforeseen circumstances arise. Clear and professional communication is essential in these discussions to ensure a win-win outcome. Key points to address include the amount owed, payment terms, timelines, and any potential adjustments based on current financial constraints. Providing context, such as current market conditions or business cash flow issues, can foster understanding. It's important to emphasize commitment to fulfilling obligations and maintaining a positive supplier relationship, ensuring continued collaboration and support.

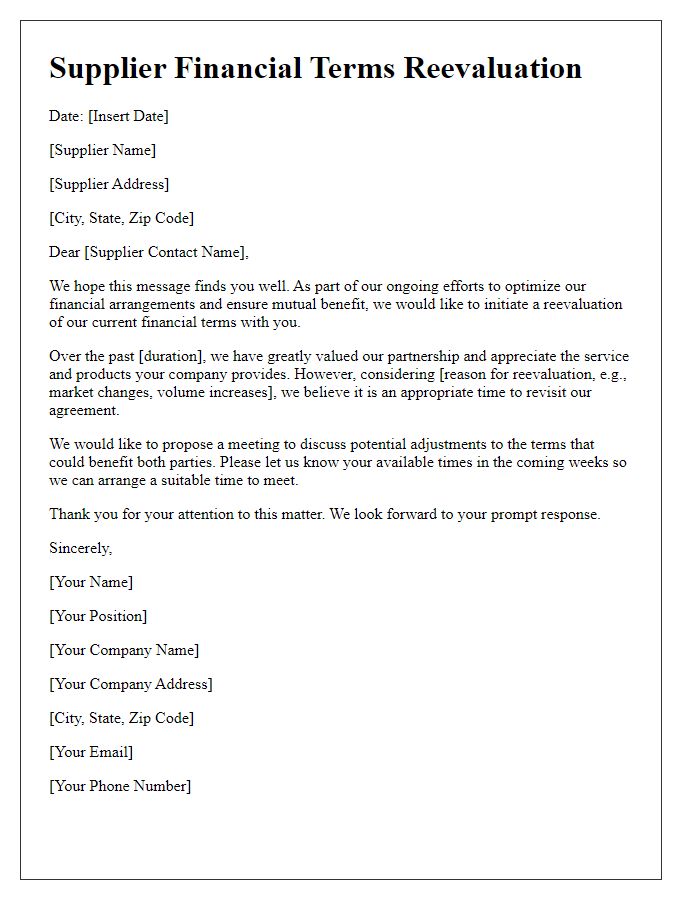

Mutual benefits and long-term relationship

Negotiating supplier payments can significantly impact the sustainability of business operations and the strength of professional relationships. Constructive discussions about payment terms can lead to mutual benefits for both parties, enhancing cash flow management and ensuring financial stability. Establishing flexible payment terms, such as extending periods from 30 to 60 days, can alleviate immediate financial pressure on businesses during fluctuating market conditions. Strong partnerships often thrive on open communication about payment capabilities, fostering trust and reliability. Regular review meetings can further solidify relationships, allowing suppliers to understand the buyer's needs, leading to tailored solutions that support long-term collaboration and shared success. Prioritizing this strategic dialogue can create a more resilient supply chain, benefiting suppliers and buyers alike.

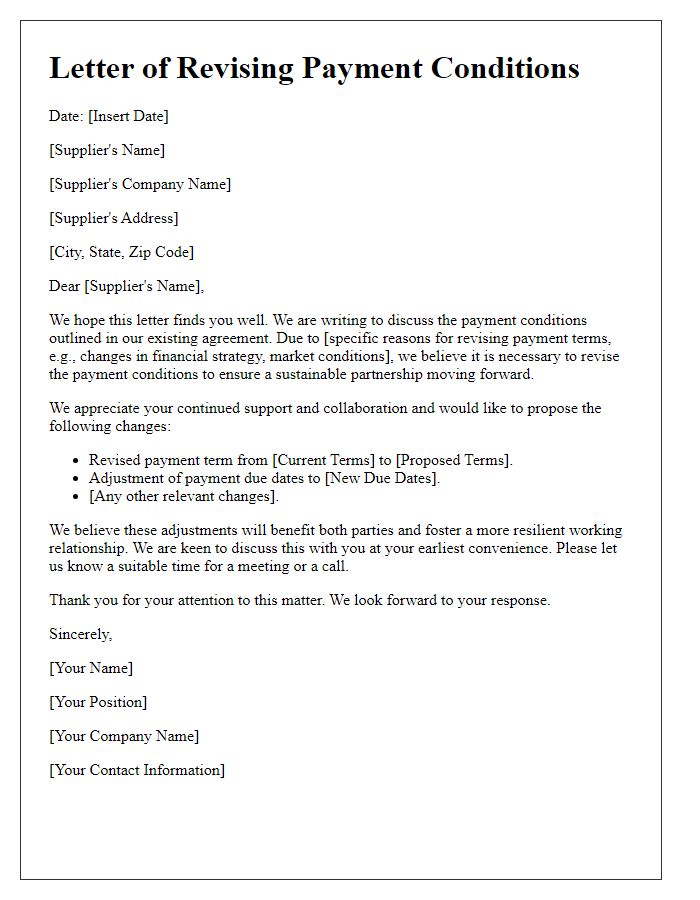

Specific payment terms and conditions

Negotiating specific payment terms and conditions with suppliers is crucial for maintaining a healthy cash flow. Factors such as payment schedules (e.g., net 30 or net 60 days) and early payment discounts (typically 2% for settling invoices ahead of the due date) can significantly influence liquidity for businesses. Establishing clear communication about purchase order quantities (e.g., bulk orders of 500 units) and delivery timelines (e.g., shipments within 10 business days) ensures both parties align on expectations. Flexibility in payment methods (including bank transfers, credit cards, or digital wallets) can also facilitate smoother transactions and strengthen supplier relationships. Understanding the implications of late fees, which can range from 1.5% to 5% monthly, protects the financial interests of both the supplier and purchaser.

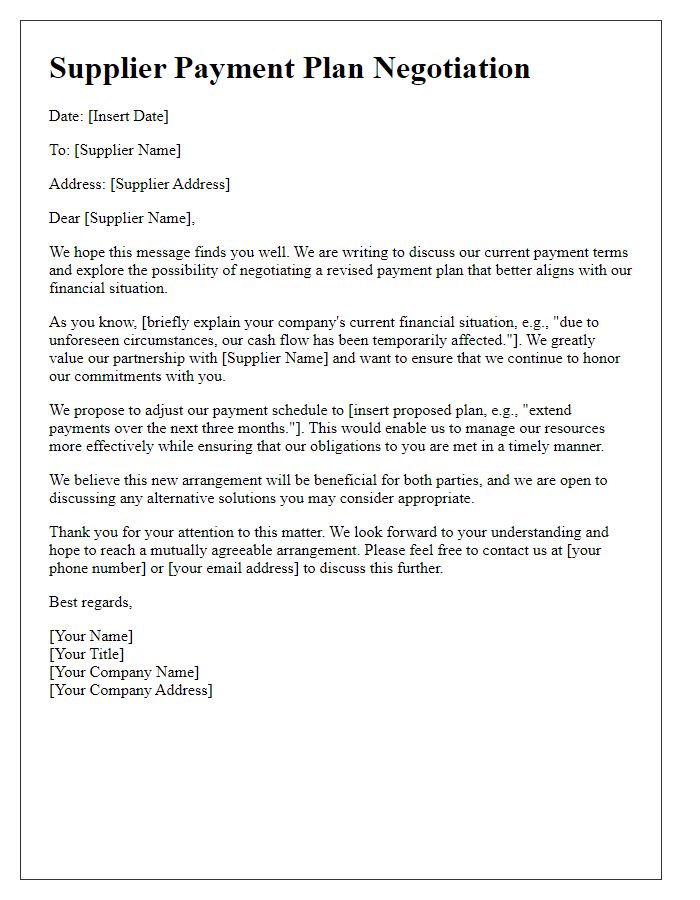

Justification for negotiation

Suppliers play a critical role in the supply chain, impacting operational efficiency and financial health. Payment terms often require negotiation due to factors like increased material costs, economic conditions, or project delays. Cash flow constraints may arise from unforeseen expenses, necessitating adjustments in payment schedules. Businesses aim to maintain strong supplier relationships while ensuring financial stability, making negotiation a vital process. Open communication about challenges facing both parties can lead to mutually beneficial terms. Effective negotiation often results in extended payment periods, reduced costs, or promotional discounts that strengthen long-term partnerships. Ensuring transparency during discussions fosters trust and collaboration.

Contact information for follow-up

Supplier payment negotiation plays a crucial role in maintaining healthy business relationships and ensuring smooth cash flow. Open communication channels are vital for this negotiation process. Clear contact information, including email addresses, phone numbers, and designated representatives, fosters effective dialogue. For example, the accounts payable manager, John Smith, can be reached at john.smith@company.com or (555) 123-4567. Additionally, utilizing a follow-up schedule with specific dates, like bi-weekly check-ins, can help both parties stay aligned on payment timelines and expectations, ensuring transparency and facilitating resolution of any outstanding issues. This structured approach contributes to trust and collaboration that strengthens supplier partnerships over time.

Comments