Submitting an insurance claim can often feel overwhelming, but it doesn't have to be! In this article, we'll guide you through a simple and effective letter template that streamlines the process, ensuring you include all the essential details your insurer requires. Whether you've experienced property damage, health-related issues, or any other qualifying incidents, having a well-structured letter can make a significant difference in the speed of your claim. Ready to simplify your insurance claim submission? Read on to learn more!

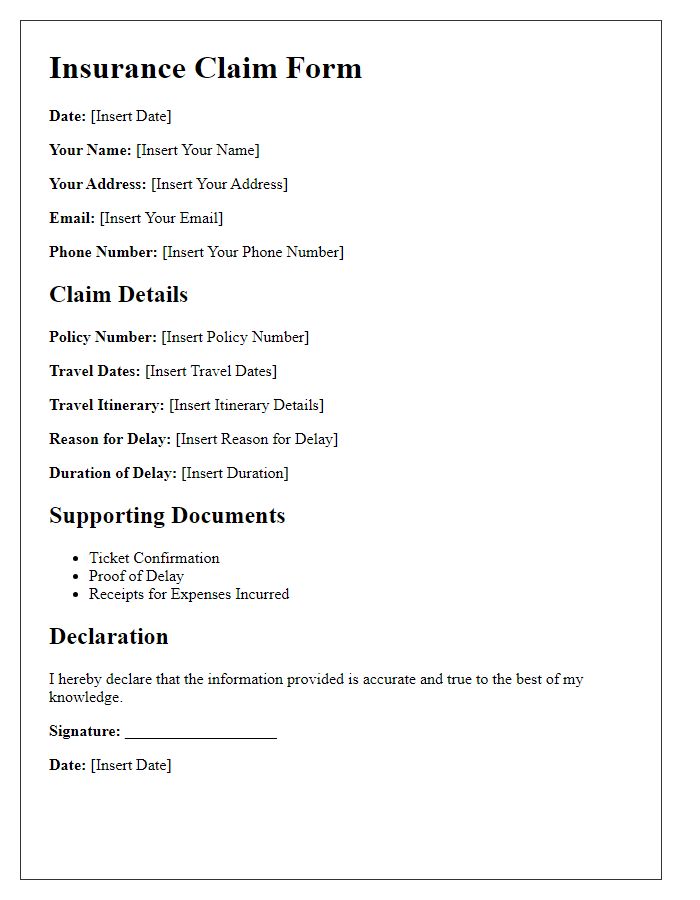

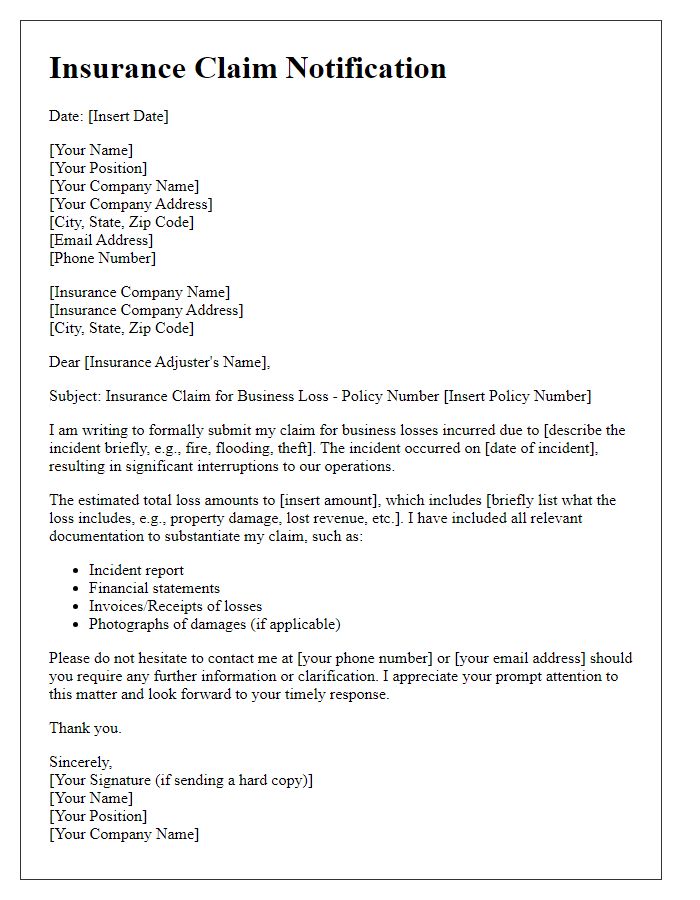

Clear identification of policyholder and policy details

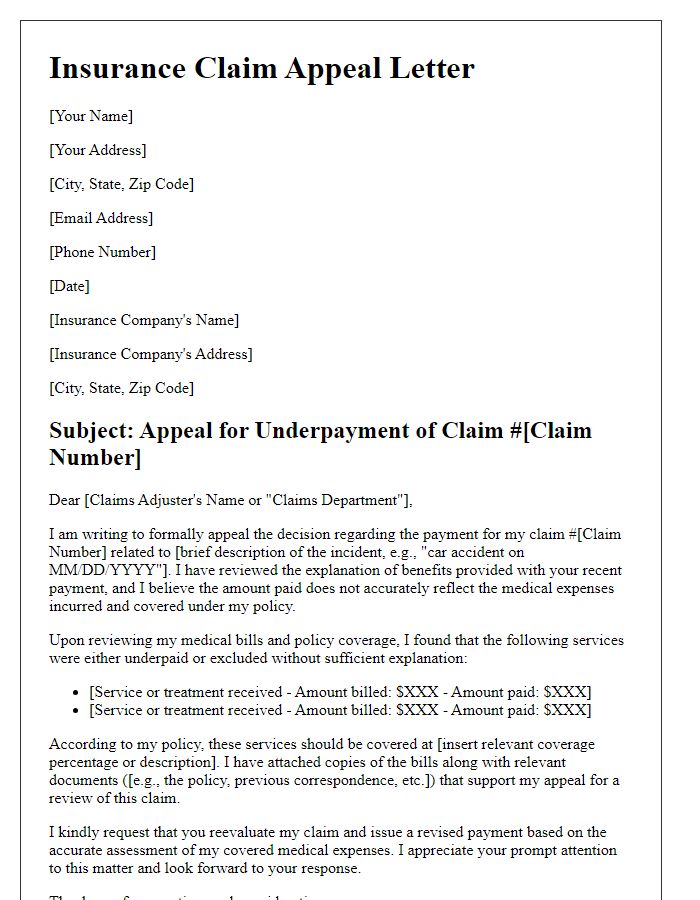

The insurance claim submission process requires accurate identification of the policyholder and comprehensive policy details. The policyholder, typically an individual or business, needs to provide their full name, address, contact number, and policy number, which uniquely identifies their insurance coverage. Details about the specific policy should include the type of insurance, such as homeowner's insurance or auto insurance, the effective date of coverage (the date the policy became active), and the expiration date (the date the policy is set to end). It is essential for policyholders to include any relevant endorsements (modifications to a standard policy), coverage limits (maximum amounts payable under the policy), and relevant claim information, such as the date of the incident and any preliminary estimates for damage or loss. This comprehensive identification ensures prompt processing of the claim and accurate assessment of coverage entitlements.

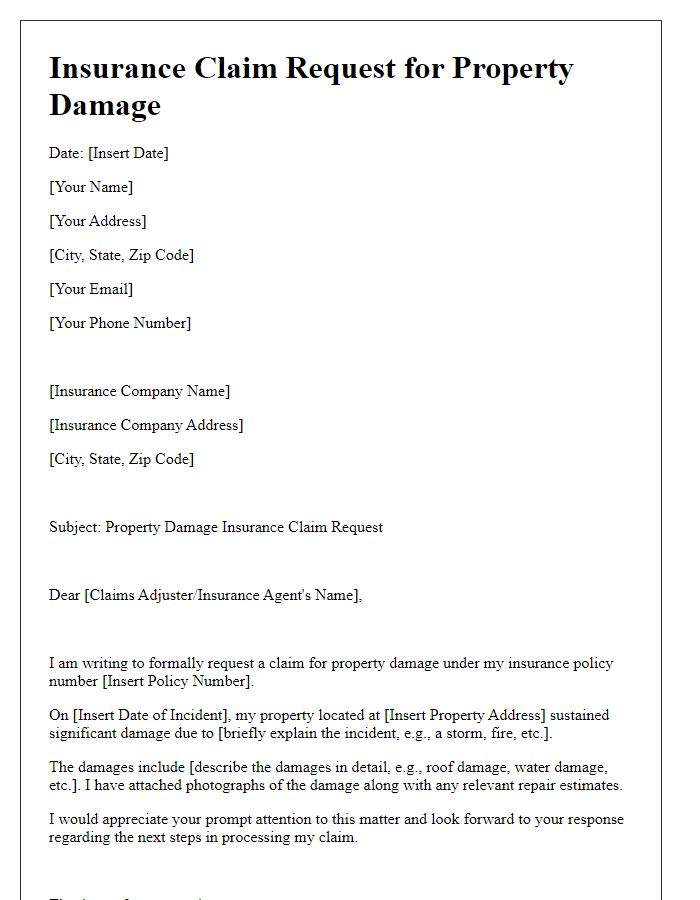

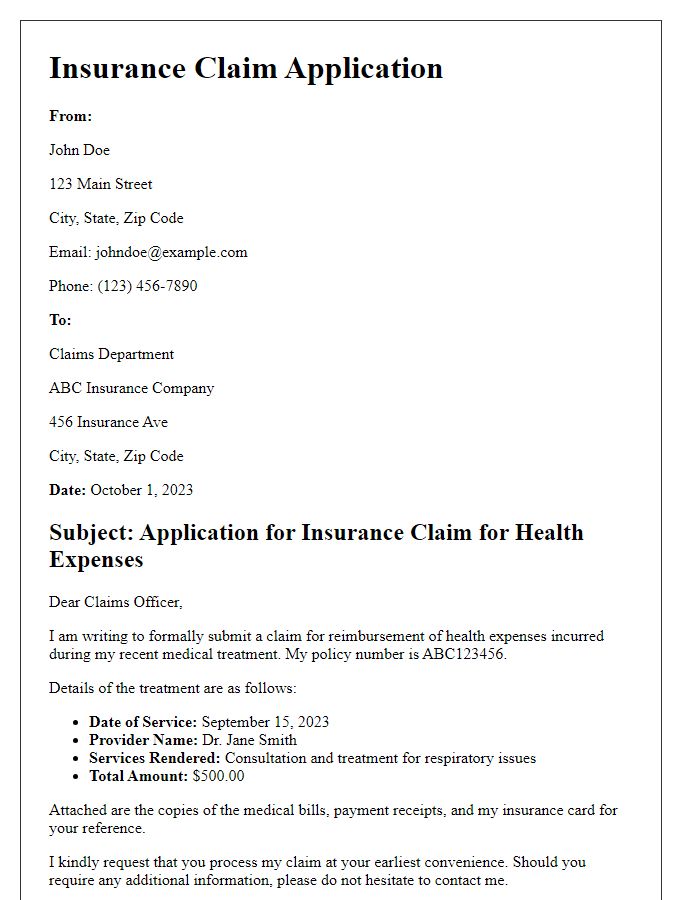

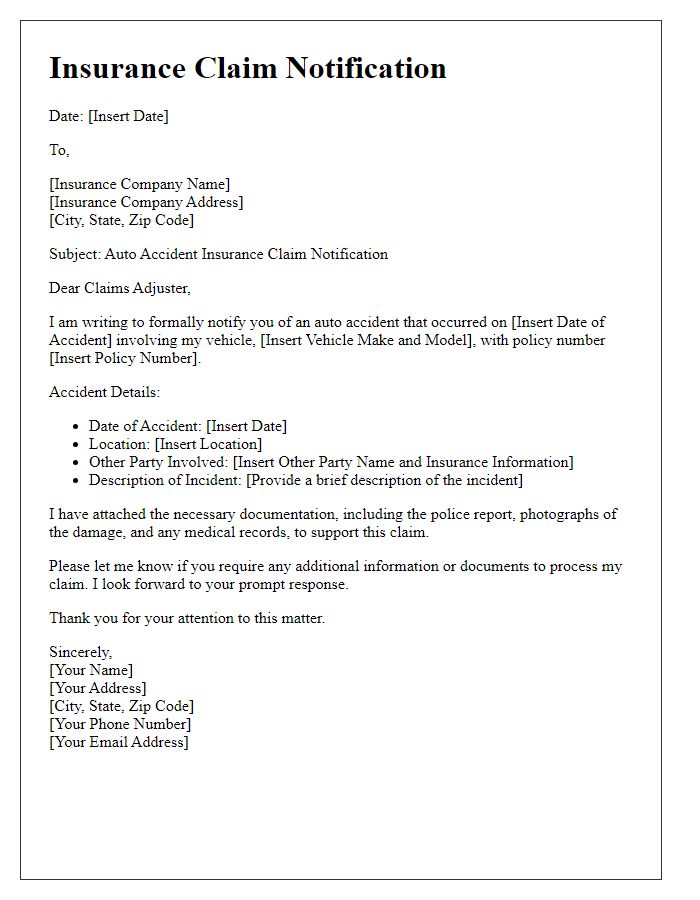

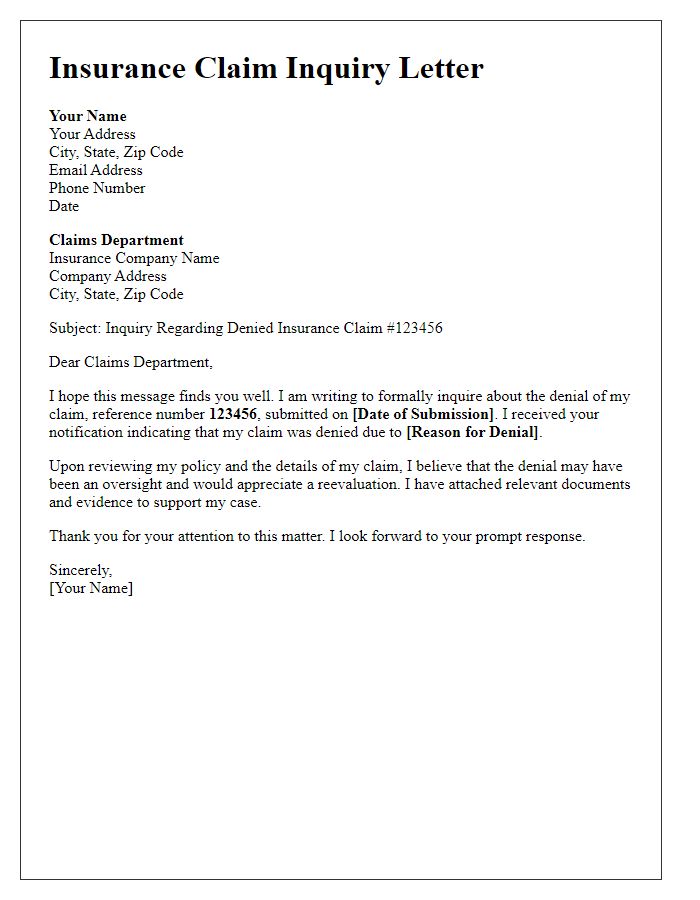

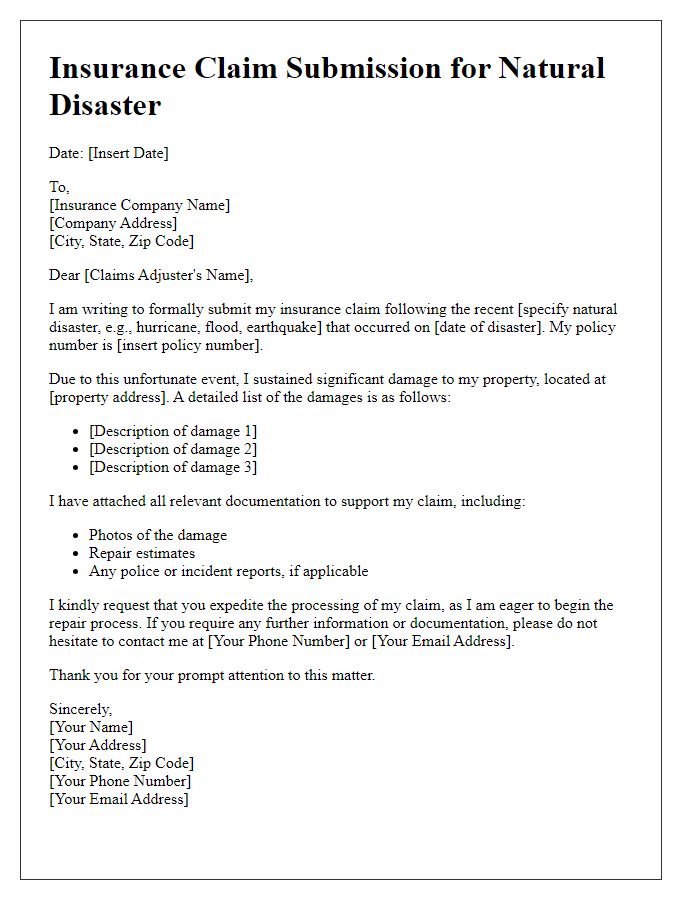

Detailed incident description with date and location

On March 15, 2023, a significant vehicle accident occurred at the intersection of Maple Street and 5th Avenue in Springfield, Illinois. At approximately 2:30 PM, a red Toyota Corolla, driven by John Smith, collided with a blue Ford F-150, operated by Jane Doe, when the latter failed to stop at a red traffic light. The impact caused extensive damage to both vehicles, with the Corolla sustaining a shattered rear window and a crumpled left side, while the F-150 experienced a deployed airbag and a crumpled front hood. Emergency services arrived promptly, documenting the incident, providing medical assistance to the involved parties, and filing a police report (Report #78943). Witness accounts from nearby pedestrians corroborated the lack of adherence to the traffic signal by the Ford driver, leading to the collision. This documented event serves as essential information for the insurance claim process.

Itemized list of damages or losses with estimated values

An insurance claim submission requires a precise itemized list of damages or losses along with their estimated values to facilitate the assessment process. For example, in a residential fire event occurring on Main Street in Springfield, damages to the property may include structural damage to the roof, estimated at $15,000, damage to the kitchen appliances, estimated at $2,500, and destruction of personal belongings such as clothing and electronics valued at $3,000. Additionally, external property damage to landscaping and fencing might be estimated at $1,500. Documenting these specific items with detailed values provides a clear overview of the total loss, which in this instance would amount to $22,000, and ensures a comprehensive review by the insurance adjuster.

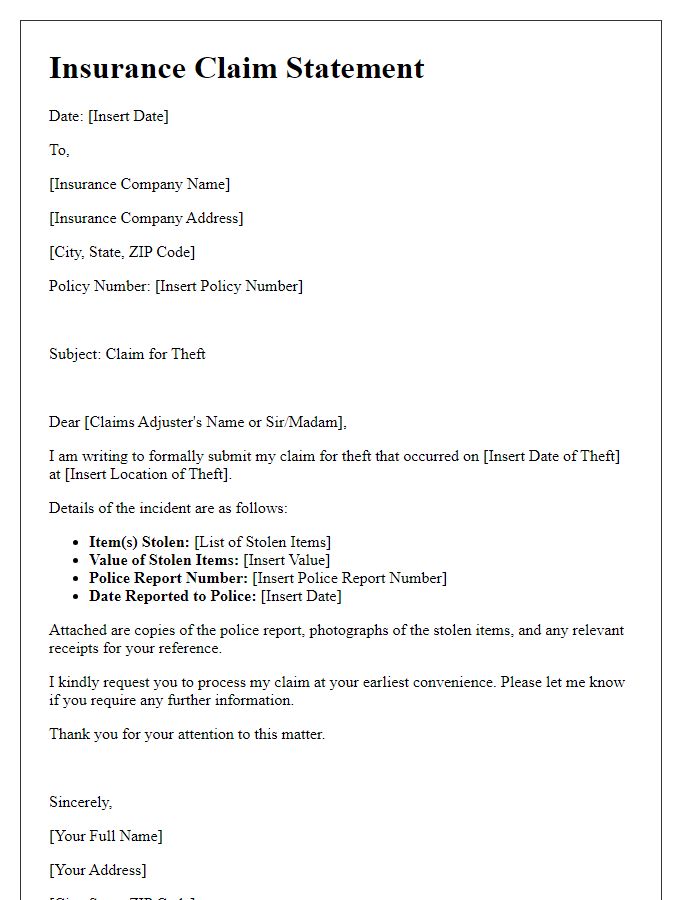

Attached supporting documents and evidence

When submitting an insurance claim, it is essential to include comprehensive and detailed supporting documents to substantiate the claim. Key documents often include a completed claim form that outlines the specifics of the incident, such as the date, time, and location of the event (for instance, a car accident on Main Street, March 15, 2023). Photographs of the damage--such as dents on a vehicle or a flooded basement--serve as visual evidence for claims related to property damage or personal injury. Additional documentation may include medical reports for health-related claims, repair estimates from licensed contractors, and police reports if applicable. Ensuring all documents are organized and clearly labeled can enhance the processing speed and accuracy of the claim review by the insurance company.

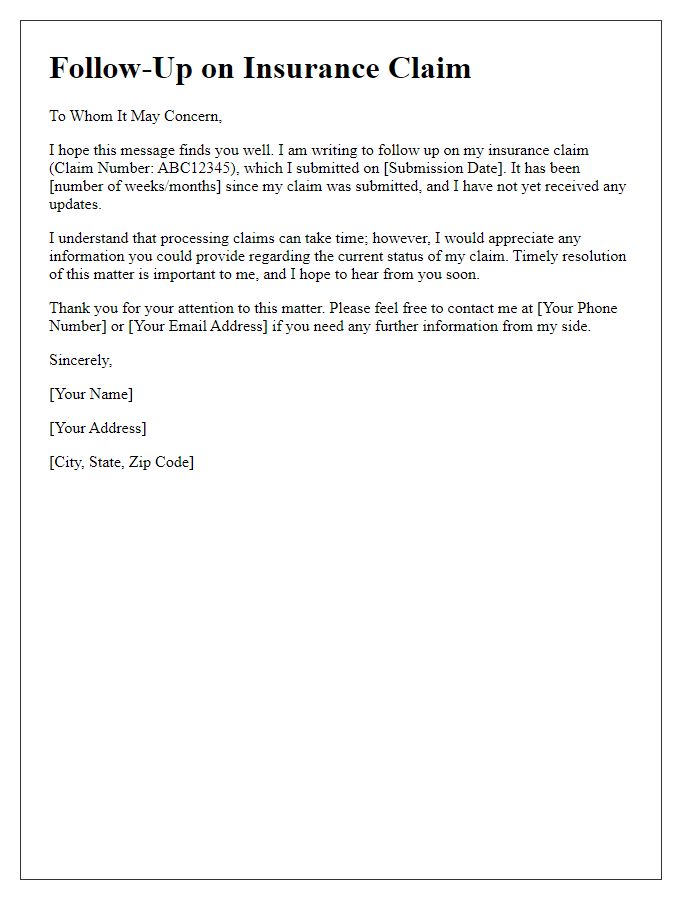

Contact information for further communication

For further communication regarding the insurance claim submission, please utilize the following contact details. The primary contact should be Dave Johnson, the claims manager at Reliable Insurance Company, located at 1500 Main Street, Springfield, IL 62701. His direct phone number is (217) 555-0147, which is available Monday to Friday, from 9 AM to 5 PM CST. Additionally, email correspondence can be sent to d.johnson@reliableinsurance.com for prompt responses concerning your claim inquiries or documentation requirements.

Comments