Are you ready to take charge of your health and secure the best health insurance coverage? Navigating the world of health insurance enrollment can feel overwhelming, but it doesn't have to be! Whether you're a first-time enrollee or looking to switch plans, understanding the ins and outs can make a huge difference in your peace of mind. Dive into our detailed guide to discover essential tips and templates that will simplify your enrollment process!

Personal Information

Health insurance enrollment requires accurate and comprehensive personal information for proper processing. Essential details include full name (as per government documents), date of birth (to verify age eligibility), social security number (for identity verification), and contact information (address, phone number, and email). In addition, information about household members (spouse, dependents) may be necessary to determine family coverage options. Employment details (employer name and address) may also be required, especially if the insurance is offered through an employer-sponsored plan. Accurate representation of this data ensures seamless enrollment and helps in making informed healthcare decisions.

Policy Details

Health insurance policies play a crucial role in ensuring individuals have access to necessary medical care and services. Premiums often range from $200 to $800 per month, depending on coverage level and provider. Deductibles, which can vary between $500 and $4,000, determine the amount individuals must pay out-of-pocket before coverage kicks in. Additionally, co-pays (fixed fees per visit) and coinsurance (a percentage of costs after the deductible) affect overall expenses. Understanding the breadth of coverage is vital; policies typically include essential health benefits such as hospitalization, preventive services, and prescription drugs. Enrollment periods, often occurring annually in the fall, are critical for individuals to review and select the best options for their specific health needs.

Enrollment Period

Health insurance enrollment occurs during a designated period known as the Open Enrollment Period, which typically lasts for several weeks each year. This crucial timeframe, often spanning from November 1 to December 15 in the United States, allows individuals and families to select, change, or sign up for new health insurance plans through federal or state marketplaces, such as Healthcare.gov or Covered California. During this period, applicants can explore various coverage options, including Bronze, Silver, Gold, and Platinum plans, each offering different levels of benefits and monthly premiums. Moreover, the enrollment process requires the provision of personal information, such as income and household size, to determine eligibility for financial assistance programs, ultimately making healthcare more accessible. Missing this enrollment window may result in limited options, with a few exceptions for qualifying life events, such as marriage or loss of coverage.

Required Documentation

Health insurance enrollment requires specific documentation, ensuring eligibility and accurate coverage. Essential documents include proof of identity, such as a government-issued photo ID (e.g., passport or driver's license), which confirms personal details like name and date of birth. Income verification documents, such as recent pay stubs or tax returns, are necessary to assess eligibility for premium subsidies. Additionally, Social Security numbers for all applicants help streamline the enrollment process. In some cases, proof of residence, like a utility bill or lease agreement, may also be needed to verify living arrangements. These documents must be submitted accurately and within specified deadlines to complete the enrollment process successfully.

Contact Information

Health insurance enrollment requires precise contact information to ensure accurate communication and processing of applications. Essential details include full name (first and last), residential address (street, city, state, zip code), phone number (home and mobile), and email address. The inclusion of date of birth (month, day, year) assists in verifying eligibility for specific health plans, while Social Security number serves for identification and coverage options. Accurate representation of dependents' information is also crucial, detailing their names and birthdates, ensuring comprehensive family healthcare coverage.

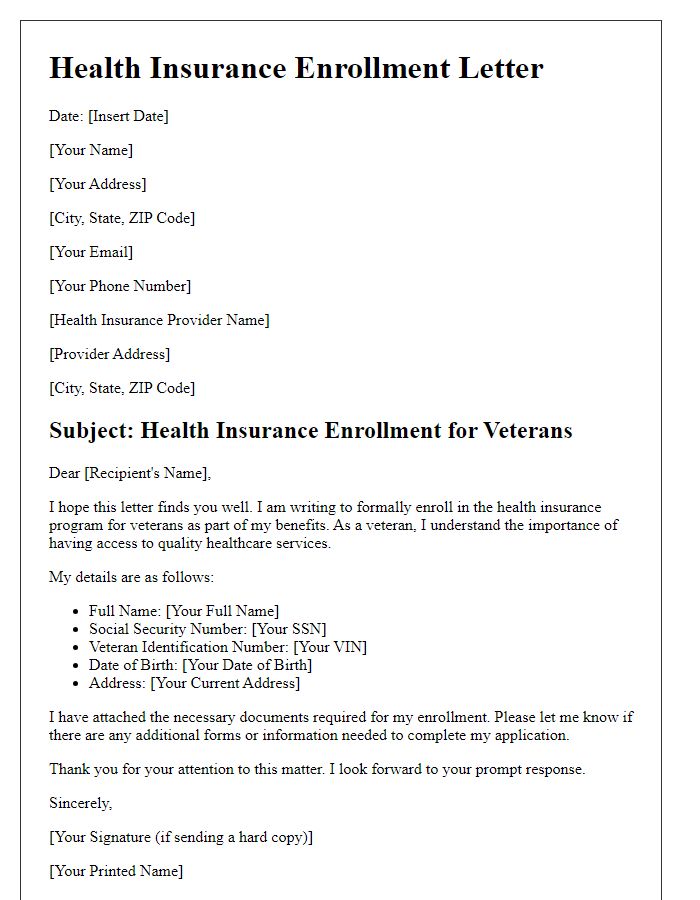

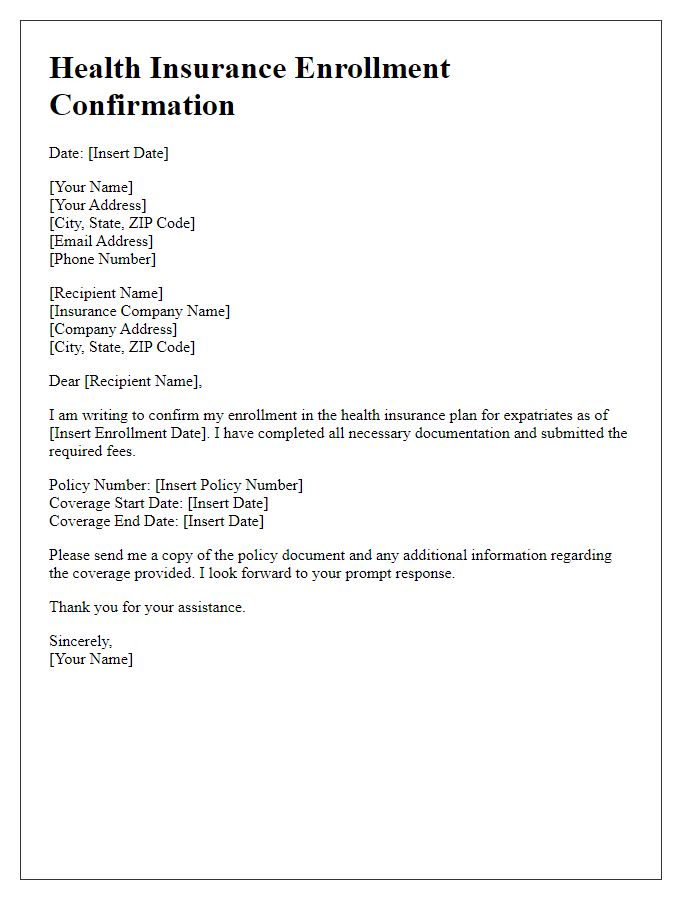

Letter Template For Health Insurance Enrollment Samples

Letter template of health insurance enrollment for low-income households

Comments