Hey there! If you've ever ventured out on a business trip, you know how crucial it is to stay organized when it comes to expenses. Navigating the process of reimbursement can feel overwhelming, but with the right template at your fingertips, you can make it a breeze. In this article, we'll delve into the essential components of a professional business travel reimbursement letter and share tips on how to streamline your request. Ready to simplify your reimbursement process? Let's dive in!

Date and Recipient Details

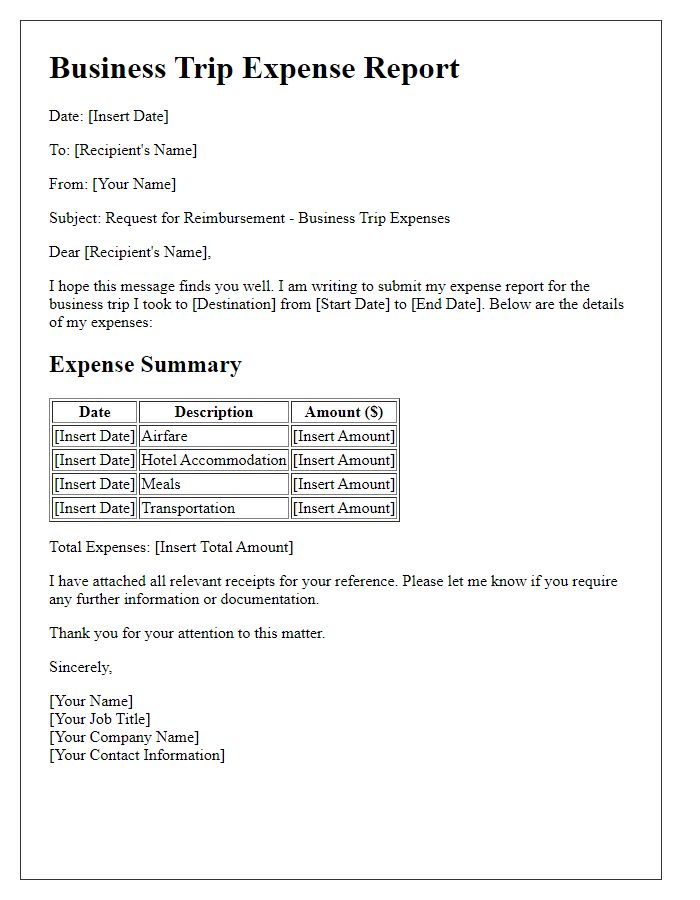

Business travel reimbursement requests require accurate documentation to ensure timely processing. Receipts should include specific expenses such as airfare costs, hotel accommodations, and meal allowances. Dates of travel should align with the business itinerary, capturing departure and return details for clarity. Destination cities, such as New York or San Francisco, play a crucial role in validating expenses against corporate travel policies. Itemization of expenses improves transparency, indicating whether travel was for client meetings, conferences, or training events. Always include a calculation of total expenses to simplify the approval process and ensure compliance with organizational budgets.

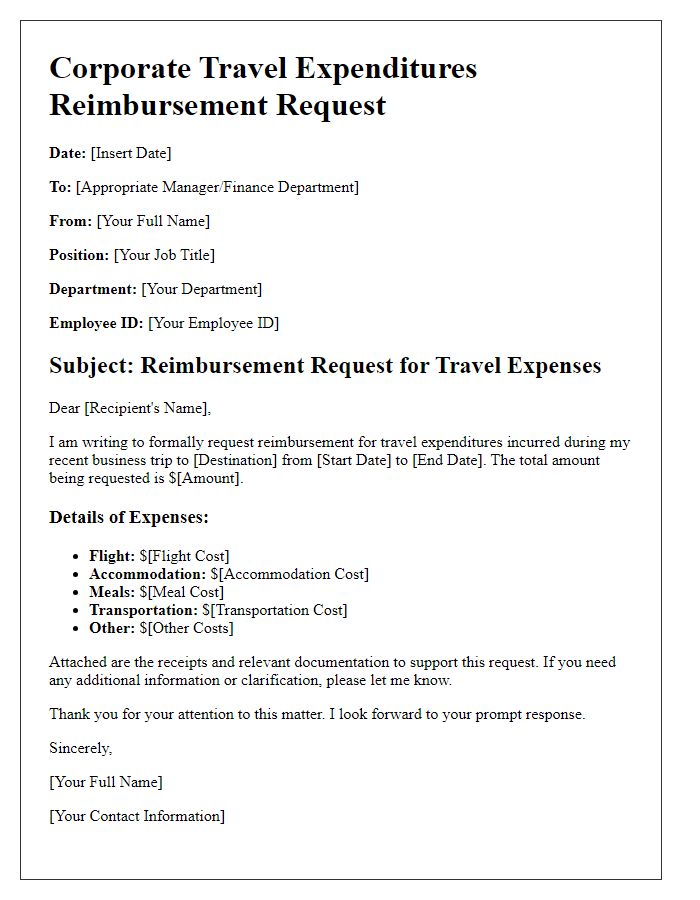

Employee Identification and Trip Details

Employee identification is crucial for processing business travel reimbursement, ensuring accuracy and accountability. The employee's full name, position title, and identification number (commonly used by the organization) should be clearly stated. Trip details must include the origin city, destination city, travel dates (departure and return), and the purpose of the trip (meetings, conferences, client visits). Itemized expenses (airfare, hotel accommodations, meals, transportation) should be documented with receipts attached. Accurate recordkeeping assists finance departments in assessing and approving reimbursement efficiently. Additional notes regarding company policy on eligible expenses will aid in avoiding any discrepancies in claims.

Expenses Breakdown and Receipts Attached

Business travel reimbursement requires detailed documentation of expenses incurred during the trip. Categories may include transportation costs, such as flights, taxis, or mileage for personal vehicles; lodging expenses, typically hotel stays; meals consumed, which often have per diem limits based on location (such as $50 in major cities); and miscellaneous expenses like parking fees or conference registration costs. Receipt documentation must accompany each expense, with clear dates, amounts, and descriptions. Proper organization of these items ensures timely reimbursement processing, adhering to company policies and financial regulations.

Reimbursement Amount and Payment Method

Business travel reimbursement requests often include specific details regarding the reimbursement amount and the preferred payment method. The reimbursement amount typically encompasses expenses such as airfare (often ranging from $200 to $1,500 depending on the destination), hotel accommodations (averaging between $100 and $300 per night), meals (usually capped at $50 per day), and transportation costs (like taxi fares or rental car fees). Payment methods may include direct bank deposit (preferred for quick transactions), checks (which can take longer to process), or company credit card reimbursement (where charges are directly applied to company accounts). Accurate documentation, such as receipts and itineraries, is essential for processing these reimbursements efficiently and ensuring compliance with company policies.

Contact Information for Queries

For inquiries regarding business travel reimbursement, employees can contact the Finance Department at XYZ Corporation. Contact details include the main office number, (555) 123-4567, available from Monday to Friday, 9 AM to 5 PM EST. Additionally, employees may reach out via email at finance@xyzcorporation.com for detailed queries or assistance. The reimbursement process can typically take up to two weeks, depending on submission date and required documentation. For urgent questions, employees are encouraged to speak directly with the designated finance officer, Jane Doe, who can be reached at extension 7890.

Letter Template For Business Travel Reimbursement Samples

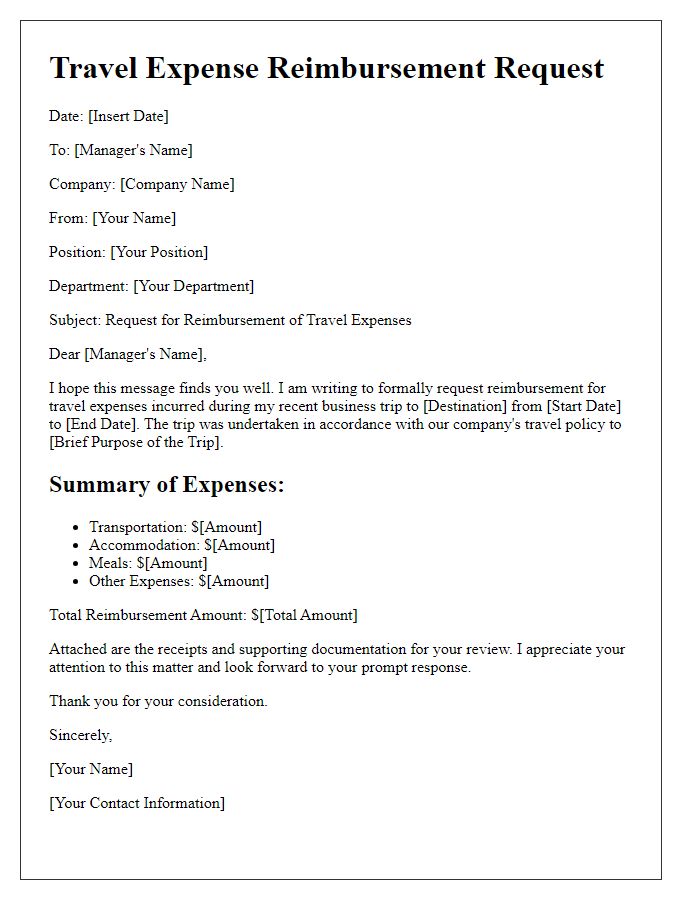

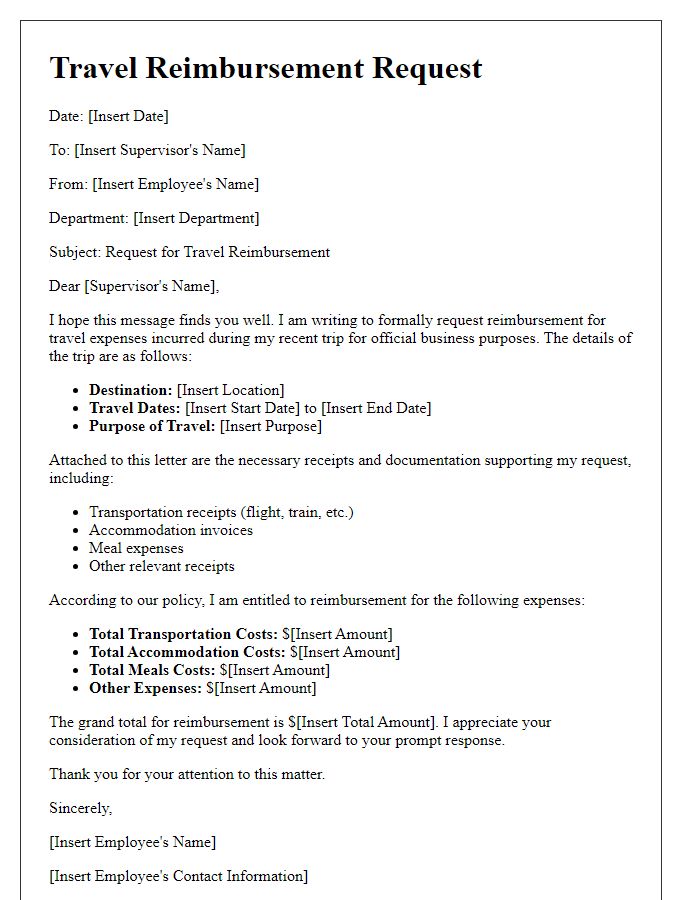

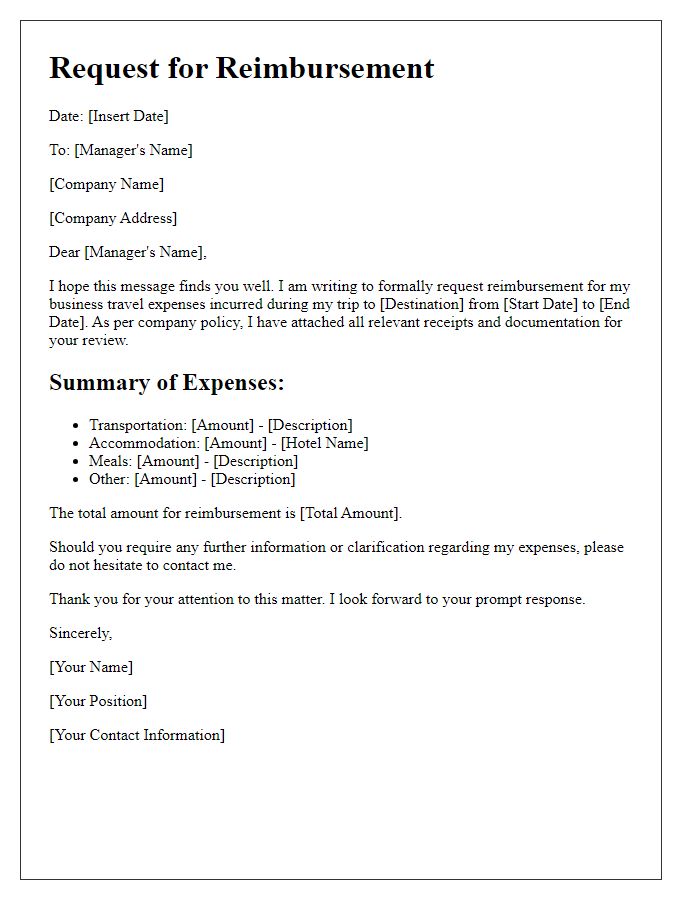

Letter template of travel expense reimbursement request for business purposes

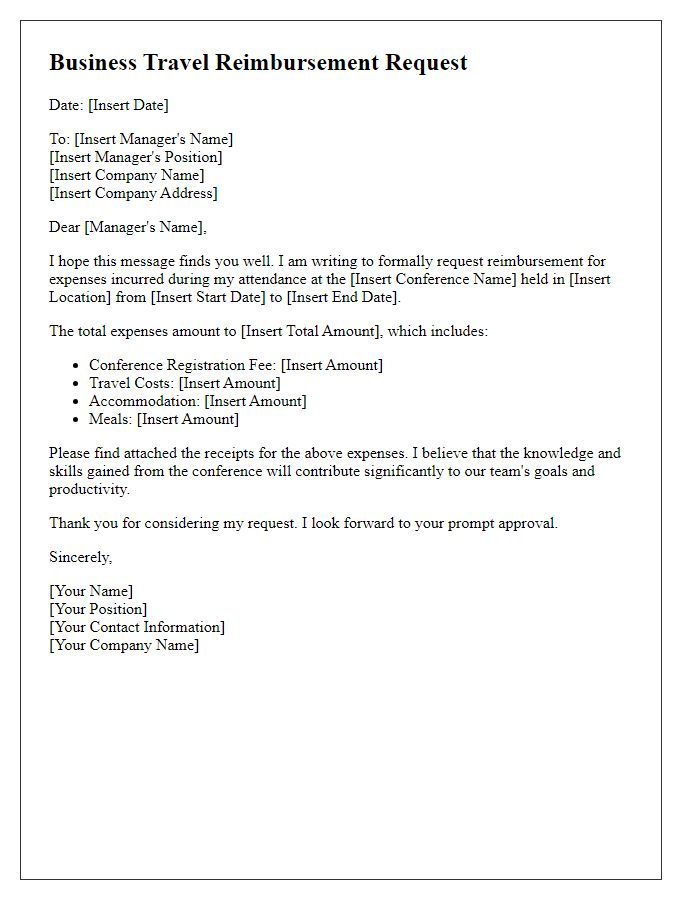

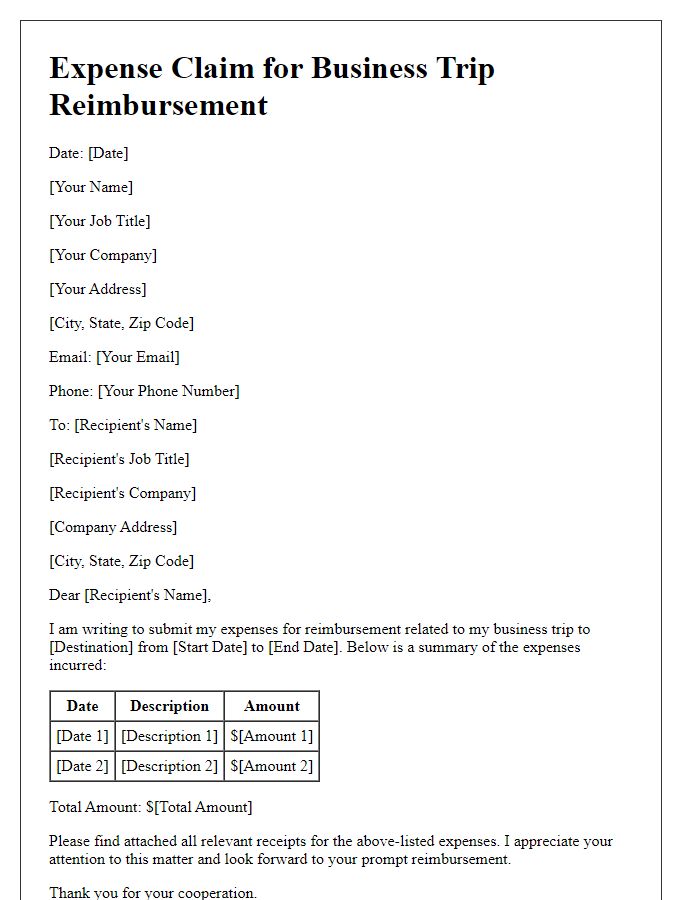

Letter template of business travel reimbursement for conference attendance

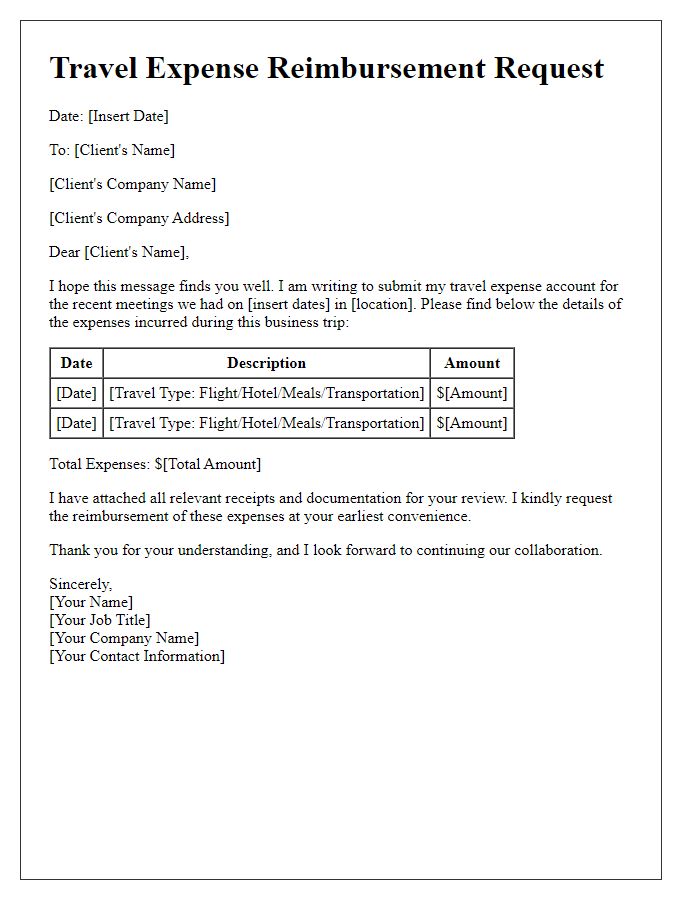

Letter template of travel expense account for client meetings reimbursement

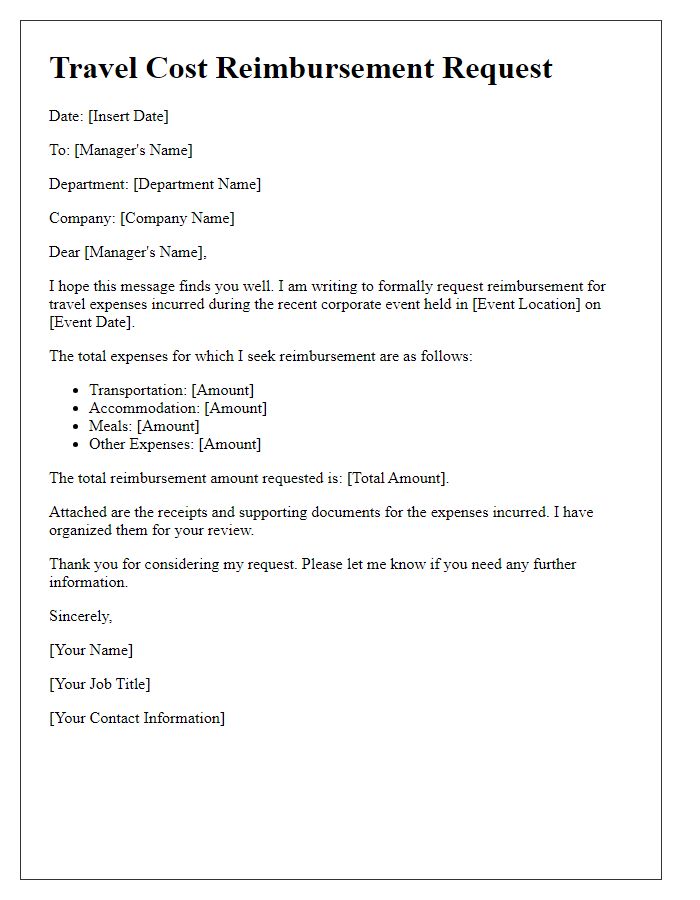

Letter template of travel reimbursements for official business functions

Comments