Have you ever found an unexpected charge on your bank statement that left you scratching your head? Unauthorized transactions can be a real headache, but there's a way to resolve these issues effectively. In this article, we'll guide you through a simple letter template to help dispute those pesky charges and reclaim your hard-earned money. So, if you're ready to take action and regain control of your finances, keep reading!

Account Information

Unauthorized transactions often lead to significant concerns regarding financial security and customer trust. Account information, such as the account number and transaction details (including dates and amounts), plays a critical role in the dispute resolution process. Financial institutions typically require this information to investigate claims and identify fraudulent activity. Swift reporting is essential as many banks have specific timeframes for reporting unauthorized transactions, often within 30 days. In addition, the financial institution may ask for supporting documentation, such as transaction receipts or communication logs, to facilitate the investigation. Personal information, such as the name and contact details for the account holder, is necessary for verification purposes, ensuring that the claims are properly authenticated.

Transaction Details

Unauthorized transactions can lead to financial distress for individuals, particularly in instances where bank accounts or credit cards are compromised. In February 2023, a notable case involved a consumer reporting a $250 charge on their Visa credit card from an online retailer, "ShopEasy," which they had never authorized. The transaction occurred in a location identified as "online" and was traced back to a payment processing service based in Delaware. The consumer promptly contacted their bank, outlining the need for urgent dispute resolution, citing identity theft as a potential cause. Following procedural guidelines, the bank initiated an investigation, emphasizing the importance of tracking the transaction through timestamp records and requiring verified documentation for a thorough examination.

Dispute Description

Unauthorized transactions can significantly impact a customer's financial security and necessitate a prompt resolution process. Customers often report unauthorized transactions on their bank statements, which may involve amounts ranging from a few dollars to several hundred or thousands of dollars. Commonly, these transactions might take place on e-commerce platforms (such as Amazon or eBay) or physical retail stores (like Walmart or Target) without the account holder's consent. It is crucial to gather relevant details, including transaction dates, amounts, and merchant information, for accurate dispute resolution. Furthermore, financial institutions typically require proof, such as account statements or transaction history, to support the claim and initiate an investigation, which can take between 14 to 30 days. Reporting these incidents immediately not only aids in recovering lost funds but also protects against potential future fraud.

Desired Resolution

When navigating unauthorized transaction disputes, customers often seek resolution methods to address concerns surrounding fraudulent financial activity. The desired resolution typically encompasses a full refund of the disputed amount, ensuring financial security. Additionally, customers might request an investigation into the transaction, particularly focusing on details such as the transaction date, merchant information, and time. Furthermore, enhanced security measures, including temporary card suspension and updates to account access protocols, are frequently desired to prevent future occurrences of unauthorized transactions. Clear communication from the financial institution, detailing steps taken for resolution and anticipated timelines, is also a crucial aspect of the desired resolution process.

Contact Information

Unauthorized transaction disputes often arise from fraudulent activities, identity theft, or banking errors. Essential contact information typically includes the account holder's name, the bank's name (such as JPMorgan Chase or Bank of America), the specific transaction date (e.g., August 15, 2023), the transaction amount (e.g., $150.00), and a detailed description of the disputed transaction (e.g., unauthorized purchase at Amazon). Providing a valid telephone number (including area code), a mailing address for correspondence, and an email address for digital communication can facilitate prompt resolution. Keeping records of previous communications and any additional transaction details, like transaction IDs, enhances the clarity of the dispute process.

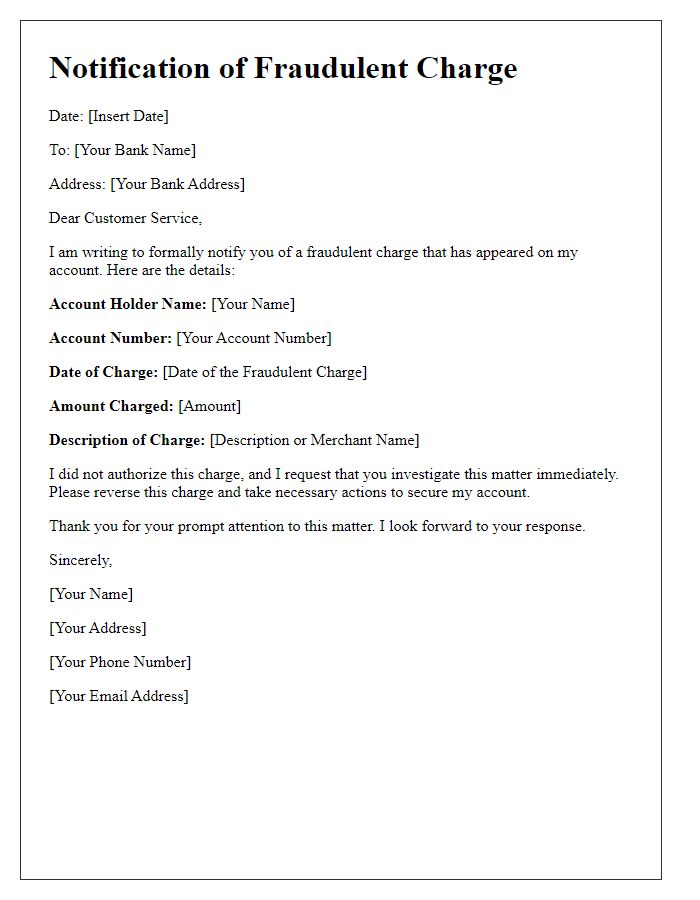

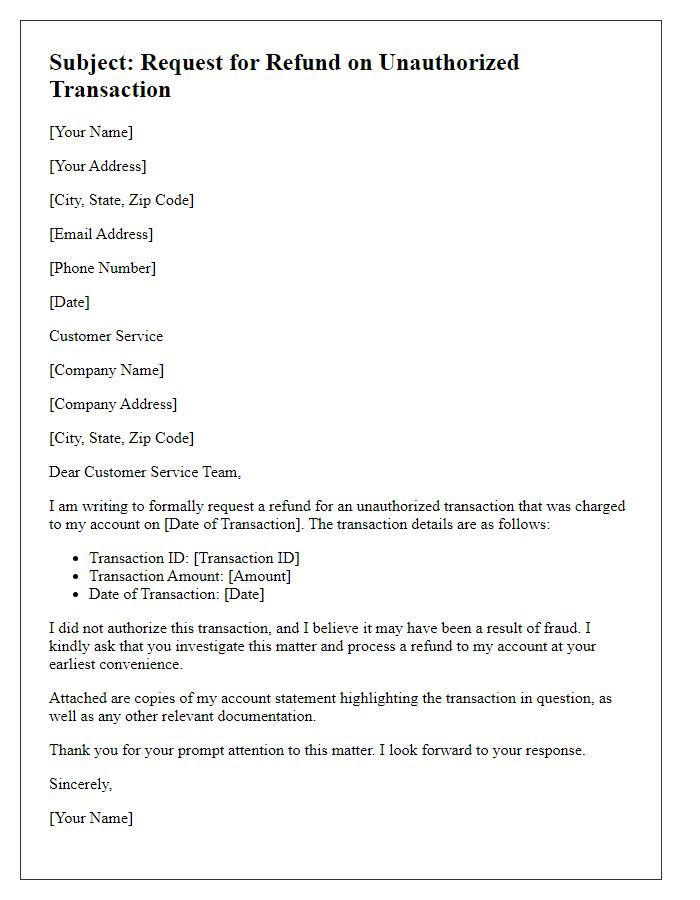

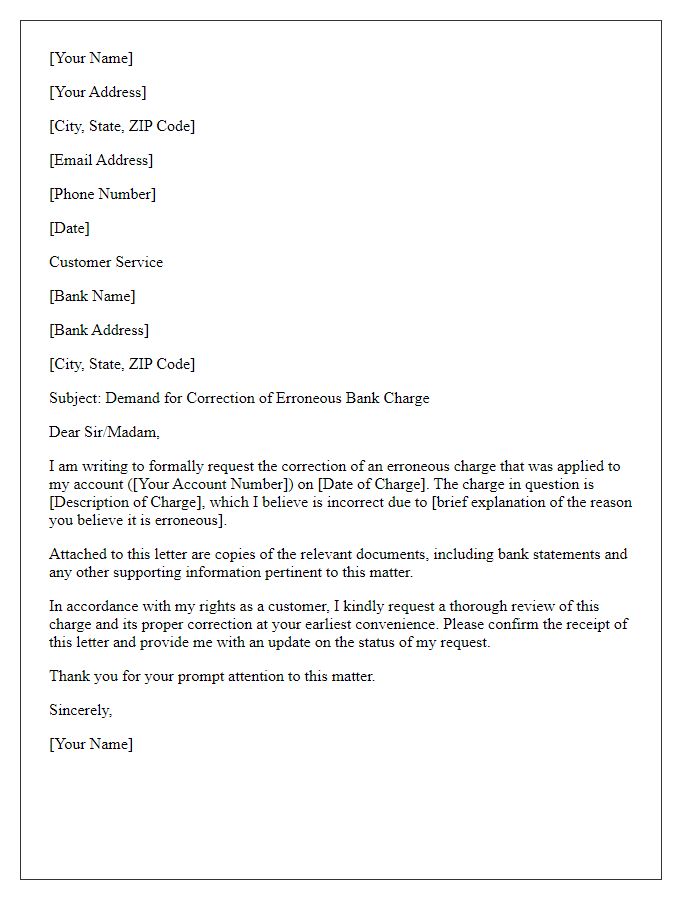

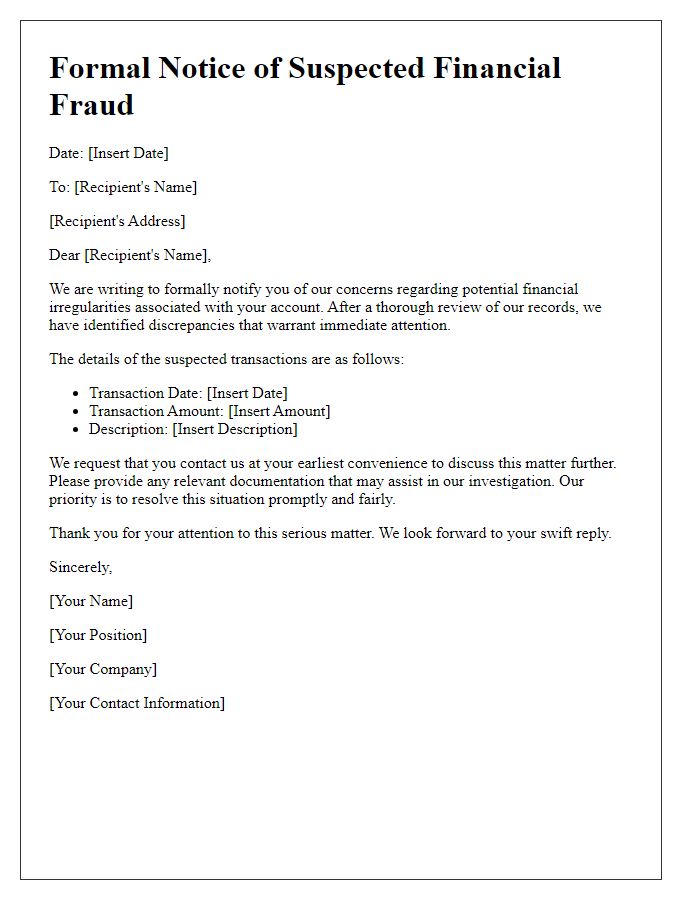

Letter Template For Unauthorized Transaction Dispute Resolution Samples

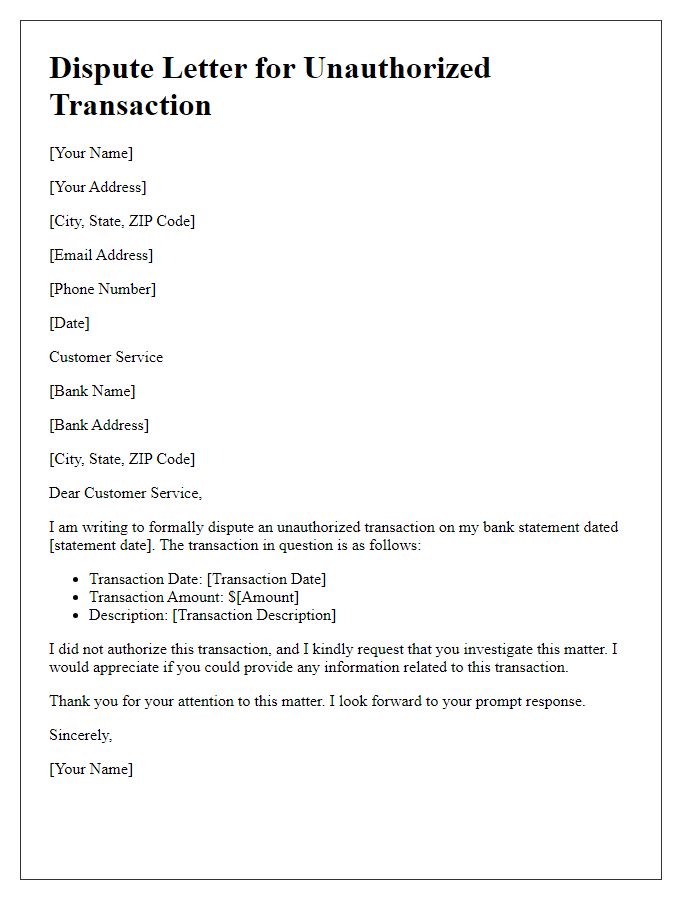

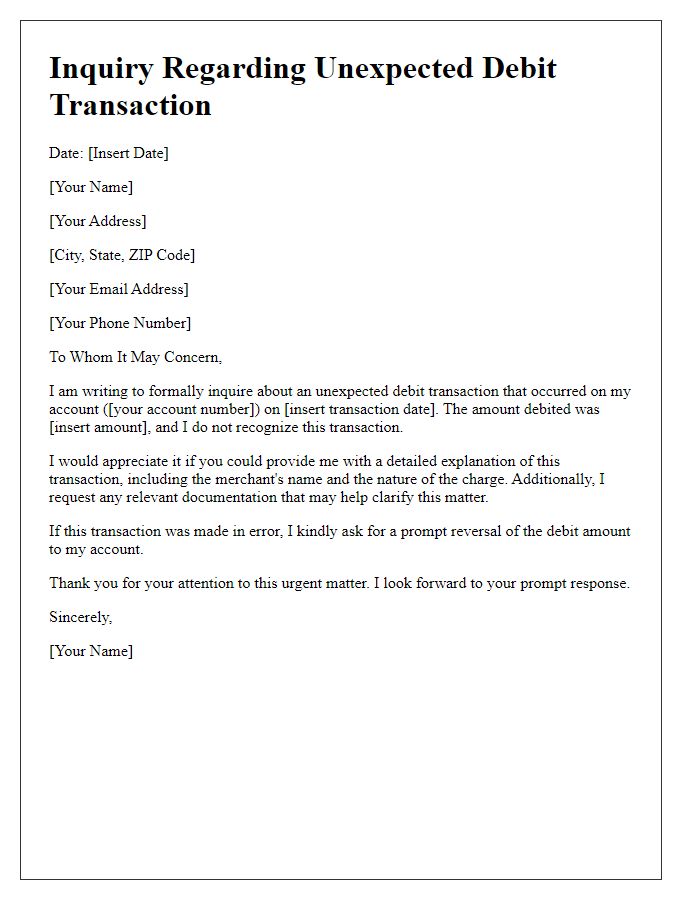

Letter template of dispute regarding unauthorized transaction on bank statement

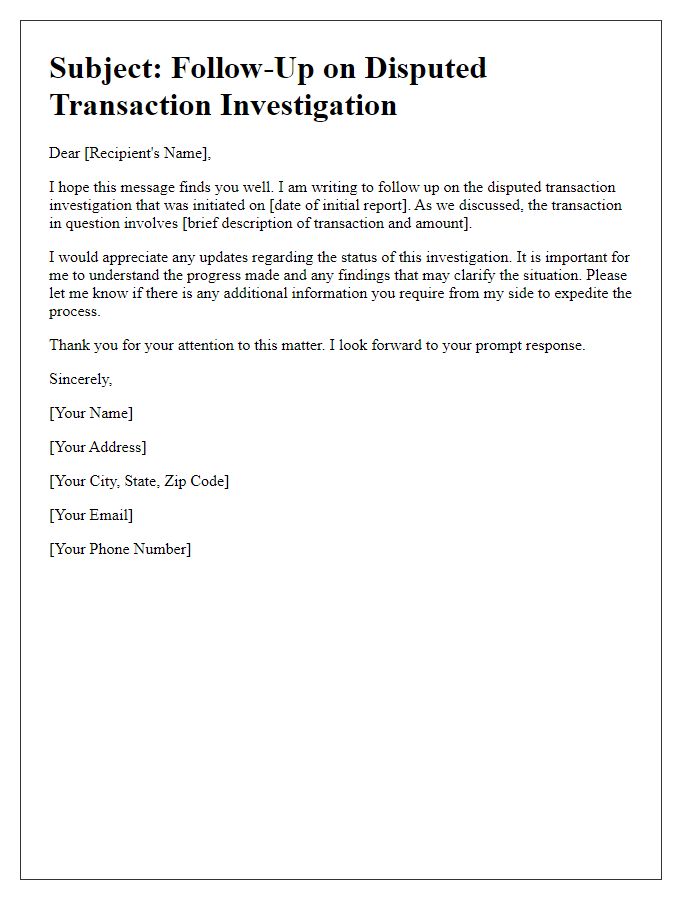

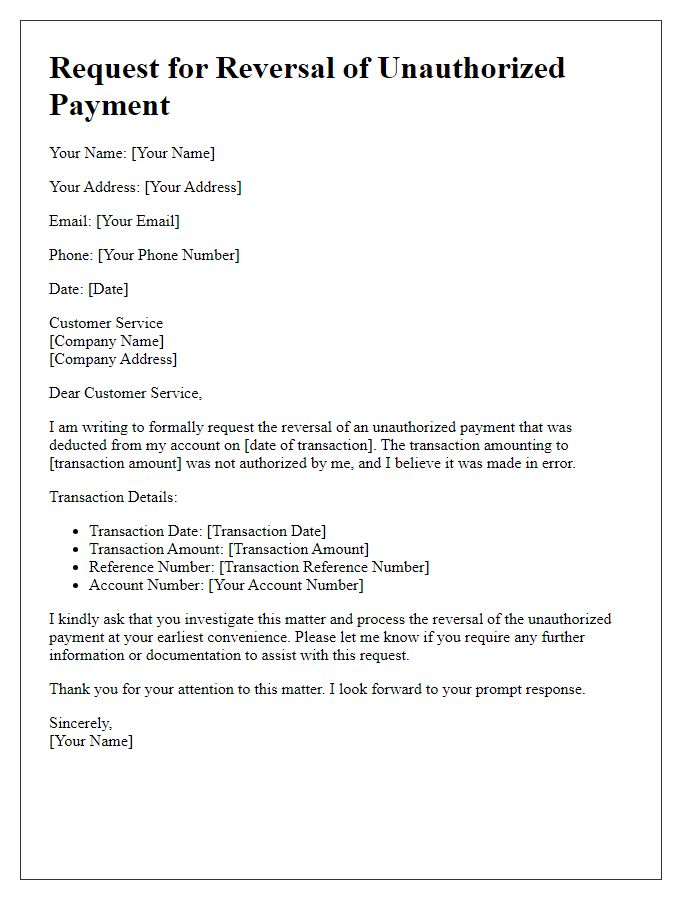

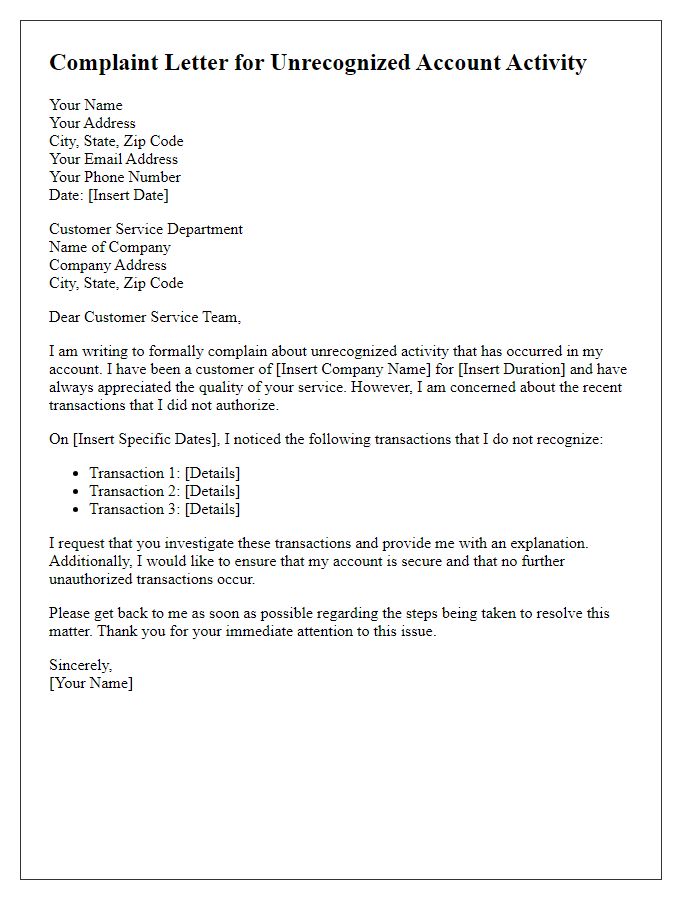

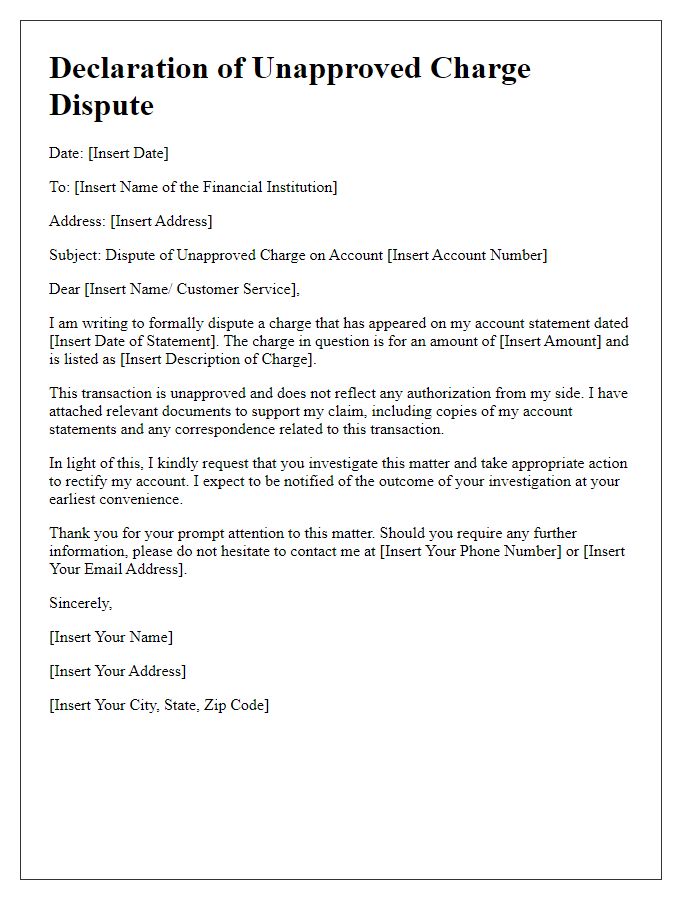

Letter template of follow-up regarding disputed transaction investigation

Comments