Are you feeling stressed about potential late payment penalties? You're not aloneâmany individuals and businesses encounter unexpected financial challenges that can make it difficult to stay on top of bills. Fortunately, there's a way to formally request a waiver for those pesky late fees, allowing you to regain your financial footing. If you're curious about how to craft an effective letter for approval, keep reading for tips and a helpful template.

Polite tone and gratitude

Late payment penalties can significantly impact individuals and businesses financially. Acknowledge the specific due date and the amount due while explaining the circumstances that led to the delay. Express gratitude for past support and understanding from the financial institution or service provider. Request consideration of the waiver based on previous positive payment history. Highlight a willingness to maintain future compliance with payment deadlines. Emphasize the importance of the relationship with the institution or provider, reinforcing commitment.

Specific account details and payment reference

A late payment penalty waiver can significantly benefit individuals facing financial challenges. For accounts such as those with a balance of $500 or more, a penalty fee can range from 5% to 10%, depending on the company's policy. Payment references like invoice numbers or account IDs ensure that the waiver request is accurately processed. Clients should provide specific details, including the reason for late payment, along with documentation supporting their request, such as bank statements or payment confirmations. Timely communication with customer service representatives can facilitate quicker resolutions, enhancing the chances of approval for the waiver.

Explanation for the penalty waiver consideration

Late payment penalties can impose financial strain on individuals or businesses facing unexpected hardships. Circumstances such as a sudden job loss, medical emergencies, or natural disasters (e.g., hurricanes affecting coastal areas) can disrupt regular payment schedules. Many creditors, including mortgage lenders or utility companies, may recognize these challenges and offer consideration for penalty waivers in good faith. Such waivers can provide relief by eliminating extra charges, enhancing customer loyalty, and fostering positive relationships. Documenting hardships, such as medical bills or termination notices, can strengthen waiver requests by presenting a compelling case for understanding and support from the creditor.

Confirmation of revised payment terms

Late payment penalties can significantly impact individuals and businesses. A revised payment terms agreement, addressing the original payment schedule, often proves beneficial. Negotiations may result in reduced interest rates or extended deadlines. This flexibility allows parties to maintain relationships while managing financial obligations. Furthermore, timely communication regarding payment issues ensures transparency, fostering trust. Documenting the revised payment terms in writing protects both parties, providing a clear reference point. Legal entities must also consider jurisdiction-specific regulations governing payment agreements, ensuring compliance and mutual understanding.

Contact information for further assistance

Late payment penalties can be a source of stress for individuals and businesses. In situations where late payments occur, financial institutions often provide a formal process for requesting a waiver of such penalties. For instance, a small business (with annual revenue below $1 million) may face a late fee of $50 for overdue invoices. Companies like credit card issuers (e.g., Visa, MasterCard) generally offer customer service numbers such as 1-800-VISA-911 for assistance regarding penalties. Additionally, specific banks might have dedicated departments for penalty waivers, allowing customers to directly communicate with representatives who can assess their situations, often requiring an account number and a brief explanation of financial hardships. Grasping these details could help in effectively navigating the waiver request.

Letter Template For Late Payment Penalty Waiver Approval Samples

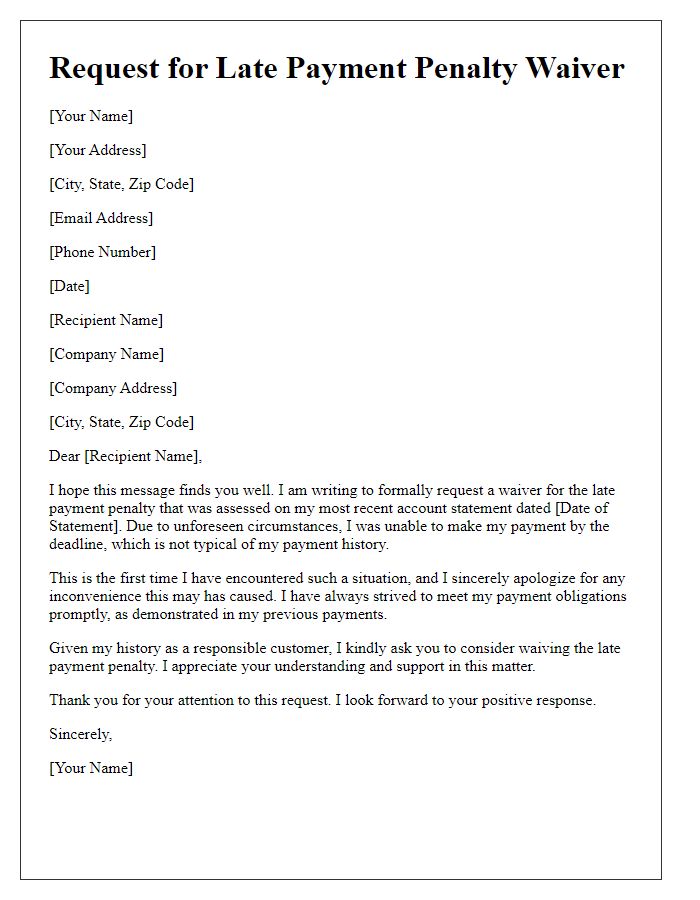

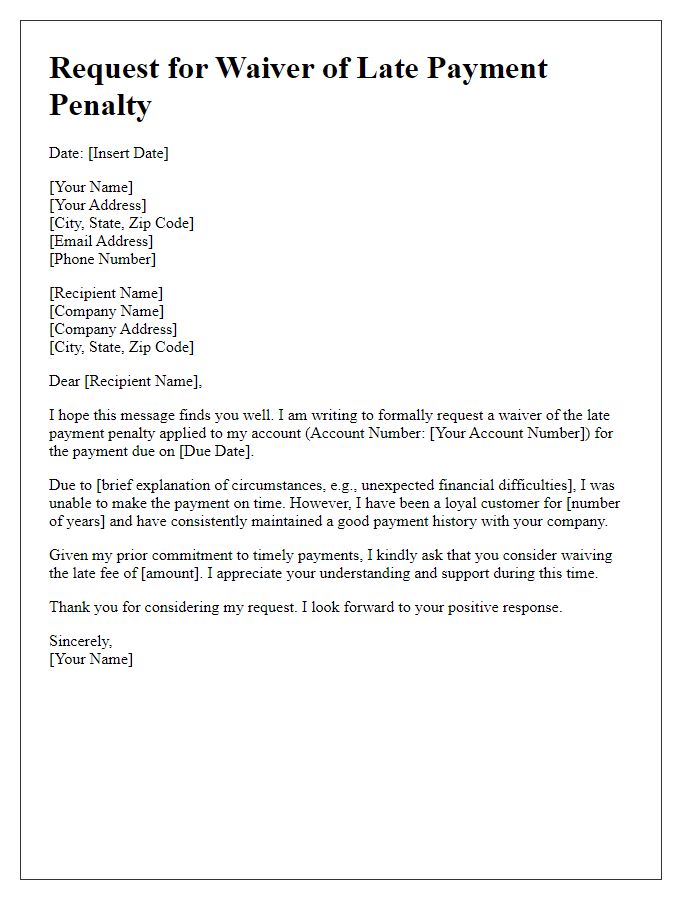

Letter template of late payment penalty waiver request for first-time offenders.

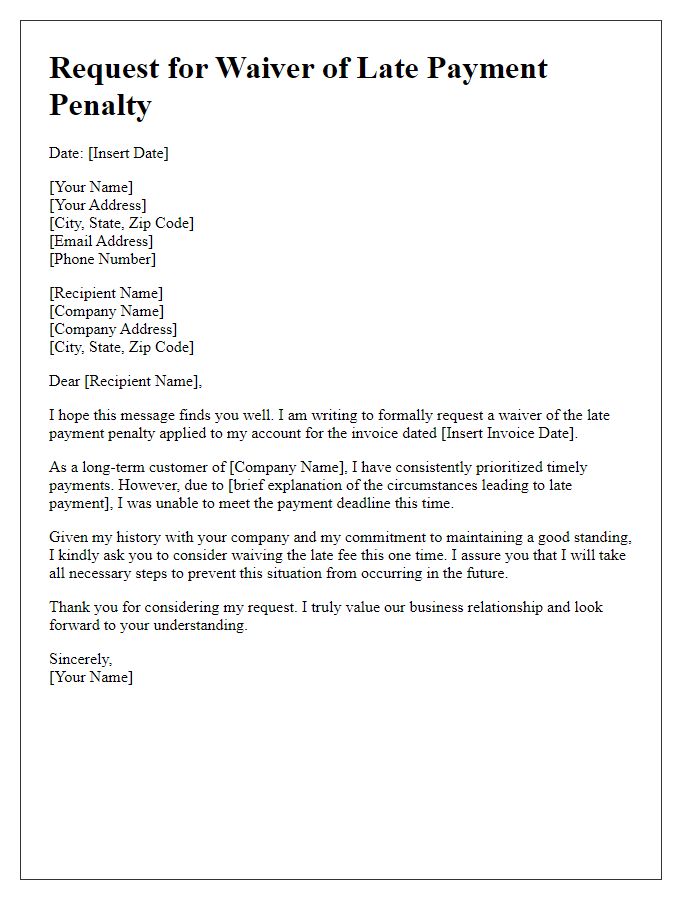

Letter template of late payment penalty waiver request for long-term customers.

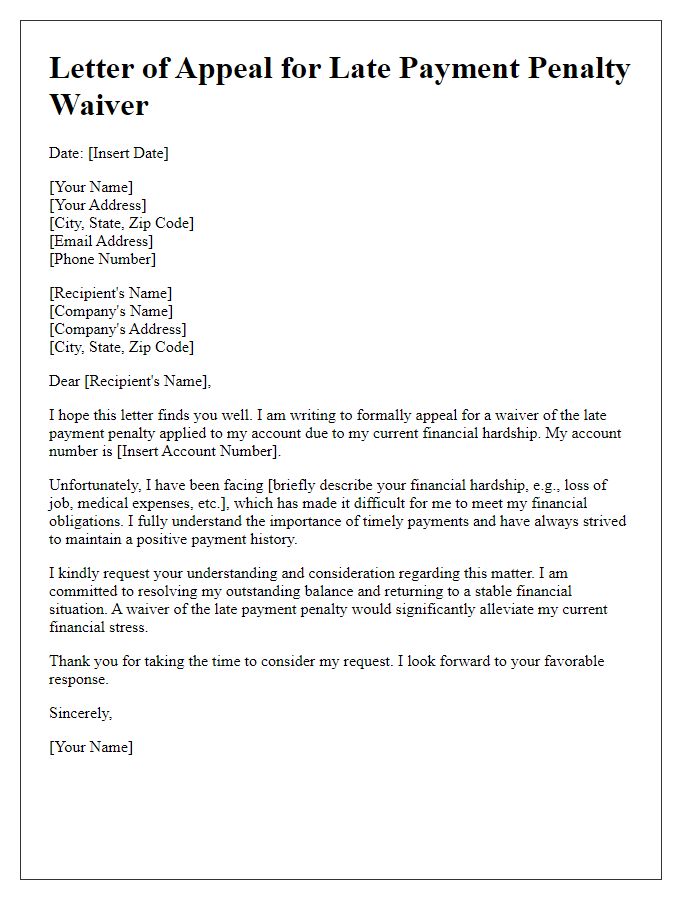

Letter template of late payment penalty waiver appeal during financial hardship.

Letter template of late payment penalty waiver justification for unforeseen circumstances.

Letter template of late payment penalty waiver request for non-profit organizations.

Letter template of late payment penalty waiver inquiry for small businesses.

Letter template of late payment penalty waiver request for service interruptions.

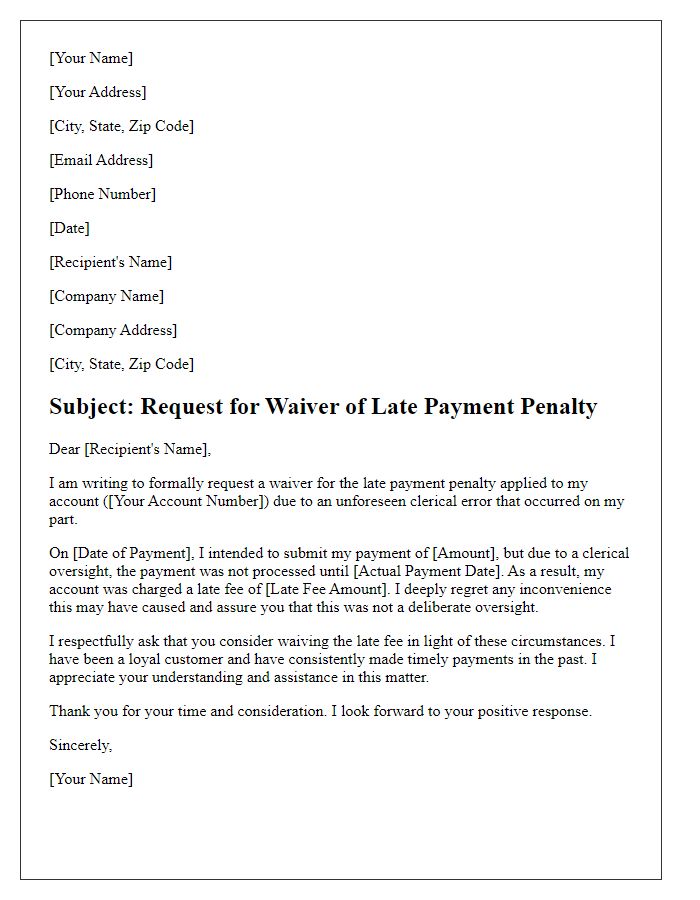

Letter template of late payment penalty waiver request due to clerical errors.

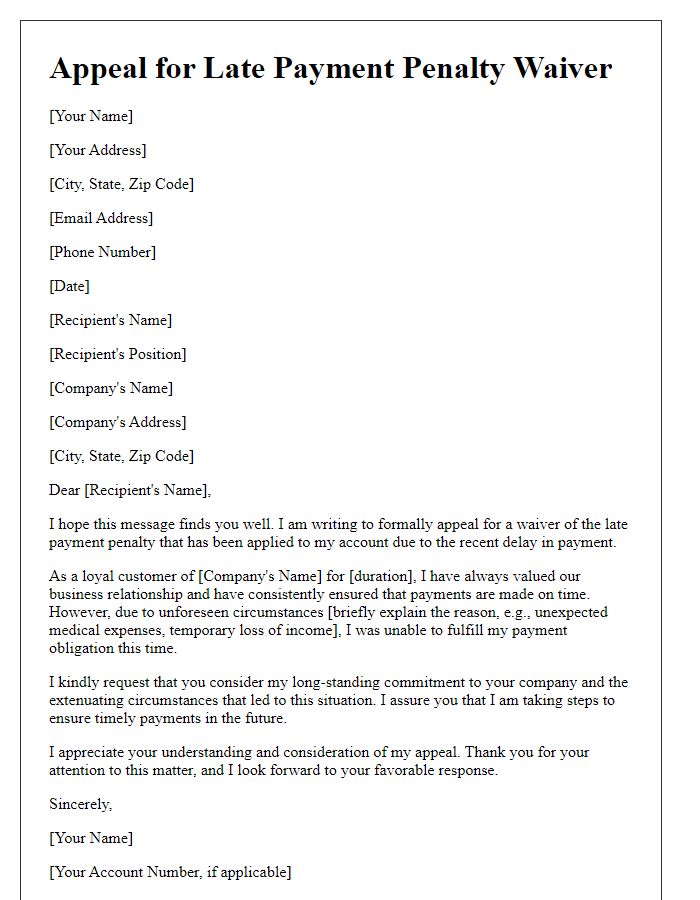

Letter template of late payment penalty waiver appeal for loyal clients.

Comments