Navigating payment processing can sometimes feel like a maze, especially when delays crop up unexpectedly. We understand that waiting for funds can be frustrating, and we want to keep you in the loop about what's happening. In this letter, we'll outline the reasons behind these delays and what steps we're taking to resolve them swiftly. Stick around as we delve into the details and offer solutions to help you manage this situation better!

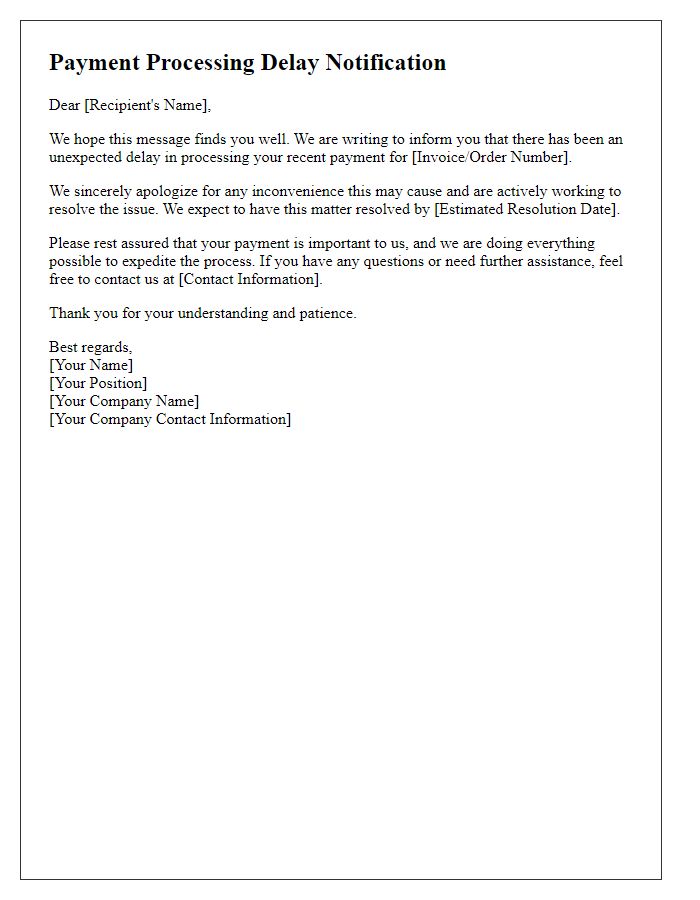

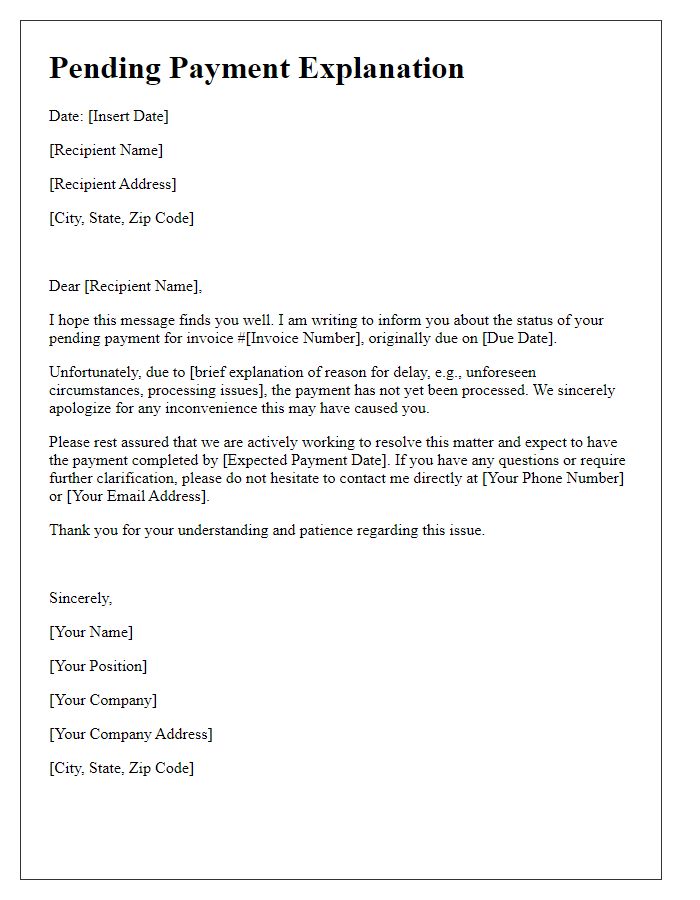

Apology Statement

Payment processing delays can significantly impact financial transactions for businesses and individuals alike. Common causes include system errors, banking holidays, and high transaction volumes, which can result in processing times extending beyond the typical one to three business days. In cases where delayed payments affect services such as utility bills or loan repayments, additional fees may be incurred, exacerbating the situation. Organizations like PayPal or Square may also face unique challenges in their payment systems, leading to customer dissatisfaction and potential loss of trust. Timely communication and proactive customer service are essential in addressing these issues effectively.

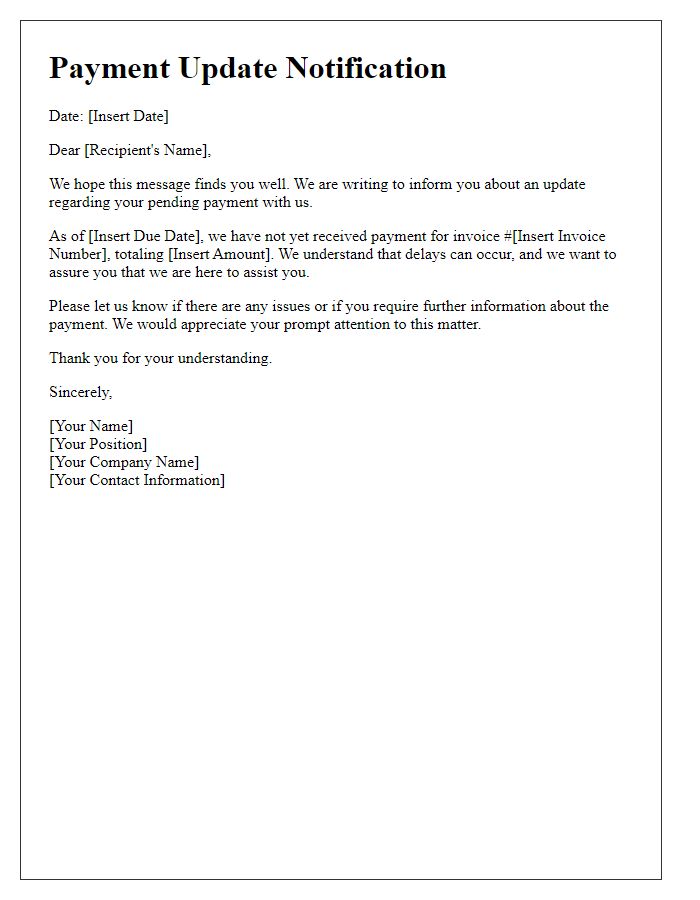

Explanation of Delay

Payment processing delays can occur due to various factors, including technical glitches within financial institutions or discrepancies in transaction details. For instance, during peak processing times (like the end of the month), banks may experience increased workloads, slowing down payment authorizations. Additionally, if a payment involves international funds transfer (such as a wire transfer from a US bank to a European Union bank), it could encounter transfer delays due to differing banking regulations and time zones, often taking 1 to 5 business days. Moreover, issues such as insufficient funds, account verification problems, or missing information can further hinder swift payment completion. Timely communication regarding these delays is essential to manage expectations and ensure smooth transactions in the future.

Assurance of Resolution

Payment processing delays can create significant concerns for businesses, particularly in cash-dependent operations like retail. A delay of more than 48 hours may disrupt inventory replenishment, impacting sales at significant retail stores such as Walmart or Target. Affected entities often experience increased customer dissatisfaction, leading to the potential loss of repeat business. Furthermore, delayed payments can hinder the ability to meet payroll, particularly in small businesses with around 10-50 employees, which rely on consistent cash flow for operational stability. Immediate communication regarding the issue and reassurance of prompt resolution strategies is crucial in maintaining trust and ensuring ongoing operations.

Contact Information

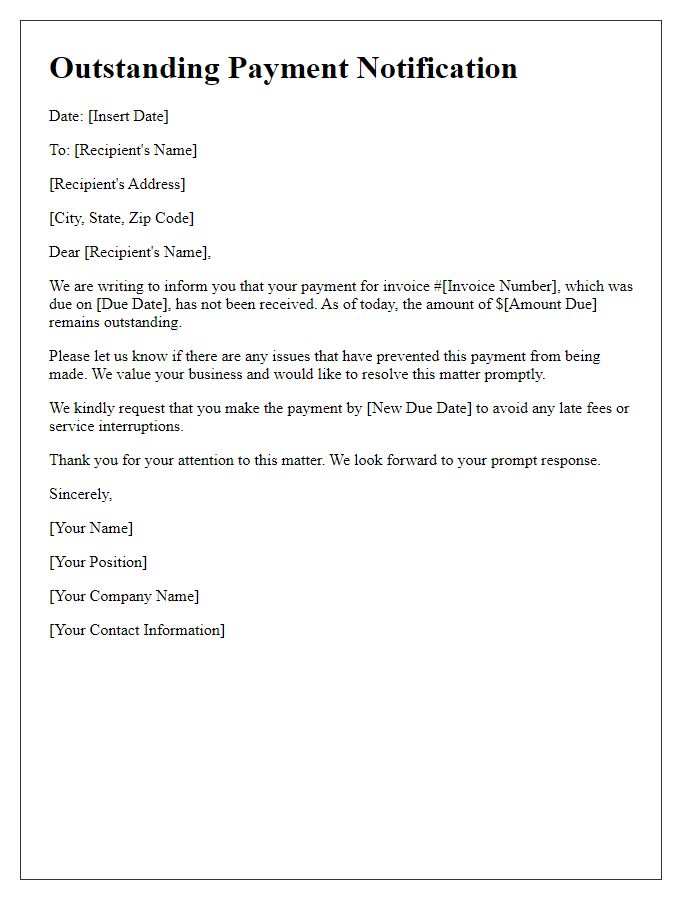

Payment processing delays can significantly impact cash flow and operations for businesses. Organizations often experience such issues due to various factors including banking errors, system outages, or extensive verification procedures. For instance, a transaction tied to a business account at Wells Fargo can take up to three to five business days if compliance checks are involved. In high-volume transaction periods like Black Friday, delays may become even more pronounced, stressing the importance of efficient financial workflows. Companies relying on prompt payments may suffer from budget disruptions, which can hinder their ability to meet financial obligations or invest in growth initiatives.

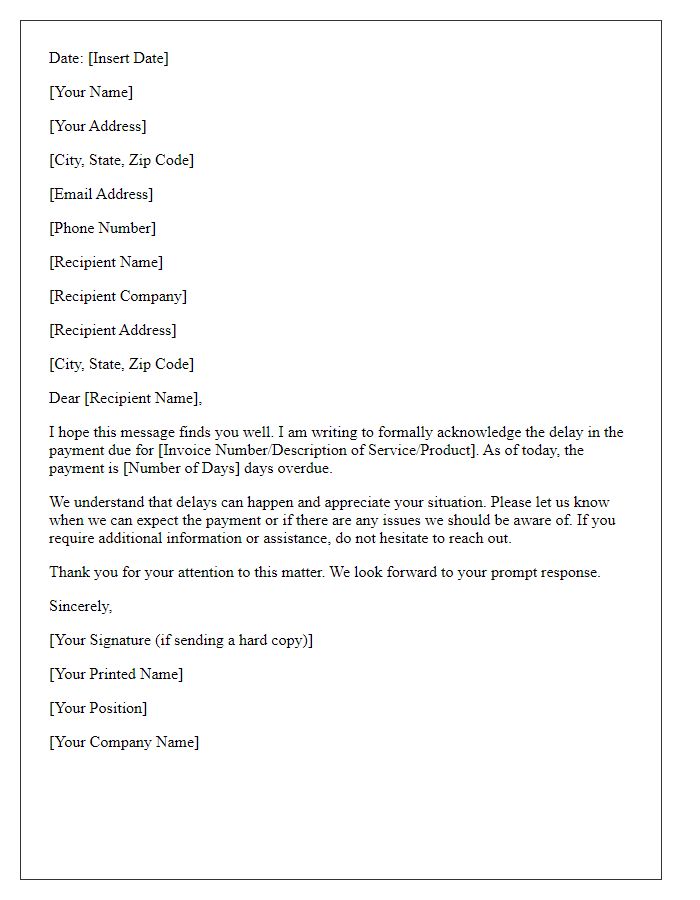

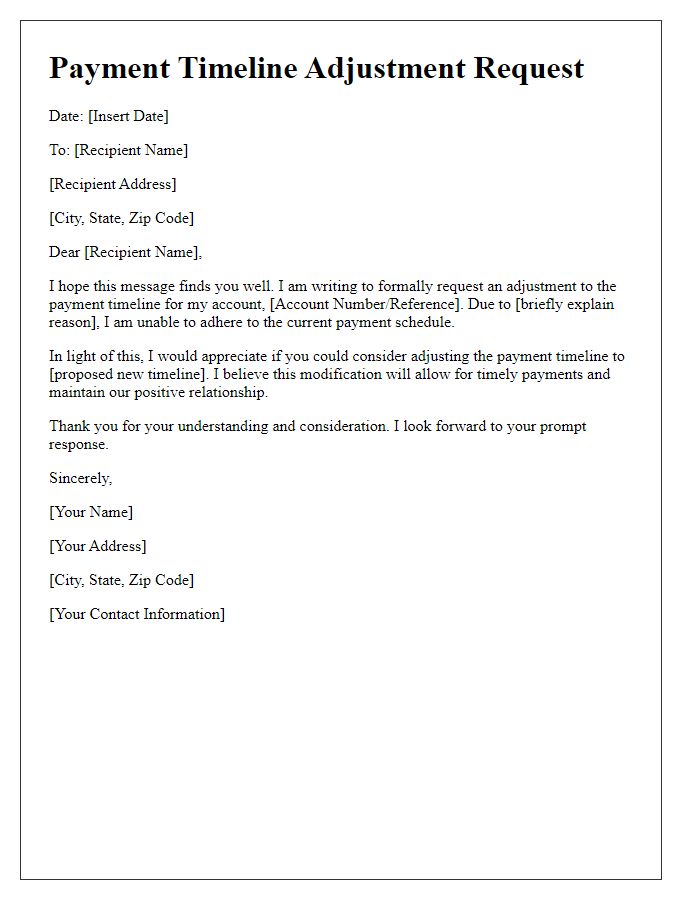

Request for Understanding

Payment processing delays can create significant challenges for businesses and customers alike. Delays often arise from factors such as high transaction volumes during peak shopping seasons or system maintenance issues at financial institutions. For instance, during holiday seasons like Black Friday, spikes in credit card usage can lead to longer processing times, sometimes extending beyond the typical 24-48 hour window. Additionally, payment gateways, such as PayPal or Stripe, may experience outages, affecting overall transaction speed. Customers may feel frustrated when invoices are not marked as paid, impacting their access to services or products. Understanding and communication from all parties involved can help mitigate anxiety during these exceptional circumstances.

Comments