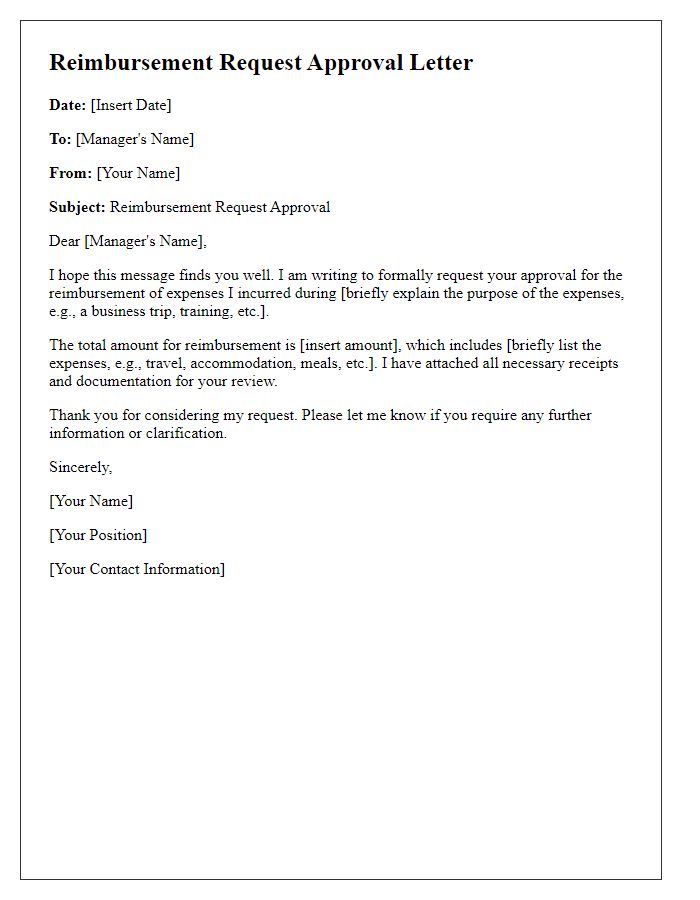

Are you tired of waiting endlessly for your reimbursement requests to get approved? You're not alone! Many people face confusion and delays when it comes to navigating the reimbursement process. In this article, we'll share a clear and concise letter template that will help you effectively communicate with your finance team and get your approvals faster. So, let's dive in and streamline your reimbursement experience!

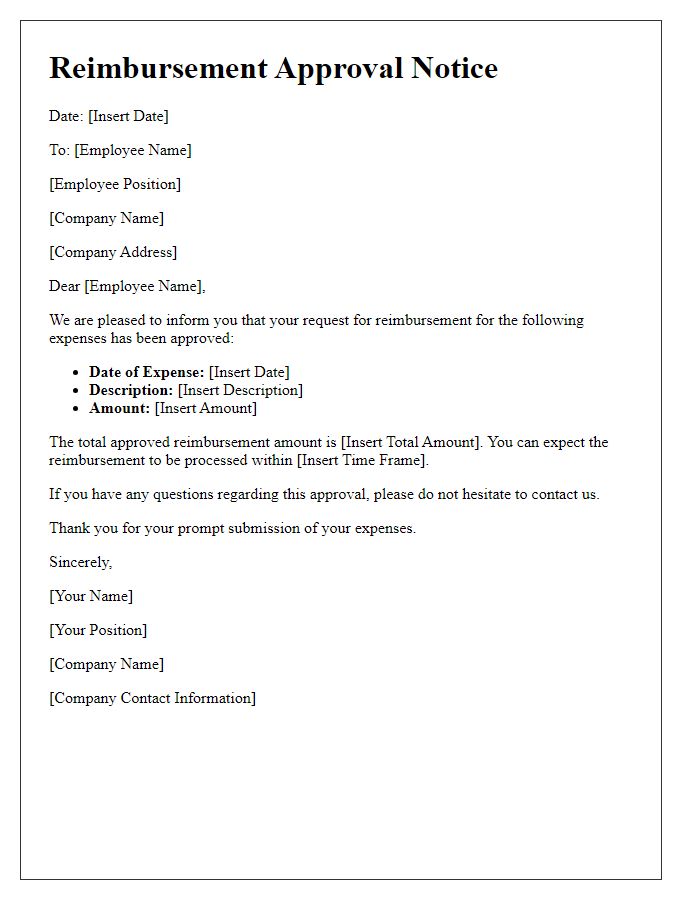

Recipient information

The reimbursement approval notification process encompasses various key elements that ensure clarity and efficiency in communication. This document typically includes recipient information, which involves the full name of the individual (for instance, Johnathan Smith), their department (such as Human Resources), and contact details (including email address and phone number), alongside the date of the notification (e.g., October 4, 2023). Additionally, the notification outlines the specific reimbursement amount approved (for instance, $150.75) and references the associated expense report number (e.g., ER-2023-435). Clear identification of the recipient streamlines the process, ensuring that funds are accurately disbursed and that all necessary parties are informed regarding the approval status.

Reimbursement details

Reimbursement notifications provide crucial details about the approval process. The reimbursement approval notification typically includes the reimbursement amount, which may vary based on the expenses incurred, often requiring submission of receipts or invoices for verification. The notification should specify the time frame, usually within 30 days post-submission, for any approved reimbursements to be processed. It also outlines the method of reimbursement, commonly through direct deposit to the employee's bank account or via a company check mailed to the registered address. Additionally, it may include reference numbers for tracking purposes and mention any required forms or documentation that should accompany future claims. Understanding these details enhances transparency within the financial workflow of an organization.

Approval confirmation

The reimbursement approval notification confirms the successful processing of a claim submitted by an employee for eligible expenses. This communication typically includes details such as the amount approved, the specific categories of expenses covered (e.g., travel, supplies), and the associated receipts that were submitted for verification. Companies often utilize an internal tracking system, like an expense management software, to streamline this process. Timely notifications (generally sent within two weeks of submission) ensure that employees are informed about their reimbursement status, fostering a transparent and efficient financial workflow within the organization.

Instructions for next steps

Reimbursement approval notifications serve as essential communications within corporate finance departments. Upon receiving an approval notification, employees must carefully review the reimbursement details outlined in the document. This typically includes the approved amount, reimbursement categories such as travel expenses, office supplies, or training costs, and any accompanying receipts or documentation required. Employees should verify the submission date, ensuring that all claims fall within the designated fiscal period, often defined by corporate policy. Next steps include filling out any required forms, often found in the company's finance portal, and submitting these forms along with the approved notification to the designated financial officer or department. Adhering to internal deadlines, usually set for two weeks after approval, ensures timely processing of funds. Finally, employees should keep a copy of all documentation, including the original submission and approval email, for record-keeping purposes, as this aids in future reference or potential audits.

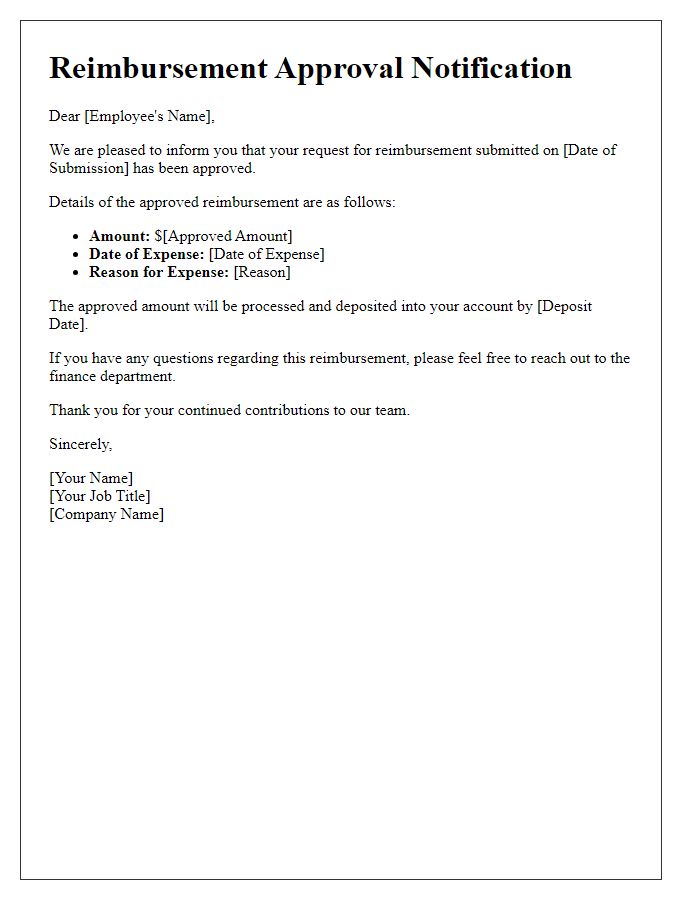

Contact information for inquiries

Notification regarding reimbursement approval typically involves the details of the reimbursement process, expense types eligible for reimbursement, accompanying documents required, approval timelines, and any relevant contact information for inquiries. For example, employees may need to submit receipts, must use specific forms (such as Expense Reimbursement Form), and follow company policy regarding allowable expenses, which can vary depending on the business unit or project. If further clarification is needed, employees are encouraged to reach out to the HR department at (555) 123-4567 or email hr@company.com for additional support and guidance.

Comments