Are you struggling to find the right words for a pending payment notice? We've all been thereânavigating the delicate balance between professionalism and urgency can be tricky. In this article, we'll explore effective letter templates that not only convey your message clearly but also maintain a good relationship with your clients. So, let's dive in and discover the best practices for crafting a polite yet firm payment reminder!

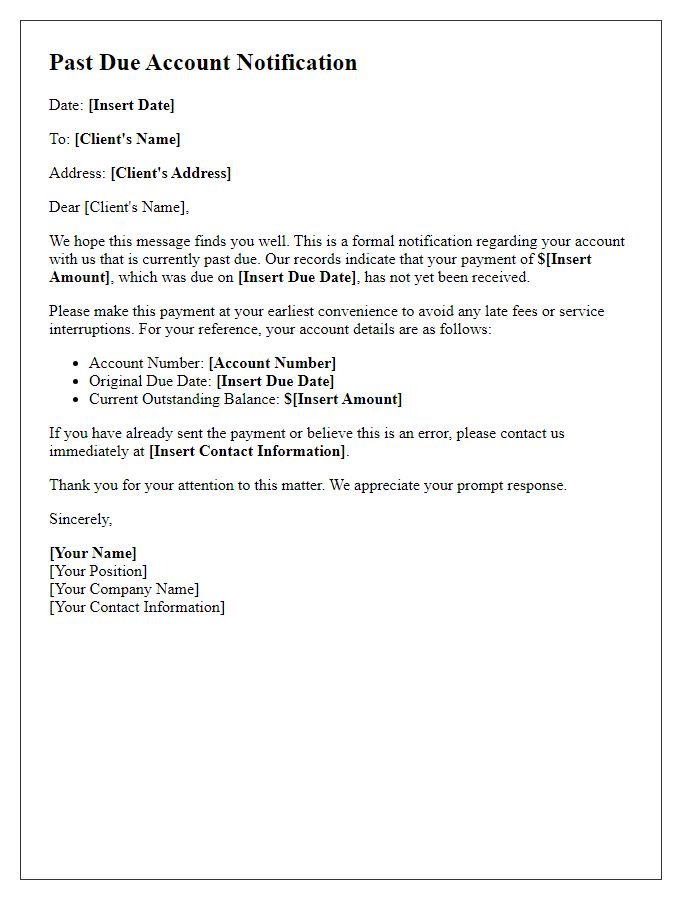

Clear Account Information

Pending payment notices must include clear account information to avoid confusion. The statement should feature the account holder's name, account number for identification, and the total amount due. A breakdown of the charges, including invoice numbers and dates, adds clarity to the communication. Deadlines for payment are crucial, with specific dates highlighted to prompt prompt action. Payment methods accepted, such as credit card, bank transfer, or online payment options, should be clearly stated to facilitate the process. Contact information for customer service inquiries ensures that any questions or issues can be swiftly addressed, enhancing customer experience and encouraging timely resolution.

Specific Due Amount

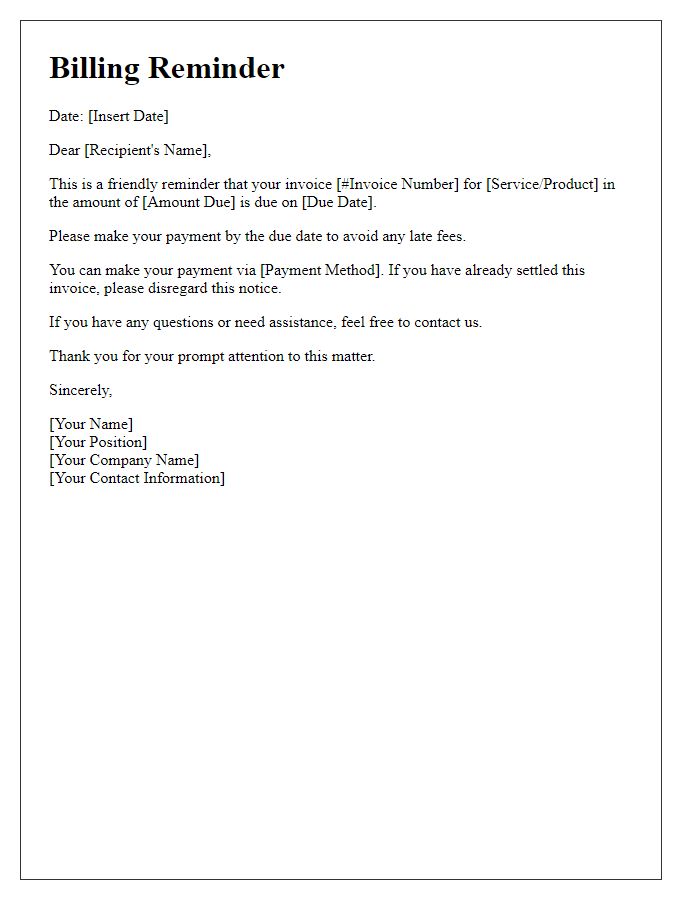

Pending payment reminders can be crucial for maintaining cash flow in business operations. A pending payment notice typically highlights the specific due amount, which may include invoices from various suppliers or services contracted. For businesses, this figure can significantly impact monthly budgeting and financial forecasting. The notice should specify the due date, often set within a standard payment term of 30 days, but can vary depending on contractual agreements. Additionally, including applicable late fees or interest--usually ranging from 1% to 5% of the total amount--can incentivize timely payment. Addressing the notice to the specific accounts payable department or contact person enhances clarity and encourages prompt action on the invoice.

Deadline for Payment

Pending payments can significantly impact business cash flow, particularly for small enterprises reliant on timely accounts receivable. A pending payment notice typically specifies payment deadlines, often set between 15 to 30 days from the invoice date. Clear communication is crucial to ensure that clients, such as local businesses or corporate partners, understand the expectations. Including details such as invoice numbers, amounts owed (potentially ranging from a few hundred to several thousand dollars), and specific payment methods (bank transfer, credit card) enhances clarity. Regular reminders, ideally using professional templates, reinforce payment deadlines and foster prompt responses, thereby ensuring financial health.

Payment Instructions

Pending payments can disrupt cash flow for businesses, particularly small enterprises needing timely compensation. Payment instructions should be clear and concise, outlining methods for payment, such as bank transfers to designated accounts, detailing the bank name (for instance, JPMorgan Chase), account number (123456789), or payment platforms like PayPal. Specific deadlines for payment, including late fees or interest rates, should be mentioned to encourage prompt action. Including contact information for customer service can facilitate resolution in cases of confusion, ensuring smoother transactions for both parties involved in the financial exchange.

Consequences of Non-Payment

Pending payments can cause significant consequences for businesses and individuals alike. Missed payment deadlines, often reaching 30 days past due, can lead to late fees that compound monthly, sometimes accumulating up to 25% of the original invoice amount. Additionally, credit scores may deteriorate as the payment information is reported to agencies like FICO. This drop in credit rating can affect future loan approvals and interest rates, making financial products less accessible. Furthermore, legal action may ensue, starting with notices from collections agencies, which can lead to court judgments against the debtor, resulting in wage garnishment or bank account levies. Ultimately, the ongoing financial strain can hinder cash flow management, affecting overall business operations and growth potential.

Comments