Hey there! We all know that managing finances can sometimes get a bit tricky, and encountering duplicate charges on your account is one hassle no one wants to deal with. It can be frustrating and confusing, especially when you're trying to keep track of your expenses and budget effectively. If you've found yourself in this situation, don't worry; we've got you covered with a handy letter template to help you address those duplicate account charges. Read on to discover how you can take the right steps to resolve the issue smoothly!

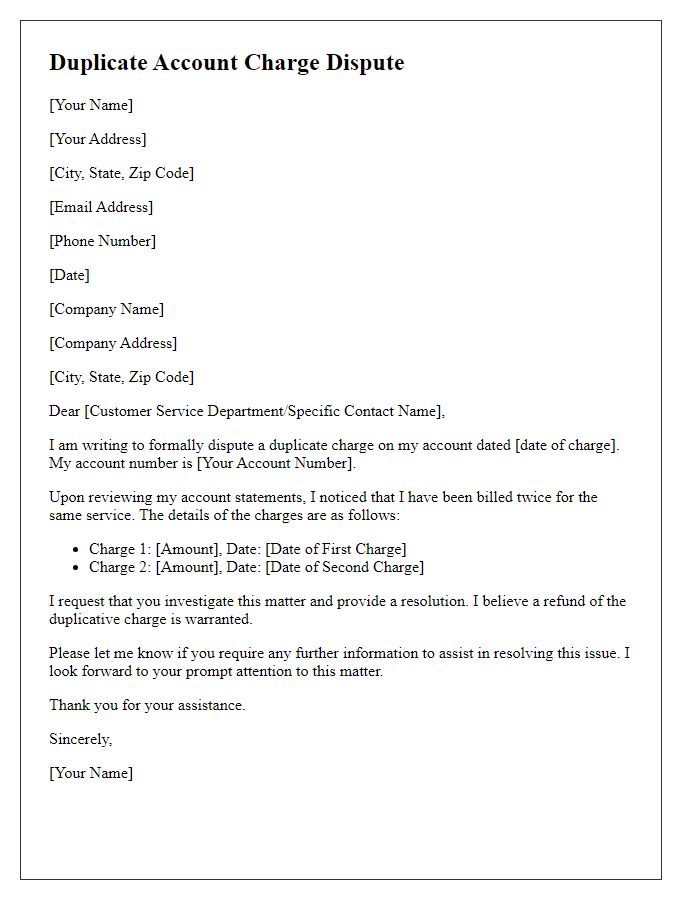

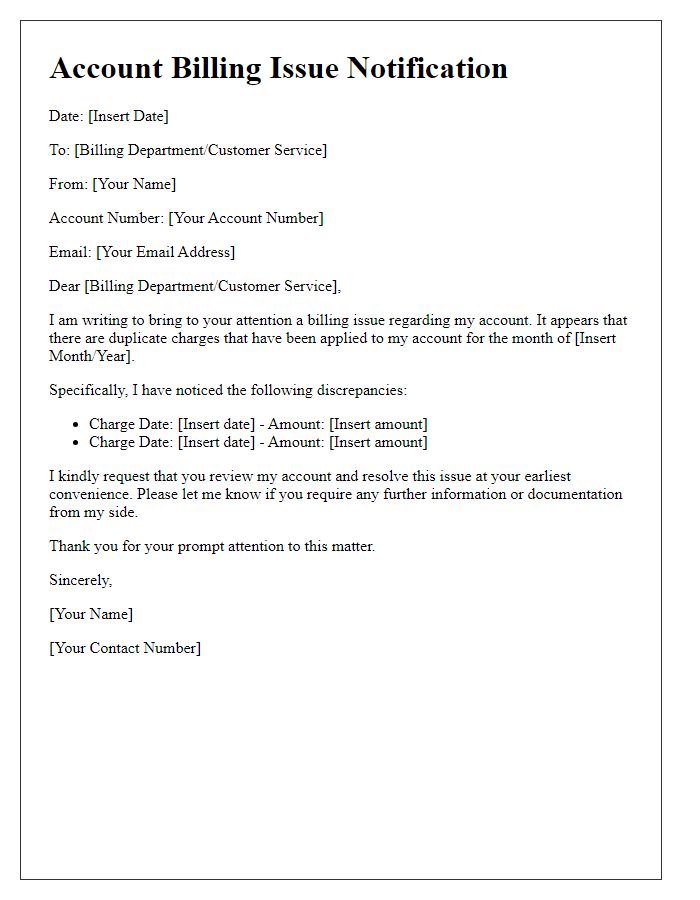

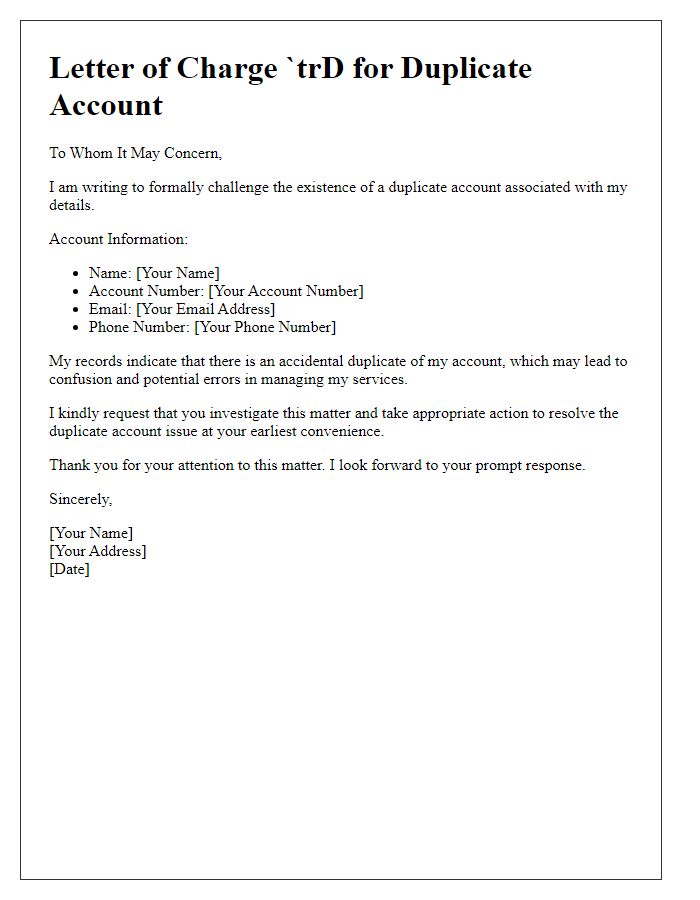

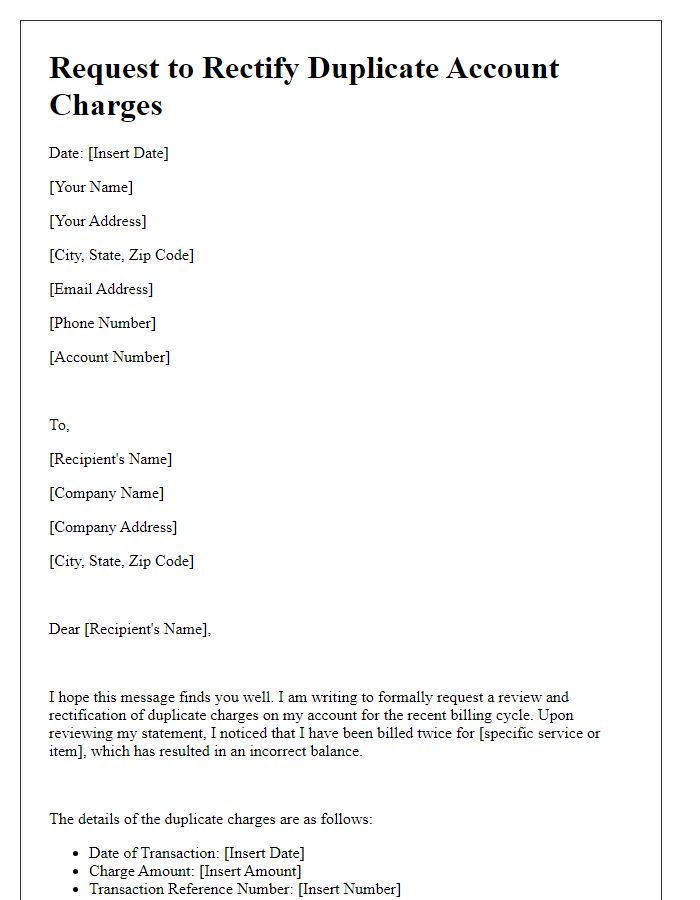

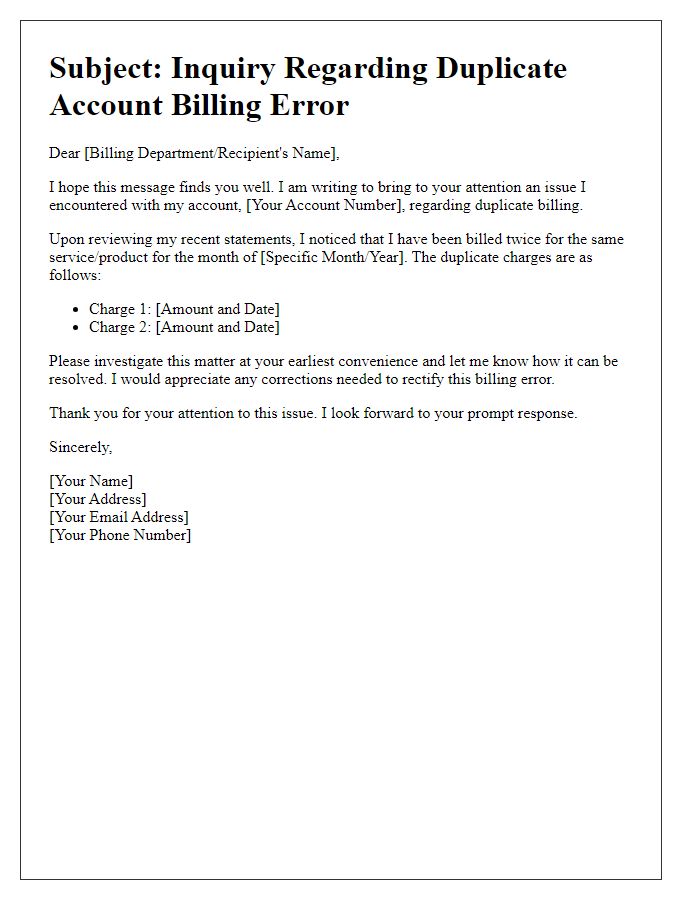

Account Details

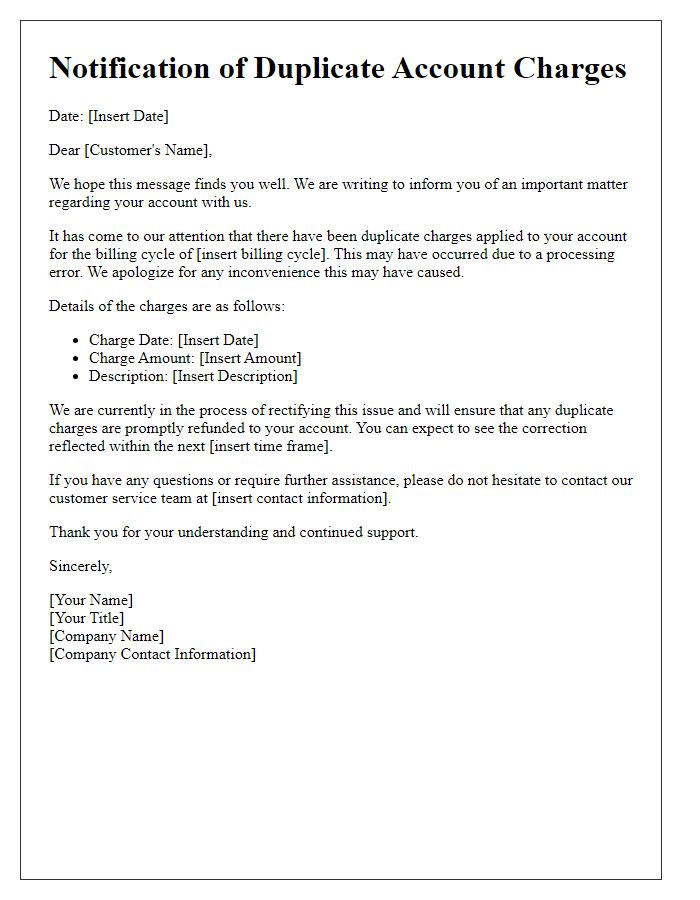

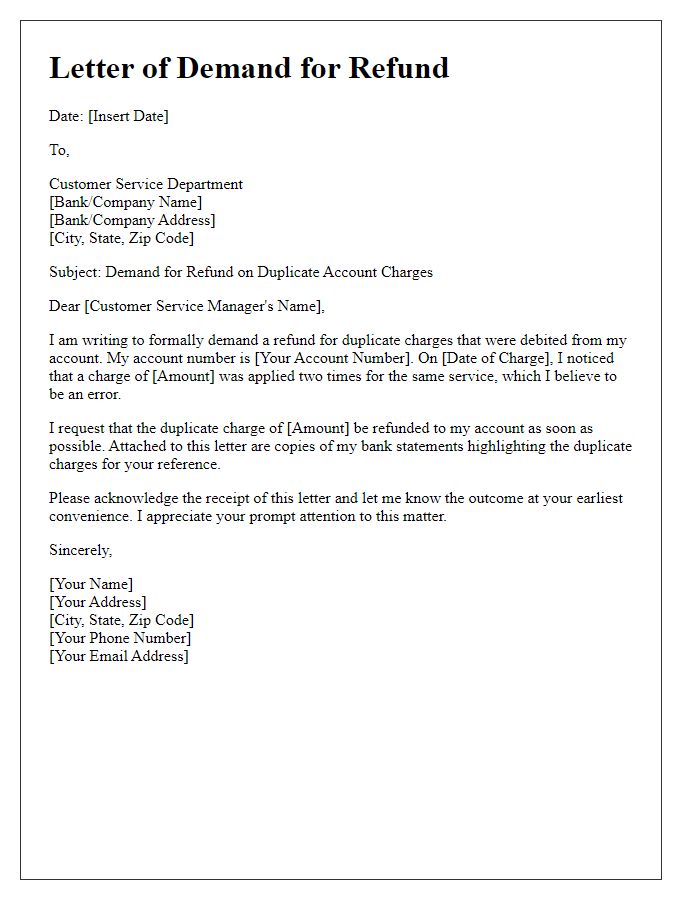

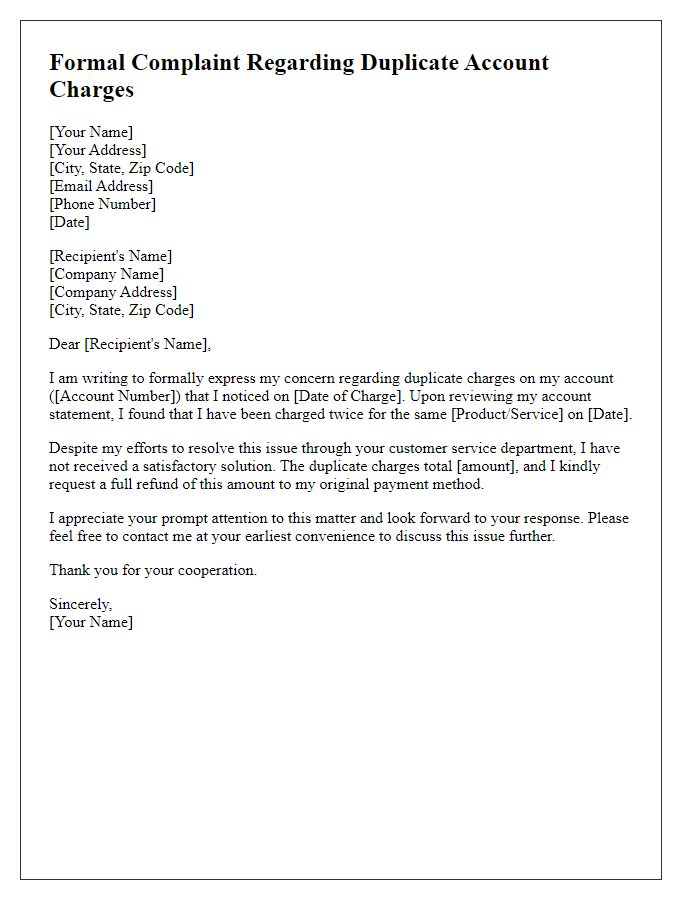

Duplicate account charges can lead to significant financial discrepancies for individuals. In banking institutions, such as JPMorgan Chase or Bank of America, a duplicate charge may occur when transactions are processed twice within the same billing cycle. For example, an account holder with a checking account number 123456789 may see unauthorized withdrawals--often for amounts like $250 or $500--resulting in overdraft fees and financial strain. This situation often emerges from system errors or mistaken identity due to similar account numbers. Resolving these issues typically involves contacting customer service representatives who require detailed transaction records and proof of the duplicate charge, often provided via account statements or transaction histories spanning the previous 30, 60, or even 90 days.

Description of the Charge

A duplicate account charge may occur when a financial institution incorrectly processes multiple payments for the same service or product, leading to an unfair deduction from a customer's bank account. This often happens due to system errors or miscommunication within administrative processes. For example, a charge of $49.99 from a subscription service (like streaming or online membership) may appear twice in a billing statement due to incorrect payment processing. Customers can typically identify these discrepancies by closely examining their monthly statements, noting each transaction's date, amount, and description. Resolution often requires contacting customer service for a detailed transaction review, which may involve providing evidence such as receipts or transaction IDs for clarification and prompt reimbursement.

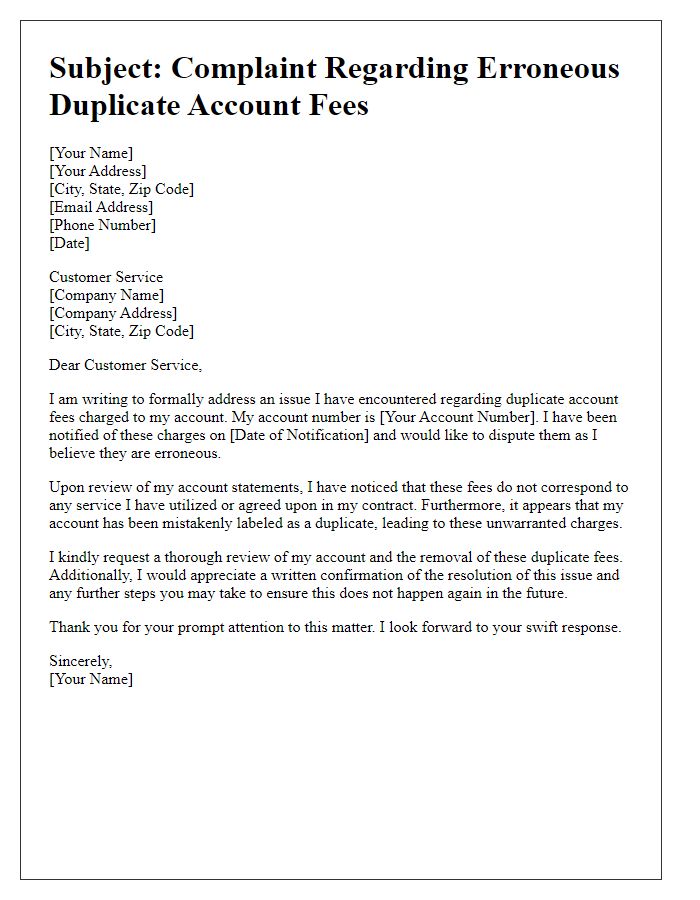

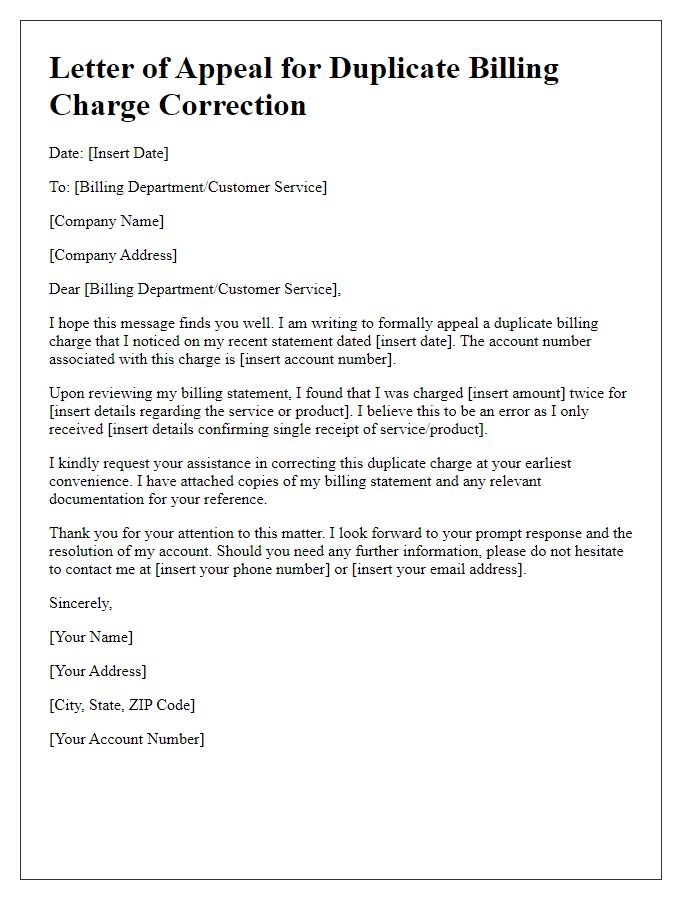

Request for Resolution

Duplicate account charges can lead to significant financial discrepancies for users of online services like streaming platforms, bank accounts, or e-commerce websites. Instances of such billing errors may arise when a user mistakenly creates multiple profiles or when system glitches occur during registration, often leading to unauthorized charges on a credit card. For example, if a subscription fee of $9.99 is mistakenly billed twice, this can create confusion and frustration for users attempting to manage their bank statements effectively. To address these issues, users typically need to contact customer service representatives, providing specific account details, transaction dates, and any relevant correspondence, to facilitate prompt resolution and potential reimbursement for erroneous charges.

Supporting Evidence

Duplicate account charges can lead to significant financial discrepancies for consumers, particularly in instances involving subscription services or utility bills. Such errors may result in multiple deductions from bank accounts, leading to unexpected overdraft fees, which can sometimes exceed $35 per occurrence in the United States. Additionally, bills processed through automated systems often lack adequate verification measures, enabling unauthorized charges. Furthermore, discrepancies reported to customer service can take weeks to resolve, causing stress and potential credit score impacts, especially when accounts are reported as delinquent. Documentation required for complaints typically includes account statements, transactions highlighting inconsistencies, and billing summaries.

Contact Information

Duplicate account charges can cause significant inconvenience for customers. Financial institutions, such as banks or credit card companies, may inadvertently issue duplicate bills due to system errors or clerical mistakes. These charges can lead to erroneous overdraft fees, impacting financial stability for individuals. Affected customers must document relevant account numbers, transaction dates, and charge amounts clearly. Reporting discrepancies promptly to customer service representatives often resolves issues more effectively. Providing detailed information, such as contact details and a timeline of the event, is essential for expediting the investigation process. Resolution usually entails reimbursement of duplicate charges and assurance of preventive measures for future transactions.

Comments