Are you feeling puzzled by a billing discrepancy on your recent statement? It can be frustrating to encounter unexpected charges, and you're not alone in seeking clarity. In this article, we'll guide you through crafting a polite letter to request an explanation, ensuring your concerns are addressed effectively. So, grab a cup of coffee and let's dive into the steps to resolve this issue together!

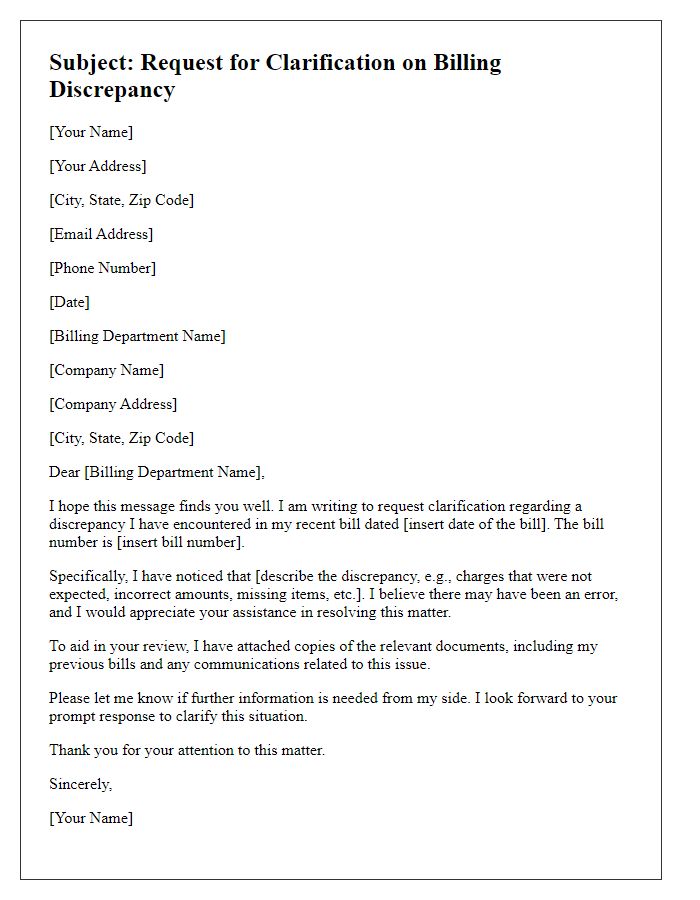

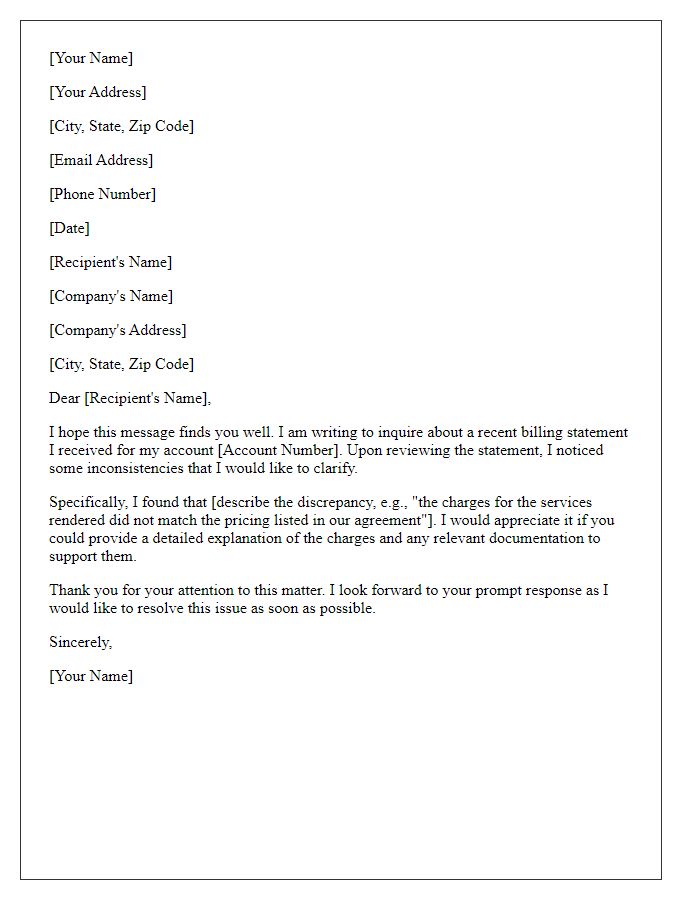

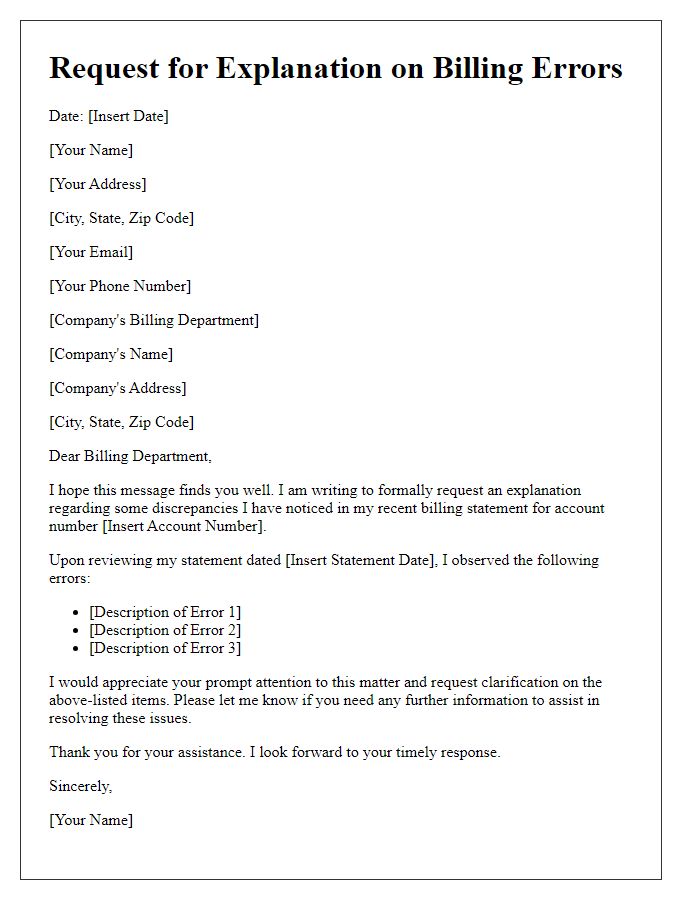

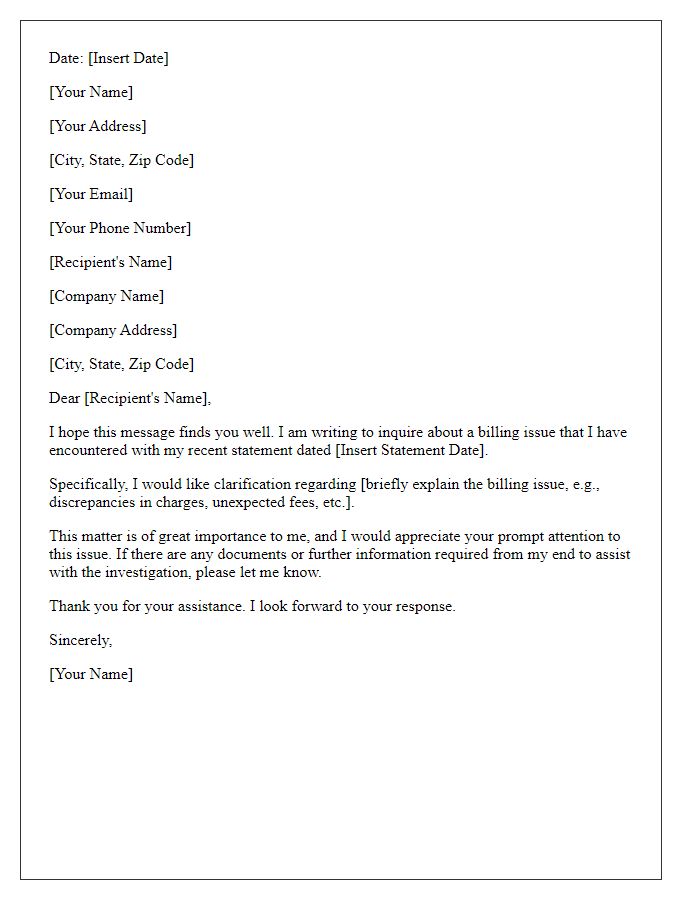

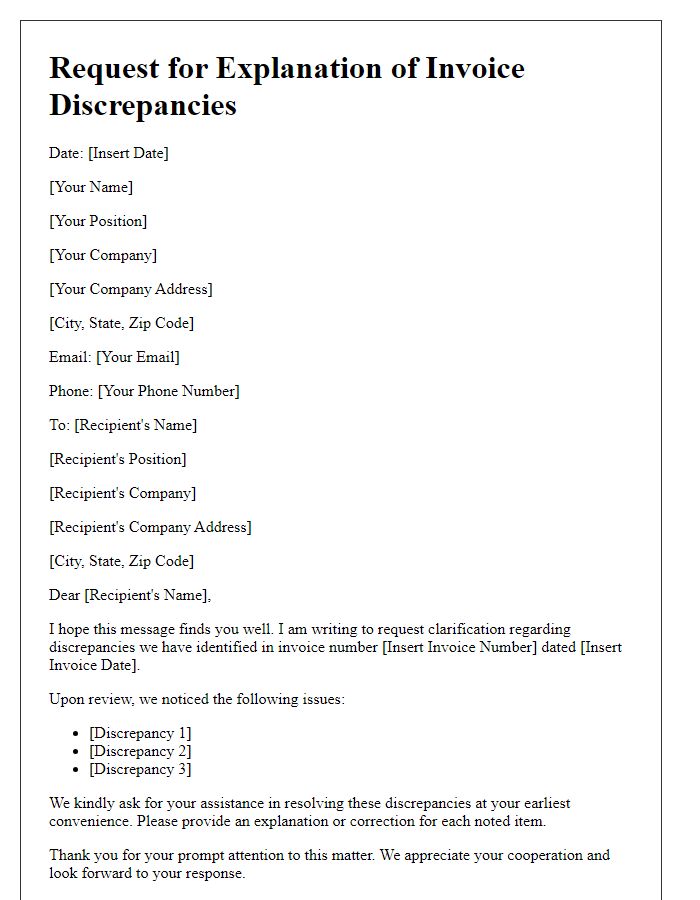

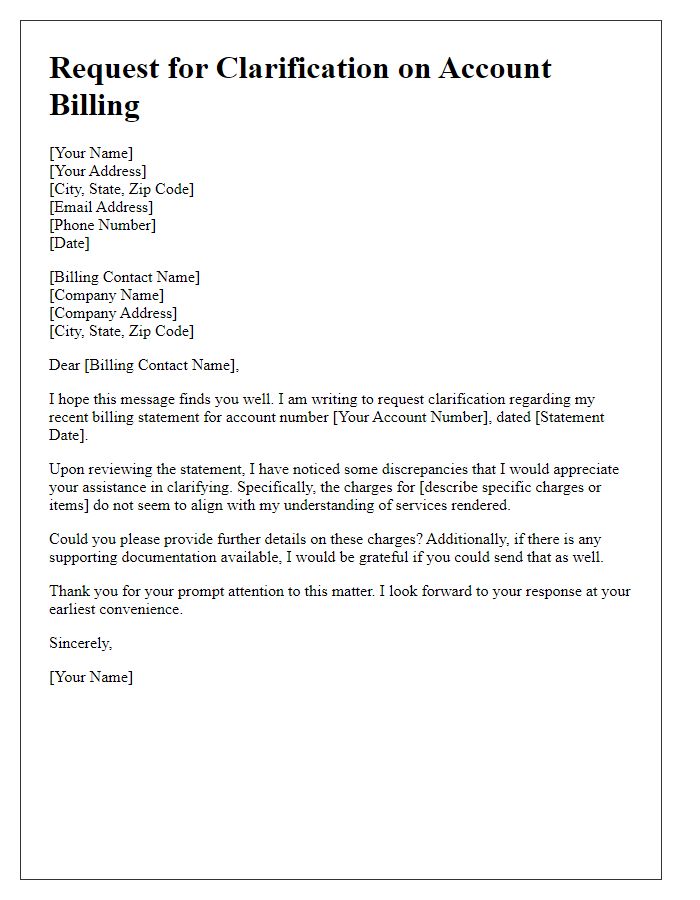

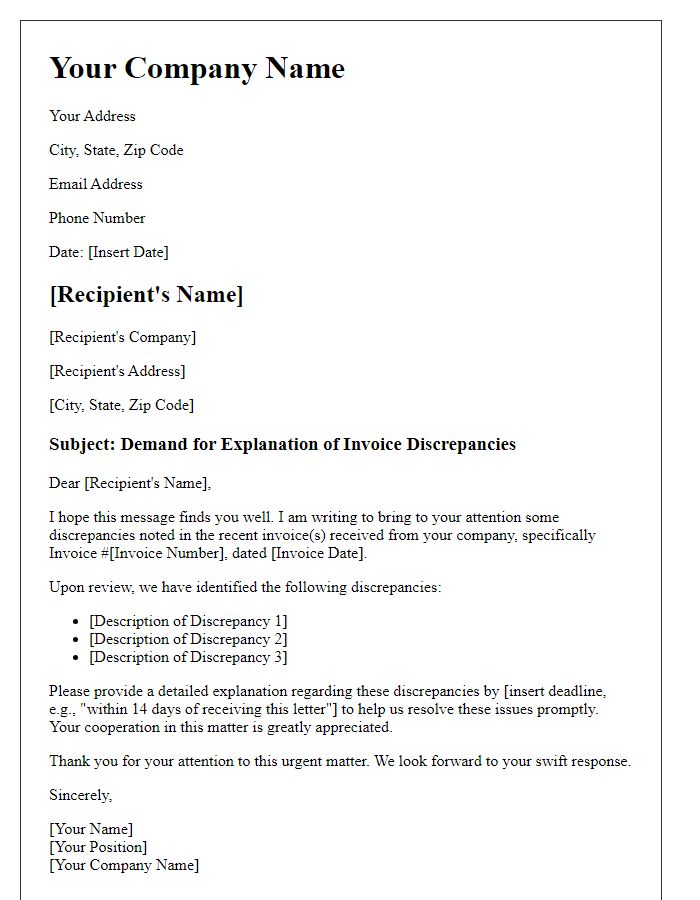

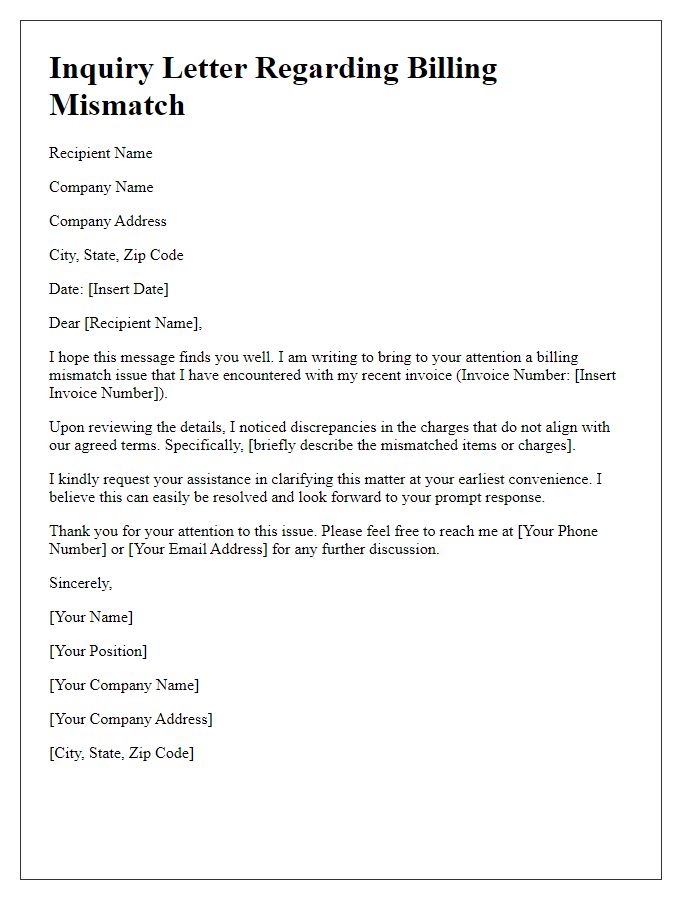

Subject line clarity.

A billing discrepancy often arises from miscalculations or unrecorded transactions on monthly invoices, potentially affecting consumers' financial records. Billing statements generated by utilities, such as water and electricity, could show significant differences, sometimes exceeding 20% of the expected amount due. It's crucial to address these discrepancies promptly, as they can lead to delayed payments or disputes with service providers. Upon identifying an inconsistency, consumers usually gather documents, including receipts or previous statements, to support their claim when contacting customer service departments of companies like AT&T or Comcast for clarification and resolution. Prompt communication through clear subject lines, such as "Request for Billing Discrepancy Review" or "Inquiry Regarding Incorrect Invoice," helps streamline the process and ensure that the issue is addressed effectively.

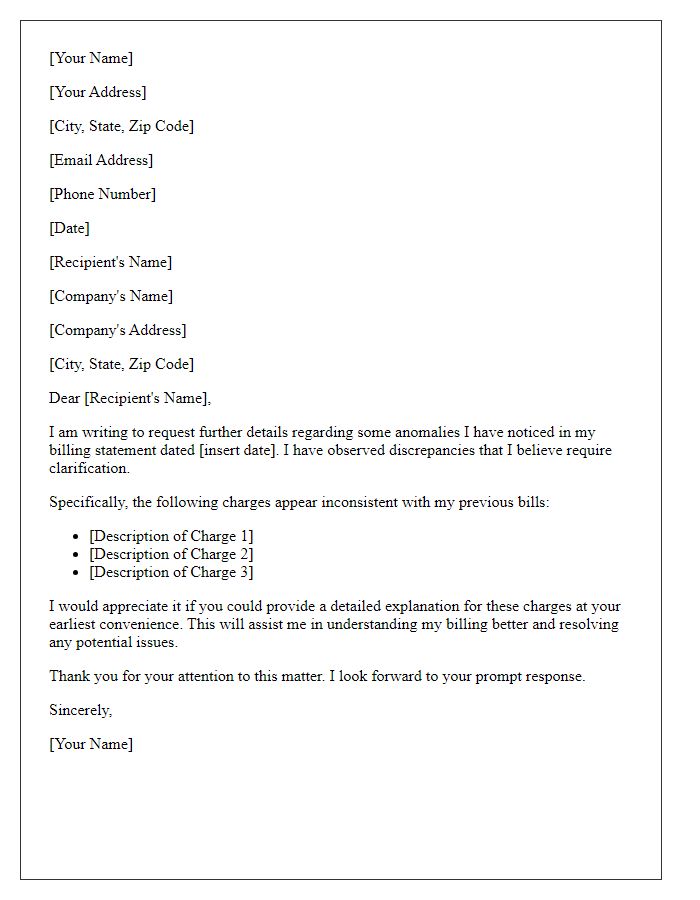

Detailed account information.

Billing discrepancies can often arise in various accounts, such as utility services, credit card transactions, or subscription fees. Customers may notice inconsistencies in charges, such as unexpected fees or incorrect billing amounts. This situation commonly occurs due to human errors in data entry, system glitches, or miscommunication regarding service usage. To resolve such issues, it is essential to provide detailed account information, including account numbers, billing cycles, and specific transaction dates. Documented evidence like receipts or previous statements may further substantiate the claim. Clear communication with the billing department can expedite the resolution process and ensure accurate adjustments.

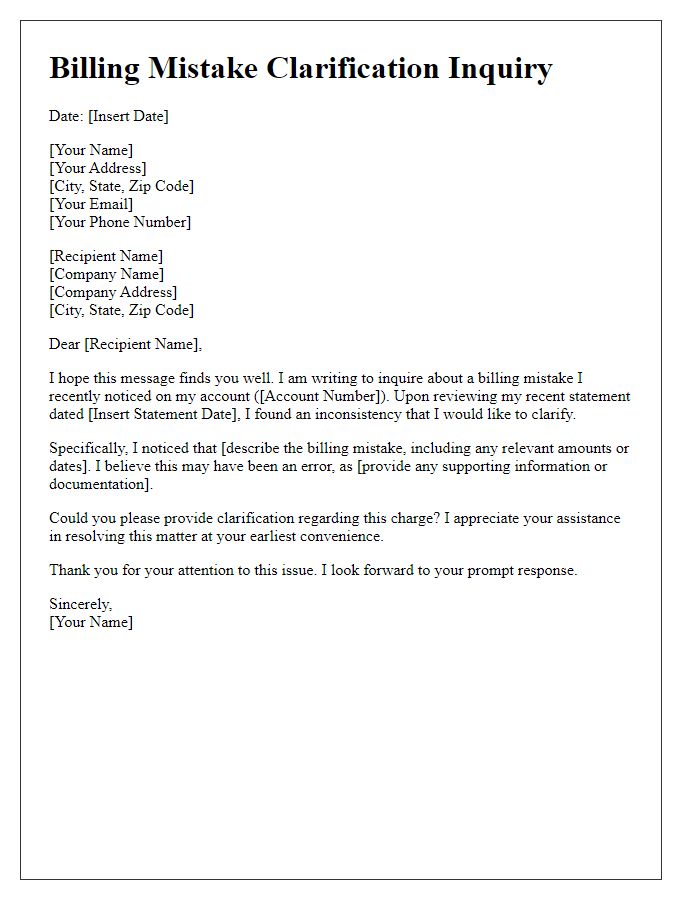

Specific discrepancy explanation.

A billing discrepancy can occur when there is a mismatch between the amount charged and the expected amount based on prior agreements or records. For instance, a customer might notice an unexpected fee of $50 on a bill from Utility Company X for January usage, particularly when the previous month's bill was only $30 for similar consumption levels. Key factors include reviewing the billing statement, checking for recent changes in service agreements, and analyzing any additional fees or taxes that may have been applied erroneously. Accurate records, such as previous bills and service agreements, should be gathered for clarification and resolution. Prompt communication with the billing department can expedite the investigation into the issue and seek reimbursement if necessary.

Request for prompt resolution.

Billing discrepancies may arise from various factors, including incorrect charges, calculation errors, or misapplied payments. To ensure a swift resolution, it is crucial to gather relevant documentation, including invoices, receipts, and account statements. For instance, discrepancies regarding utility bills from companies like Con Edison may involve fluctuations in monthly charges due to changes in usage patterns or billing cycles. Prompt communication with the billing department, including clear details about the specific discrepancy, such as the account number and the disputed amount, can expedite the review process. Additionally, maintaining a courteous tone while providing a clear explanation of the issue often leads to a more favorable resolution.

Contact information for follow-up.

The billing discrepancy can lead to confusion and potential financial distress for consumers. An example of this can be seen in telecommunication companies, where monthly statements often include service charges, taxes, and fees that may not align with customer contracts. A specific case may involve overcharges of up to 15% on the billed amount, resulting from incorrect data entry or system errors. Customers may be advised to provide their account numbers, invoice numbers, and detailed descriptions of the discrepancies to assist in resolving these issues. Additionally, companies generally encourage customers to contact their customer service departments via phone numbers listed on the bill or through official websites, where follow-up procedures are clearly outlined. Clear communication is crucial in reconciling such financial errors and maintaining customer satisfaction.

Comments