Are you looking to land a role in the banking sector? Crafting the perfect letter can make all the difference in capturing the attention of hiring managers. From tailoring your skills to highlighting your passion for finance, there are key elements that can set your application apart. Join us as we delve into insider tips and effective letter templates that will help you make a memorable impression in the competitive banking industry!

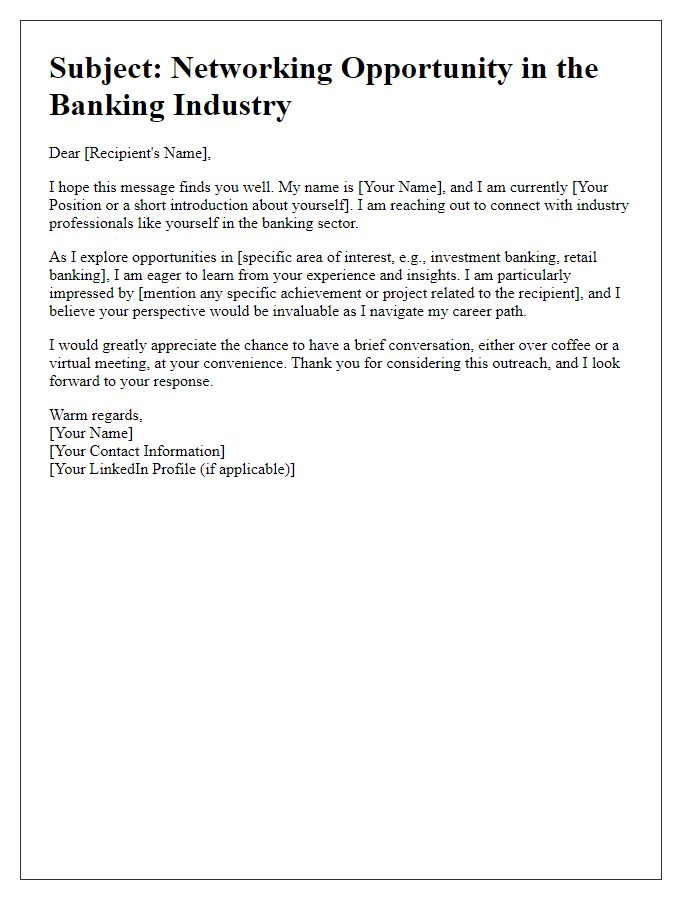

Professional Salutation

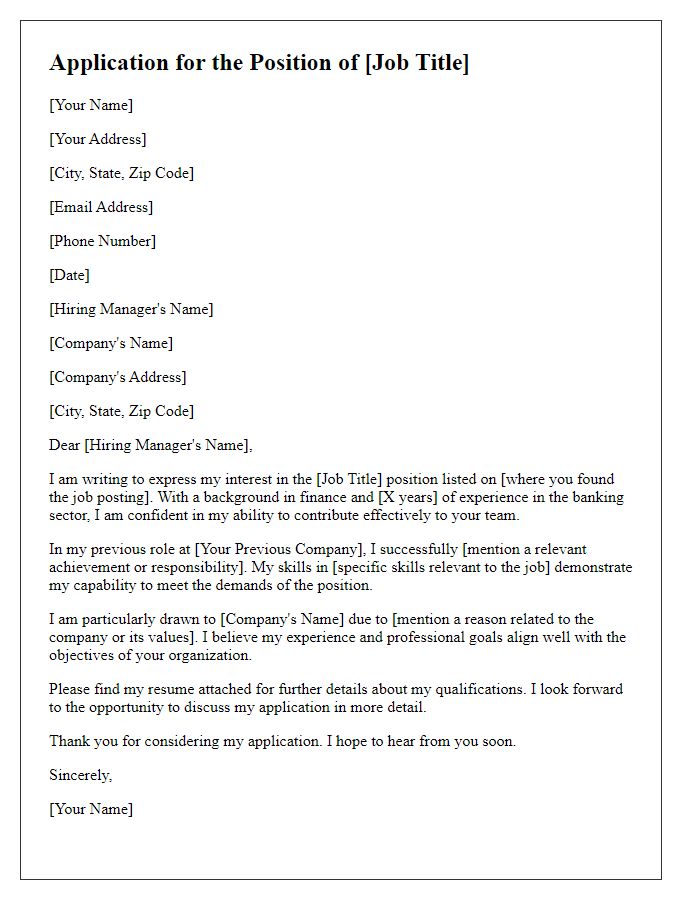

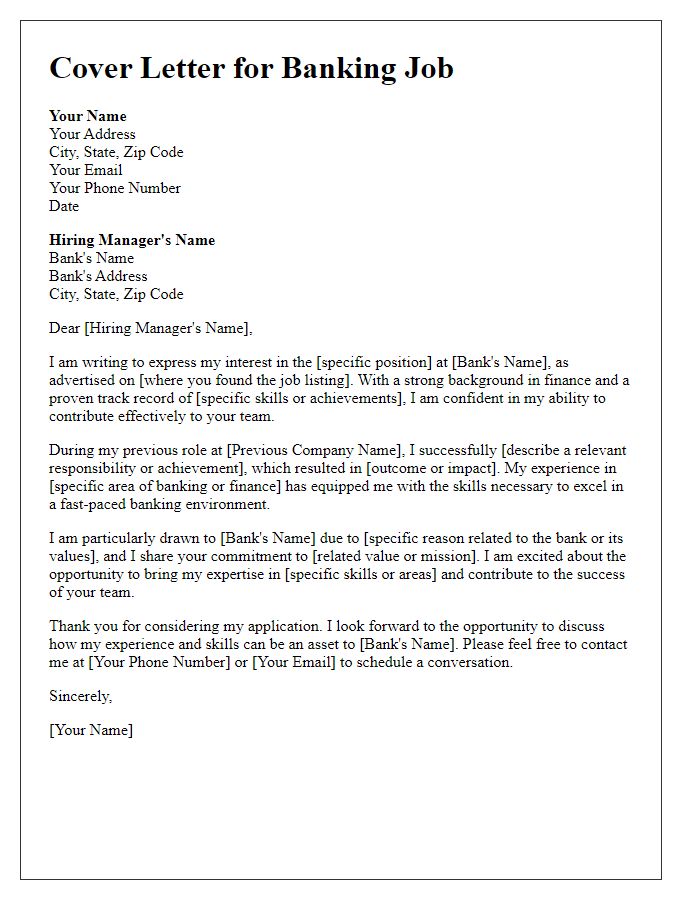

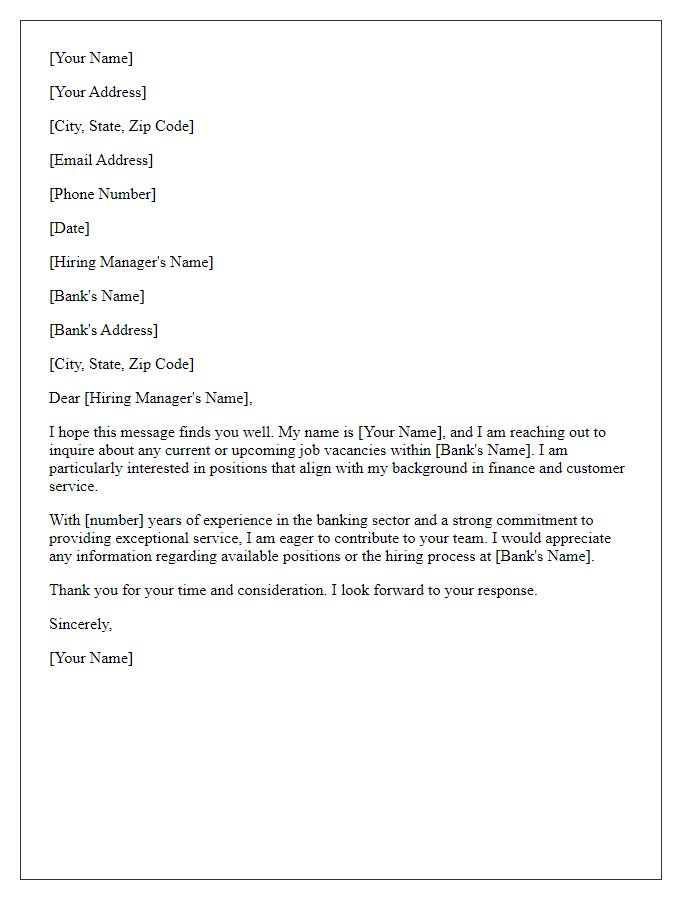

In the banking sector, a professional salutation sets the tone for communication. A typical salutation might include "Dear [Recipient's Name]," utilizing their full professional title when known, such as "Mr. John Smith" or "Ms. Jane Doe." Formality is crucial; therefore, avoiding informal greetings like "Hi" or "Hello" is advisable. The use of a respectful approach enhances professionalism, ensuring proper decorum in financial communications. Implementing standards such as addressing the recipient by their title (e.g., "Dr." or "Professor") when applicable can further signify respect and recognition of their professional standing.

Clear Subject Line

In the competitive landscape of the banking sector, crafting a concise subject line is crucial for ensuring your message stands out. For instance, "Application for Relationship Manager Position - [Your Name]" immediately informs the recipient of the nature of the communication and identifies the candidate. While engaging with hiring managers at prominent banks, like JPMorgan Chase or Bank of America, utilizing precise subject lines helps streamline recruitment processes and reflects professionalism. Clear and targeted subject lines not only enhance email clarity but also increase the likelihood of prompt responses.

Detailed Experience Description

The comprehensive experience of banking professionals often encompasses various roles, demonstrating skills in financial analysis, customer relationship management, and compliance with regulatory standards. For instance, in retail banking positions at institutions like JPMorgan Chase, responsibilities may include conducting over 200 customer consultations weekly, assessing financial needs, and recommending suitable products such as savings accounts and personal loans. In corporate banking, professionals might manage diverse loan portfolios, with portfolios exceeding $100 million, engaging in risk assessment and financial forecasting pivotal for strategic decision-making. Moreover, adherence to regulations from the Federal Reserve and the Securities and Exchange Commission requires meticulous attention to detail, as deviations can lead to substantial penalties. Additionally, proficiency in banking software such as FIS and Oracle Financial Services enhances operational efficiency, with systems handling over 2 million transactions daily, demonstrating the importance of technology in contemporary banking environments.

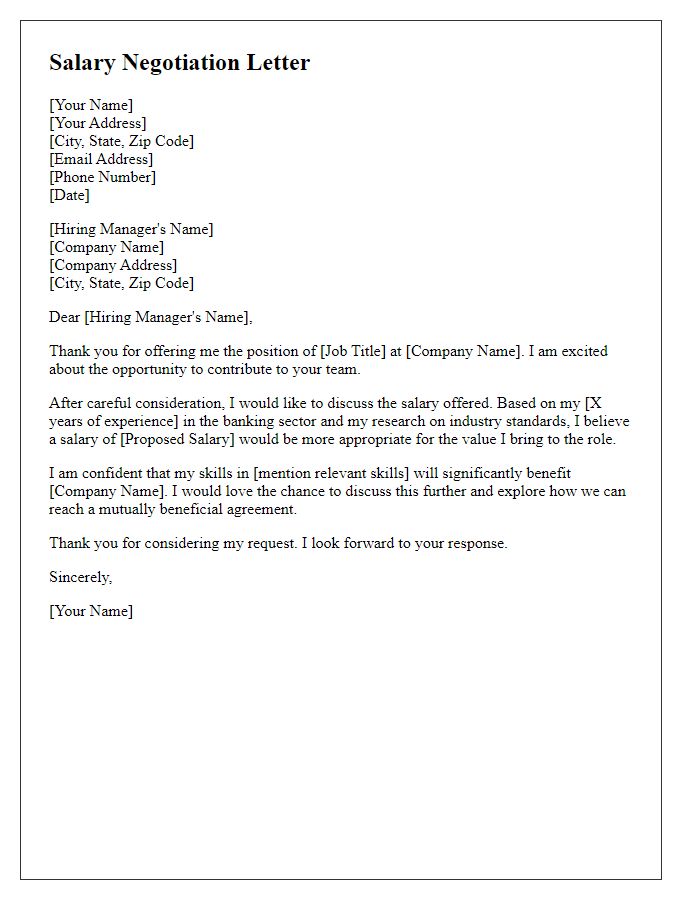

Specific Skills Highlight

In today's competitive banking sector, candidates must demonstrate specific skills that align with the industry's demands, including analytical proficiency, proficiency in financial software applications like QuickBooks and SAP, customer relationship management (CRM) capabilities, and risk assessment knowledge. Strong numerical aptitude enables accurate forecasting and budgeting, while excellent communication skills facilitate clear interactions with clients and internal stakeholders. Knowledge of compliance regulations, such as the Anti-Money Laundering (AML) laws and the Dodd-Frank Act, is vital for maintaining operational integrity. Team collaboration is essential for success in diverse projects, ensuring effective problem-solving and innovation within dynamic market environments.

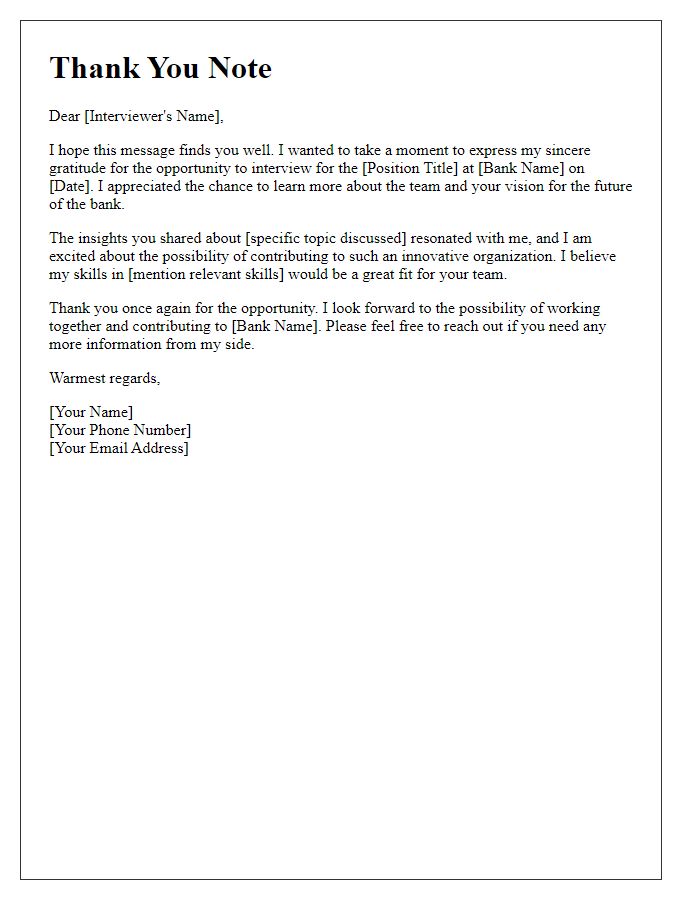

Contact Information

Established communication channels are essential in the banking sector, where clarity and professionalism are paramount. Key components of contact information include the applicant's full name, which serves as the primary identifier, followed by a detailed address providing geographical context. Additionally, a professional email address is crucial for direct correspondence, while a functional phone number (including area code) facilitates prompt communication. Inclusion of a LinkedIn profile link can enhance professional credibility and connectivity within the banking industry.

Comments