Are you ready to take the next step in your career as an actuary? Crafting a compelling cover letter is crucial to making a strong impression on potential employers. In this article, we'll guide you through the essential components of an impactful letter that showcases your skills and enthusiasm for the actuarial profession. So, settle in and let's dive into the details that can help you land that coveted position!

Personalization and Addressing

When applying for an actuarial position, personalizing your application is crucial. Start with the hiring manager's name, such as "Ms. Johnson" or "Mr. Smith," followed by the company's name, like "ABC Insurance Company." Include specific details about the job title, such as "Actuarial Analyst" or "Senior Actuary," and reference any relevant events or initiatives the company is involved in, such as the recent expansion into online insurance solutions or community outreach programs. Mention how your skills, like proficiency in statistical software such as R or SAS, align with the company's goals and the specific actuarial tasks required for the role. Highlight your academic background, including your degree from a recognized institution like the University of California and any relevant professional certifications, such as passing the first two exams of the Society of Actuaries (SOA). Tailor the tone to reflect the company's culture, whether it's formal or more innovative, and demonstrate your enthusiasm for contributing to the company's success in the insurance industry.

Relevant Experience and Skills

Actuarial professionals possess specialized knowledge in mathematics, statistics, and financial theory, crucial for assessing risk in industries like insurance and finance. Relevant experience includes working with statistical software such as R and Python, applying predictive modeling techniques to real-world scenarios, and analyzing data sets to forecast future trends. Skills necessary for success in this field encompass mastery of complex actuarial concepts such as life tables, risk assessment methodologies, and investment strategies. Holding professional certifications like ASA from the Society of Actuaries or equivalent credentials further highlights commitment to the profession. Practical exposure to regulatory environments, such as Solvency II in Europe or NAIC in the United States, enhances the ability to navigate compliance challenges. Participation in actuarial internships, relevant workshops, or industry conferences fosters network building and keeps practitioners updated on emerging trends and technologies in the actuarial landscape.

Understanding of Actuarial Principles

Proficient comprehension of actuarial principles is essential for candidates pursuing careers in the actuarial field, particularly in roles involving life insurance, health insurance, or pension planning. Key concepts include probability theory, which quantifies uncertainty in financial forecasts by analyzing risk metrics, and the time value of money, prioritizing the present value of future cash flows. Additionally, familiarity with statistical analysis, incorporating data sets to inform decision-making, is vital in assessing claim probabilities and determining premium pricing. Regulatory standards established by the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS) also guide actuaries in ethical practices and compliance, ensuring industry integrity. Continuous professional development through seminars, webinars, and certification exams enhances understanding and application of these principles in real-world scenarios.

Enthusiasm and Career Goals

Actuarial professionals play a crucial role in risk management and financial planning, employing advanced mathematical techniques and statistical analyses to inform decisions in insurance and finance sectors. Passion for this field often stems from academic studies in mathematics, statistics, or economics, combined with a commitment to ongoing professional development, such as passing examinations from recognized actuarial bodies like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). Aspiring actuaries often seek entry-level positions in companies located in financial hubs, like New York City or London, where exposure to diverse cases and mentorship opportunities can accelerate career advancement. Aligning personal career goals with the organization's objectives can result in fulfilling contributions to developing innovative insurance products or improving risk assessment methodologies. Networking at industry events, such as the Annual Society of Actuaries Conference, can further enhance visibility and foster valuable connections in a competitive job market.

Professional Tone and Formatting

Actuarial professionals play a critical role in evaluating financial risks using mathematics, statistics, and financial theory. They often work in life insurance companies, pension funds, and government agencies, carrying out complex analyses to predict future events such as mortality rates, accident frequencies, and investment returns. Key qualifications typically include exceptional proficiency in calculus and probability theory, as well as familiarity with software such as R or SAS used for statistical analysis. Educational backgrounds usually encompass degrees in mathematics, statistics, or actuarial science, with many candidates obtaining professional certifications through organizations like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). Mastery of quantitative skills not only enhances decision-making processes but also supports financial planning efforts for businesses and individuals alike, ensuring their stability and growth in a dynamic market landscape.

Letter Template For Actuarial Position Applications Samples

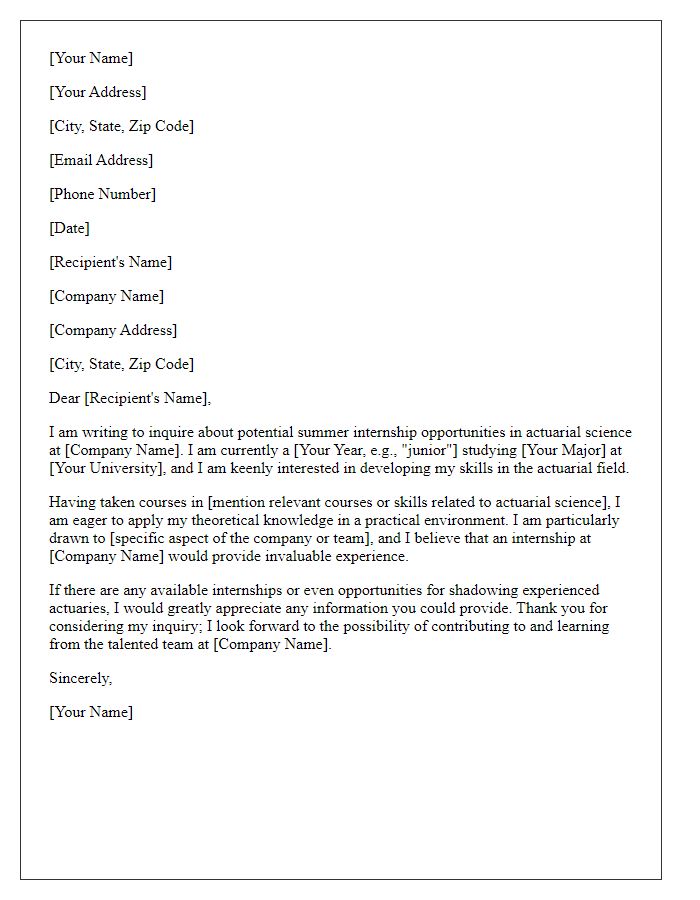

Letter template of inquiry for a summer internship in actuarial science.

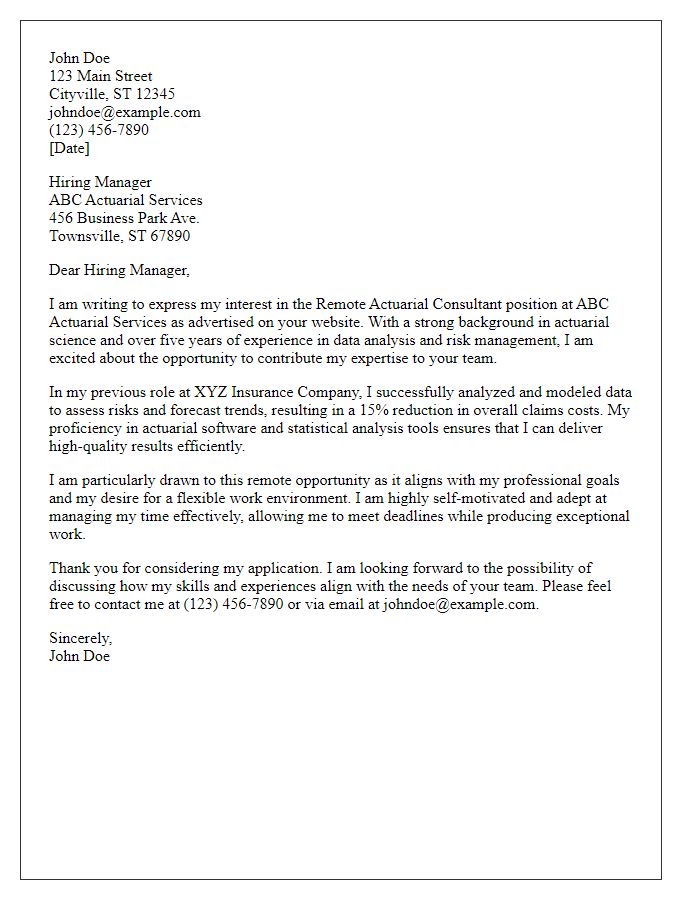

Letter template of application for a remote actuarial consultant position.

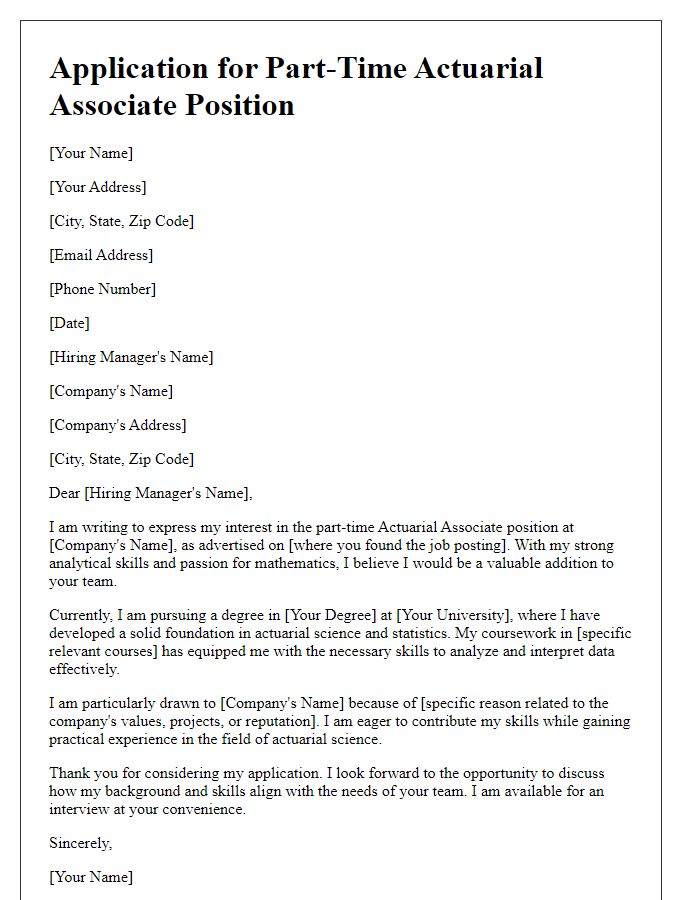

Letter template of application for a part-time actuarial associate role.

Letter template of request for informational interview regarding actuarial careers.

Letter template of application for a specialized actuary position in risk management.

Letter template of expression of interest for an actuarial researcher position.

Comments