Are you feeling overwhelmed by the upcoming tax filing deadlines? You're not aloneâmany people find the process daunting, but with the right information and preparation, it can be a breeze. From understanding key dates to organizing your documents, there are simple strategies that can help you stay on track and avoid any last-minute panic. Dive into our article to discover essential tips that will make your tax filing experience smooth and stress-free!

Clear Subject Line

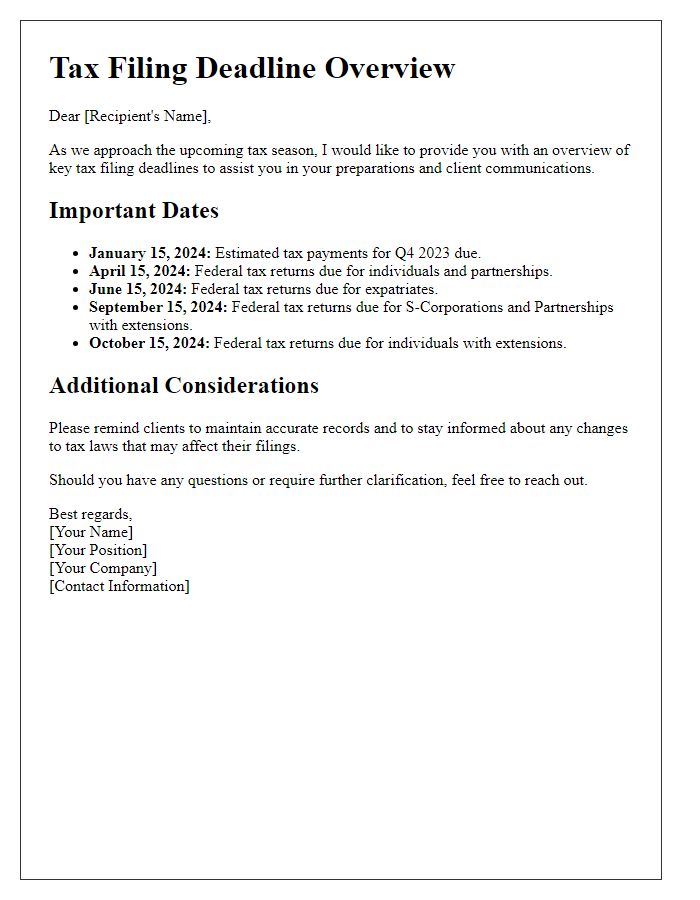

Tax filing deadlines are crucial for individuals and businesses in avoiding penalties. The Internal Revenue Service (IRS) mandates that individual tax returns, specifically Form 1040, must be filed by April 15 each year, unless extended (October 15 for extended returns). For corporations, the deadline for filing Form 1120 is March 15, with an extension possible until September 15. Missing these deadlines can result in penalties estimated at 5% of the unpaid tax for each month the return is late, up to 25%. Additionally, state tax agencies may have varying deadlines, which necessitates careful planning to ensure compliance and prevent unnecessary financial repercussions.

Recipient's Information

Tax filing deadlines play a crucial role in the financial planning of individuals and businesses. In the United States, the primary deadline for personal income tax returns, known as IRS Form 1040, is April 15, with extensions allowing submissions by October 15. The Internal Revenue Service (IRS), the federal agency overseeing tax collection, sets these deadlines annually, impacting millions of taxpayers. Corporate tax filings typically utilize IRS Form 1120, due on the 15th day of the fourth month after the end of the corporation's fiscal year. Different states may impose additional deadlines and requirements, significantly affecting compliance for local businesses. Awareness of these dates is essential for avoiding penalties, interest charges, and potential audits. Taxpayers are encouraged to prioritize preparation and consult financial advisors for optimal strategies in meeting these deadlines.

Key Deadlines

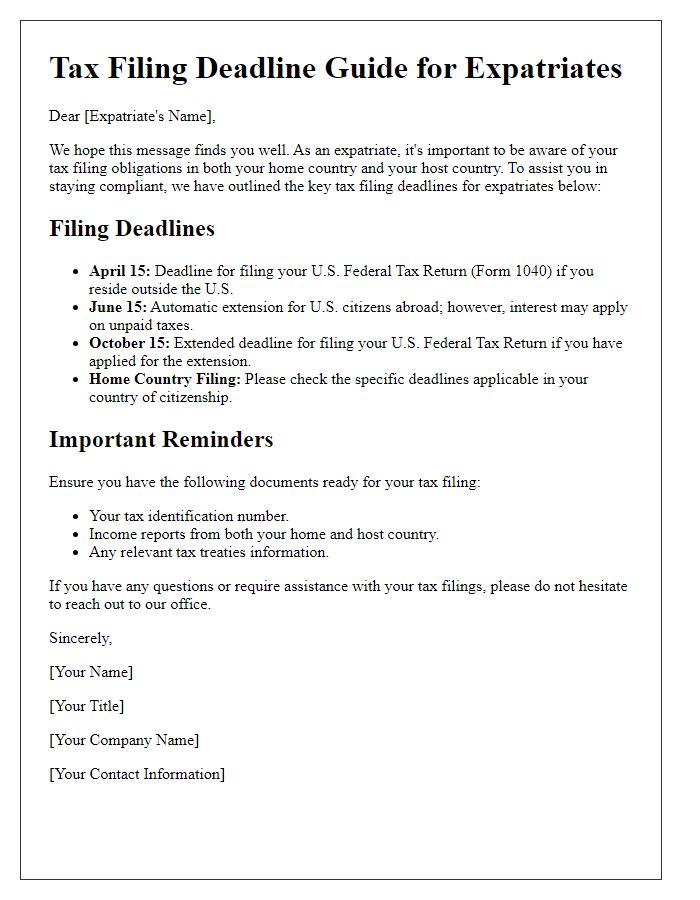

Tax filing deadlines are critical dates for individuals and businesses to comply with federal and state tax regulations in the United States. The Internal Revenue Service (IRS) generally sets April 15 as the due date for individual tax returns (Form 1040) for the previous tax year. For 2023, this deadline falls on Tuesday, April 18, due to the Emancipation Day holiday in Washington, D.C. Businesses operating as corporations must file their returns (Form 1120) by the 15th day of the fourth month following the end of their fiscal year, usually April 15 for calendar year corporations. Important extensions, such as Form 4868, can provide an additional six months for individuals to complete their filings, moving the deadline to October 15. Additionally, estimated tax payments for self-employed individuals must be submitted quarterly, with significant dates falling on April 15, June 15, September 15, and January 15 of the following year, ensuring timely compliance and avoidance of penalties.

Detailed Instructions

Tax filing deadlines require precision and awareness of specific dates mandated by the Internal Revenue Service (IRS). In the United States, the deadline for individual income tax returns typically falls on April 15, unless extended due to weekends or holidays, as in 2023, when taxpayers enjoyed an extra day until April 18. Small businesses, classified under S corporations, must file their federal tax returns by March 15. Important forms include Form 1040 for individual taxpayers and Form 1120S for S corporations. Extensions can be requested using Form 4868, granting an additional six months for individuals, pushing the final deadline to October 15. To avoid penalties, ensure that all pertinent documents, such as W-2 forms for employees and 1099 forms for independent contractors, are accurately reported and submitted on time. Familiarizing oneself with state-specific deadlines is equally crucial, as they may differ from federal timelines, impacting overall compliance.

Contact Information for Assistance

Tax filing deadlines are critical times for individuals and businesses in the United States, particularly the April 15 deadline for personal income tax submissions. The Internal Revenue Service (IRS), headquartered in Washington, D.C., provides guidance and resources for taxpayers needing assistance. Taxpayers can reach out via the IRS helpline at 1-800-829-1040, available Monday through Friday from 7 a.m. to 7 p.m. local time. Additionally, local tax assistance centers offer in-person support across various states, helping taxpayers navigate complex forms such as the 1040 or 1120 series. Free services, such as Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE), are also available, ensuring that those in low-income brackets or seniors obtain the support needed during the tax season.

Letter Template For Tax Filing Deadlines Samples

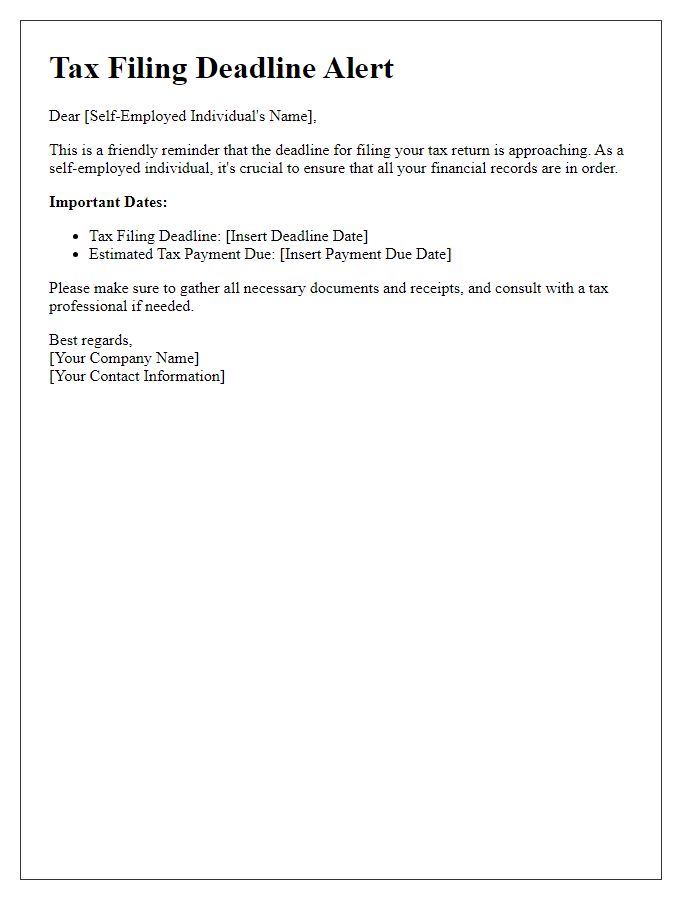

Letter template of tax filing deadline alert for self-employed individuals

Comments