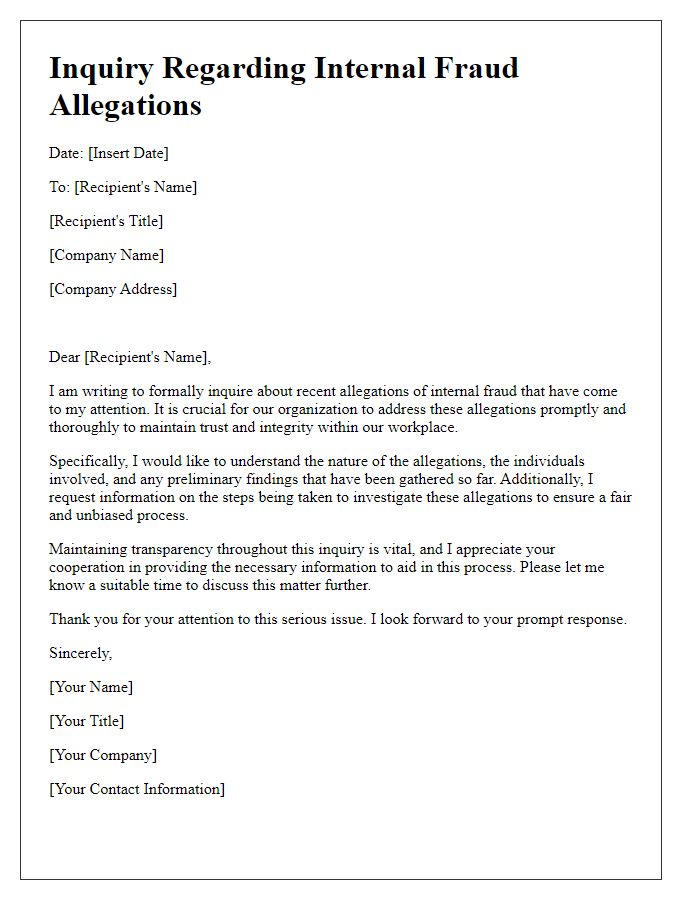

Welcome to our guide on crafting effective letter templates for internal fraud investigations. Addressing sensitive issues like fraud requires a thoughtful approach, balancing professionalism and clarity. Our templates aim to equip you with the right framework to communicate your findings while maintaining confidentiality and respect for all parties involved. Ready to dive deeper into the intricacies of effective communication in these situations?

Purpose and Scope of Investigation

Internal fraud investigations aim to uncover and address fraudulent activities within an organization, such as embezzlement, financial misreporting, or any unethical conduct that compromises the integrity of operations. The investigation encompasses examining relevant financial records, interview processes, and potential collusion among employees, as identified within specific departments like finance, procurement, or human resources. Categorizing the scope involves assessing monetary values at stake, timelines of suspicious activities, and patterns of behavior that suggest fraudulent intent. Documentation from incident reports, whistleblower tips, and audit trails provides critical evidence for this inquiry, ensuring adherence to legal and regulatory requirements while safeguarding the organization's reputation and trust.

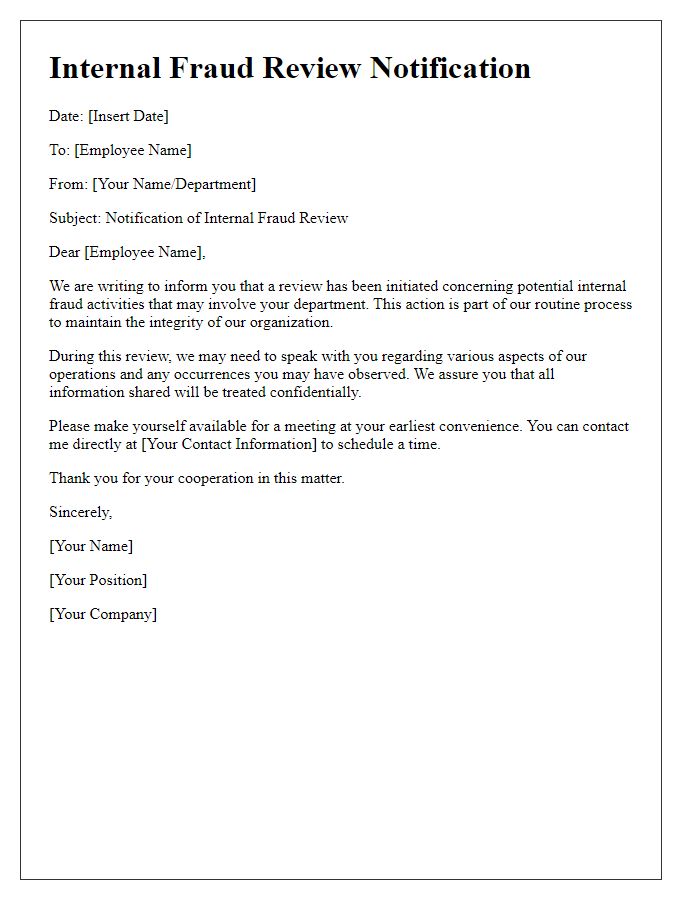

Confidentiality and Privacy Assurance

Internal fraud investigations require strict adherence to confidentiality and privacy assurance protocols to protect sensitive information and maintain trust within the organization. The investigation process involves examining financial records, employee behavior, and transactional data without disclosing identities or sensitive details. Individuals involved in the investigation, including auditors and compliance officers, must secure access to confidential documents such as audit trails and personnel files, often safeguarded under legal frameworks like the Data Protection Act. Safeguards, including secure communication channels and restricted document access, ensure the integrity of the investigation and protect the rights of affected employees. Furthermore, organizations often implement training sessions on ethical conduct and fraud awareness, fostering a culture of transparency and vigilance against fraudulent activities.

Required Documentation and Evidence Submission

Internal fraud investigations require meticulous documentation to ensure the integrity of the process. Evidence submissions should include financial records such as recent bank statements, invoices, and payroll records, usually from the last twelve months, to identify discrepancies or unauthorized transactions. Internal communications, specifically emails and memos relating to the suspected fraudulent activity, must be gathered for analysis. Witness statements from employees who may have observed the misconduct should also be documented, ensuring anonymity where necessary. Access logs from relevant systems, detailing user activities during the period in question, can reveal suspicious access patterns. Additionally, any physical evidence, such as surveillance footage from locations like offices or break rooms, should be preserved to substantiate claims of fraud. Overall, a comprehensive compilation of all relevant materials is critical for a thorough investigation.

Contact Information for Investigation Team

The internal fraud investigation team is accessible for reporting suspicious activities within the organization. They specialize in cases involving financial misconduct, asset misappropriation, and ethical violations. Contact Person, John Smith, leads the team with extensive experience in forensic accounting. Phone Number, (123) 456-7890, is available for immediate assistance. Email Address, investigations@companyname.com, allows for secure communication regarding sensitive matters. Their office, located at 456 Corporate Blvd, Suite 200, Cityville, State, 12345, operates Monday through Friday, 9 AM to 5 PM. All inquiries are treated with the utmost confidentiality to ensure a safe reporting environment.

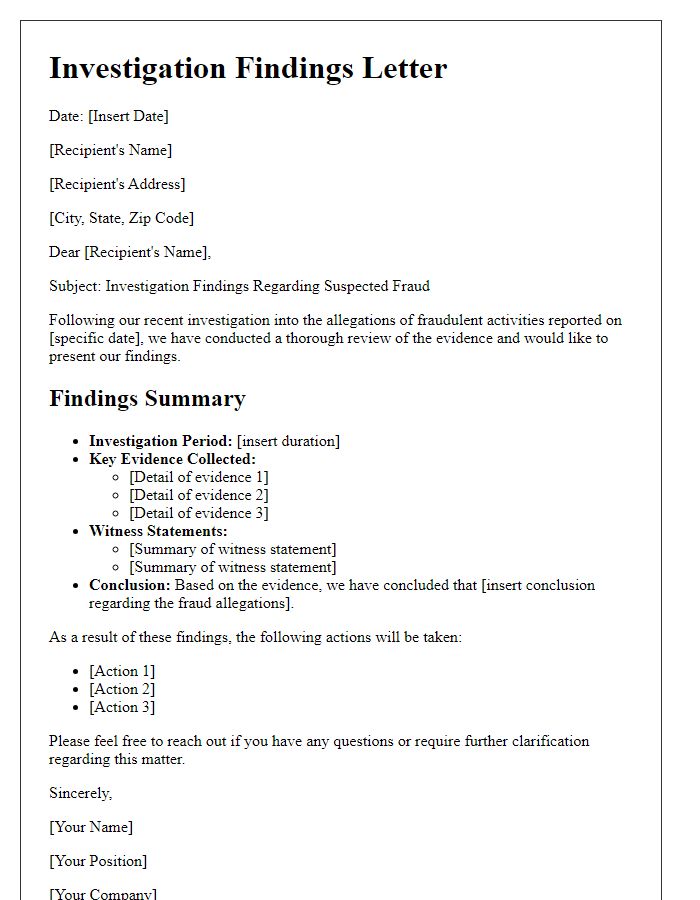

Timeline and Process Overview

Internal fraud investigations often necessitate a structured timeline and clear process overview to ensure thoroughness and compliance. Typically, an initial report of suspected fraud may be logged within a company's incident management system, prompting an investigation team formation within 24 hours. Preliminary assessments are conducted to gather relevant documentation (such as financial records, email correspondence, and access logs), usually completed within one week. The investigation phase may span several weeks, during which forensic accounting experts analyze discrepancies in accounting practices or anomalies in vendor transactions, potentially involving thousands of dollars in misappropriated funds. Following the investigation, findings are compiled into a comprehensive report, detailing evidence and recommended actions, which often includes recommendations for corrective measures to prevent future occurrences. Final outcomes, which may include disciplinary actions or legal proceedings, are typically communicated to relevant stakeholders within two weeks after the report's completion.

Comments