Are you finding it challenging to navigate the process of submitting your expense reports? You're not alone! Many individuals struggle with the nuances of creating an organized and thorough expense report template that satisfies their company's requirements. Dive into our comprehensive guide to simplify the process and make submissions a breeze â read on for all the tips and templates you need!

Formal Greeting

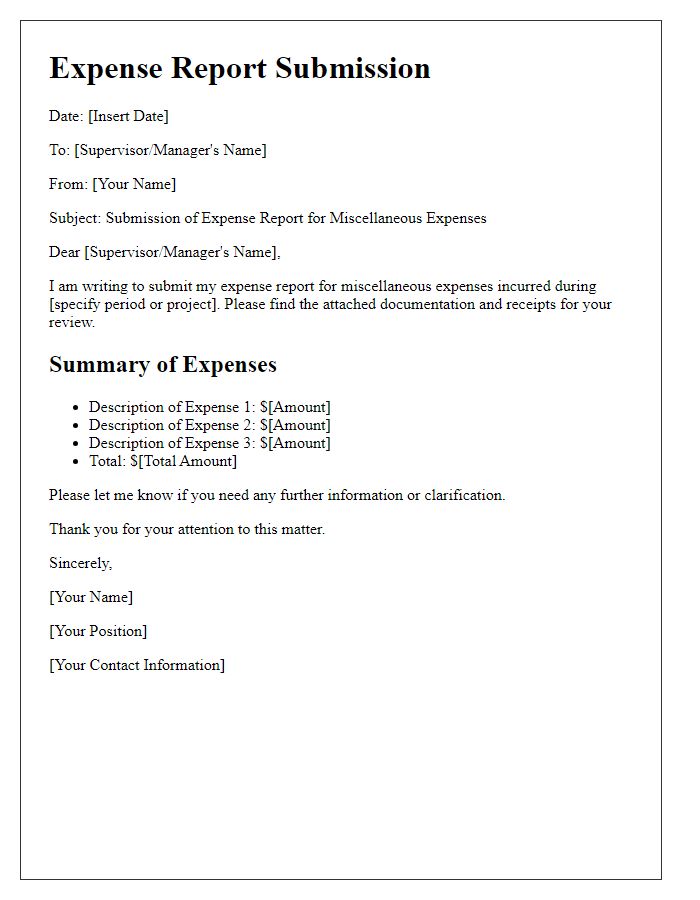

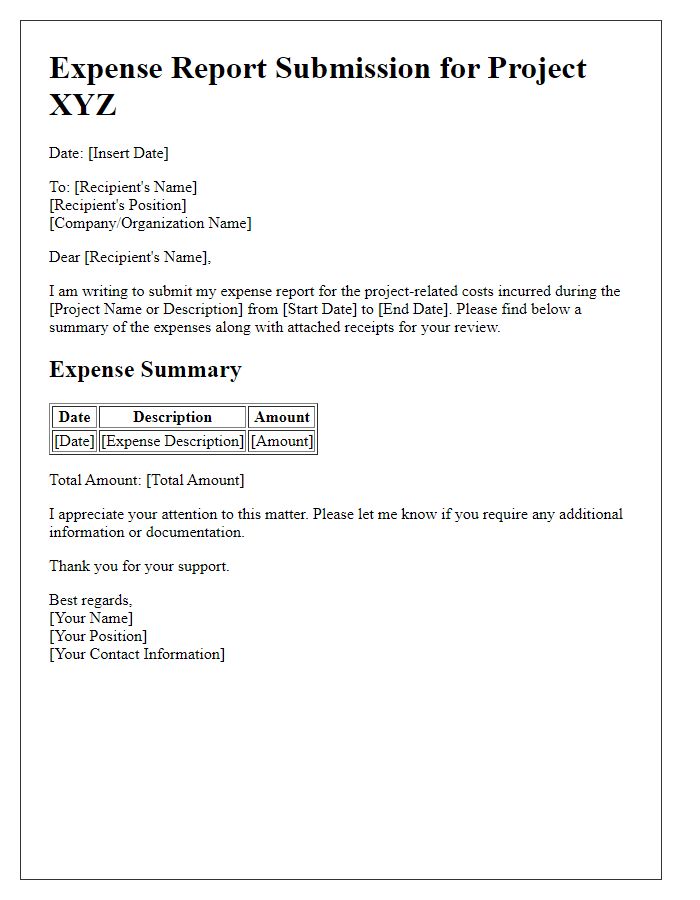

Expense reports require accurate documentation to ensure proper reimbursement for business-related expenditures. Key elements to include are date, itemized listing of expenses (e.g., travel costs, meals, lodging), total amounts, and accompanying receipts for verification. Additionally, federal guidelines mandate compliance with the Internal Revenue Service (IRS) regulations to avoid discrepancies during audits. Timely submission of these reports--ideally within five business days post-expense--facilitates faster processing and payment. The report should also be submitted through the designated online portal, commonly used in corporate finance departments, to streamline workflow and maintain record integrity.

Purpose of the Report

The expense report serves to document and justify expenditures related to business operations, ensuring accurate financial tracking and accountability within organizations. Common usage includes travel expenses, office supplies, and client entertainment costs, typically submitted on a monthly basis. Detailed categories such as transportation (airfare, mileage), lodging (hotel stays), and meals are included, requiring receipts for amounts exceeding $25. Approved reports facilitate timely reimbursement for employees, adhering to company policies and budget constraints, while providing management with essential insights into spending patterns and allocation of resources. This process is crucial for maintaining financial integrity and compliance with regulatory standards.

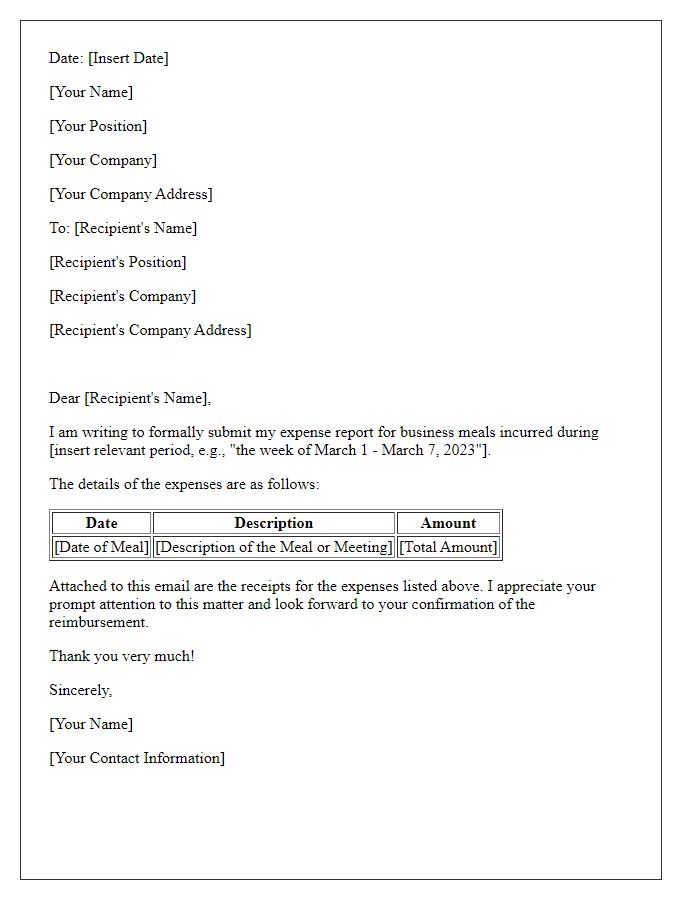

Detailed Expense Breakdown

Expense reports are essential for tracking and managing business expenditures accurately. For efficient processing, include a detailed breakdown of each expense category, such as travel, meals, lodging, and supplies, specifying dates, locations (like company headquarters in New York City), vendors (for instance, hotel chains or airlines), and amounts. Each entry should reflect the purpose of the expense, compliance with company policy, and attached receipts for verification. Furthermore, indicate the total amount requested for reimbursement, alongside a summary of overall expenses to provide transparency. Timely submissions ensure prompt payments and maintain accurate financial records for budgeting and forecasting purposes.

Attachments and Documentation

Expense report submissions require thorough documentation to ensure transparency and accountability in financial practices. Essential attachments include itemized receipts (proof of purchase detailing individual expenses), invoices (requests for payment outlining services rendered or products provided), and travel itineraries (schedules indicating dates and locations of business-related travel). Additional supporting documents may consist of credit card statements (summaries of purchases made during a specific period), expense approval emails (correspondences indicating pre-approved expenses), and any relevant memos (internal communications detailing specific requests or clarifications). Proper organization of these documents facilitates a smoother review process, ensuring that all claimed expenditures align with company policy for reimbursement eligibility.

Contact Information for Queries

Expense report submissions require accurate contact information to address any queries effectively. Essential details include a full name, such as Jane Doe, alongside a title like Financial Analyst. Providing a direct phone number, such as (555) 123-4567, allows immediate communication. An email address, for instance, jane.doe@example.com, ensures documentation and follow-up inquiries can be managed efficiently. Including a department name, like Marketing, is crucial for proper routing within an organization. Additionally, a physical office location, such as 123 Corporate Ave, Suite 100, Cityville, States, supports in-person interactions if needed.

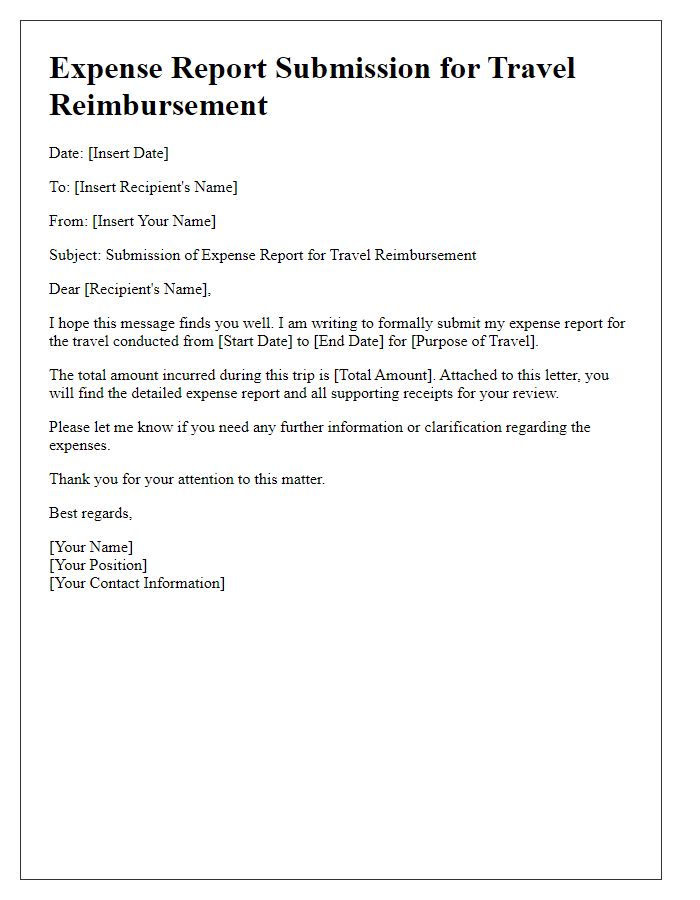

Letter Template For Expense Report Submissions Samples

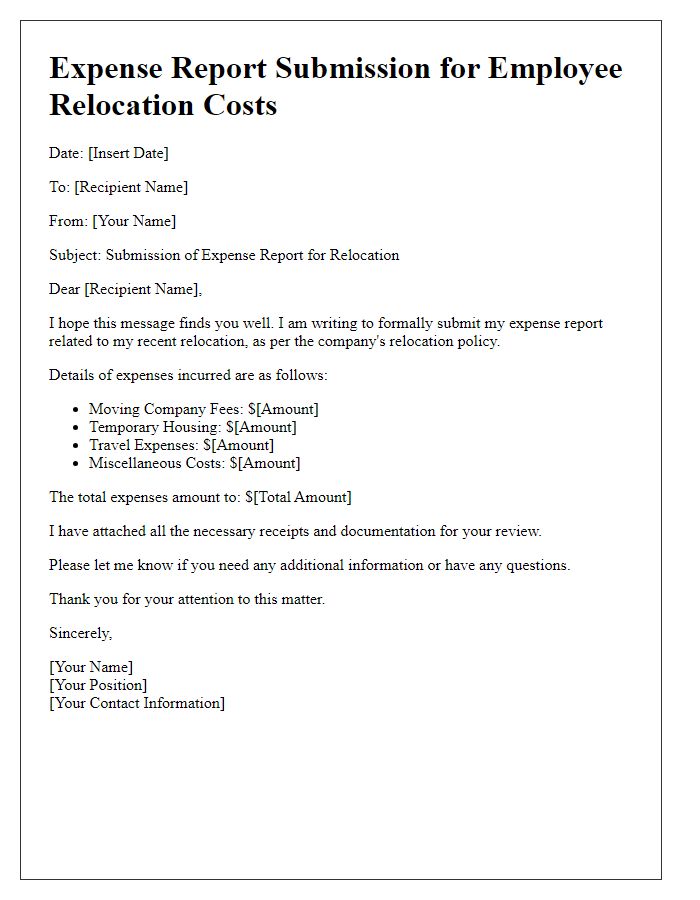

Letter template of expense report submission for employee relocation costs

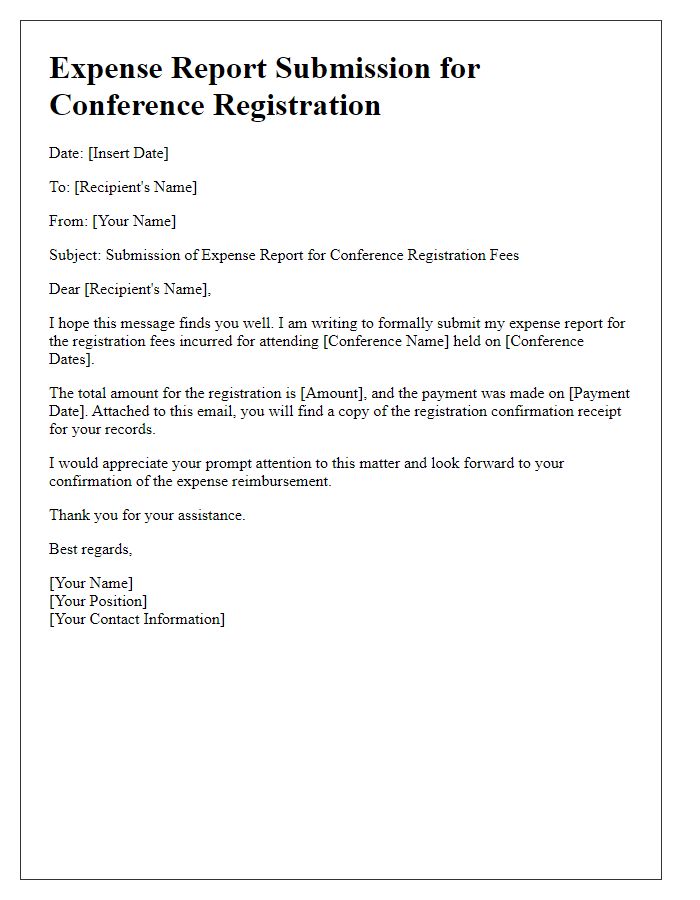

Letter template of expense report submission for conference registration fees

Comments