Are you considering entering into an investment partnership but unsure where to start? Crafting a well-structured investment partnership agreement can be crucial for defining the terms and ensuring a smooth collaboration. This type of letter template serves as a foundation for establishing clear expectations, roles, and responsibilities among partners. Ready to dive deeper into the details of drafting your own agreement? Read on to discover everything you need to know!

Introduction and Purpose

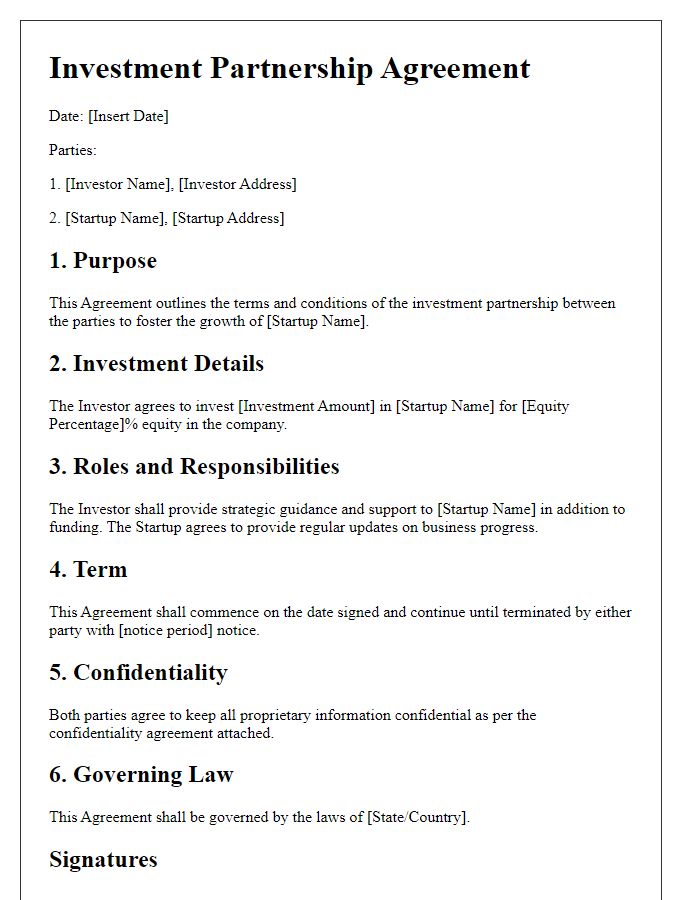

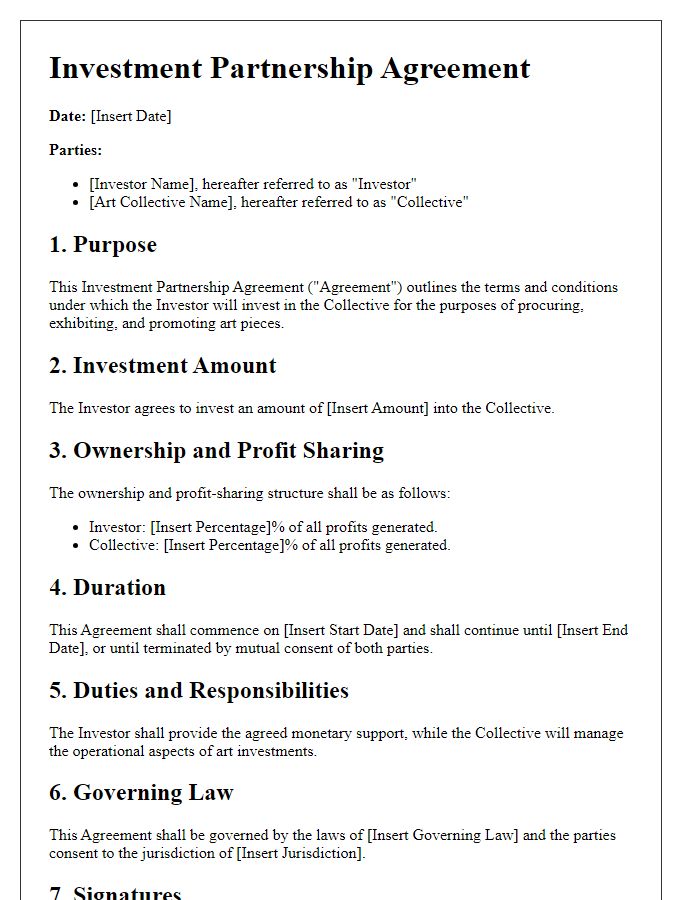

The Investment Partnership Agreement establishes a formal collaboration between multiple parties to collectively invest in various assets, including stocks, real estate properties, or startups. This agreement outlines initial contributions, profit-sharing ratios, and decision-making protocols essential for managing and optimizing investments. Clearly defined roles and responsibilities ensure smooth operation and transparency among partners. Its purpose is to align the financial goals of all parties, fostering a shared commitment to achieving substantial returns while mitigating risks typically associated with investment ventures. Furthermore, it serves as a legal framework, reducing potential disputes and providing mechanisms for conflict resolution.

Definitions and Interpretations

An investment partnership agreement outlines the terms and conditions between involved parties regarding the management of funds and shared profits. Definitions section includes key terms: "Limited Partner" refers to individuals or entities providing capital without management responsibilities, while "General Partner" defines those actively managing the investment. "Capital Contribution" denotes the initial financial investment made by partners, essential for establishing the partnership's operational framework. "Distributions" describes the process of allocating profits among partners based on their contributions. "Partnership Interest" reflects each partner's ownership percentage in the partnership. "Term" signifies the duration of the partnership, typically spanning several years, subject to renewal options. Interpretation guidelines clarify ambiguous terms to ensure mutual understanding and agreement enforcement, critical for effective collaboration. Clarity in these definitions fosters transparency and helps mitigate disputes throughout the partnership's life cycle.

Capital Contributions and Allocation

The investment partnership agreement outlines the capital contributions and allocation among partners in a business venture. Each partner's initial investment, defined as the capital contributions (dollar amount contributed, e.g., $50,000), must be clearly stated. Percentages of ownership interest are calculated based on total contributions, establishing a framework for profit-sharing (i.e., annual distributions based on percentage ownership). Specific allocation methods (such as priority returns) ensure transparency and fairness. The agreement may also delineate any additional capital calls, requiring partners to contribute further funding based on predetermined conditions. Valuing assets and liabilities at the end of each fiscal year is necessary for accurate reporting of each partner's stake in the investment partnership.

Management and Decision-Making

Investment partnerships rely on clear management structures and decision-making processes to ensure efficient operation and equitable profit distribution. Effective management practices involve designated roles such as General Partner overseeing day-to-day operations and Limited Partners providing capital but with limited control. Decision-making frameworks need to define thresholds for significant choices, such as selling assets or modifying investment strategies, often requiring unanimous consent for critical changes. Regular meetings, often quarterly, facilitate communication and transparency among partners, fostering collaboration and trust. Written procedures for conflict resolution should also be established to address disagreements, ensuring that the partnership can continue to operate smoothly.

Confidentiality and Dispute Resolution

Investment partnerships require strict confidentiality measures to protect sensitive information, such as financial projections, business strategies, and personal data of the partners involved. This confidentiality can extend indefinitely beyond the termination of the partnership agreement, ensuring all parties maintain discretion regarding proprietary details. Dispute resolution processes must also be clearly outlined to address potential conflicts. Mediation and arbitration are common methods used, often specified in jurisdictions such as New York or California, where legal frameworks support efficient resolutions. Timeframes for disputes, typically 30 to 90 days for the initial mediation phase, play a crucial role in preventing prolonged disagreements that could hinder business operations.

Letter Template For Investment Partnership Agreement Samples

Letter template of Investment Partnership Agreement for Real Estate Ventures

Letter template of Investment Partnership Agreement for Green Energy Projects

Letter template of Investment Partnership Agreement for Agriculture Investments

Letter template of Investment Partnership Agreement for Franchise Opportunities

Letter template of Investment Partnership Agreement for Venture Capital Initiatives

Letter template of Investment Partnership Agreement for Healthcare Enterprises

Letter template of Investment Partnership Agreement for Hedge Fund Collaborations

Letter template of Investment Partnership Agreement for Peer-to-Peer Lending

Comments