Crafting a hedging agreement contract can seem like a daunting task, but it doesn't have to be! This essential document serves as a protective measure against market fluctuations, ensuring that you're shielded from unexpected financial risks. Whether you're a seasoned trader or new to the financial arena, understanding the key components of a hedging contract is crucial for maintaining stability in your investments. Dive into our article to discover a comprehensive letter template that simplifies the process and sets you up for success!

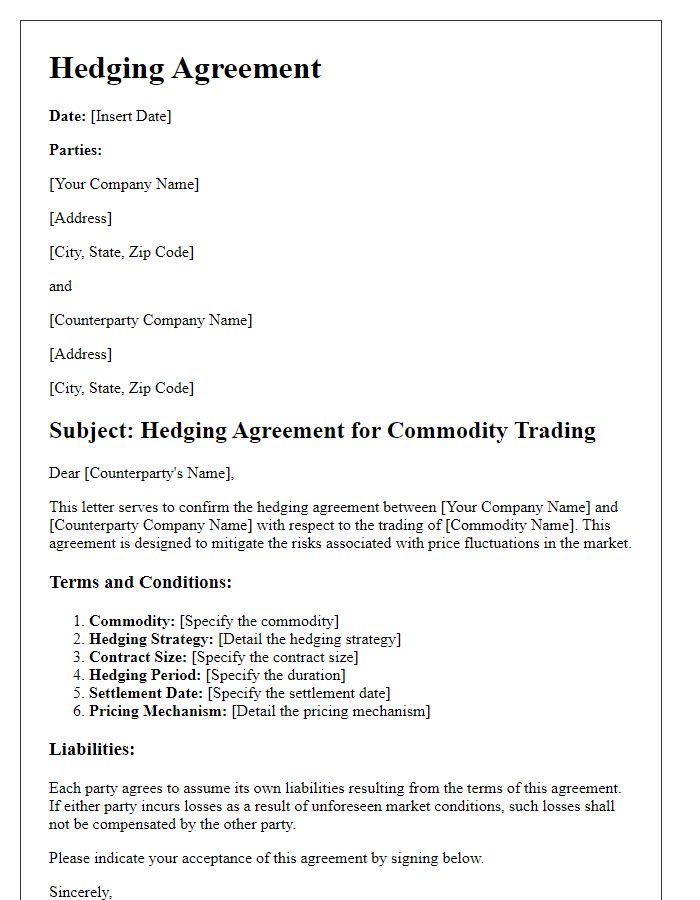

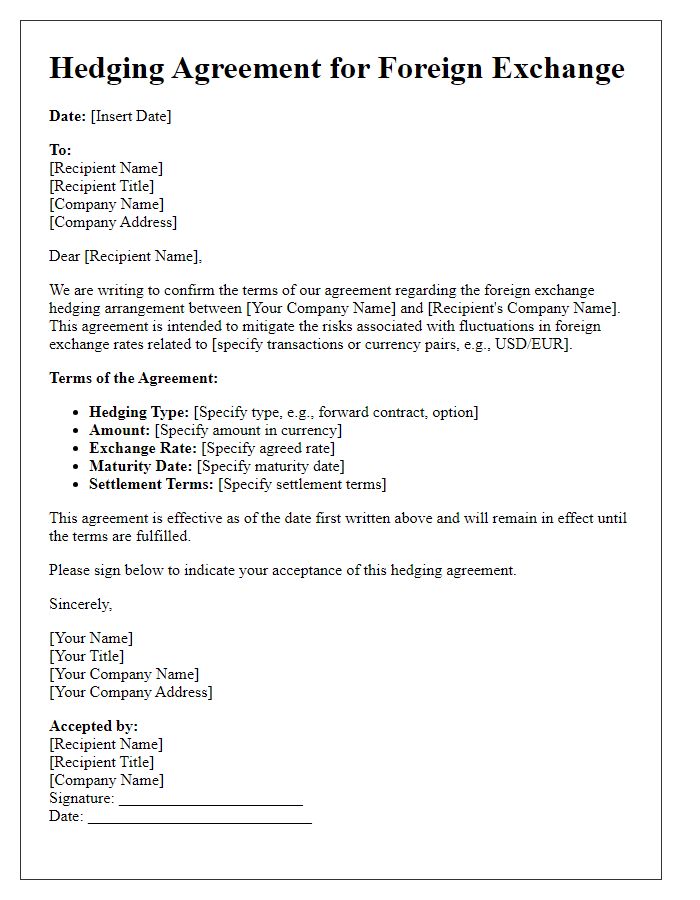

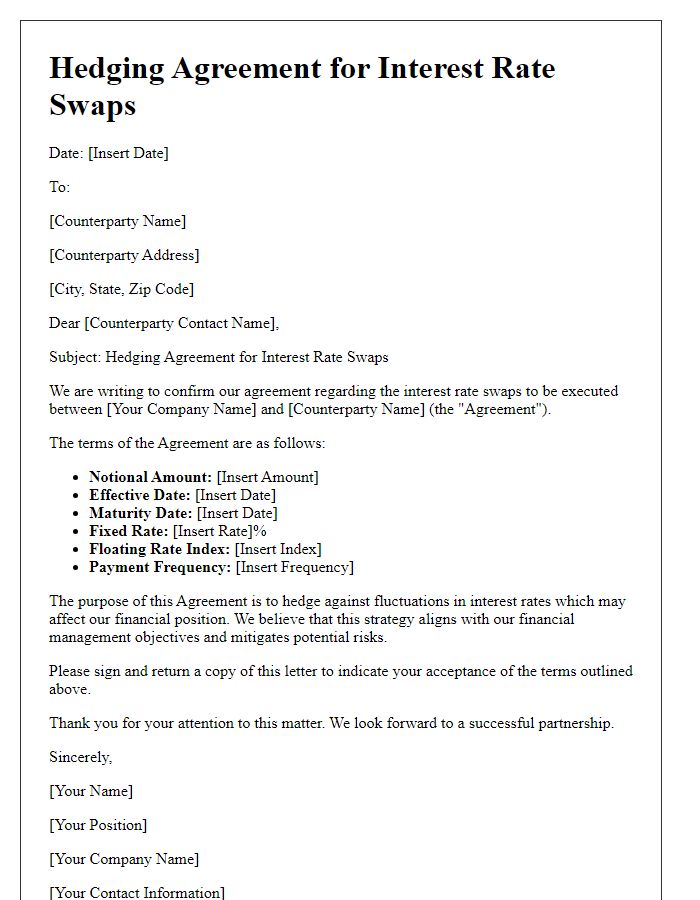

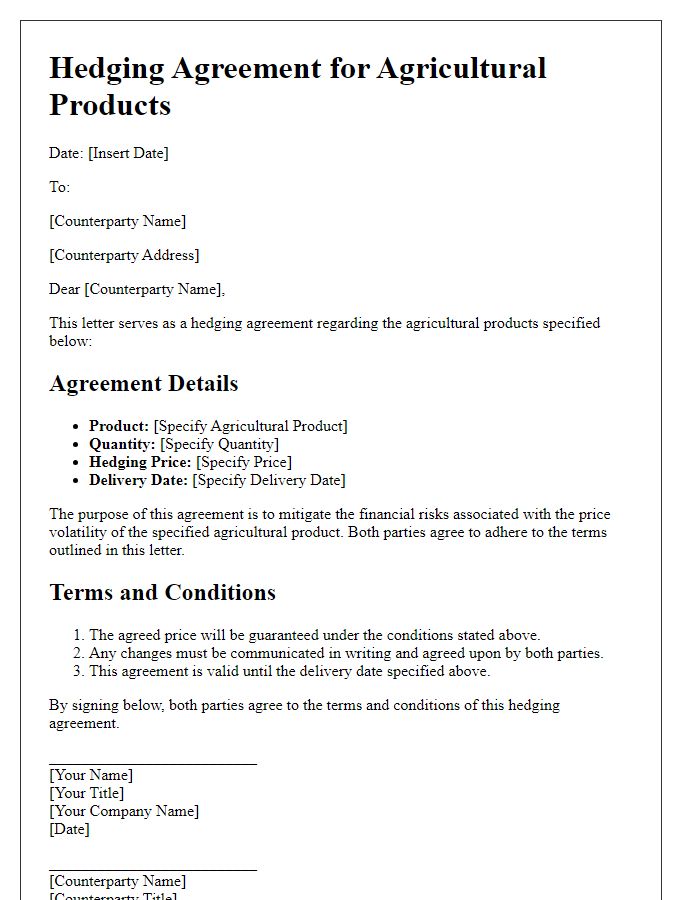

Parties Involved

In a hedging agreement contract, the parties involved typically include entities such as financial institutions, corporations, or individual investors who wish to mitigate risk associated with fluctuations in market prices, interest rates, or currency exchange rates. The primary participant, often referred to as the "hedger," actively seeks to offset potential losses in one asset by taking a position in a related asset; for example, a grain producer hedging against falling crop prices through futures contracts. Additional parties may encompass "counterparties," which can be investment banks like JPMorgan Chase or Goldman Sachs that provide liquidity and facilitate trades within financial markets. Contract terms often specify details such as transaction dates, payment structures, and conditions for settlement, aiming to foster a mutual understanding between all involved regarding risk management strategies.

Terms and Definitions

Hedging agreements in financial contexts refer to contracts that mitigate the risk of price fluctuations in assets or financial instruments. Key terms include "hedge," which denotes an investment strategy aimed at reducing potential losses in another investment, typically through derivatives such as options or futures. "Counterparty" refers to the other party involved in the hedge transaction, often a financial institution or investor. "Margin" indicates the collateral required to open and maintain a hedging position, ensuring that both parties are financially committed to the agreement. "Notional amount" signifies the value of the underlying asset upon which the hedge is based, critical for evaluating the extent of exposure. "Settlement" pertains to the process of resolving the financial obligations arising from the hedge, either through cash payment or physical delivery of the underlying asset. Understanding these terms is essential for parties involved in hedging transactions to navigate their contractual obligations effectively and mitigate financial risks.

Responsibilities and Obligations

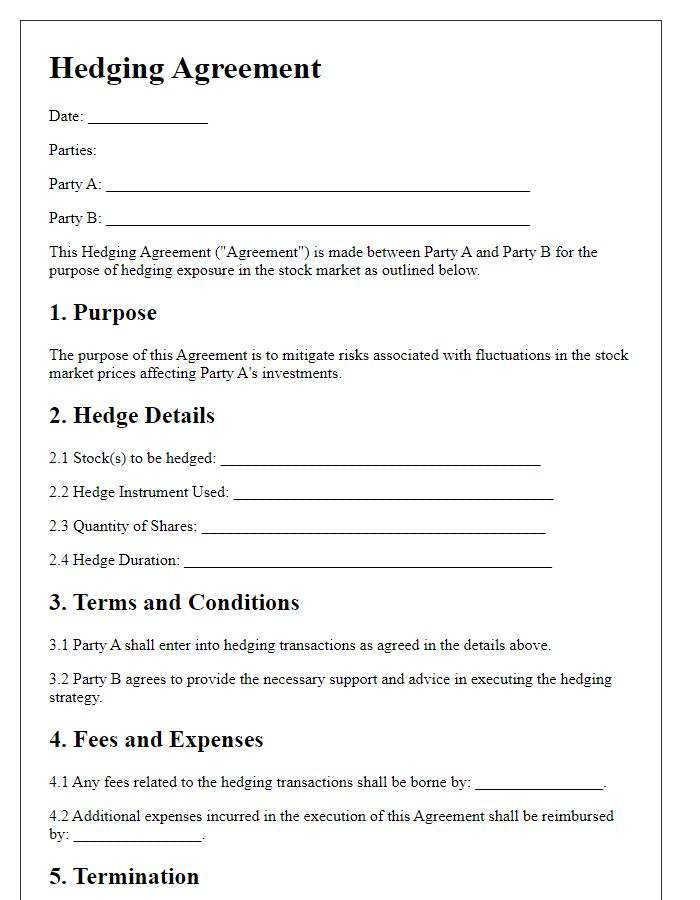

The responsibilities and obligations detailed in the hedging agreement contract encompass a range of critical financial duties. The parties involved, typically defined as the hedger and the counterparty, must adhere to specific guidelines focusing on risk management strategies related to market volatility. For example, the hedger is responsible for executing transactions that protect against price fluctuations in assets, including commodities like crude oil, or financial instruments like currency swaps. Each party must maintain compliance with regulatory frameworks, such as the Dodd-Frank Act in the United States, which oversees derivatives trading. Further, timely reporting of executed trades, collateral management, and maintaining adequate margin requirements are essential elements that strengthen the integrity of the hedging strategy. Failure to fulfill these obligations may result in penalties or exposure to increased financial risk.

Risk Management Clauses

A hedging agreement contract encompasses various risk management clauses designed to mitigate potential financial losses. These clauses may include provisions such as credit risk assessment, which evaluates the counterparty's creditworthiness through metrics like credit ratings or financial health indicators. Additionally, market risk clauses specify conditions for price fluctuations of underlying assets, outlining how changes in market conditions can trigger adjustments or settlements. Liquidity risk management provisions ensure that parties can access necessary funds to meet their financial obligations, often detailing the minimum funding levels required. Furthermore, force majeure clauses protect against unforeseen events, such as natural disasters or geopolitical disruptions, that could impede contract performance. These comprehensive risk management strategies aim to safeguard both parties involved in the hedging agreement by minimizing exposure to unpredictable financial events.

Termination and Renewal Conditions

The termination of a hedging agreement is subject to specific conditions outlined in the contract, which may include a notice period of 30 days prior to termination. Events such as a significant change in market conditions or default by one party can trigger immediate termination. Renewal conditions often stipulate that parties must negotiate terms at least 60 days before the agreement's expiration date. This includes reassessing the underlying asset's value, prevailing interest rates, and any regulatory changes impacting the contract. Additionally, acceptance of mutually agreed terms must be documented in writing to ensure clarity and compliance.

Comments