Have you ever felt trapped by a contract that seemed more like a puzzle than a promise? Many of us encounter terms that are confusing or unfair, leaving us wondering what our rights truly are. In this article, we'll unpack the essentials of disputing unfair contract terms and share effective strategies to navigate this tricky terrain. So, if you're ready to take control and learn how to advocate for yourself, keep reading!

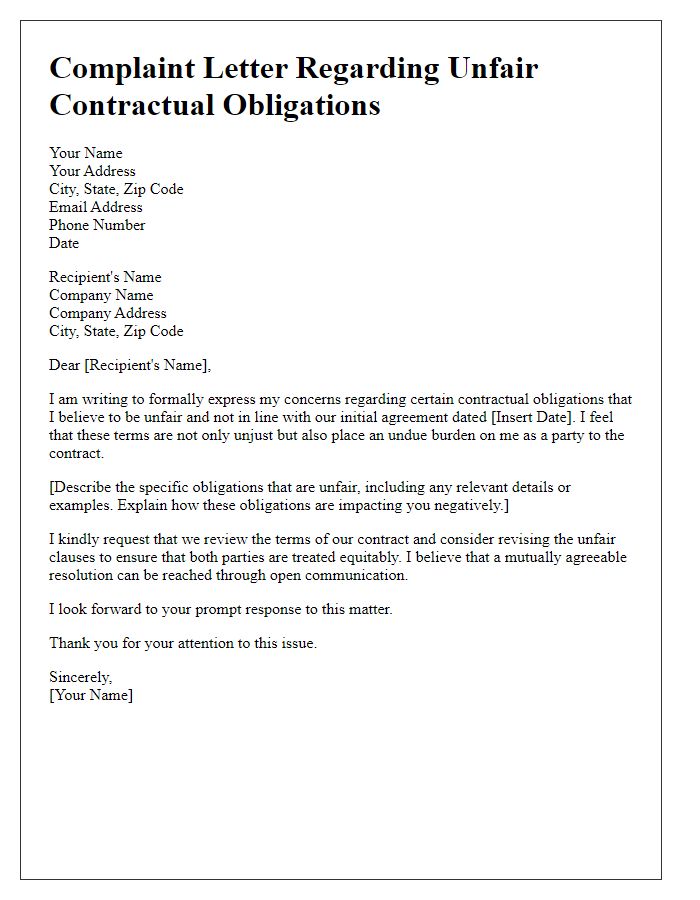

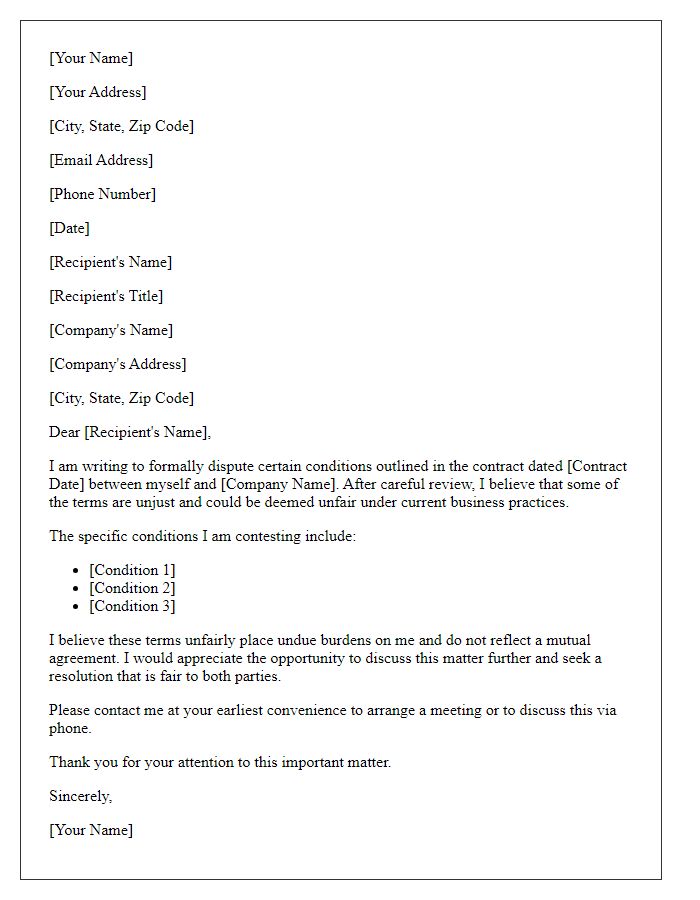

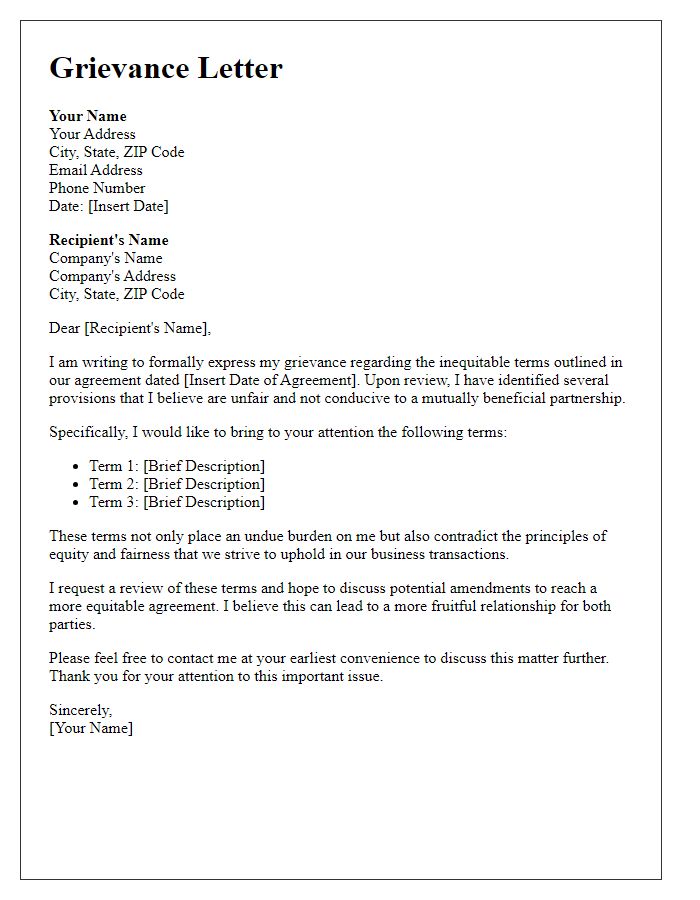

Clarity and Specifics

Unfair contract terms can lead to significant issues in agreement enforcement, particularly in consumer contracts. Clear definitions regarding obligations, penalties, and limitations (often found in fine print) can create confusion. Specificity in terms protects parties from misinterpretation, especially regarding cancellation policies and refund processes. For instance, vague clauses surrounding service delivery timelines may allow one party to delay services without consequence. Additionally, excessive fees for early termination can be deemed unconscionable under laws in various jurisdictions. Companies may face legal scrutiny when terms are deemed not transparent or disproportionately favorable to one side.

Legal References

Unfair contract terms can significantly undermine consumer rights, particularly in business transactions. The Consumer Rights Act 2015, applicable in the United Kingdom, outlines specific provisions regarding unfair terms in contracts, defining such terms as creating a significant imbalance in the parties' rights and obligations, to the detriment of the consumer. Section 62 of this act states that a term may be considered unfair if it is not necessary to protect legitimate interests of the seller or supplier. Additionally, case law, such as the seminal decision in the case of OFT v Abbey National Plc (2011), illustrates the judicial approach towards identifying and invalidating unfair contract terms. The Unfair Contract Terms Act 1977 also plays a significant role in regulating clauses that limit liability in consumer agreements, asserting that consumers should not be subjected to unreasonable terms. Engaging legal advice is often crucial in navigating these complex legal frameworks to ensure contract compliance and uphold consumer rights.

Tone and Professionalism

An unfair contract term can significantly impact consumer rights and business practices. Common scenarios involve hidden fees or ambiguous language disadvantaging one party. For instance, a mobile phone service provider might include a clause that automatically extends the contract without clear notification, creating frustration and financial strain for customers. Legislation protecting consumers, such as the Consumer Rights Act 2015 in the United Kingdom, seeks to address these issues by prohibiting terms that create a significant imbalance between parties. Engaging legal counsel to analyze the specific contract in question can provide clarity on rights and options available for addressing the unfair conditions.

Desired Resolution

Unfair contract terms can lead to significant disadvantages for consumers, particularly within industries such as telecommunications and utilities. These terms often include hidden fees, unreasonable cancellation policies, and restrictive clauses that limit consumers' rights. For instance, a telecommunications contract might impose exorbitant penalties for early termination, sometimes exceeding several hundred dollars, making it financially burdensome for customers wishing to switch providers. Additionally, in cases involving service-level agreements (SLAs), vague language can leave consumers without recourse if promised service levels are not met, leading to frustrating experiences. The desired resolution often includes seeking a renegotiation of contract terms to enhance fairness, reimbursement for unfair fees charged, or a complete termination of the contract without penalties.

Supporting Evidence and Documentation

Unfair contract terms can significantly impact consumers, leading to financial loss and limited rights. Various legislation, such as the Unfair Contract Terms Act 1977 in the United Kingdom, protects individuals against terms deemed unfair. Supporting evidence may include the original contract agreement, highlighting clauses that are one-sided, ambiguous, or excessively penalizing. Documentation could encompass correspondence with the contracting party, such as emails or letters, illustrating concerns regarding specific terms. Additionally, records of any financial transactions that showcase the adverse effects of these terms can bolster a complaint. Dispute resolution documents from relevant authorities may also provide context and credibility to the claim against such contractual inequities.

Comments