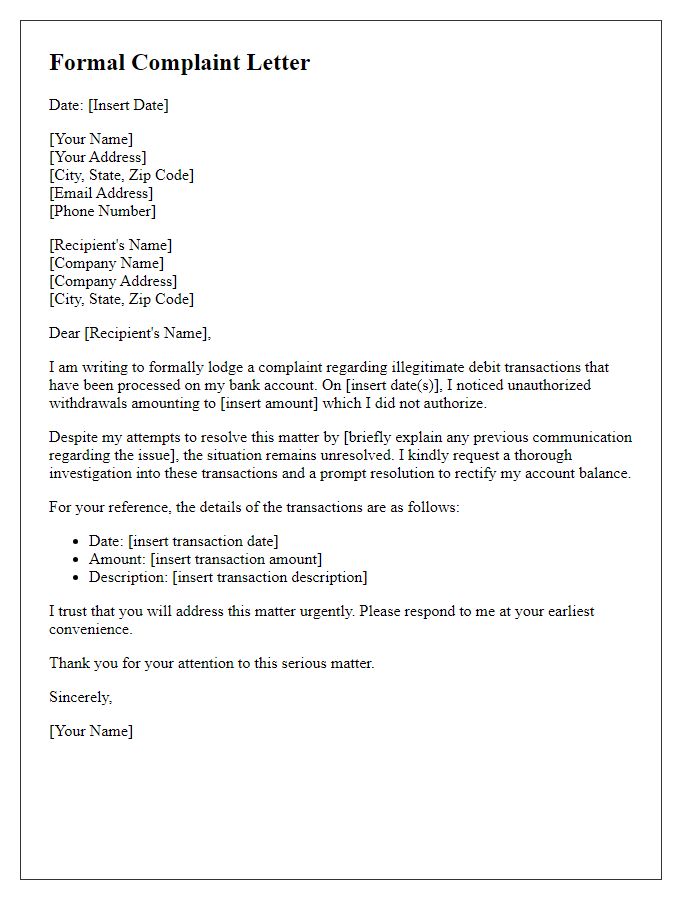

Have you ever checked your bank statement only to find a mystery charge that you didn't authorize? It can be frustrating and concerning to see an unexpected debit, especially when it feels like you've lost control over your finances. In this article, we'll discuss how to effectively address these unauthorized charges and ensure your money is secure. So, keep reading to discover the steps you can take to resolve this issue and protect yourself moving forward!

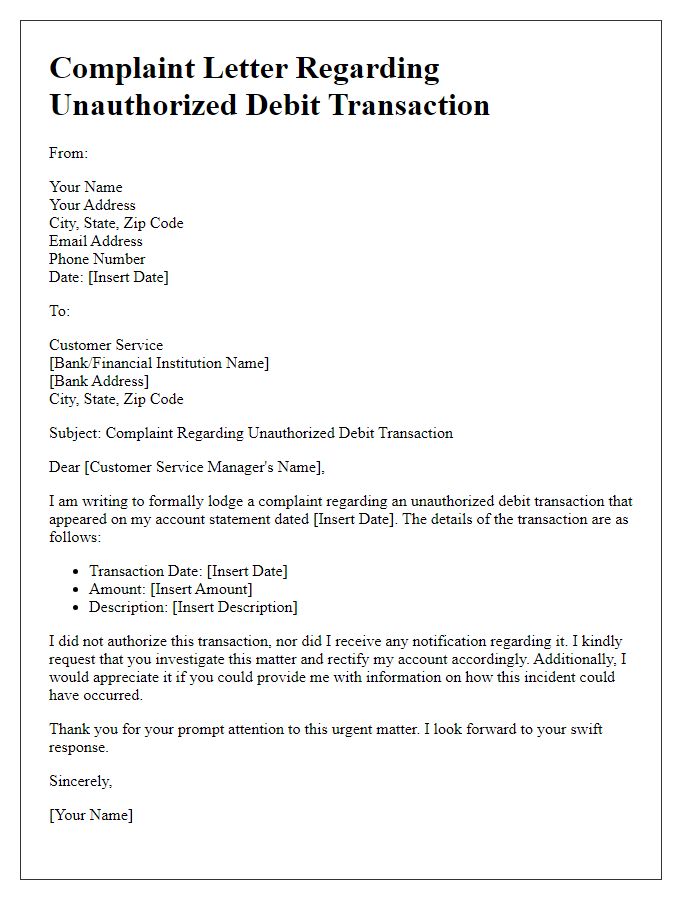

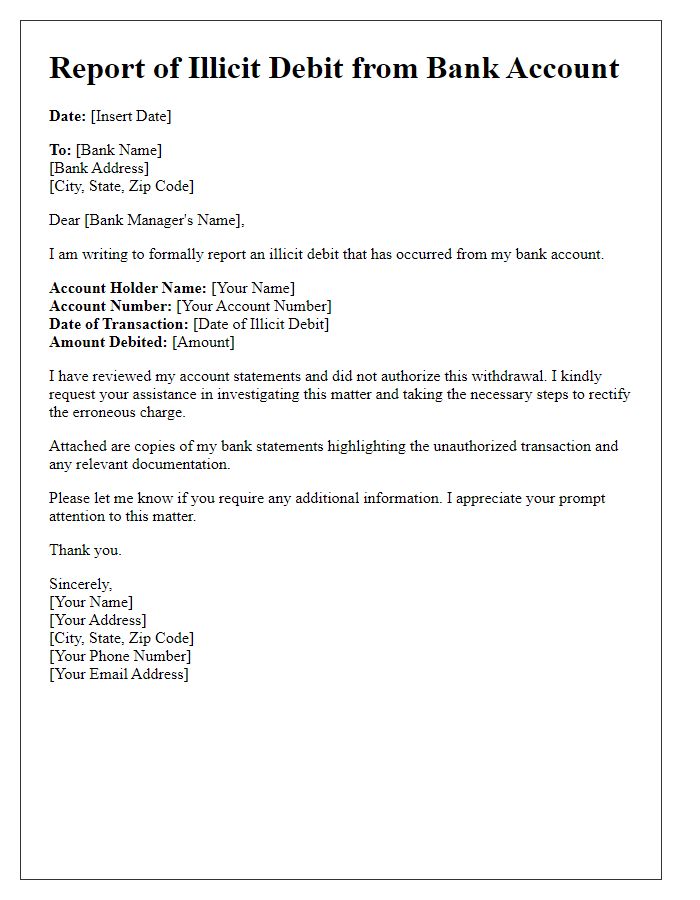

Account Information

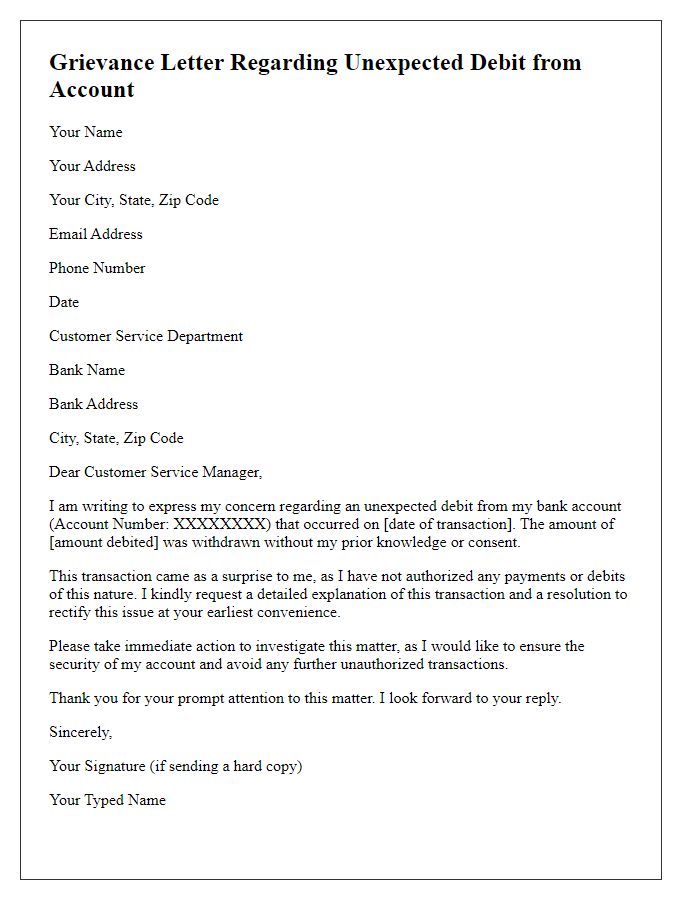

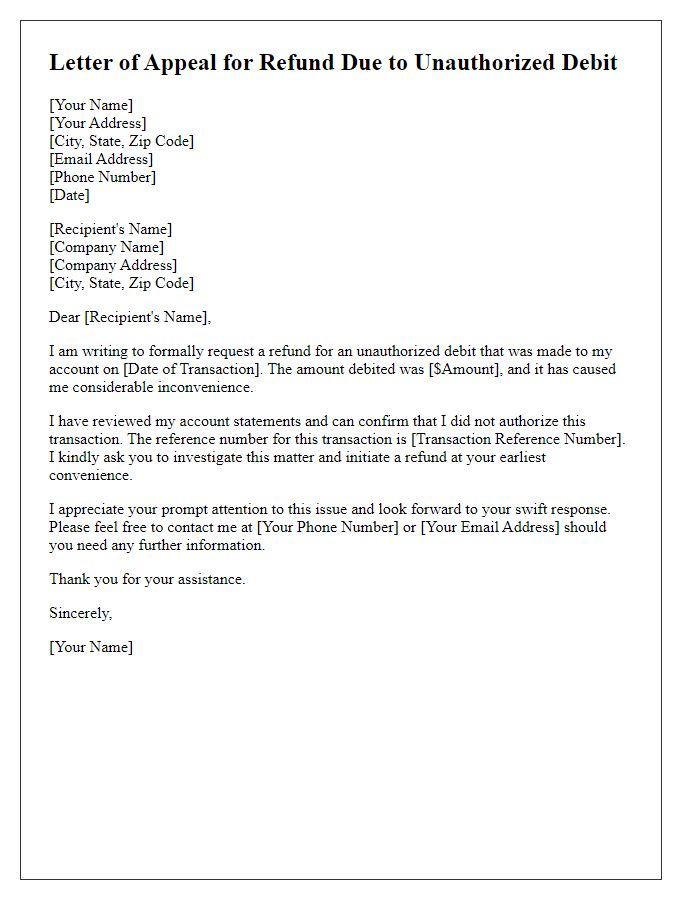

Unauthorized debit transactions can lead to significant issues for account holders. Instances of such debits may occur unexpectedly, reflecting discrepancies in account balances or unauthorized access to personal financial information. For example, a debit charge of $150 from a location such as an online retailer (like "XYZ Shopping") might appear on the account statement without the account owner's consent, leading to concern and confusion. Key details including account number (account holders should protect this information), date of transaction (for reference), and any associated confirmation numbers aid in resolving discrepancies swiftly. Financial institutions often require documentation to investigate these issues, emphasizing the importance of maintaining accurate records of all transactions and promptly addressing unauthorized charges with customer service or fraud prevention teams. Immediate action can prevent further financial loss and restore account integrity.

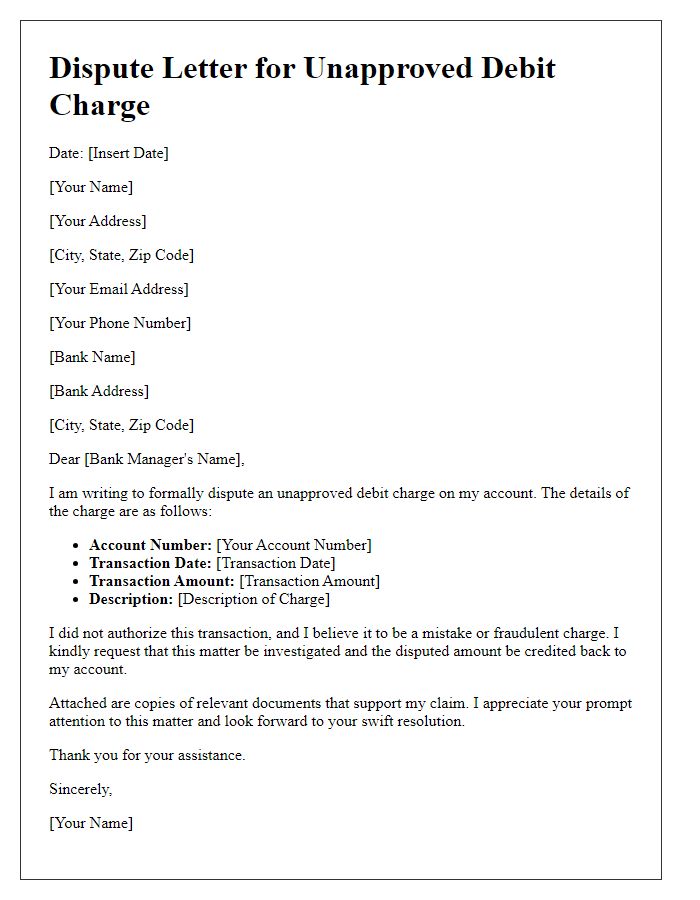

Unauthorized Debit Details

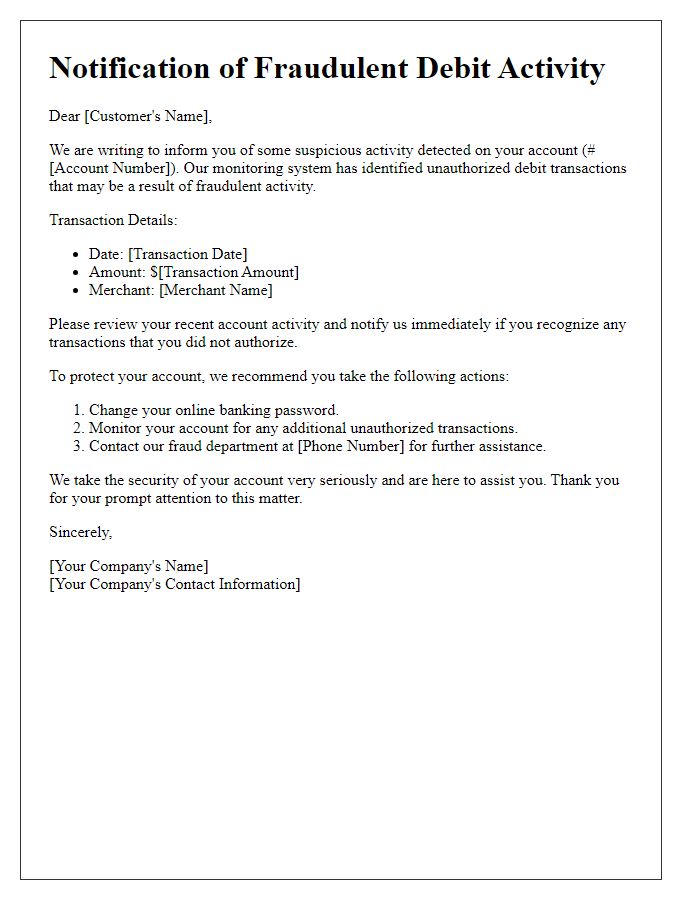

Unauthorized debit transactions can lead to significant financial distress for account holders, as seen in cases where funds are withdrawn without consent from banking institutions such as Bank of America or Wells Fargo. For instance, a recent incident involved an unauthorized debit of $200 on September 15, 2023, detected on an online banking statement. The affected party often experiences not only the immediate loss of funds but also prolonged issues with cash flow and budgeting. Reporting such discrepancies promptly is crucial; detailed documentation, including transaction dates and amounts, strengthens the claim for refunds and further investigations into potential fraud. Consumer protection agencies, like the Consumer Financial Protection Bureau, provide essential guidelines for addressing such incidents effectively.

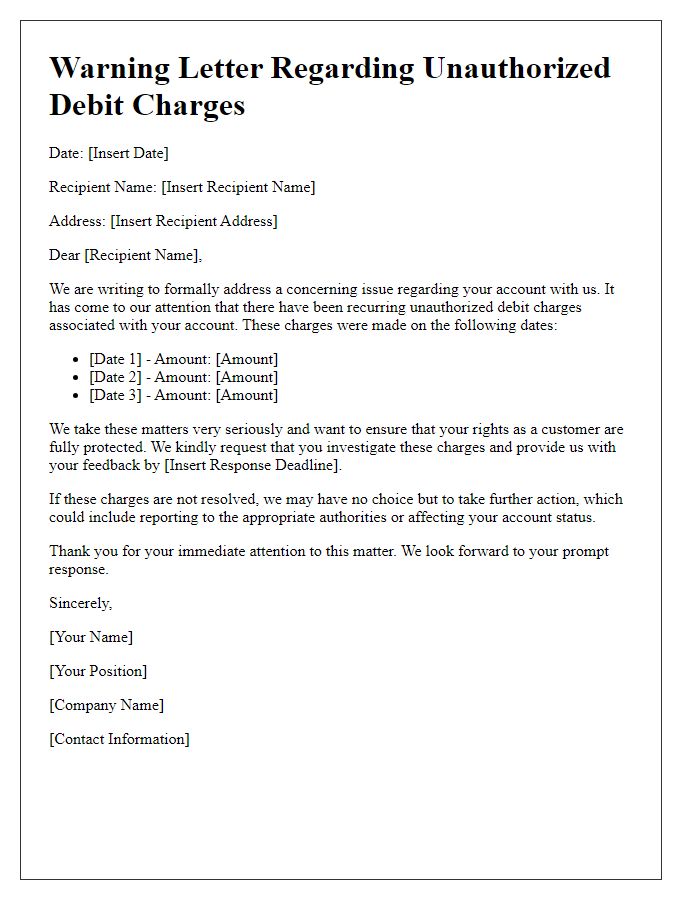

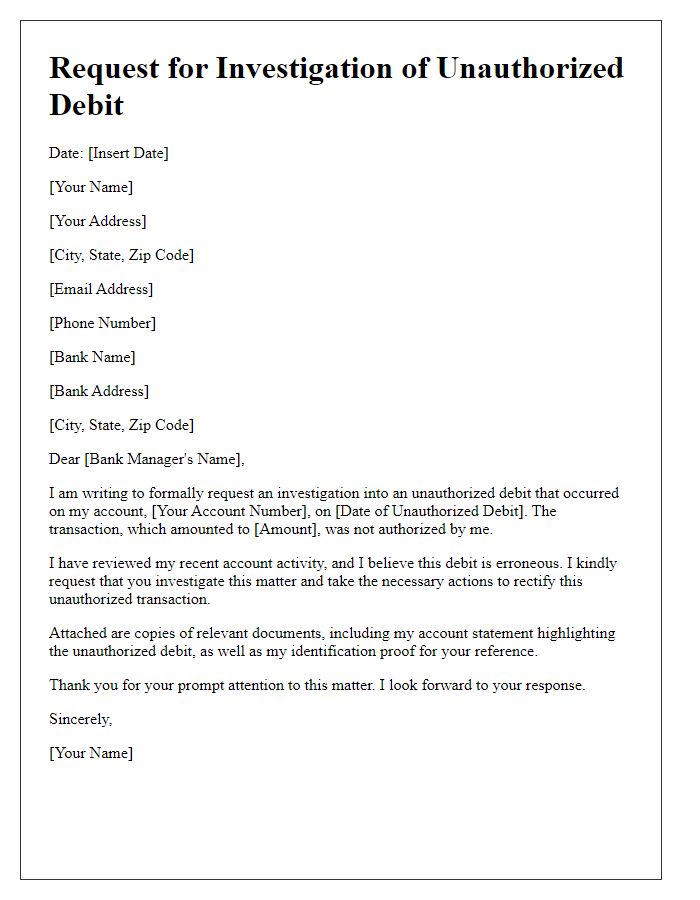

Request for Resolution

Unauthorized debit transactions can lead to significant financial distress for individuals. In recent incidents, individuals have reported unexplained deductions from bank accounts, often exceeding amounts of $100, leading to paused transactions for essential services. Financial institutions, such as JPMorgan Chase or Bank of America, maintain protocols under federal regulations, including the Electronic Fund Transfer Act, to protect consumers. Immediate reporting to customer service hotlines marked as 24/7, allows users to dispute such charges typically within 60 days of occurrence. Sufficient documentation, including bank statements and account details, plays a crucial role in resolving these disputes. A prompt reversal of unauthorized debits restores trust and stability to affected account holders.

Contact Information

Unauthorized debit transactions can lead to significant financial distress for individuals. Banks, such as Bank of America or Chase, can inadvertently process these transactions, resulting in unexpected charges on customer accounts. An instance of a $200 withdrawal without consent may raise flags for potential fraud. Quick reporting to customer service, typically reachable at 1-800-432-1000 for Bank of America, ensures investigation into the matter. Regulatory bodies, like the Consumer Financial Protection Bureau (CFPB), emphasize the need for swift action in disputing unauthorized charges, protecting consumer rights under the Electronic Fund Transfer Act, which applies to most financial institutions in the United States.

Formal Closure

Unauthorized debit notifications can significantly impact personal finances, resulting in unexpected account imbalances. A sudden deduction of funds, especially in cases of identity theft or billing errors, can lead to financial distress for account holders. Banks and financial institutions, such as Chase or Bank of America, have specific protocols to address these complaints, emphasizing the importance of immediate reporting within a 60-day window from the transaction date. Additionally, federal regulations under the Electronic Funds Transfer Act provide consumers with protection against unauthorized transactions, often capping liability at $50 if reported promptly. Resolution processes typically involve transaction investigation, funds reversal, and potential replacement cards if account security is compromised.

Comments