Are you feeling frustrated after your insurance claim was denied? You're not alone; many people face this unexpected hurdle and struggle to understand what went wrong. In this article, we'll explore the common reasons for claim denials and provide you with effective strategies to appeal and navigate the process. Stick around to learn how to assert your rights and turn that denial into an approval!

Policy Details

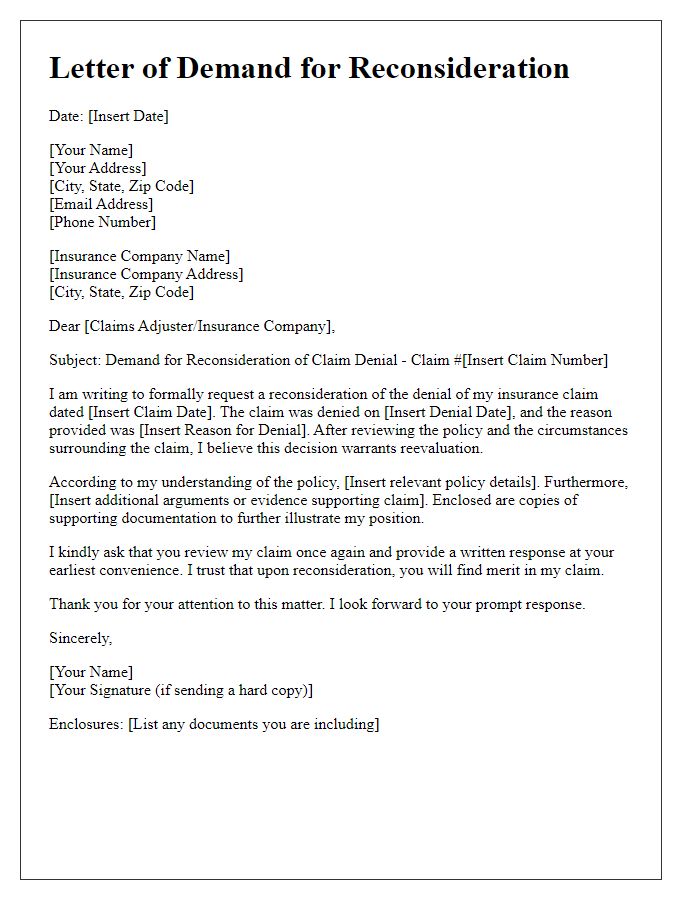

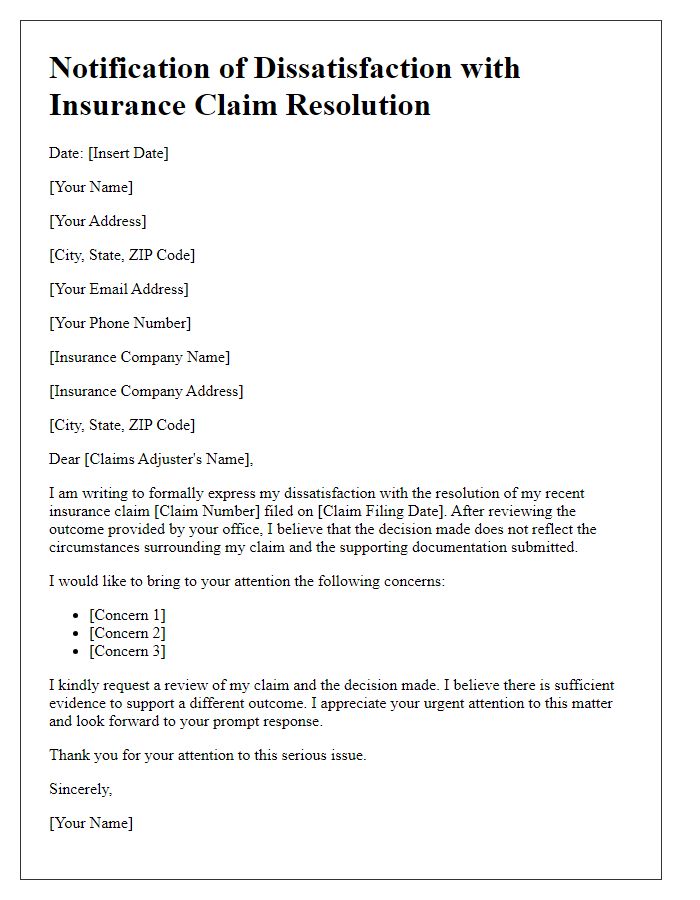

The denial of an insurance claim can have significant financial implications for policyholders, particularly in cases of health emergencies or property damages. Insurance policy details, such as the policy number (e.g., A123456) and terms of coverage, stipulate the extent of benefits provided. Denied claims often arise from misinterpretation of coverage limits or excluded conditions stated in the policy--such as pre-existing health conditions in health insurance plans. Furthermore, the reason for denial, typically documented in a denial letter, can relate to missing documentation, failure to meet policy terms, or other disputed circumstances. Understanding these nuances is crucial for effective communication with the insurance provider, especially in seeking a reconsideration or appeal of the claim denial.

Claim Reference Number

Insurance claim denials can stem from various reasons, leading to frustration for policyholders. One common issue arises when claims, such as medical expenses from an unexpected accident, are rejected on the grounds of insufficient documentation. A typical scenario involves a claim reference number, which serves as a unique identifier for tracking the status of the claim, often assigned by the insurance company. For instance, an individual attempting to secure reimbursement for a hospital visit might encounter difficulties if the insurance provider claims that the submitted medical records do not align with their guidelines, causing financial strain. Additionally, policyholders may face extended delays in receiving adequate support or clarification regarding their claims, creating further anxiety during already stressful situations.

Summary of Incident

In March 2023, I experienced significant water damage in my residential property located at 123 Main Street, Anytown, due to a severe storm that recorded over 3 inches of rainfall within a 24-hour period. My homeowners insurance policy, number 789456123, was expected to cover the damages incurred, including structural repairs and replacement of personal belongings. Upon filing my claim on April 1, 2023, I provided extensive documentation including photographs, repair estimates totaling $15,000, and the storm report from the National Weather Service confirming the weather event. Despite this evidence, my insurance claim was denied on May 15, 2023, citing a lack of coverage for flood-related damages, leading to my confusion regarding the terms of my policy.

Reasons for Denial

Insurance claim denials can be frustrating and perplexing, particularly when they stem from specific reasons outlined by the insurance provider. Common reasons for denial include lack of coverage, where the policyholder discovers that the service or event is not covered under their plan, or failure to provide necessary documentation, which can include medical records or police reports that substantiate a claim. Additionally, claims may be denied due to policy exclusions, such as pre-existing conditions in health insurance or specific circumstances like natural disasters in home insurance. Insurers may also deny claims based on policy limits, meaning that the amount claimed exceeds the coverage available. Understanding these elements is crucial for addressing and potentially overturning such denials effectively.

Supporting Documents

Many insurance policies provide essential coverage for unforeseen events, necessitating a clear understanding of the claims process. A common issue arises when an insurance claim, such as for home damage due to a natural disaster like Hurricane Katrina in 2005, is denied despite the submission of supporting documents like photographs, repair estimates, and relevant correspondence. The denial often stems from misunderstandings regarding policy coverage, insufficient evidence, or the insurer's internal guidelines. Policyholders fight for justice by referencing documentation that details the circumstances of the loss, along with corresponding policy clauses, showcasing the financial impact, often amounting to thousands of dollars, that the denial imposes. Careful re-evaluation of submitted evidence and persistent communication with the insurance provider, such as Allstate or State Farm, can sometimes lead to a successful appeal.

Comments