Navigating the world of health insurance can be a bit overwhelming, but ensuring that your plan is verified is an essential step in securing your healthcare. Whether you're a first-time applicant or looking to update your existing coverage, having a clear understanding of the verification process can ease your mind and help you stay informed. In this article, we'll walk you through a simple letter template that makes health insurance verification a breeze. So, let's dive in and empower you with the knowledge you need to take charge of your health insurance!

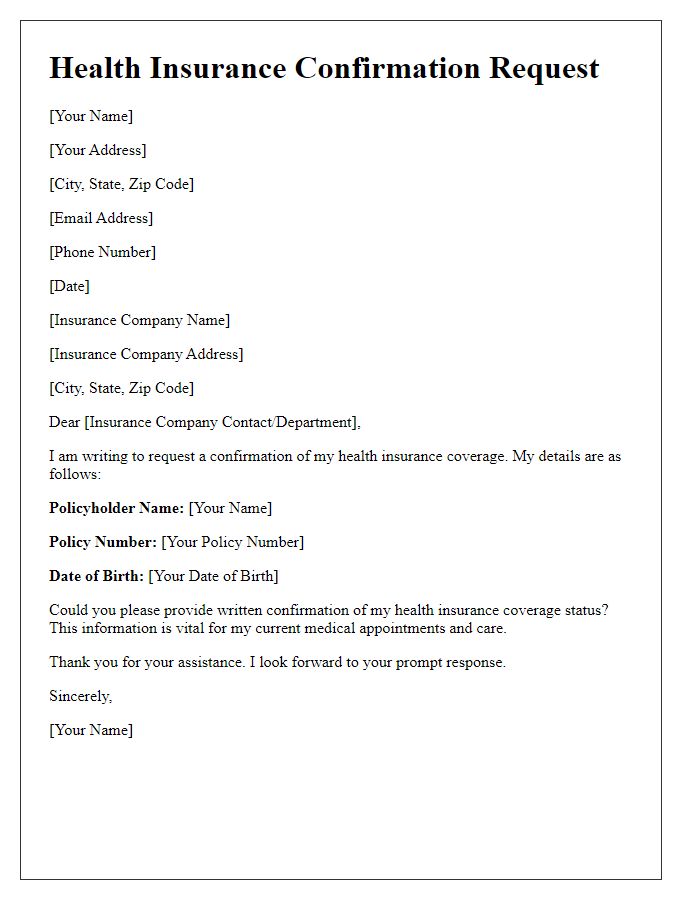

Policyholder Information

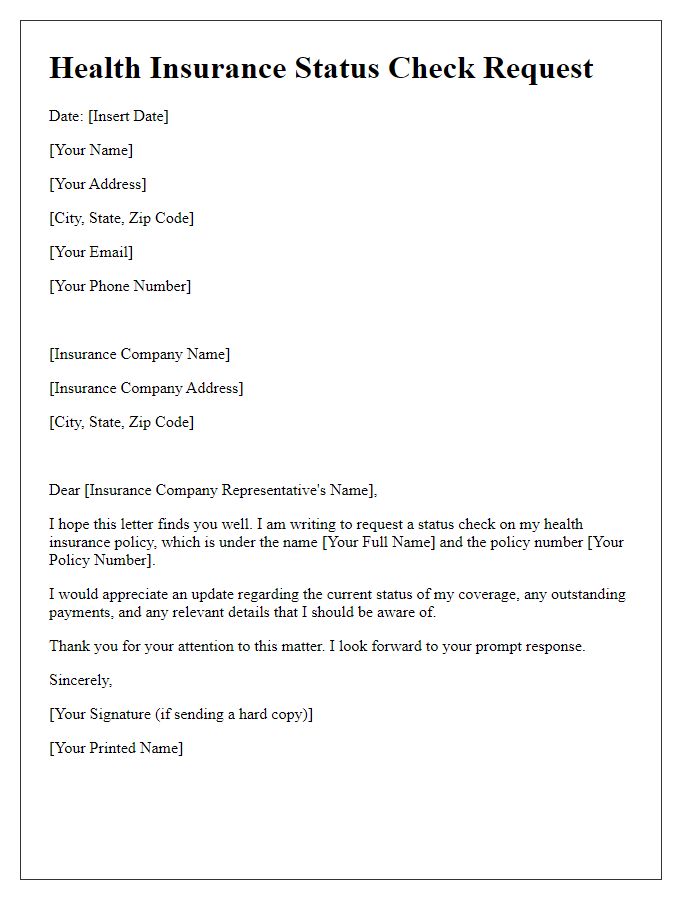

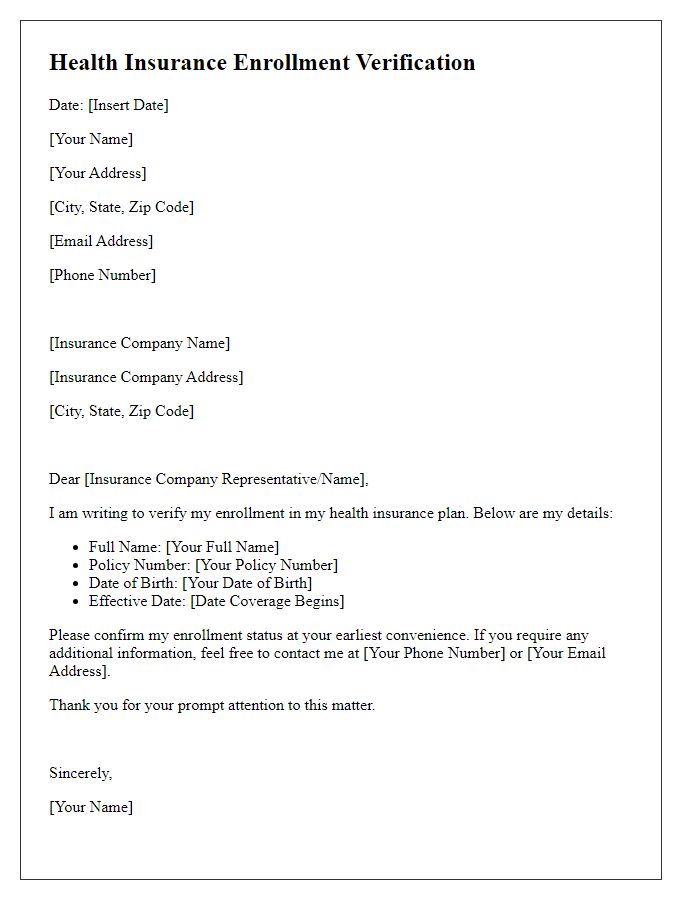

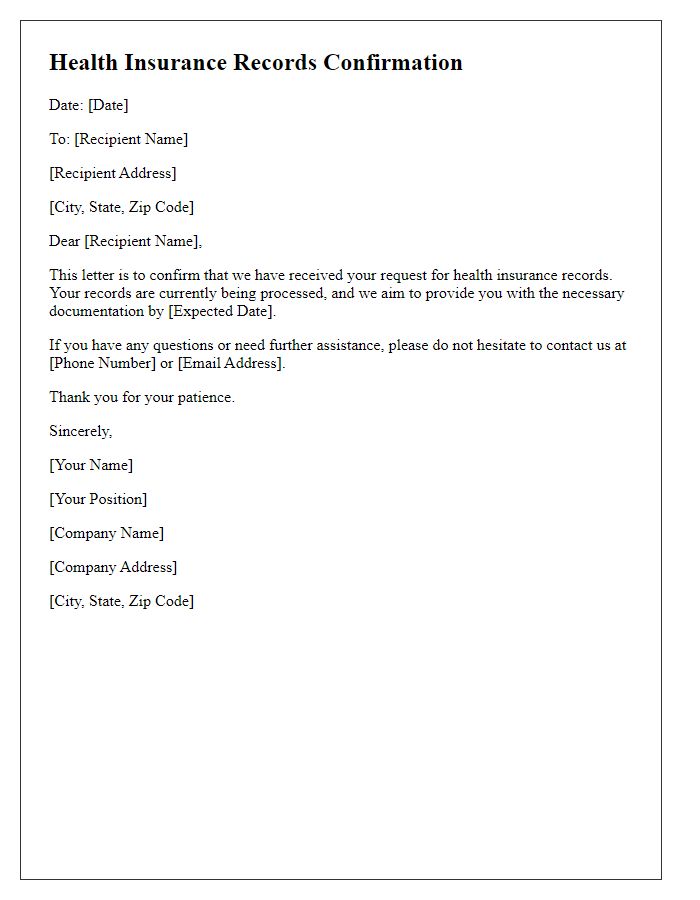

Health insurance verification requires essential information about the policyholder to ensure accurate coverage confirmation. The policyholder's full name should be included, identifying them as the insured individual. Date of birth must be provided to match records and confirm eligibility. The policy number, a unique identifier assigned by the insurance company, serves as crucial information for verifying coverage details. Insurance company's name, such as UnitedHealthcare or Blue Cross Blue Shield, is necessary to pinpoint the provider associated with the policy. Additionally, the group number, if applicable, may be needed for policies linked to employer-sponsored plans. Contact information including phone number and mailing address ensures prompt communication regarding any verification issues or follow-up needs. Lastly, an indication of the type of coverage, such as individual or family plan, helps clarify the policyholder's specific benefits and limitations.

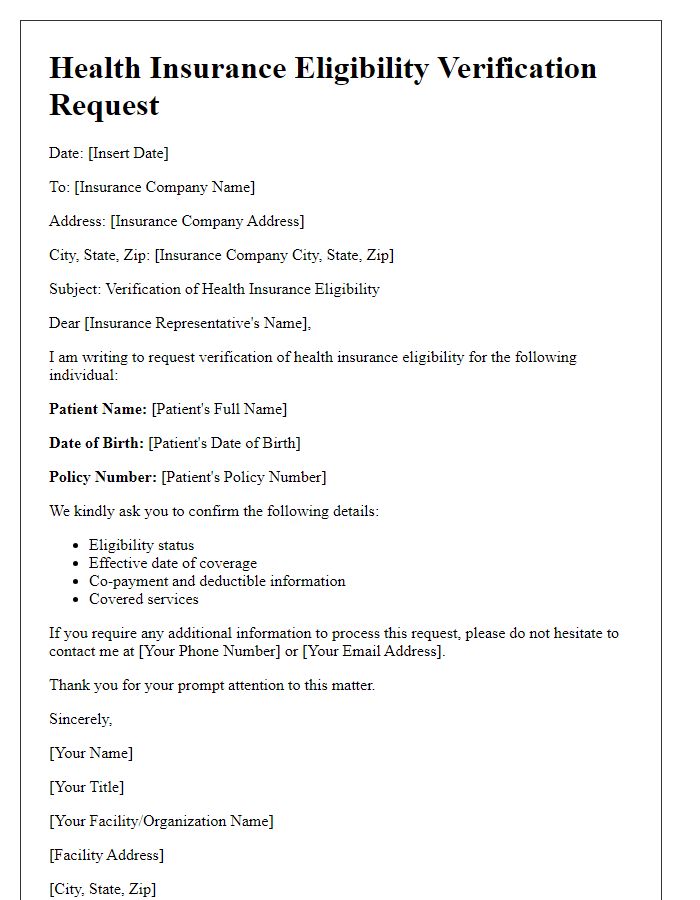

Insurance Provider Details

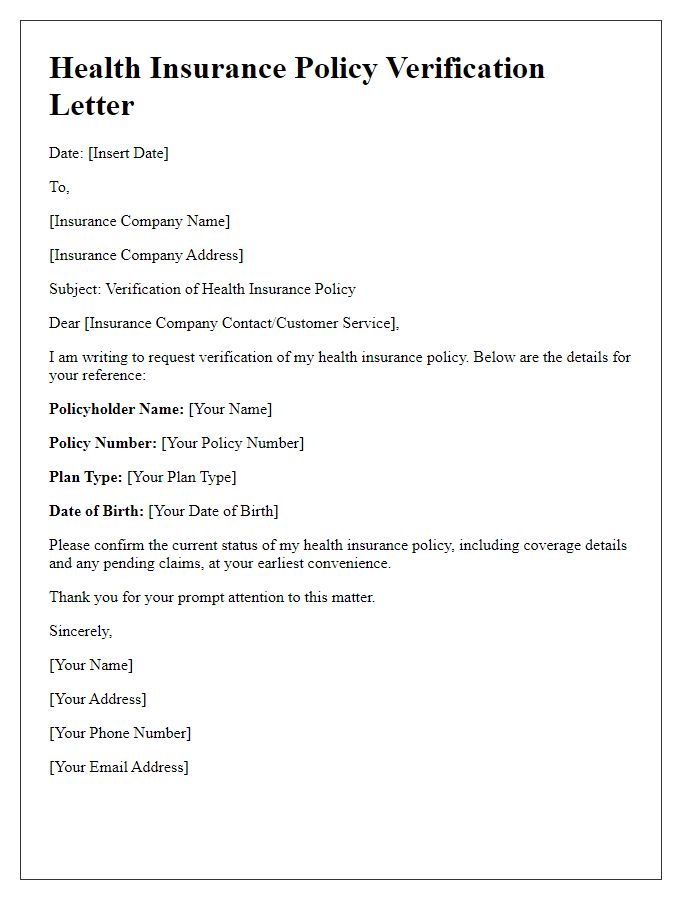

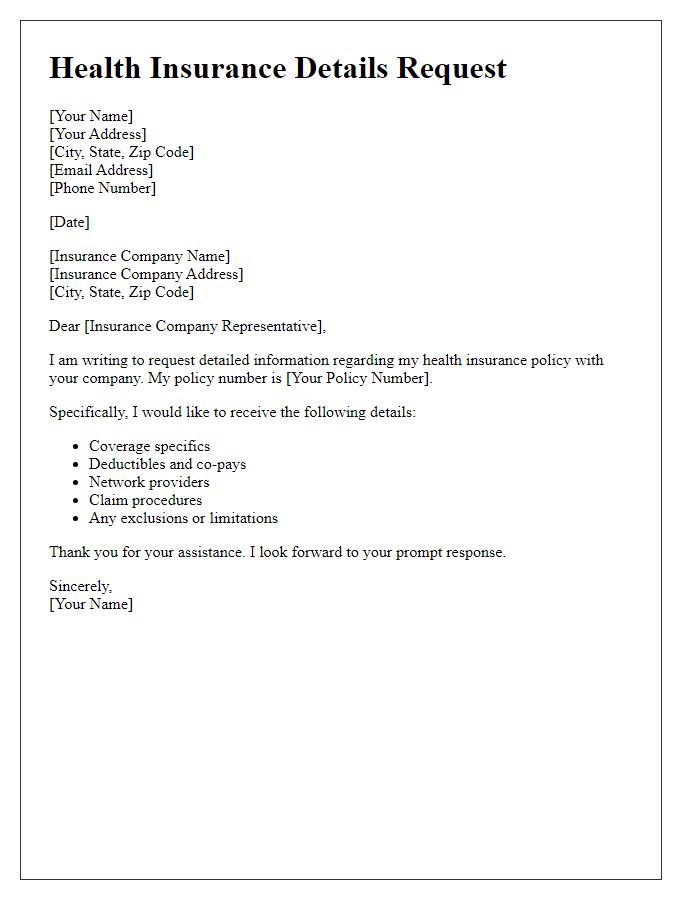

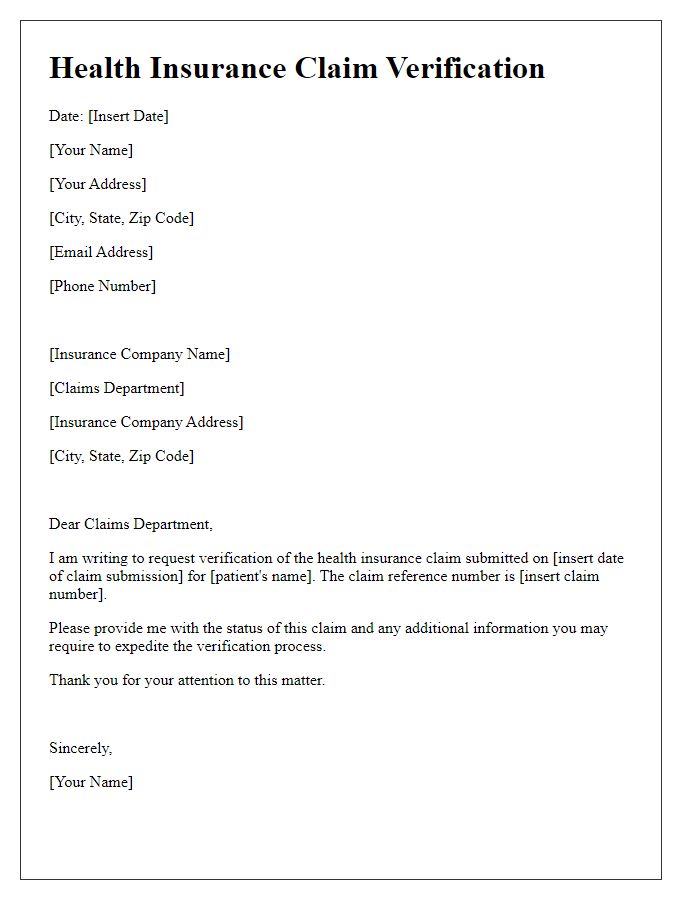

Health insurance verification is essential for confirming coverage and benefits for medical services. Insurance provider details include the name of the insurance company, policy number assigned to the insured individual, contact information for customer service representatives, and specific coverage details such as deductibles and copay amounts. Accurate collection of these details ensures that healthcare providers can effectively process claims, reducing the risk of billing errors and delays in reimbursement. Moreover, understanding provider networks is crucial, as it impacts the costs associated with out-of-network versus in-network services. Proper documentation and verification of these elements are vital for both patients and healthcare facilities.

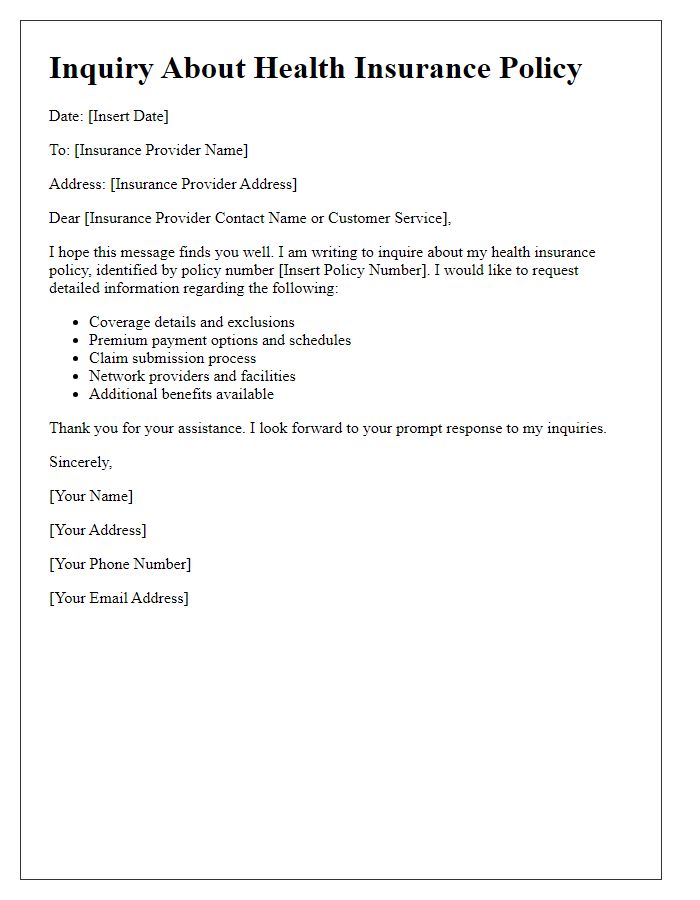

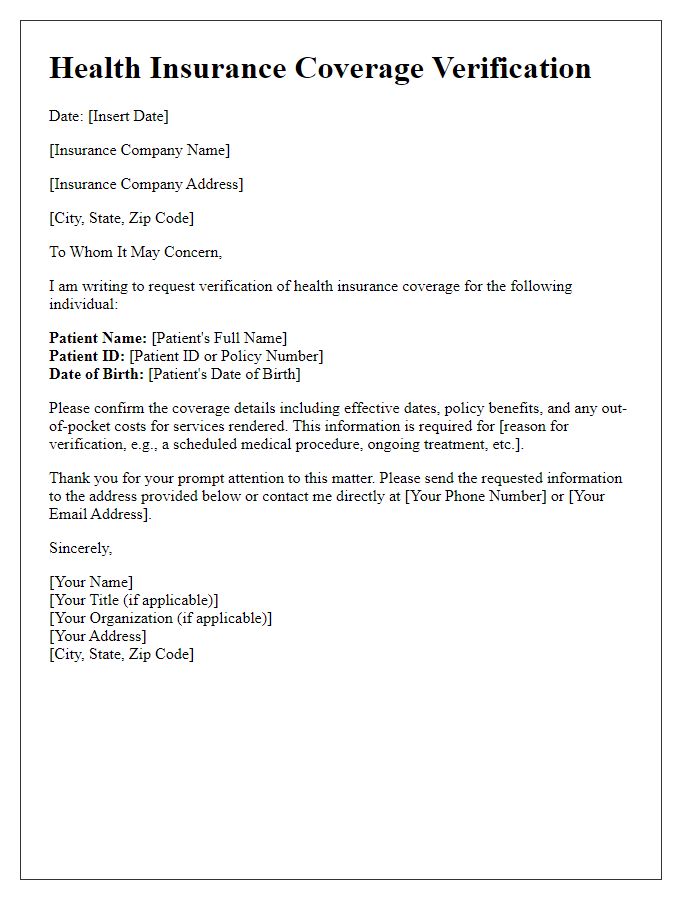

Coverage Verification

Health insurance verification is critical for healthcare providers to ensure patients receive the necessary services without unexpected costs. Insurance providers, such as Blue Cross Blue Shield or Aetna, require specific patient information, including policy numbers and group identifiers, to confirm eligibility. The verification process usually takes place through electronic means, like API integrations or dedicated phone lines, ensuring real-time updates on coverage status. Providers must also account for prior authorization requirements, which may vary significantly between plans, to avoid claim denials. In cases of emergency services, understanding how policies apply in urgent care settings, such as hospitals in New York or California, is essential for both patient assurance and financial transparency.

Patient Information

Health insurance verification is vital for ensuring coverage for medical services. Patient information must include essential details such as full name, date of birth, and insurance policy number. Accurate submission of this data allows healthcare providers to confirm benefits and eligibility efficiently. Additional components like the contact information of the patient and the insurance company, as well as the specific services requested, play a crucial role in expediting the verification process. Delays can occur if any information is missing or incorrect, potentially impacting timely access to necessary healthcare services.

Contact Information for Queries

Health insurance verification plays a crucial role in ensuring patients receive the coverage they are entitled to when seeking medical services. Verification processes typically involve confirming policy details, coverage limits, and patient eligibility through health insurance providers such as UnitedHealthcare, Aetna, or Blue Cross Blue Shield. Insurance representatives may provide assistance through dedicated contact numbers, often available 24/7, facilitating timely issue resolution. Additionally, verification can include specifics like claims processing times and necessary documentation for pre-authorization, which is essential for various services like surgeries or specialized treatments, ensuring patients understand their financial responsibilities upfront.

Comments