Hey there! We all know how important it is to keep our finances in check, especially when it comes to invoices. If you've recently made changes to your order or service, you might find yourself in need of an updated invoice for your records. Don't worry; I'll guide you through the simple steps to craft a polite request for that updated invoice. Keep reading to discover how to effortlessly communicate your needs!

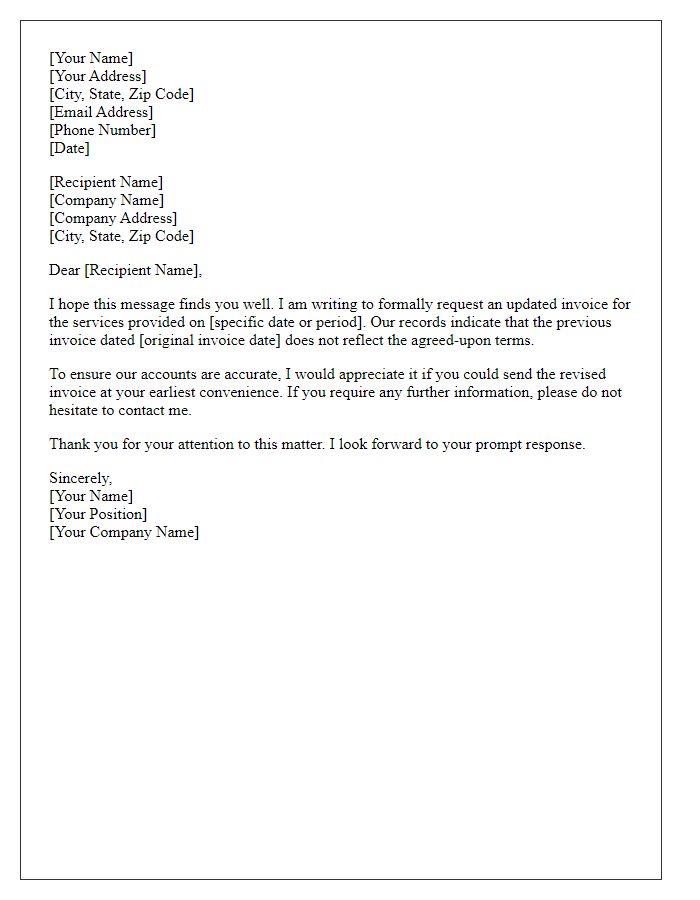

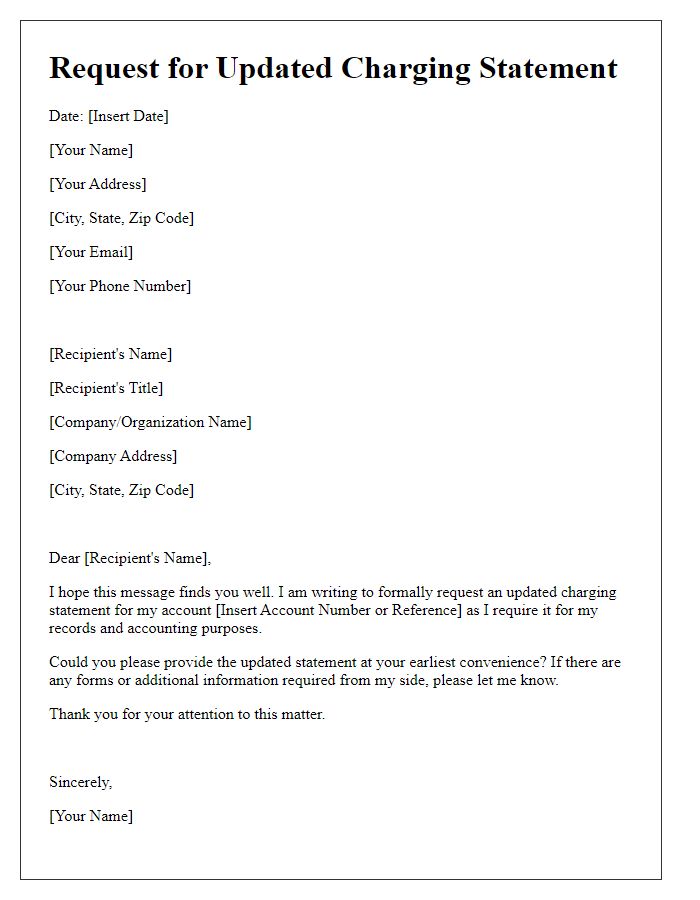

Contact Information

An updated invoice request is essential for ensuring accurate financial records in transactions with suppliers. When addressing this issue, include key details such as the invoice number (for instance, #12345), original amount ($1,200), date of the initial invoice (March 15, 2023), and specific items or services rendered (such as 50 units of product X). Highlight the need for adjustments (e.g., due to price changes or returns) and provide your contact information, including your name, email address, and phone number. Mention your company's name (for instance, ABC Corp) and address to streamline communication. Emphasizing the importance of prompt resolution for accounting and budgeting processes showcases professionalism in business dealings.

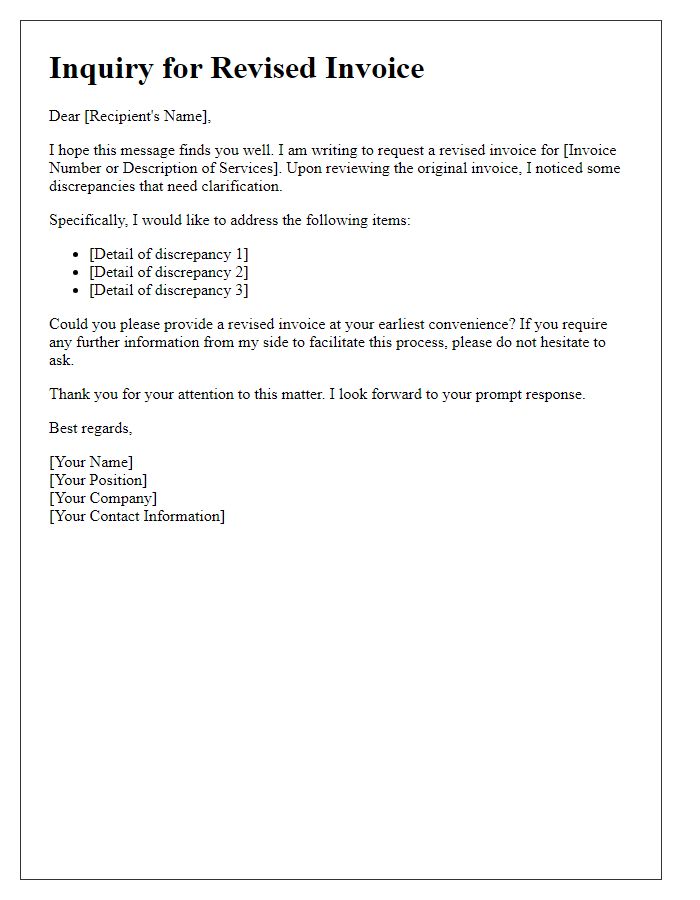

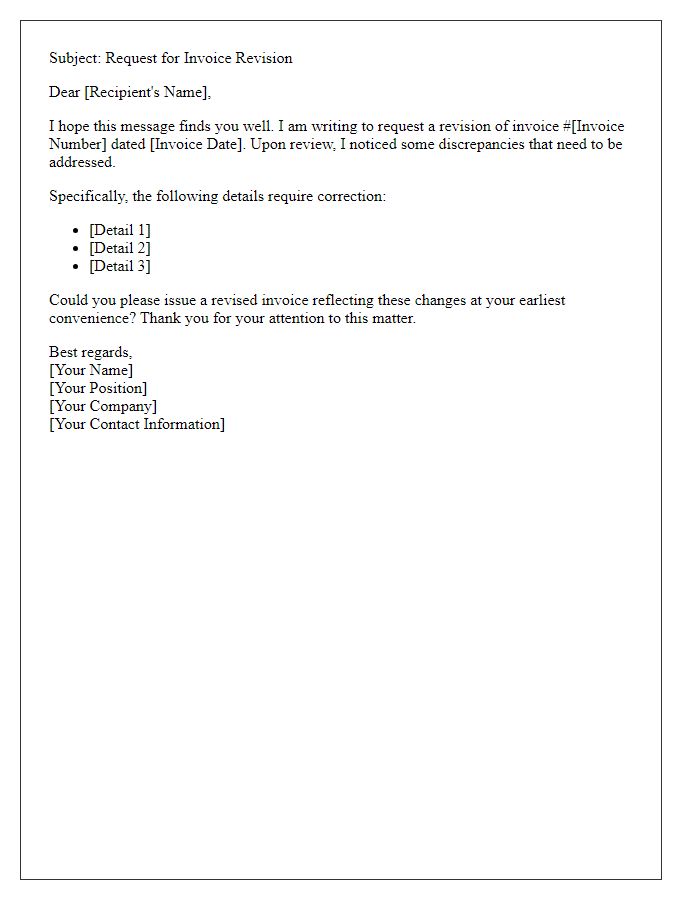

Invoice Details

An updated invoice may be necessary to ensure accurate record-keeping for financial transactions. The invoice number, which is a unique identifier (typically composed of several digits), plays a critical role in tracking specific transactions. The date of issuance is also important, as it provides the timeframe for payment expectations, usually ranging from 30 to 90 days depending on agreed terms. Additionally, discrepancies in itemized charges, such as quantity, unit price, or applicable taxes, can lead to confusion if not clarified promptly. Requesting an updated invoice from the vendor or service provider, preferably through official channels, ensures that all parties maintain transparent communication regarding financial obligations.

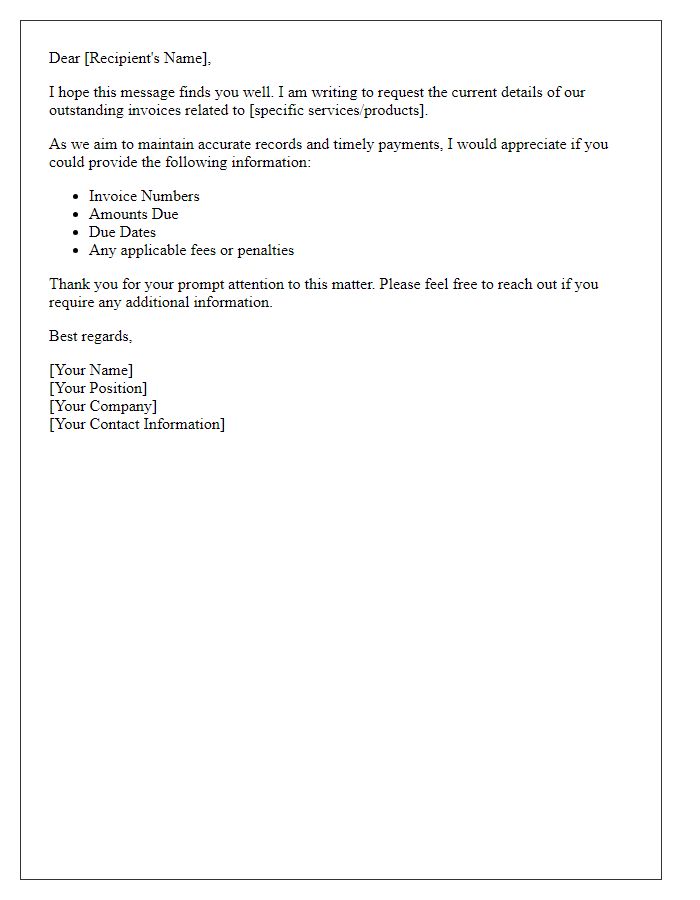

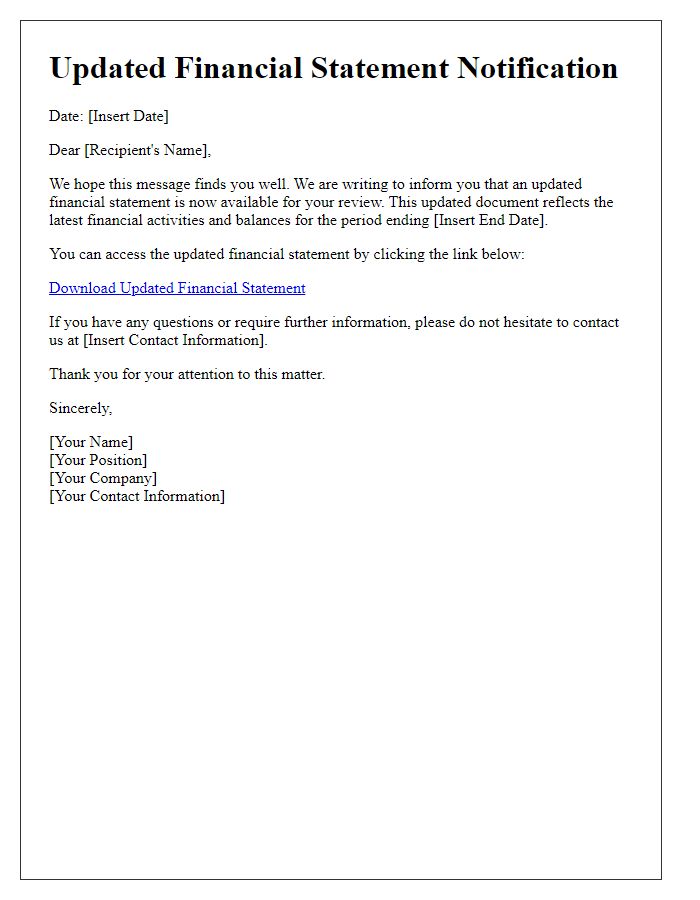

Request for Update

An updated invoice is essential for accurate financial documentation and budgeting. Businesses typically require this document, especially in instances of discrepancies in billing amounts or changes in service agreements. When requesting an updated invoice, it is crucial to specify invoice numbers, dates, and any previous communications regarding billing issues. Providing a detailed description of the discrepancies, including exact amounts and services rendered, reinforces the request's legitimacy. Clarity in communication ensures a prompt resolution and maintains professional relationships, essential in transactions exceeding thousands of dollars.

Reason for Update

A request for an updated invoice typically arises from changes in order details, pricing adjustments, or discrepancies noticed in the original invoice. Businesses may require this update to maintain accurate financial records, ensure timely payments, or reflect new agreements reached with suppliers or clients. An updated invoice clarifies the total amount due, itemizes any changes made, and ensures compliance with accounting standards. Such requests should ideally specify the original invoice number, the date it was issued, and the particular reasons necessitating the revision, promoting transparency and facilitating efficient financial transactions.

Closure and Contact Information

Contacting the vendor for an updated invoice is essential for maintaining accurate financial records. An outdated invoice may lead to discrepancies in payment processing. Specify the invoice number and original date for clarity. Include the necessary closure details, such as mailing address, contact phone number, and email information for prompt communication. Timely updates are crucial for staying compliant with accounting standards and ensuring smooth transactions. Accurate invoices support efficient budgeting and maintain healthy vendor relationships. An updated document ensures alignment with financial reporting requirements and streamlines payment schedules.

Comments