In any organization, maintaining accurate documentation is crucial for seamless operations and transparency. However, discrepancies can sometimes creep in, leading to confusion and inefficiencies. Addressing these issues promptly not only helps rectify the situation but also fosters a culture of accountability. Stay with us as we delve deeper into the essential steps for effectively reporting documentation discrepancies.

Subject Line

Discrepancies Identified in Documentation for Review and Action (Note: Include specific reference numbers, dates, or document titles to clarify the nature of discrepancies and ensure accurate follow-up.)

Opening Statement

Reporting discrepancies in documentation can significantly impact project timelines and compliance audits. Precise documentation, including project reports and regulatory filings, ensures clarity in communication and adherence to protocols. Often, discrepancies arise from factors such as data entry errors (common in spreadsheets), misinterpretations of regulatory requirements (like FDA guidelines), and outdated information that fails to reflect current practices or changes in laws. Immediate attention to these discrepancies is critical to maintain accuracy and integrity within operational workflows, particularly in high-stakes environments like healthcare or finance. Documenting these issues thoroughly is essential for rectification and future reference.

Description of Discrepancy

Inaccurate financial records can lead to significant issues within corporate environments, particularly in accounting departments. A discrepancy in documentation, such as a missing invoice (potentially over $5,000 from a March 2023 order), can disrupt balance sheets and cash flow analysis. Such inconsistencies often arise from human error, system failures, or miscommunication between departments. For instance, invoices may not be matched correctly with purchase orders, resulting in incomplete records in accounting software like QuickBooks or Oracle. Additionally, overlooked entries or miscategorized expenses can further complicate financial reporting and audits, highlighting the necessity for diligent review processes within organizations to ensure accuracy and compliance during fiscal evaluations.

Evidence and Supporting Details

Discrepancies in documentation can significantly impact the validity of records and decision-making processes in organizations. Such inconsistencies may arise from errors in data entry or variations in compliance with established standards, such as the International Organization for Standardization (ISO) guidelines. A thorough review of documented materials, including internal reports from fiscal year 2022 and external audit findings, reveals several inaccuracies. For instance, the financial statements for Q2 2022 show a misalignment in reported revenue figures, with discrepancies amounting to approximately $50,000, likely stemming from misclassified transactions. Additionally, customer service logs from March 2023 indicate an incomplete record of tickets resolved, leading to inconsistencies in client satisfaction metrics. These discrepancies necessitate immediate attention to ensure the integrity of the documentation and restore stakeholder confidence.

Request for Action

Discrepancies in documentation can lead to significant issues in processes such as financial reporting, inventory management, or regulatory compliance. For instance, a missing invoice in an accounting system might disrupt the financial reconciliation process at a corporation like Acme Corp. In a healthcare context, inaccurate patient records can jeopardize treatment protocols at facilities like St. Mary's Hospital. Such documentation errors can stem from data entry mistakes or system integration issues, which can undermine data integrity. Timely action is essential to rectify these discrepancies, ensuring accurate reporting and compliance with regulations, such as those set forth by the Securities and Exchange Commission (SEC) or the Health Insurance Portability and Accountability Act (HIPAA). Addressing these issues swiftly not only maintains operational efficiency but also fosters trust among stakeholders, including clients, regulatory bodies, and employees.

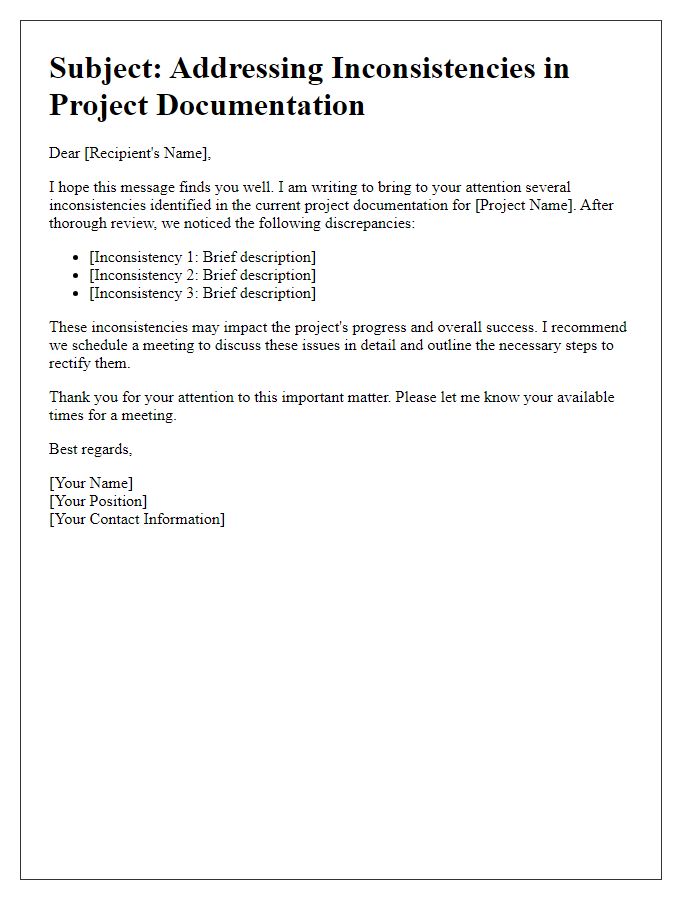

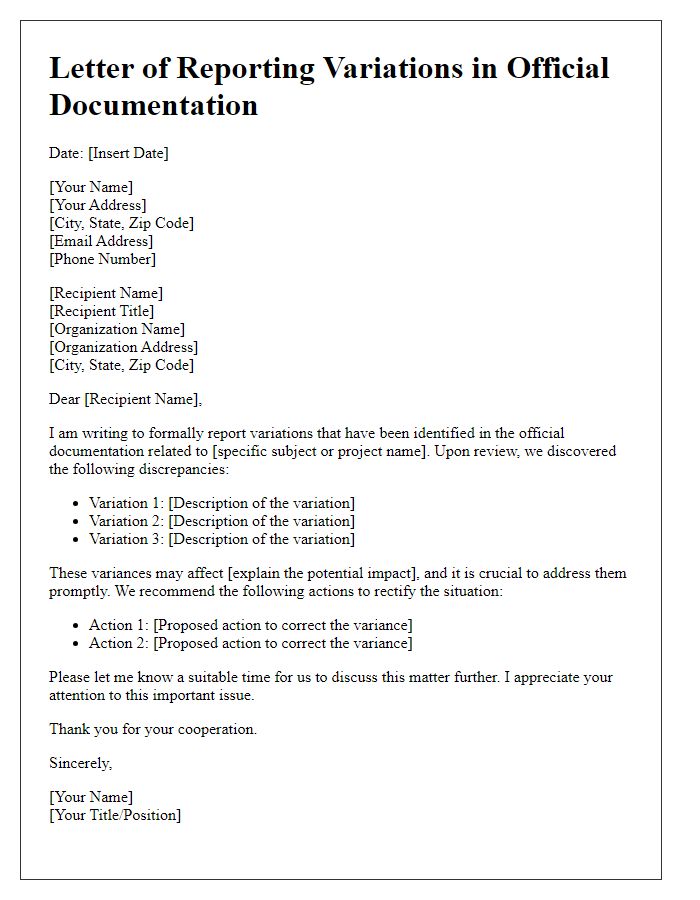

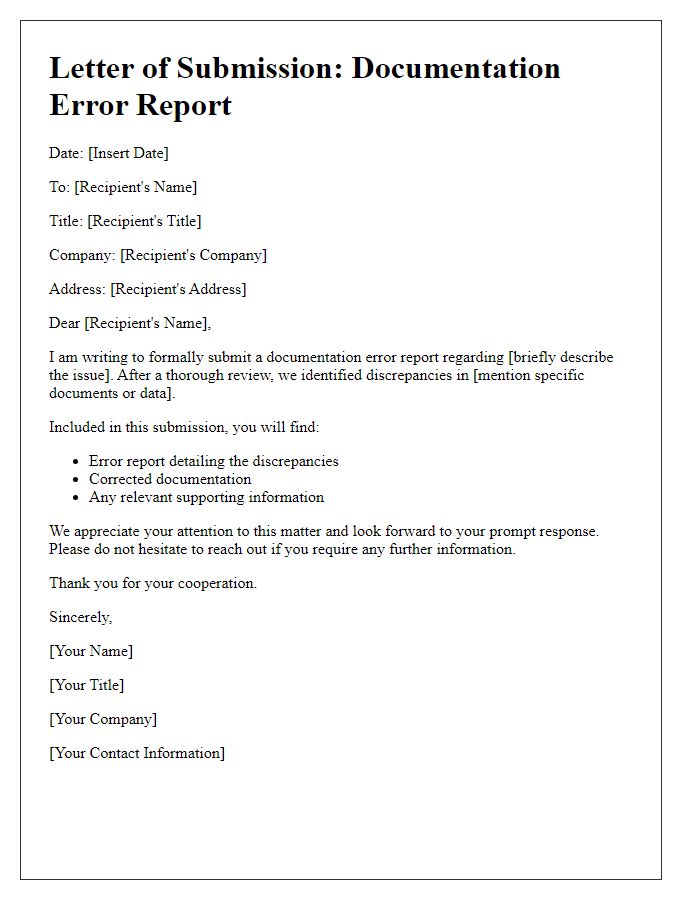

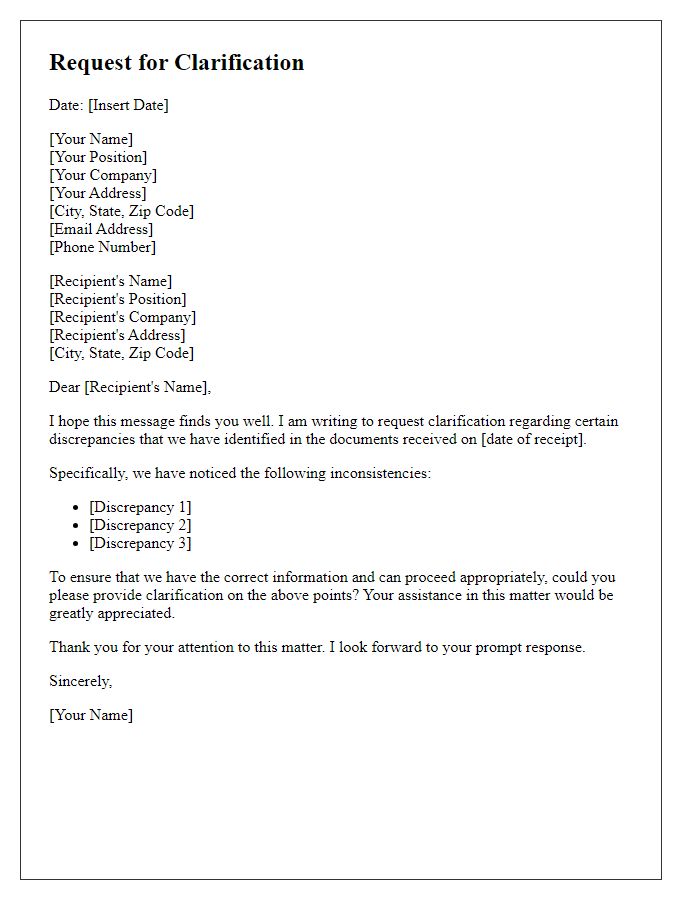

Letter Template For Reporting Discrepancies In Documentation Samples

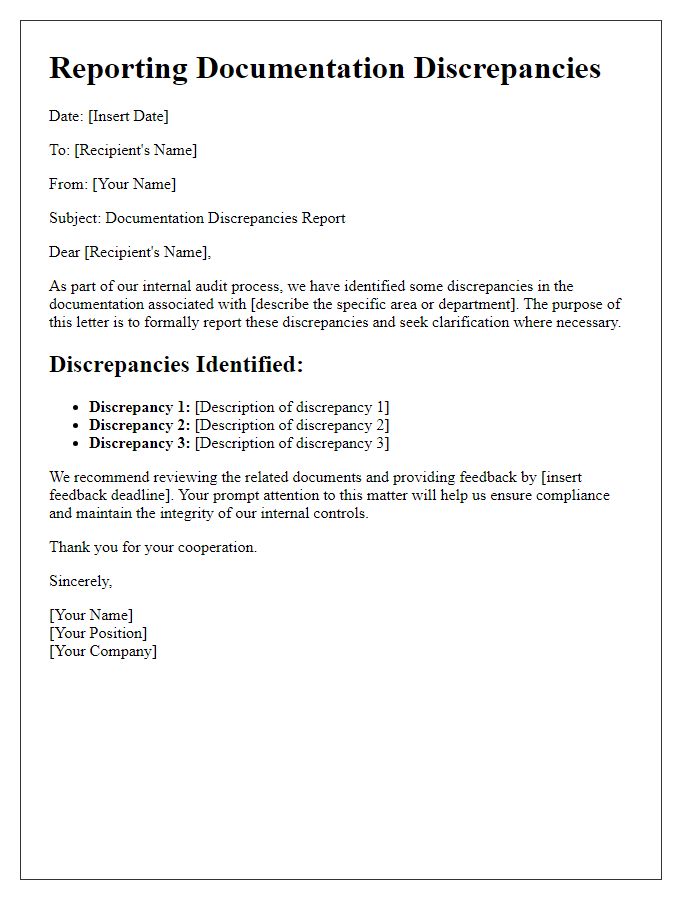

Letter template of Reporting Documentation Discrepancies for Internal Audit

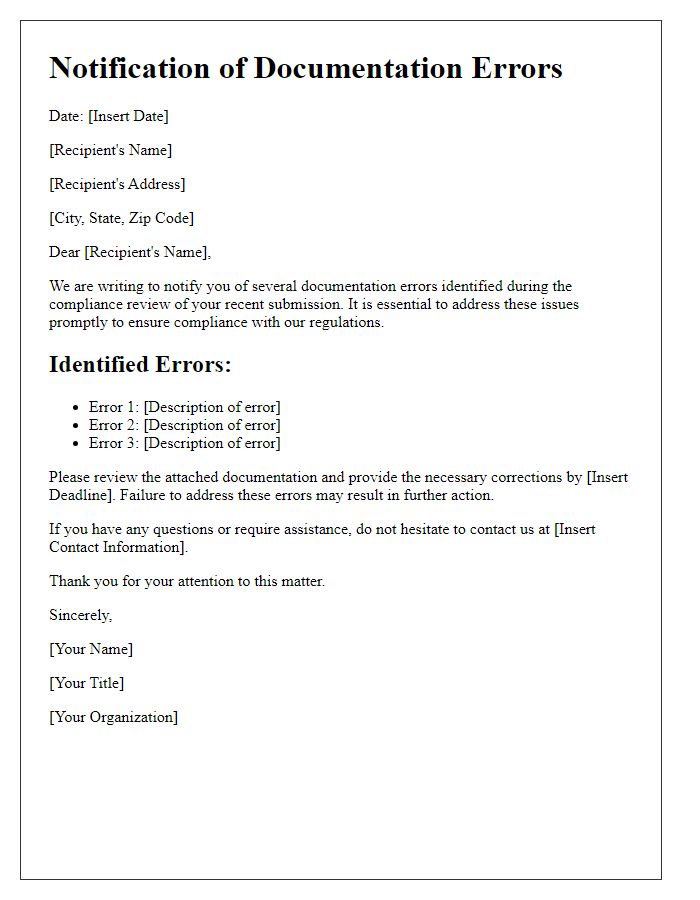

Letter template of Notification of Documentation Errors for Compliance Review

Comments