Are you looking to navigate the complexities of securing a charity tax exemption? Understanding the steps and requirements can feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential components of a charity tax exemption letter, offering you clear guidance and practical tips to streamline the process. So, let's dive in and ensure your charitable efforts can thriveâread on for all the essential insights!

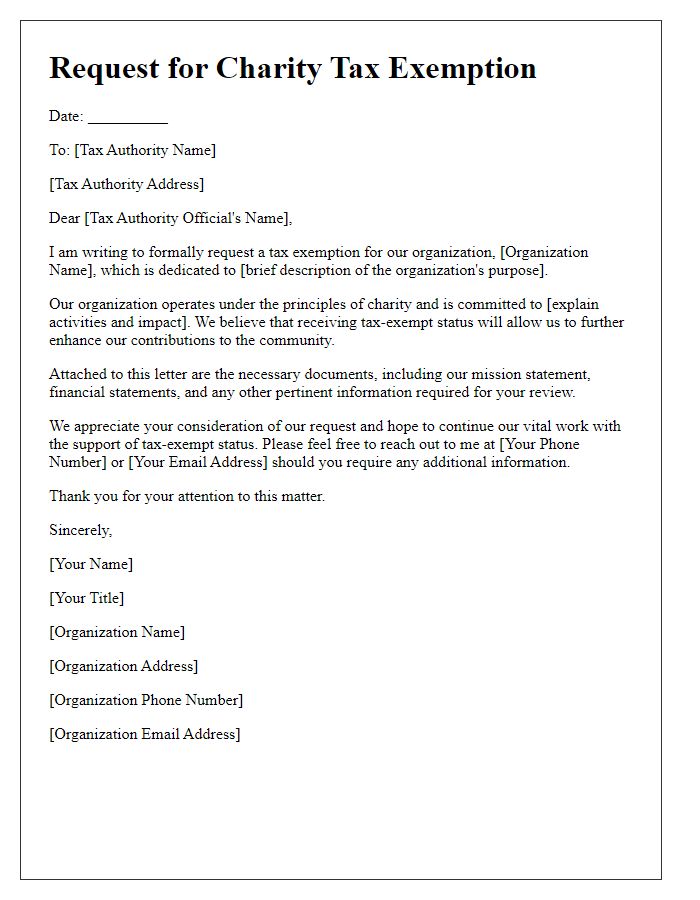

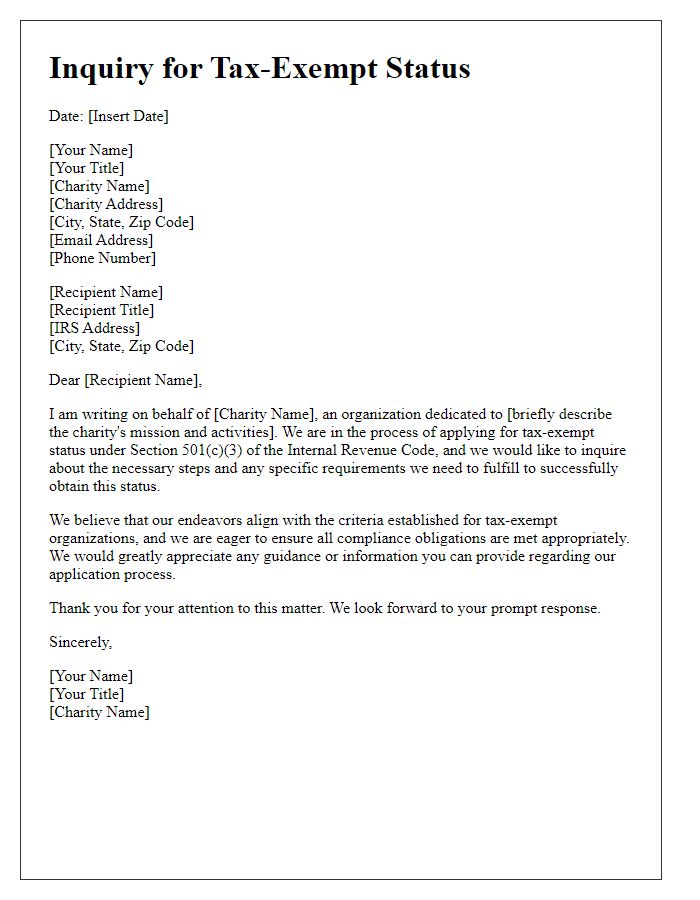

Organization's full name and contact information

The mission of nonprofit organizations, such as Hope for Tomorrow, focuses on community development and social welfare initiatives. Established in 2015, this charity operates in Denver, Colorado, and the contact information includes a phone number (555-0123) and an email address (info@hopefortomorrow.org). The organization actively engages in programs that provide food security, educational resources, and homeless assistance. Essential documentation has been submitted to the IRS to obtain tax-exempt status under section 501(c)(3), making donations eligible for tax deductions for contributors.

Charity's tax identification number

A charity's tax identification number (TIN) is crucial for obtaining tax-exempt status. This unique number, assigned by the Internal Revenue Service (IRS) in the United States, allows the charity to prove its eligibility for federal tax exemption under section 501(c)(3). Proper documentation of the TIN can facilitate donations, as contributors may seek assurance that their contributions are tax-deductible. Accurate representation of this number in correspondence is essential, ensuring compliance with IRS regulations and fostering trust with potential donors. Additionally, the presence of the TIN on official materials, such as receipts and acknowledgment letters, reinforces the charity's commitment to transparency and accountability in financial matters.

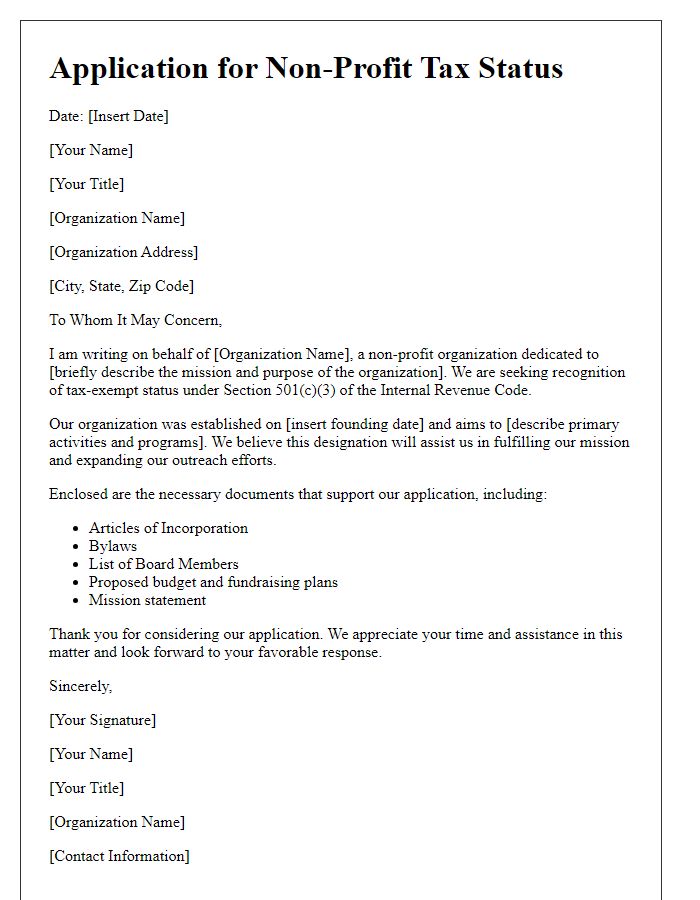

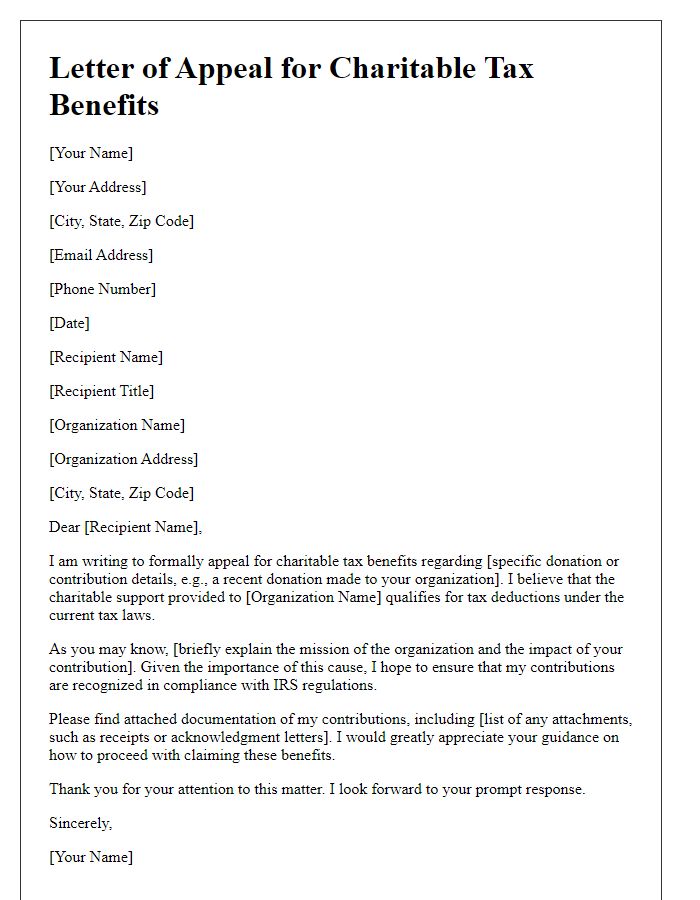

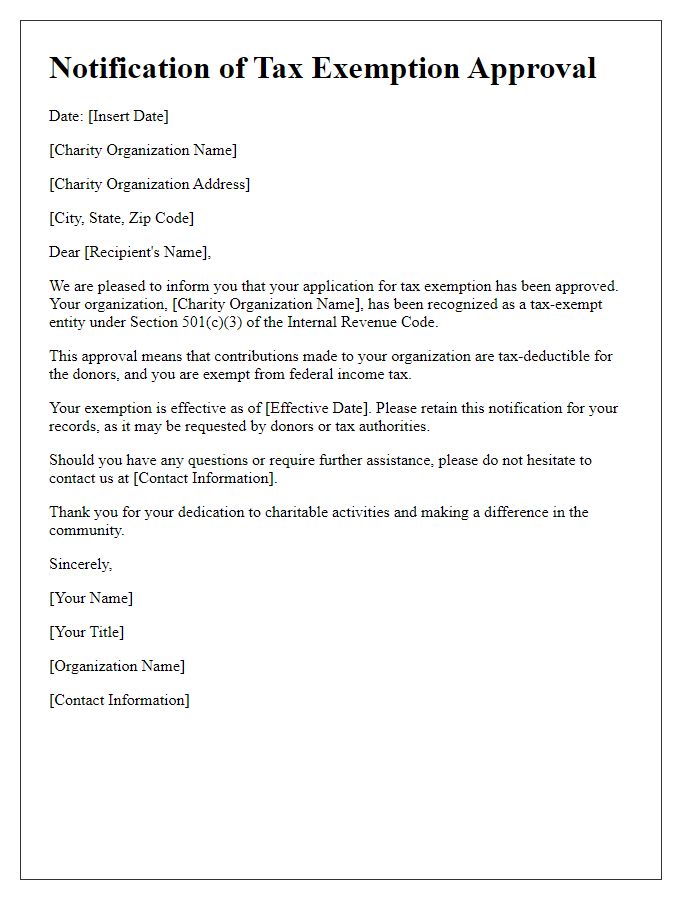

Statement of 501(c)(3) status confirmation

A charity's tax-exempt status significantly impacts its operations and fundraising efforts, especially organizations classified under section 501(c)(3) of the Internal Revenue Code. These non-profit entities, such as the American Red Cross, provide charitable services, engage in educational programs, and conduct research for public benefit. Receiving this designation exempts them from federal income tax and allows donors to deduct contributions on their tax returns. Essential to maintaining this status are annual filings, like the Form 990, which detail financial activities, fostering transparency and accountability. Organizations must ensure compliance with state regulations and engage in activities consistent with their mission to retain their 501(c)(3) classification.

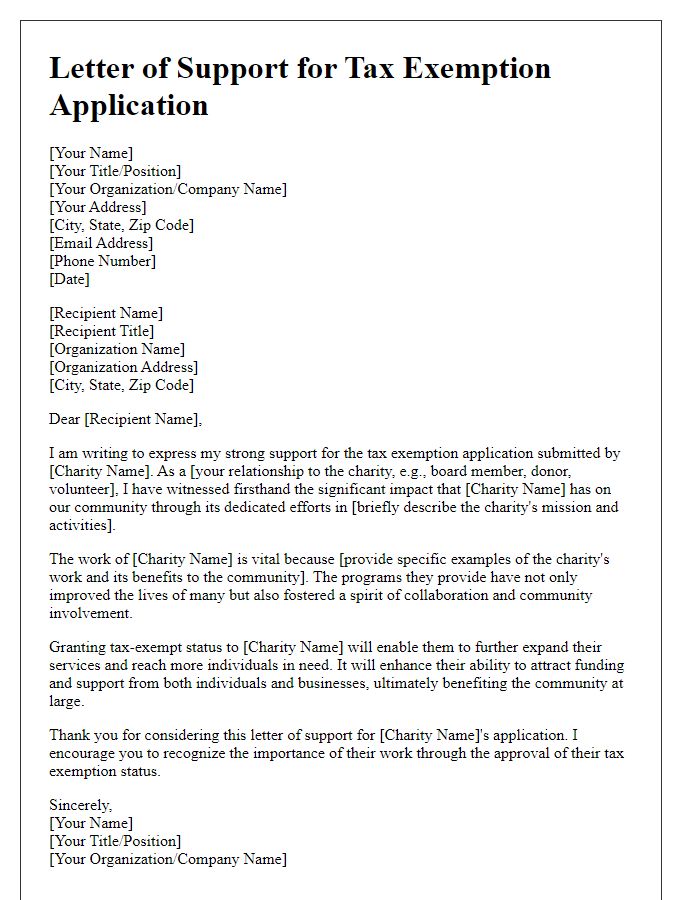

Description of charitable activities and purpose

The organization, dedicated to supporting underprivileged children, conducts educational programs, such as after-school tutoring and summer camps, in various locations like New York City and Los Angeles. With funding from donations surpassing $100,000 annually, we provide essential learning resources, including books and technology, to over 500 children each year. Our goal focuses on improving literacy rates, which currently stand at 60% among low-income families. Alongside educational assistance, we organize community events, fostering engagement and awareness, such as our annual fundraising gala, which attracts over 300 attendees and raises significant funds for ongoing initiatives. The overarching mission is to empower children to achieve academic success and break the cycle of poverty through education and community support.

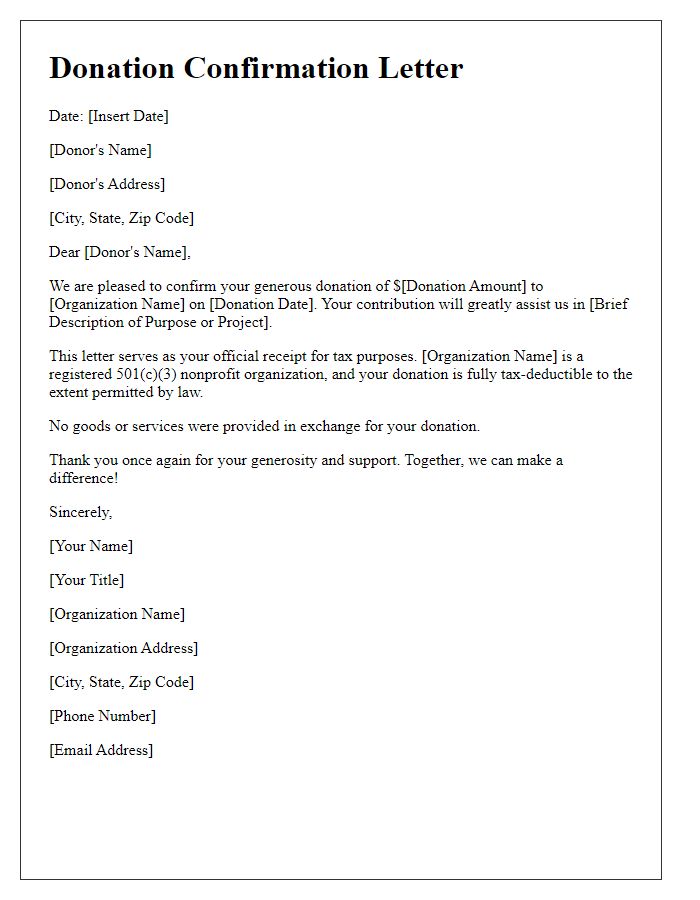

Request for acknowledgment and retention of donation records

The documentation of charitable contributions is vital for tax exemption purposes, especially for nonprofit organizations recognized under section 501(c)(3) of the Internal Revenue Code in the United States. Donors should retain copies of receipts, indicating the donation amount, the date of contribution, and the charity's name. This acknowledgment, often provided within 30 days of the donation, is essential for tax filing and ensuring compliance with IRS regulations. Organizations must maintain accurate records for their donors to facilitate tax deductions, which can significantly influence future fundraising efforts. A well-documented donation history not only strengthens relationships with supporters but also assures compliance with financial transparency standards.

Comments