Are you looking to make a meaningful impact in your community? Writing a letter for charitable financial contributions can be a great way to express your intentions and rally support. In this article, we'll explore effective templates and tips to craft a heartfelt message that resonates with potential donors. Join us as we dive into the art of writing compelling letters that inspire generosity and encourage giving!

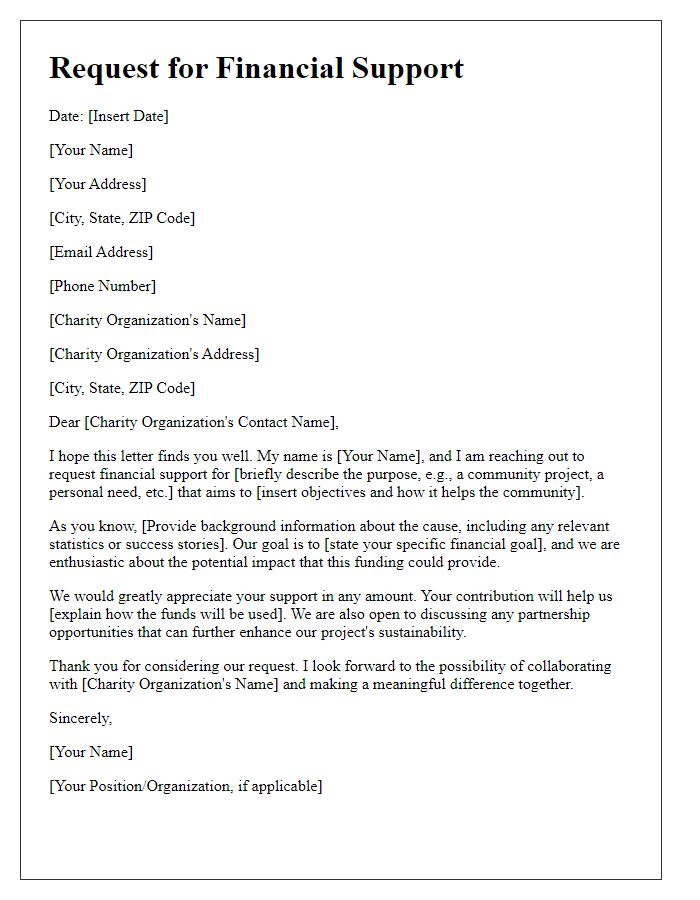

Donor's information

Financial contributions from donors play a crucial role in supporting charities and their missions. Detailed donor information includes essential data such as full name, address, and contact number. A well-documented record of donations, including dates and amounts, fosters transparency within the charity sector. Recording donor preferences, such as earmarked funds for specific projects or general operational support, enhances engagement and trust. Additionally, collecting feedback from donors regarding their experiences with the charity can provide valuable insights for future outreach and fundraising efforts. This comprehensive approach not only strengthens donor relationships but also promotes sustainable growth for charitable organizations.

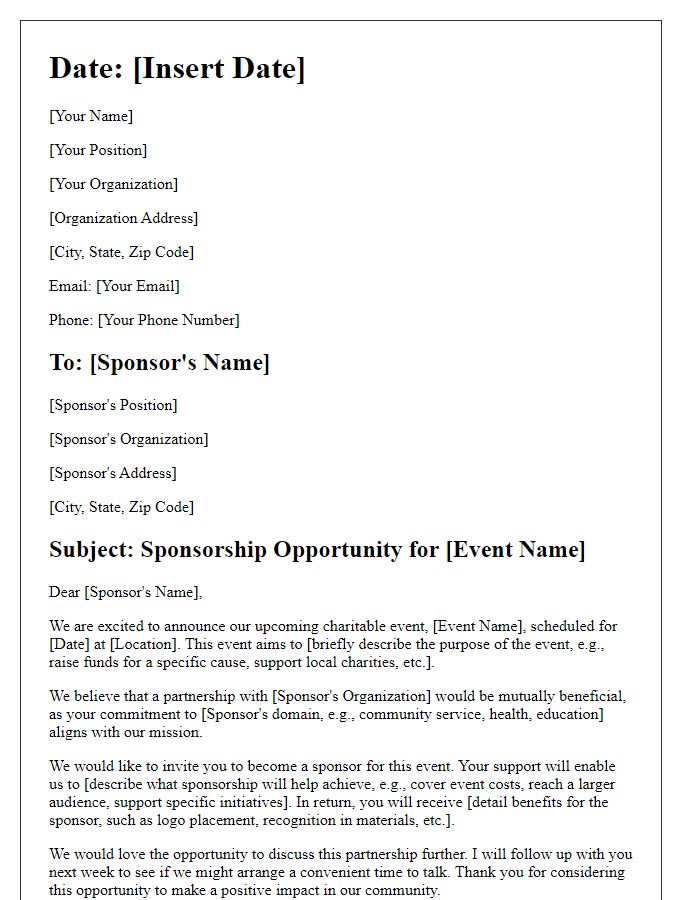

Personalization

Charitable organizations rely on financial contributions to support their missions and serve communities effectively. Personalized donation appeals can significantly enhance engagement with potential donors, such as individuals, corporations, and foundations. Tailored messaging should include specific project details, for instance, funding requirements of $10,000 for healthcare initiatives and $5,000 for educational programs. Highlight personal stories or testimonials from beneficiaries in regions like Sub-Saharan Africa and Southeast Asia to emphasize the impact of donations. Incorporating statistics, such as the number of people served annually or success rates, will further persuade individuals to contribute. Acknowledging previous contributions from long-term supporters can strengthen relationships and encourage continued involvement, fostering a deeper sense of community and shared purpose.

Clear purpose of contribution

Charitable financial contributions significantly impact community welfare, particularly in critical areas such as education, healthcare, and poverty alleviation. Organizations like Feeding America, which provides meals to over 40 million individuals annually, rely on donations to sustain their vital programs. Contributions can help fund educational initiatives, covering costs like textbooks or classroom supplies, essential for promoting learning environments in underprivileged schools. Moreover, supporting healthcare charities, including St. Jude Children's Research Hospital, enables advancements in pediatric care, offering free treatment and hope to families battling life-threatening illnesses. Clear purpose-oriented contributions empower nonprofits to allocate resources effectively, address pressing societal needs, and enhance the quality of life for countless individuals.

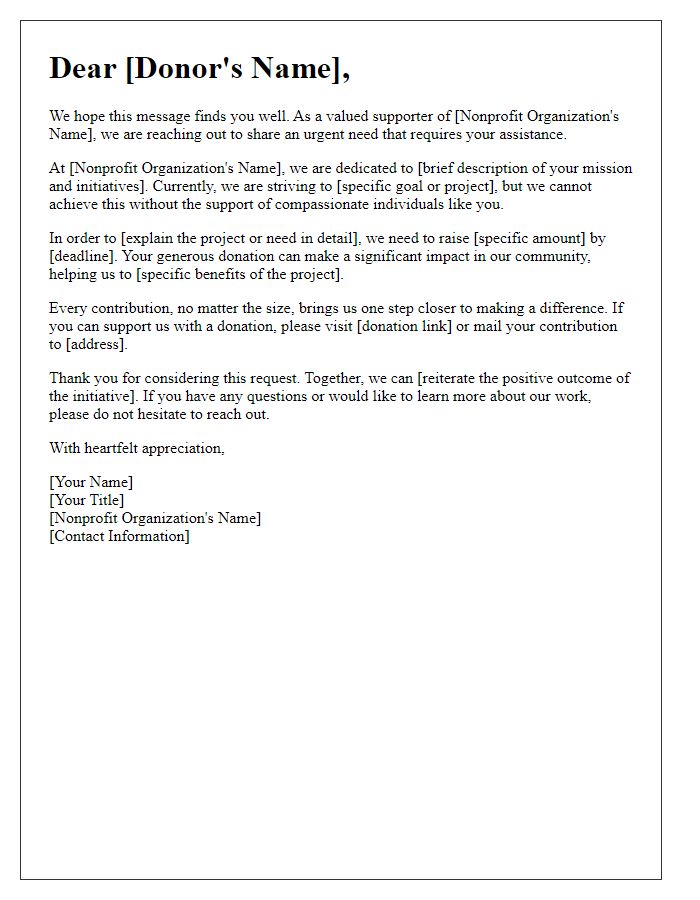

Impact statement

Charitable financial contributions play a crucial role in enhancing community welfare and addressing pressing social issues. In 2023, funding allocations amounting to $10 million enabled organizations such as the American Red Cross and Feeding America to support disaster relief efforts and provide meals to 4 million food-insecure individuals. These contributions fuel initiatives that deliver essential services, including healthcare, education, and housing assistance, directly benefiting underserved populations. For instance, a partnership with local food banks in Chicago yielded a 25% increase in meal distribution, significantly reducing hunger levels. Furthermore, regular donations ensure sustainability, empowering organizations to plan long-term projects that make lasting impacts on community resilience and well-being.

Contact information

Charity organizations often require structured contact information for financial contributions to streamline donations and ensure donor transparency. Essential details include the charity's legal name, often registered with the IRS (Internal Revenue Service), along with a recognized tax identification number (EIN). Mailing addresses for correspondence should specify city, state, and ZIP code for accurate processing. Email addresses, typically hosted on institutional domains, allow for efficient electronic communication. Phone numbers, often toll-free, enable quick inquiries regarding contributions. Website URLs provide donors access to online donation platforms and detailed financial reports. Including these elements fosters trust and simplifies the contribution process for donors.

Comments