Are you looking to make a meaningful impact through your charitable contributions? Donor-advised funds are an excellent way to streamline your giving while maximizing your tax benefits. With the flexibility to recommend grants to various organizations, these funds allow you to support the causes you are passionate about with ease. So, let's dive deeper into how a donor-advised fund can enhance your philanthropic journeyâkeep reading to discover all the details!

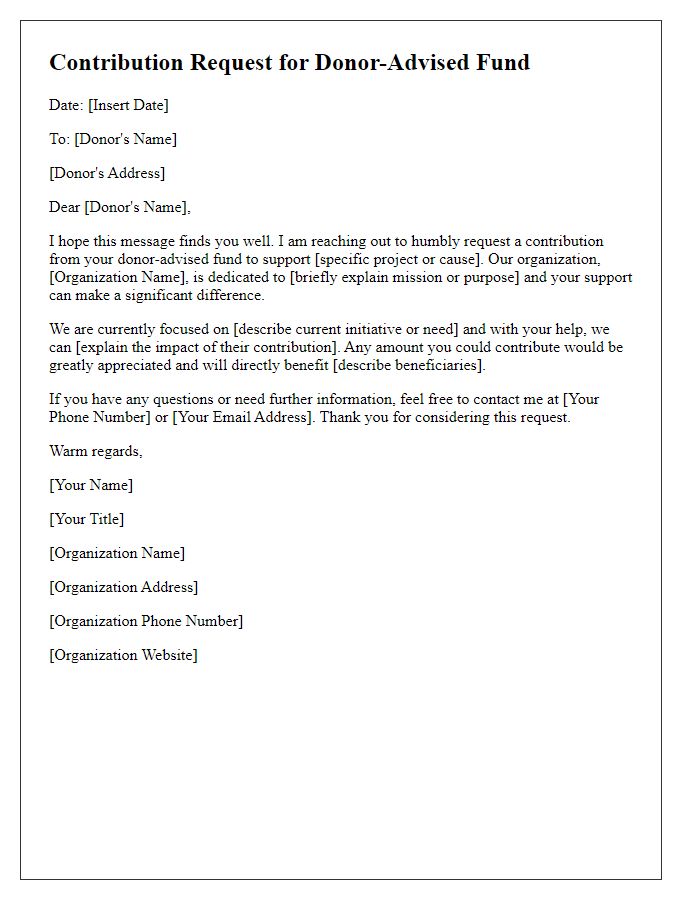

Donor information and contact details

A donor-advised fund (DAF) serves as a philanthropic vehicle, allowing individuals such as philanthropists or family foundations to recommend grants to various charitable organizations. Donor information typically includes essentials such as the donor's full name, address, phone number, and email contact details. These data points facilitate communication between the fund and the donor, ensuring effective tracking of donations and compliance with IRS regulations. Recommendations for grant allocations often follow established guidelines set by organizations like the National Philanthropic Trust, ensuring that charities receive contributions in a timely manner while maintaining transparency in financial records. Additionally, key elements such as the name of the DAF sponsoring organization, account number, and the purpose of the donation reinforce clarity throughout the process.

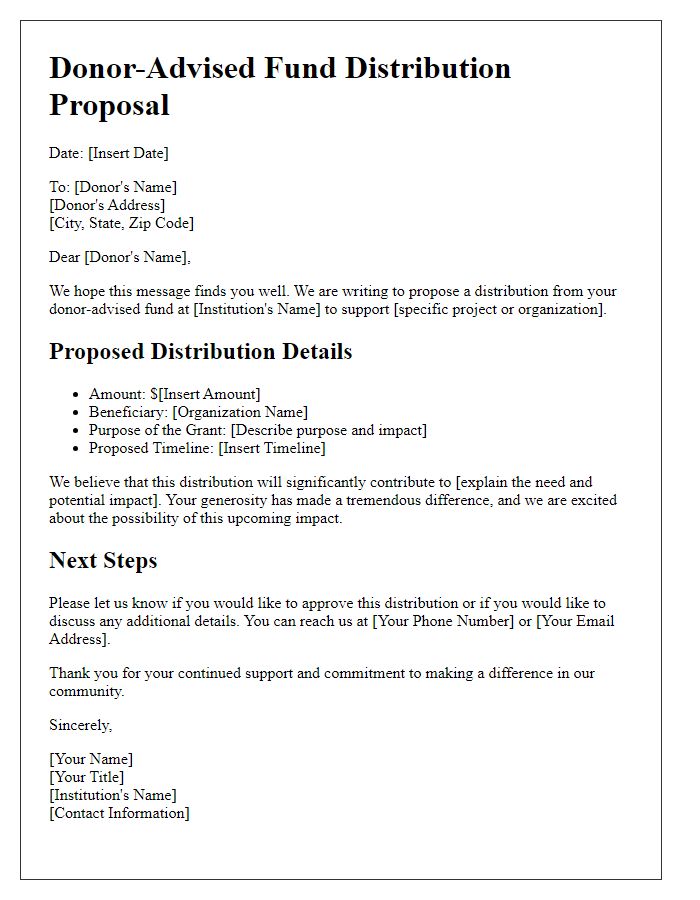

Fund account details and charitable purpose

Donor-advised funds (DAFs) provide individuals with a strategic vehicle for charitable giving. For instance, consider the XYZ Community Fund, established in 2010, which has facilitated over $2 million in grants to local nonprofits. Specific account details, including account number 123-456-789, ensure smooth processing of contributions. The charitable purpose, directed towards enhancing educational programs in underserved areas, highlights its impact on community development. Contributions can support initiatives like the ABC After-School Program, which serves over 150 children annually, or the DEF Scholarship Fund, awarding 20 scholarships each year to high-achieving students pursuing higher education.

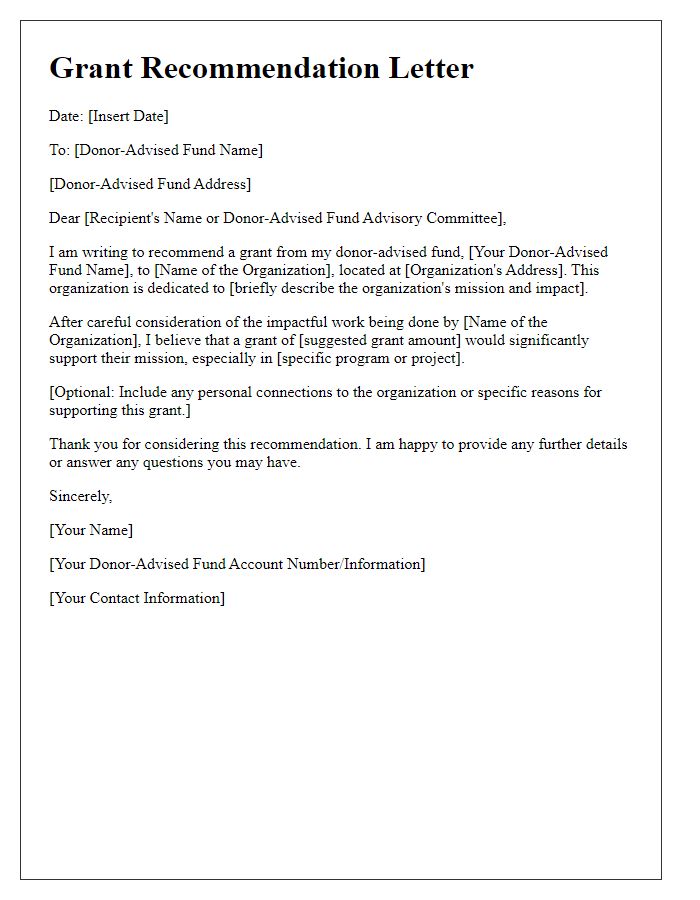

Recommended grant amount and frequency

Donor-advised funds (DAFs) allow individuals to contribute to charitable causes while enjoying immediate tax benefits. Recommended grant amounts typically range from $1,000 to $500,000 based on fund balance and donor preferences, enabling versatile support for a variety of organizations (e.g., educational institutions, healthcare initiatives). Grant frequency can vary, with options for annual disbursements or more frequent allocations, accommodating both ongoing and immediate philanthropic needs. DAFs can support local nonprofits or global initiatives, aligning with the donor's personal values and community impact goals. By establishing a consistent grant schedule, donors can strengthen relationships with their chosen charities, ensuring sustained support over time.

Charity recipient's legal name and address

The legal name of the charity recipient is "Hope for Children Foundation," located at 123 Charity Lane, Springfield, IL 62701. This nonprofit organization focuses on supporting underprivileged youth through educational programs and mentorship initiatives. The foundation is recognized for its registered 501(c)(3) status, ensuring that all donations are tax-deductible. Founded in 2002, Hope for Children Foundation has significantly impacted local communities by providing resources and opportunities for children in need.

Acknowledgment and special instructions

Acknowledgment of a donor-advised fund recommendation involves an official confirmation of the suggested grant from the fund to a specific nonprofit organization. When recommending a donation, donors should specify the precise amount of money (for example, $5,000) to be granted and the target organization, such as Habitat for Humanity, known for its mission to provide affordable housing. Special instructions might include designating the funds for a particular project within the organization (like building homes in rural areas) or requesting that the donation be used for operational support (helping with administrative costs). This process ensures that the intended impact aligns with the donor's philanthropic goals, fostering a transparent and effective giving experience.

Comments