Are you involved with a charitable organization and facing the necessity of an audit? Understanding the ins and outs of an audit notification letter can make this process smoother and less daunting. This essential communication not only informs stakeholders about the upcoming audit but also reinforces transparency and accountability, which are vital in the charitable sector. Join us as we delve deeper into how to craft the perfect audit notification letter and why it's crucial for maintaining trustâread on for more insights!

Recipient's Full Name and Address

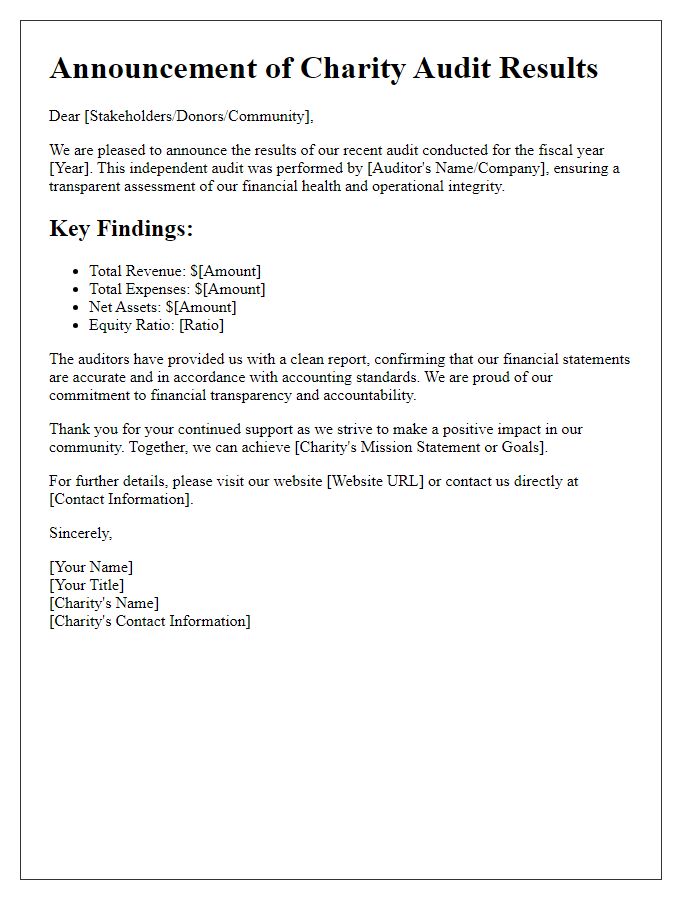

Charity audits play a critical role in maintaining transparency and accountability within nonprofit organizations. Scheduled for January 15, 2024, the audit will be conducted by Smith & Associates, a reputable accounting firm based in New York City. Donors, including the Community Foundation, will expect a comprehensive review of financial statements, ensuring compliance with IRS regulations, particularly IRS Form 990. Furthermore, the findings from this audit will be reported at the annual general meeting in March 2024, reinforcing our commitment to fiduciary responsibility and effective stewardship of donated resources. Such audits often reveal areas for improvement and drive strategic planning for enhanced operational effectiveness.

Purpose of Audit Notification

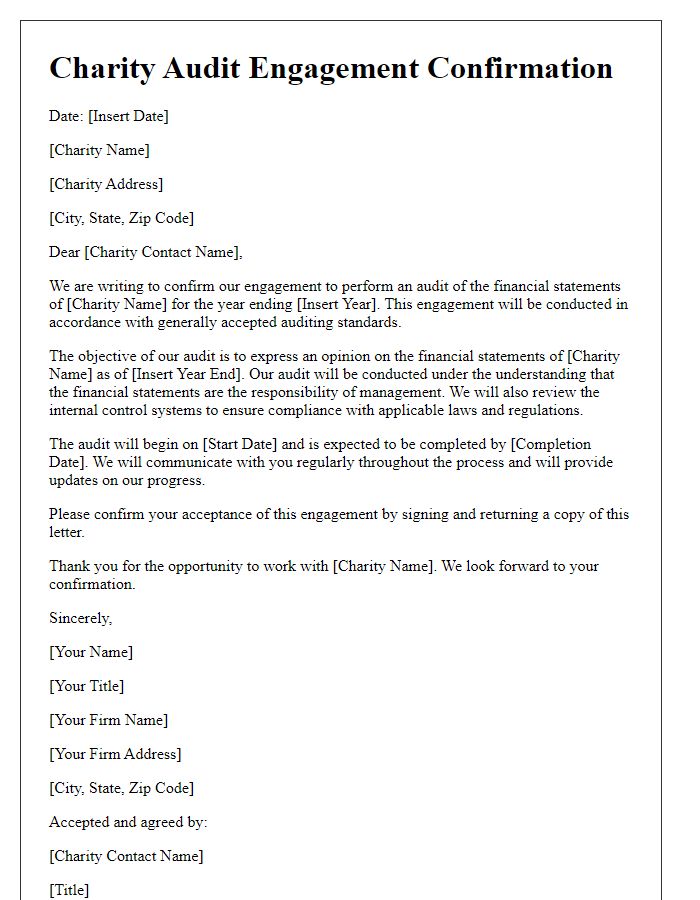

The purpose of the charity audit notification is to ensure transparency and accountability in the financial practices of nonprofit organizations, such as those operating in the United Kingdom under the Charity Commission regulations. This formal communication serves to inform stakeholders, including donors, board members, and regulatory bodies, that an external audit will be conducted on financial statements for the fiscal year ending December 31, 2023. The audit aims to assess compliance with legal requirements, ensure that funds are utilized effectively towards charitable activities, and evaluate financial health through comprehensive analysis of income, expenditures, and assets. Conducted by an independent auditor registered with the Financial Reporting Council, this process helps maintain the trust of supporters and align with best practices in governance, ultimately reinforcing the charity's commitment to fulfilling its mission while adhering to the highest standards of ethical conduct.

Audit Scope and Objectives

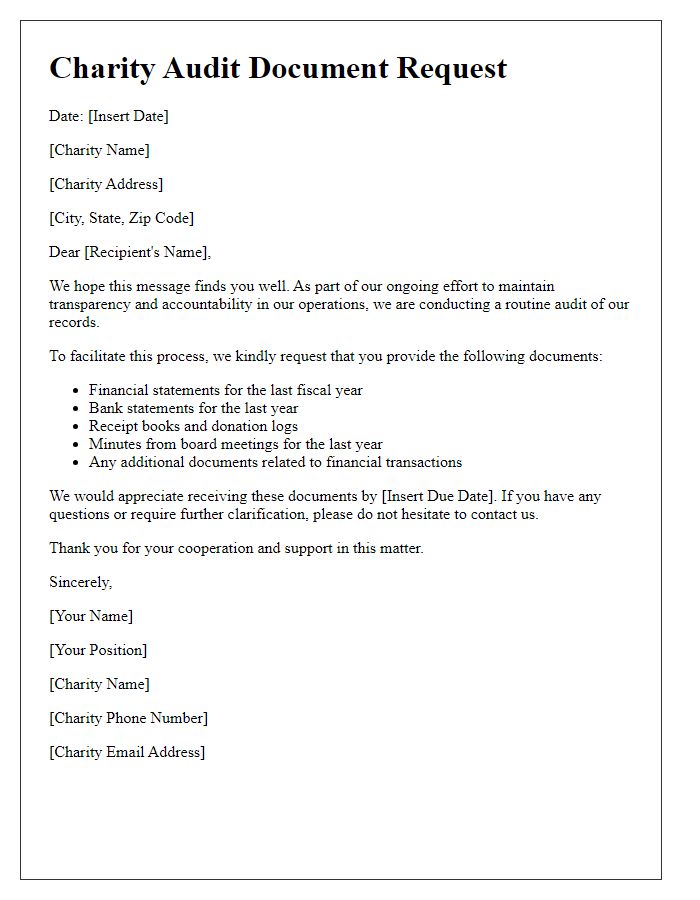

Charity audits are essential for ensuring transparency and accountability in financial reporting. The scope typically includes reviewing financial statements, examining compliance with relevant legislation, and assessing internal controls. Objectives focus on verifying accuracy in financial records, ensuring funds are used in accordance with donor intentions, and identifying areas for operational improvement. The audit process may involve interviews with key personnel, analysis of financial transactions, and observation of processes, all occurring within the organization's fiscal year, often defined in accordance with standards set by the Financial Reporting Council (FRC).

Scheduled Date and Time

A charity audit notification typically conveys essential information regarding the evaluation of financial records and operational compliance. The audit will take place on November 15, 2023, starting at 10:00 AM at the charity's headquarters, located at 123 Charity Lane, Springfield. Legal compliance will be assessed alongside financial statements from the fiscal year ending December 31, 2022. Professional auditors from ABC Audit Services will carry out the review, ensuring transparency and adherence to regulatory standards governing nonprofit organizations. All necessary documentation, including bank statements, donor records, and expense reports, must be made available for inspection.

Contact Information for Queries

During a charity audit, it's essential to provide comprehensive contact information for stakeholders seeking clarification or assistance. Key details include the charity's official name, registration number, and address in accordance with local regulations. An email address (e.g., info@charityname.org) allows for efficient communication, while a dedicated phone number (e.g., +1-800-555-0199) facilitates immediate responses. Additionally, specifying the names and roles of designated personnel, such as the Chief Financial Officer or Audit Manager, ensures accountability, offering their direct contact details for inquiries. This structured approach enhances transparency and fosters trust among donors and the community.

Comments